While a higher income generally means a higher credit limit, income is just one factor lenders consider when setting credit limits. Other credit limit influences include creditworthiness, credit utilization ratio, credit card attributes and economic trends that affect credit risk.

Credit card companies look at your income and a number of other factors, such as your credit score, your current debts, and how much of your available credit is being used, when deciding how high to set your credit limit. Your credit limit is the highest amount of money you can have on your credit card. Heres what you need to know about how lenders determine credit limits.

It may seem like a good idea to have a high credit limit on your credit card. After all, it gives you more spending options and can help you lower your credit utilization ratio. But is a $20,000 credit limit really high? Let’s take a closer look.

What Factors Determine Your Credit Card Limit?

When a credit card company sets your limit, they consider several factors including:

-

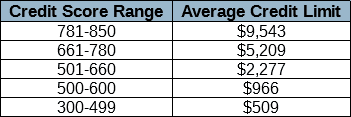

Your credit score—The higher your score, the more likely it is that you will be approved for a higher To get a $20,000 limit, your credit score needs to be good to excellent (above 700).

-

Your income – Lenders want to see you have enough income to be able to comfortably pay back what you charge to the card. Higher incomes often lead to higher limits.

-

Your existing debt – The more debt you already have, the less likely lenders will want to give you access to more. Keeping debt low helps your case for a higher limit.

-

Your credit history length – A longer history of responsible credit use works in your favor when applying for new credit,

-

Your relationship with the lender—Some issuers raise limits for customers who have banked with them for a long time.

Is $20,000 a High Limit?

In short, yes. A credit limit of $20,000 is usually thought to be high. Here are a few stats to back this up:

-

The average credit limit across all credit card holders is around $13,000 according to Experian data.

-

Most standard consumer credit cards have limits between $500 to $10,000.

-

Cards aimed at people with excellent credit scores and high incomes advertise limits starting at $10,000 or more.

-

The highest limits we typically see range from $20,000 up to $100,000+ for ultra premium cards.

So while a $20K limit is not outrageous, it puts you well above average and gives you access to a larger line of credit than most cardholders have.

Pros of a $20,000 Credit Limit

There are some advantages that come with having a higher credit limit like $20,000.

1. Lower credit utilization – One of the biggest perks is that your credit utilization ratio will be lower. This ratio measures how much of your total available credit you’re using. Experts recommend keeping it under 30%. With a $20K limit, you can charge significantly more before hitting that 30% mark. This can boost your credit score.

2. Higher spending power – A $20,000 credit limit gives you lots of spending flexibility. You can make large purchases more easily without bumping up against your limit. This can be handy when booking travel, making a major purchase, or covering emergency expenses.

3. Earn more rewards – Some rewards credit cards offer higher perks, bonuses, or redemption rates when you spend more on the card annually. A high limit enables you to earn more.

4. Exclusive benefits and perks – Premium travel rewards cards with $20K+ limits come with luxury benefits like airport lounge access, travel credits, and elite status with hotels/airlines. Perks increase the higher your limit is.

Risks of a High Limit

However, there are some potential downsides to be aware of if you have a $20,000 credit limit.

-

You could be tempted to overspend and rack up a large balance with high interest charges. Make sure you have the discipline to avoid this.

-

It may be difficult to get your utilization below 30% if your spending is too high. Try your best to keep it as low as possible.

-

Applying for other new credit can be harder since lenders will see you already have access to a lot of funds. Space out applications wisely.

-

If your card is lost/stolen or your information gets compromised, the potential for fraudulent charges increases. Monitor your accounts closely.

-

If you carry high balances month-to-month, it can negatively impact your credit score and show lenders you may be overextended. Avoid this.

Tips for Getting a $20,000 Limit

If you want to qualify for a $20K credit limit, here are some tips:

-

Have excellent credit – Shoot for a score of 740 or higher. Pay all bills on time, keep balances low, and limit credit inquiries.

-

Lower your debt-to-income ratio – Lenders like to see your existing debts take up less than 30% of your income. Pay down debts and bills.

-

Ask for credit limit increases – After 6+ months of on-time payments, request an increase from your current card issuers.

-

Boost your income – Apply when you have a higher salary. Provide proof of income documents when applying.

-

Apply for premium rewards cards – Many travel rewards cards aimed at affluent consumers advertise $10K+ limits.

-

Maintain accounts with your bank – Having a checking, savings, or investment account can help strengthen your relationship when applying.

The Bottom Line

A credit card limit of $20,000 is considered quite high compared to average. It signals that you have exceptional credit and income. While tempting, avoid viewing a high limit as free money to overspend. Manage it responsibly by keeping balances low and monitoring statements closely. Used wisely, a $20K limit can be a nice credit perk that unlocks rewards, benefits, and financial flexibility.

How Lenders Set Your Credit Limit

In addition to DTI ratio, credit card issuers weigh a number of other factors when setting credit limitsânone of which have a direct connection to your income. These include:

- Creditworthiness, as reflected in credit reports and credit scores: Your credit reports record your history of debt and repayment, and credit scores are derived from credit report data. Credit reports do not include income information, and income has no direct bearing on credit scores. The payment history recorded in your credit reports is the single most important contributor to credit scores, and even one payment thats late by 30 days or more can do significant harm to credit scores.

- Credit utilization rate: Your overall credit utilization rate is the amount of credit youre using on your revolving credit accounts (such as credit cards), stated as a percentage of your total revolving credit limit. Lenders may view high utilization rates as a sign of over-reliance on credit, and utilization rates that exceed about 30% can cause your credit scores to decline.

- Card attributes: Card issuers tailor different credit cards to different target usersâ college students, business owners or frequent travelers, for exampleâand credit limits can vary according to the intended borrower profile. A borrower seeking their first-ever credit card, for instance, might only qualify for a relatively low credit limit, even if they had a very low DTI ratio thanks to high income and low debt.

- Economic trends: Along with factors related to your credit and payment history, conditions outside your control also can affect credit limits. When global or regional economic conditions hit a slump, everyone affected is statistically at greater risk of inability to repay their debts. In response, lenders may seek to reduce their exposure by increasing credit standards, reducing credit limits for new customers, and even lowering the credit limits of existing borrowers.

Do Lenders Look at Income to Determine Your Credit Limit?

Yes, lenders typically ask you to state your income when applying for a credit card, and they may ask for verification in the form of a pay stub or income tax return. While this information is used in calculating your credit limit, it is not the only factor.

5 Steps to get MASSIVE CREDIT Limit Increases (FAST)

FAQ

Is $20,000 a high credit limit?

Yes, $20,000 is a high credit card limit. A credit card limit of $5,000 or more is usually considered high. To get a limit of $20,000 or more, you will probably need good or excellent credit and a steady income.

Is $20,000 in credit card debt a lot?

If you have a big balance, like $20,000 in credit card debt, that rate could hurt your finances even more. The longer the balance goes unpaid, the more the interest charges compound, turning what could have been a manageable debt into a hefty financial burden.

What credit card has a 20 000 limit?

A credit card with a $20,000 limit is considered a high-limit card. Many issuers offer cards with starting limits in this range, and some even go higher, potentially reaching $100,000 or more for qualified applicants.

What is considered a high credit limit?

A credit limit of $5,000 or more is generally considered a high credit limit. However, what’s considered high can also vary based on individual circumstances, such as income and credit history.