The current average mortgage rate for someone with a good credit score (700) was 7. 42% as of January 3, 2025, according to Curinos data. Your credit scores can directly impact your eligibility for a mortgage and the interest rate you receive. You may need a score in the high 700s (or higher) to get the best interest rate.

For someone with good credit (700), the average interest rate on a conventional 30-year fixed-rate mortgage was 7. 42% as of January 3, 2025, according to Curinos data. To get a mortgage, your credit score needs to be at least 580. To get the best interest rate, it needs to be at least 760.

Hey there, dreamer! Got your eye on a sweet little house but wondering, “Can I get a home loan with a 729 credit score?” Well, I’m here to tell ya—yep, you sure can! A 729 score ain’t perfect, but it’s pretty darn good and definitely enough to get you in the game for most mortgages Stick with me, and we’re gonna unpack everything you need to know about rockin’ that score, what kinda loans you might qualify for, and how to make your application shine brighter than a new penny

What’s the Deal with a 729 Credit Score? Let’s Get Real

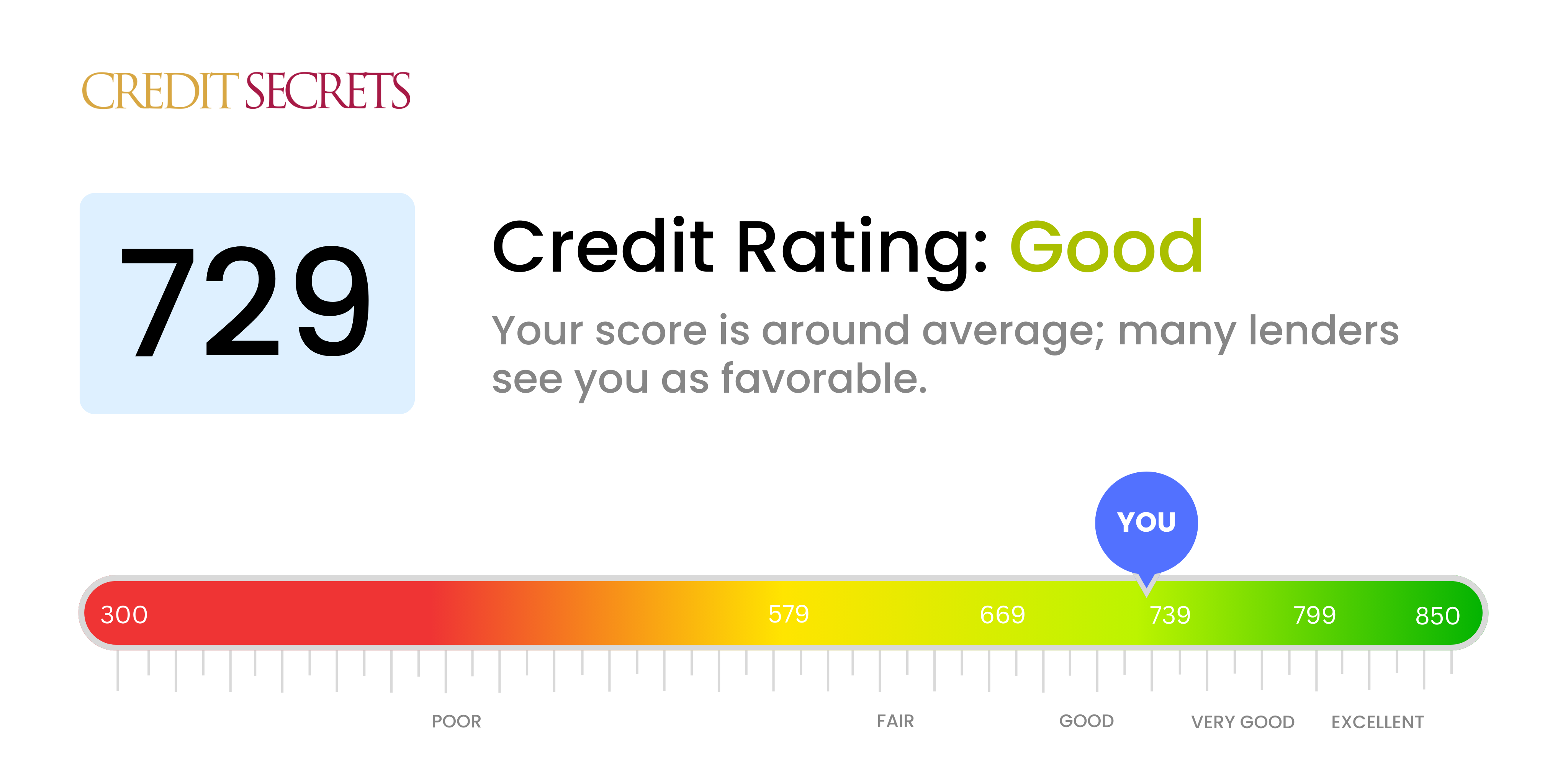

First, let’s talk about what a credit score of 729 means. Credit scores can be anything from 300 to 850, with 850 being the best. Your 729 is right in the “Good” range, which is from 670 to 739. That’s higher than the average American score of 714, so congrats! You’re doing better than a lot of people!

