If you’ve got a 625 credit score, you might be wondering if that’s a good score or a bad score. According to Equifax Canada, one of the two main credit bureaus in the country, a credit score of 625 is in the range of what most people consider to be a fair to decent credit score.

So, what does that mean really for your financial status and future? Let’s break it all down.

Is 625 a Good Credit Score in Canada?

Having a good credit score is important for accessing loans and credit products in Canada. But what exactly constitutes a “good” score? Specifically is 625 considered a good credit score in Canada? Let’s break it down.

What is a Credit Score?

A credit score is a three-digit number that gives lenders an idea of how likely you are to repay debt. It’s calculated based on your credit history and repayment behavior over time. The score typically ranges from 300 to 900, with higher scores indicating you are lower risk.

Lenders use credit scores to help decide whether to approve you for loans and credit products. They also use the scores to determine the interest rates and terms you’ll be offered. Having a higher score means you’re more likely to get approved and to receive better rates.

Credit Score Ranges in Canada

Credit scores aren’t all the same in Canada, but most lenders use the score ranges that Equifax and TransUnion, the two biggest credit bureaus, give out.

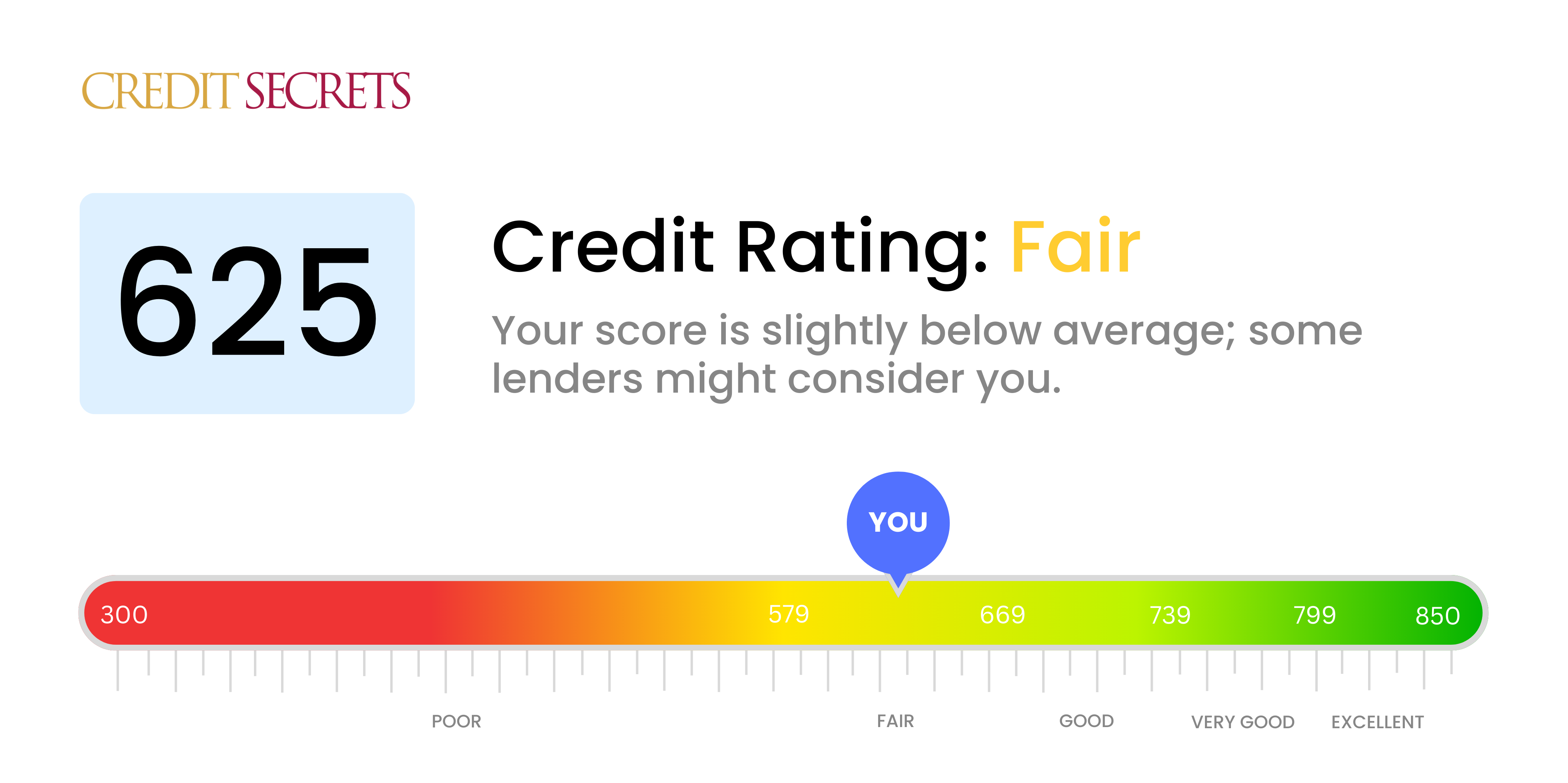

Here’s how Equifax categorizes credit scores:

- 300 to 579: Poor

- 580 to 669: Fair

- 670 to 739: Good

- 740 to 799: Very good

- 800 to 900: Excellent

So according to Equifax, a score between 670 to 739 is considered good. A score of 625 falls slightly below that, in the fair range.