Here’s why this matters for a home loan

- It’s above the minimums. Most lenders want at least a 620 for a conventional loan and 580 for government-backed options like FHA loans. You’re clearin’ those hurdles with room to spare.

- It shows you’re reliable. A score like yours tells lenders you usually pay your bills on time and ain’t drowning in debt. They see you as a lower-risk bet.

- But it ain’t elite. Scores of 740 and up often snag the best interest rates and terms. With 729, you might not get the cream of the crop, but you’re still in a solid spot.

Check out this table of credit score ranges based on the FICO model, which is what most lenders use, to get an idea of what they mean:

| Score Range | Category | What It Means for Loans |

|---|---|---|

| 300-579 | Poor | Tough luck gettin’ approved, might need special loans. |

| 580-669 | Fair | Possible with FHA, but terms ain’t great. |

| 670-739 | Good | You’re here! Most loans are doable, decent rates. |

| 740-799 | Very Good | Better rates, more options, lenders love ya. |

| 800-850 | Exceptional | Top-tier everything, best deals around. |

You’re pretty much in the “Good” zone with your 729. Most likely, lenders will agree to give you a mortgage, but they might not offer the best rates right away. No biggie—we’ll talk about how to work around that.

Can You Actually Get That Home Loan? Spoiler: Yup!

Alright, let’s cut to the chase. With a 729 credit score, you can absolutely qualify for a home loan. Most conventional loans, the kind that follow standard rules set by big players in the mortgage world, ask for a minimum of 620. You’re way past that. Even better, if you’re lookin’ at an FHA loan, which is awesome for first-time buyers or folks with smaller down payments, the bar is often as low as 580. You’re golden there too!

But hold up, it ain’t just about meetin’ the minimum. Here’s what you gotta know:

- Conventional Loans: These usually need at least a 620 score, and with 729, you’re in. You might need a decent down payment, like 20%, to avoid extra fees called PMI (private mortgage insurance). But if you can’t swing that, a smaller down payment might still work with PMI tacked on.

- FHA Loans: Backed by the government, these are more forgiving. With a score above 580, you might only need 3.5% down. Sweet deal if your savings ain’t huge yet.

- VA or USDA Loans: If you’re a veteran or buyin’ in a rural area, these government loans might be an option. VA loans often have no minimum score set by the government, though lenders might want 620 or higher. USDA loans also hover around 620-640. Your 729 clears it easy.

Now, just so you know, your score will get you in the door, but it might not get you the best APR. People whose credit scores are above 740 can usually lock in lower rates, which can save them thousands of dollars over the life of the loan. If you have a 729, your rate may be more like the national average than the very best. Still, it’s possible, and I’ve seen a lot of people with scores like yours buy their dream home.

What Else Do Lenders Look At? It Ain’t Just the Score, Fam

Now, don’t go thinkin’ your credit score is the only thing lenders care about. Nah, they’re gonna peek at your whole financial picture. A 729 score is a great start, but here’s the other stuff they’re snoopin’ on:

- Your Income: Can you afford the monthly payments? Lenders wanna see steady employment and enough cash comin’ in to cover the mortgage plus your other bills.

- Debt-to-Income Ratio (DTI): This is how much of your income goes to debt each month. For a conventional loan with a score like yours, they might let your DTI go up to 45% if other stuff looks strong. Lower is better, though—aim for under 36% if you can.

- Down Payment: Got 20% to put down? That’s ideal for conventional loans to skip extra fees. If not, options like FHA let you go lower, but your score bein’ 729 means they won’t stress too much.

- Assets and Savings: They’ll check if you’ve got reserves—some extra cash in the bank for emergencies. Shows you ain’t livin’ paycheck to paycheck.

- Employment History: Been at your job a while? Stability looks good. Jumpin’ around a lot might raise eyebrows, even with a solid score.

Here’s a quick tip from yours truly: If your DTI is high or your down payment is small, that 729 score still gives ya a fightin’ chance. Just be ready to explain your story or show other strengths, like a fat savings account. Lenders wanna lend—they just need to feel safe about it.

What Kinda Rates Can You Expect? Let’s Talk Turkey

Alright, let’s get down to the nitty gritty—interest rates. With a 729 credit score, you’re not gonna get the worst rates out there, but you prob’ly won’t get the absolute best neither. Here’s the scoop based on what I’ve seen:

- For conventional loans, someone with a score over 720 might snag rates close to the lowest available, maybe around the national average or a smidge higher.

- Compare that to someone with a score in the low 600s—they’re lookin’ at much higher rates, costin’ way more over time.

- Your 729 puts you in a sweet spot where rates are decent, prob’ly not far off what most folks pay, but you might save a bundle if you can bump that score up just a bit more.

Here’s a lil’ example (numbers are just for kicks, not exact): On a $300,000 loan over 30 years, a rate of 5% versus 4.5% could mean payin’ thousands extra in interest. That half a percent matters, and a higher score often gets ya closer to the lower end. With 729, you’re likely closer to 5% than 4.5%, but shoppin’ around with different lenders can help ya find a better deal. Don’t just settle for the first offer, alright?

How to Boost That 729 to Get Better Deals? I Gotchu

Now, if you’re thinkin’, “Man, I want those killer rates,” or just wanna make your application bulletproof, let’s talk about bumpin’ up that score. Even a few points can push ya into the “Very Good” range (740-799), where lenders start throwin’ better terms at ya. Here’s how we can make it happen:

- Pay Bills on Time, Every Time: This is huge. Late payments can tank your score faster than a hot knife through butter. Set reminders or automate payments—don’t let a silly oopsie mess ya up.

- Lower Your Credit Usage: If you’ve got credit cards, try to use less than 30% of your limit. Got a $10,000 limit? Keep the balance under $3,000. Even better, aim for under 10% if you can swing it. Pay down debt quick-like.

- Don’t Apply for New Credit Right Now: Every time you apply for a card or loan, it can ding your score a bit with a “hard inquiry.” Lay off new applications while you’re house huntin’.

- Let Your Credit Age: Older accounts help your score. Don’t close old credit cards, even if you don’t use ‘em much. Keep ‘em open to show a long history.

- Check Your Report for Goofs: Pull your credit report for free (you can do it once a year from each big bureau). Look for errors—wrong late payments or accounts that ain’t yours. Dispute ‘em if you spot somethin’ fishy.

I’ll be real with ya—boostin’ your score takes a bit of time, usually a few months to see big changes. But even small jumps, like gettin’ to 740, can save ya dough on interest. Start now, and by the time you’re ready to sign papers, you might be in a better spot.

What If Your Score Ain’t the Only Issue? Workarounds, Baby!

Say your 729 is solid, but other parts of your finances are a lil’ shaky. Maybe your DTI is high, or you ain’t got a big down payment saved. Don’t sweat it—there’s ways to still make this home loan happen:

- Look at FHA Loans: Like I said earlier, these need just 3.5% down if your score’s over 580. Perfect if savin’ up is tough right now.

- Get a Co-Signer: Got a family member with stellar credit? If they’re willin’ to co-sign, it can boost your application. Just know they’re on the hook if ya miss payments, so don’t mess around.

- Shop Around: Different lenders got different rules. One might say no, but another might love your 729 score and work with ya on other weak spots. Don’t give up after one rejection.

- Save More for Down Payment: Even if it takes longer, a bigger down payment can offset a not-perfect score. Shoot for 10-20% if ya can, and lenders will be more likely to say yes.

I remember when I was helpin’ a buddy buy his first place. His score was around your range, but his debt was a lil’ high. He took a few months to pay down some cards, got an FHA loan, and bam—he’s grillin’ in his own backyard now. It’s doable with a lil’ hustle.

Why Your 729 Score Is a Win, Even If It Ain’t Perfect

Let me remind ya—havin’ a 729 credit score is somethin’ to be proud of. It’s better than a huge chunk of folks out there, and it opens doors to homeownership that lower scores just can’t touch. Sure, it ain’t gonna get you the absolute best mortgage rates, but it’s more than enough to get started. Tons of people buy homes with scores in this range every day, and you can too.

Think of it this way: Your score is like a decent car—it’ll get ya where you’re goin’, even if it ain’t a Ferrari. You can still cruise into that new home, and with a bit of tunin’ (like improvin’ your score or savin’ more), you’ll be ridin’ even smoother down the road.

Other Tips to Nail That Home Loan Application

Before we wrap this up, I wanna toss out a few more nuggets of wisdom to help ya seal the deal on that home loan:

- Get Pre-Approved: Before you even start lookin’ at houses, hit up a lender for pre-approval. It shows sellers you’re serious and gives ya a clear budget. With a 729 score, pre-approval shouldn’t be a hassle.

- Avoid Big Purchases Now: Don’t go buyin’ a new car or rackin’ up credit card debt while applyin’ for a mortgage. Lenders check your finances up to the last minute, and new debt can spook ‘em.

- Work with a Pro: A mortgage broker or loan officer can be your best pal. They know the ins and outs, and with your solid score, they can match ya with the right loan type.