What Does a 625 Credit Score Mean?

A 625 credit score indicates fair credit. Canada’s average credit score is around 670, so this score is below that.

A score of 625 isn’t terrible, but it does mean that there may be some problems or bad things about your credit profile. You probably don’t have a lot of credit history, have missed or been late on payments, have high balances, or have had credit problems in the past.

With a 625 score, you may face challenges getting approved for loans and credit cards, especially from mainstream lenders like banks. You’ll also likely pay higher interest rates if approved.

Still, a score of 625 means you have a good chance of getting credit. The score isn’t great, but it’s also not terrible either.

Is 625 a Good Credit Score for Different Credit Products?

Whether a 625 credit score is considered good or not can depend on what type of credit you are seeking:

Mortgages: Most mortgage lenders prefer scores of at least 660 or higher for conventional mortgages. With a 625 score, you may need to opt for alternative or private lenders.

Auto Loans: Scores between 620 to 659 can qualify for car loans but may mean higher interest rates. Prime auto loan rates usually require 660+ scores.

Credit Cards: A 625 score makes approval challenging for many rewards cards but you may qualify for basic or secured cards to start rebuilding credit.

Personal Loans: Online lenders are often more flexible on credit scores. A 625 score may allow you to qualify for a personal loan, though your rate won’t be the lowest.

Overall, while a 625 credit score is below average, it leaves you with some borrowing options as you work to improve it over time.

How to Improve a 625 Credit Score

The good news is there are tangible steps you can take to boost your 625 score into the good or very good ranges. Here are some tips:

-

Make all loan and bill payments on time each month. Payment history is the biggest factor in your score.

-

Keep credit card balances low. Having high balances close to your limits hurts your credit utilization ratio.

-

Don’t apply for too much new credit at once. New credit inquiries can drop your score temporarily.

-

Build positive payment history by becoming an authorized user on someone else’s credit card.

-

Monitor your credit reports and dispute any errors with the bureaus. Mistakes can unjustly lower your score.

-

Consider credit-builder products or secured cards to add positive information to your credit file.

-

Allow time to pass since any past credit issues. Their impact on your score gradually decreases.

With diligence and smart credit habits, it’s realistic to improve a 625 score to 700 or higher within 12 to 24 months. Patience and commitment to building your credit is key.

The Bottom Line

A credit score of 625 is considered fair in Canada. It leaves room for improvement compared to good scores above 660. While not ideal, a 625 score is workable. It may make accessing the best rates and products challenging but won’t necessarily preclude you from getting credit. With time and effort spent building positive credit behaviors, a 625 score can be boosted significantly higher. Check your own scores, make a plan, and take steps to gain control of your credit profile.

Credit scores in Canada

Your credit score serves as a numerical summary, typically falling within a range of 300 to 900, amalgamating a wide array of financial data. It’s influenced by multiple factors and acts as a comprehensive reflection of your financial health. Put simply, the higher your score, the more favorably credit bureaus and potential lenders perceive you. A robust credit score opens pathways to numerous financial advantages, such as access to lower-interest loans, improved employment opportunities (especially in sectors like financial services, where employers often scrutinize credit scores during background checks), and an increased likelihood of securing a rental property.

Factors that negatively impact your credit score

There are several factors that decrease your credit score over time. The credit bureaus collect information on each Canadian to help them determine credit scores, and some of the things an individual does can cause a score to decrease. This includes:

What is a good credit score in Canada and how to maintain a good credit score?

FAQ

Can I get approved with a 625 credit score?

With a 625 credit score, you may only qualify for interest rates on the higher side. While using a cosigner may help you access lower rates, the best way to get the lowest interest rates on loans is to work on improving your credit reports.

How long does it take to go from a 650 credit score to 700?

Can you buy a house with 625 credit score?

A realistic credit score range to buy a house generally falls between 620 and 700. With a 650 credit score, you can still qualify for FHA or VA loans, which tend to be more flexible. It’s a good idea to review your score from Equifax, Experian, or TransUnion before submitting your mortgage application.

Is 700 a good credit score?

For a score with a range of 300 to 850, a credit score of 670 to 739 is considered good. Credit scores of 740 and above are very good while 800 and higher are excellent. For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good.