- Be Patient: If your score or finances need work, don’t rush. Takin’ a few extra months to improve things can save ya big bucks in the long run.

I’ve seen peeps jump the gun and end up with crummy terms ‘cause they didn’t wait. Take your time, get your ducks in a row, and you’ll be unlockin’ that front door before ya know it.

Wrappin’ It Up—You’ve Got This!

So, can you get a home loan with a 729 credit score? Heck yes, you can! It’s a strong score, sittin’ pretty in the “Good” range, and well above the minimums for most loans, whether conventional, FHA, or other options. Sure, you might not get the rock-bottom interest rates reserved for folks with 740+, but your score is more than enough to get ya started on the path to homeownership.

We’ve covered the basics—your score’s meanin’, the types of loans you can grab, what else lenders look at, and how to boost your chances even more. Remember, it ain’t just about the number. Your income, debt, and down payment play a part too, but with 729, you’ve got a solid foundation to build on.

If you’re feelin’ hyped to take the next step, go chat with a lender or check your full financial picture. Maybe take a stab at bumpin’ that score a tad higher for better deals. Either way, I’m rootin’ for ya. That dream home ain’t as far off as you might think—go get it, champ!

How Credit Scores Affect Mortgage Rates

Your credit score has a direct effect on the types of mortgages you can get and the interest rate you get. Generally, a higher credit score can help you qualify for more types of mortgages, a larger loan, a lower down payment and a lower interest rate.

However, unlike when you apply for most loans or credit cards, mortgage lenders tend to request credit scores based on all three of your credit reports and use specific credit scoring models.

Heres a closer look at credit scores and how they can affect your options and rates when you apply for a mortgage.

A credit score is a number that creditors can use to assess the risk that a consumer will miss a payment by at least 90 days. There are a lot of different kinds of credit scores, and companies like FICO and VantageScore® are always coming out with new versions and types.

Most credit scores get their information from your credit report from one of the three major credit bureaus: Equifax, Experian, or TransUnion. Many credit scores, including the scores commonly used for mortgages, range from 300 to 850. A higher score is better because it indicates the person is less likely to miss a payment.

Most scores consider similar factors, such as your payment history and credit utilization ratio, but the specific factors and weighting depend on the type of credit score.

Your Finances and the Loan’s Specifics

- Your DTI: If your DTI is lower, you might be able to get a lower interest rate.

- Your down payment: The loan-to-value (LTV) ratio will depend on how much of a down payment you make. A lower LTV means a bigger down payment, which could mean a lower interest rate. In the event that you don’t put down at least 20% on a conventional loan, you may also have to pay for mortgage insurance.

- If the home is your main residence: Mortgage rates can be different if the home is your main residence, a second home, or an investment property.

- The size of the loan: If your loan is very big or very small, you may have to pay more in interest. Lenders might be more risky with a big loan, and if the rate is low, a small loan might not make enough money.

- The type of loan: Interest rates are usually higher or lower for certain types of mortgages. Like, the rate on a VA loan might be lower than the rate on a regular loan.

- In general, fixed-rate mortgages have higher rates at the beginning than adjustable-rate mortgages (ARMs). However, the interest rate on an ARM could go up in the future.

- Time it takes to pay back the loan: A mortgage with a shorter time to pay it off, like 15 or 20 years, may have a lower interest rate than a 30-year mortgage.

- Mortgage credits and points: You might be able to buy mortgage points to lower your interest rate or get credits that cover your closing costs in exchange for a higher rate.

- There may be different rates and terms for loans from different lenders, even if everything else is the same.

- The current state of the market, such as inflation and bond rates, could have an impact on mortgage rates in general.

- How far away the house is: The distance between the house and the bank probably won’t have a big effect on your interest rate, but it could.

orDown paymentTermInterest rateProperty tax (annual)Home insurance (annual)Mortgage insurance (PMI)Monthly HOA

How Do I Get A Mortgage with a Zero Credit Score?

FAQ

What credit score do I need to buy a $250000 house?

To buy a $250,000 house, you’ll likely need a credit score of 620 or higher to secure a conventional home loan. Jan 1, 2025.

What can I do with a 729 credit score?

A 729 credit score is generally considered “good” and offers access to a variety of financial opportunities, including favorable loan terms and credit card options.

What is the minimum credit score to get a home loan?

The minimum credit score needed for a home loan varies by loan type, but generally, a score of 620 or higher is required for conventional loans.

What interest rate can I get with a 729 credit score?

| Used Auto Loan Rates – 2020 & Newer | Tier A+ | Tier A |

|---|---|---|

| Primary borrower credit score | 730+ | 729-680 |

| Max Term | APR | |

| 72 | 6.74% | 7.74% |

| 60 | 6.29% | 7.29% |