Ready to tackle your mortgage and get it paid off in 7 years? First, let’s get a few things straight:

Are you ready to pay off your mortgage years early? It’s time to get smart! These tried-and-true strategies will show you how to speed up your payoff and reach financial freedom faster. Let’s get into the tactics that can help you reach that 7-year goal — or even beat it!.

Do you have a 15-year mortgage and want to be debt-free in 5 years? That’s the kind of goal that gets me excited! I’m here to tell you that it’s not just a pipe dream—you can make it happen if you follow these steps. If you can pay off a 15-year mortgage in three years instead of five, you’ll save a lot of money on interest, own your home outright, and feel very free much sooner. How can we make this happen? Stay with me, and I’ll show you step by step with real-life examples and useful advice.

You can pay off a 15-year mortgage in 5 years if you make extra payments, switch to biweekly payments, refinance if it makes sense, and put all of your extra money toward the principal. It will take discipline, some budget changes, and maybe even a side job or two, but we can do it! Let’s get into the details and get you on the fast track to a paid-off crib.

Why Even Bother Paying Off a 15-Year Mortgage So Fast?

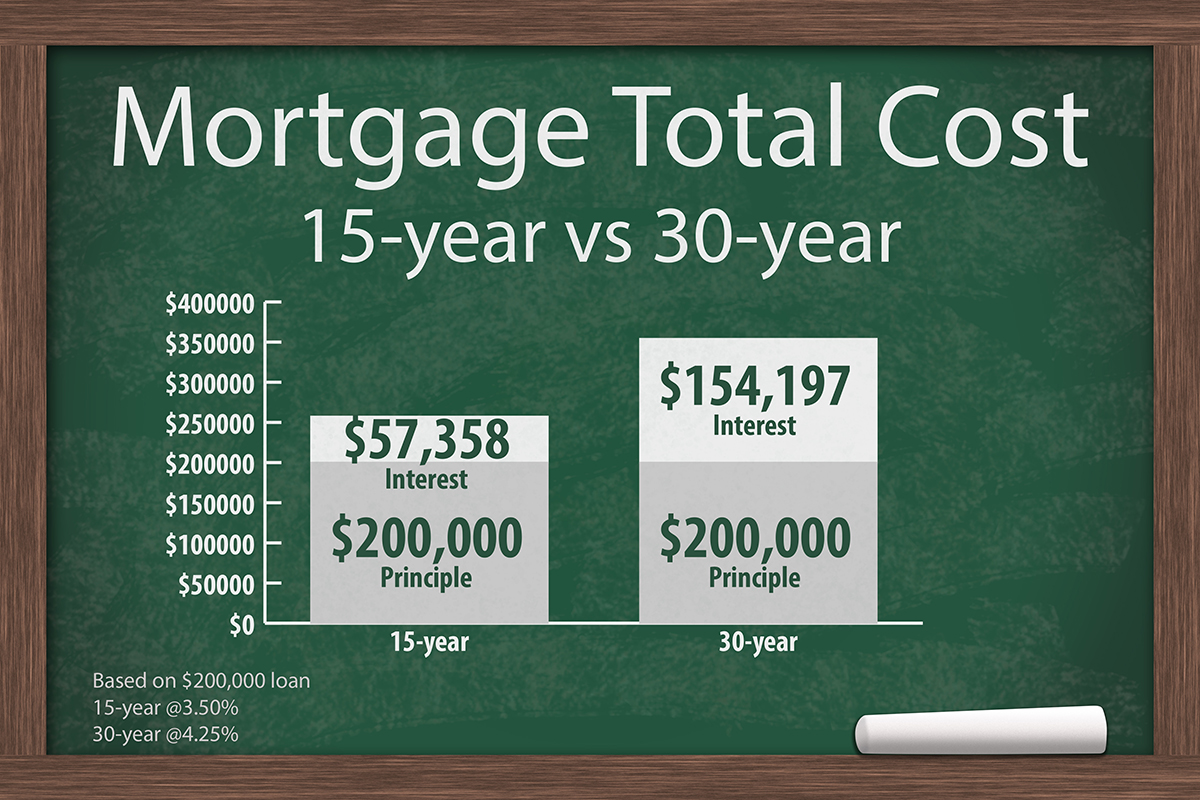

Before we get into the how let’s chat about the why. A 15-year mortgage already saves you a ton of interest compared to a 30-year one but cuttin’ it down to 5 years? That’s next-level. Here’s why it’s worth the hustle

- Save a Boatload on Interest: The quicker you pay, the less interest piles up. We’re talkin’ potentially tens of thousands saved, dependin’ on your loan size and rate.

- Own Your Home Outright: Imagine no more monthly payments by the time most folks are still a decade away from payoff. That’s real security, fam.

- Financial Freedom: No mortgage means more cash to invest, save, or just enjoy life without that debt hangin’ over ya.

- Peace of Mind: There’s somethin’ magical about knowin’ your home is 100% yours. No bank, no stress.

Let’s get to the why now that we’re excited about the how. Let’s make this happen right away.

Strategy #1: Throw Extra Cash at Your Principal Like It’s Confetti

The fastest way to chop down that mortgage is to make extra payments, plain and simple. Every extra buck you pay goes straight to the principal (the actual amount you borrowed), not the interest, which shrinks your balance faster. Here’s how to do it:

- Start Small if You Gotta: Even an extra $50 or $100 a month can shave off months or years. For a $300,000 loan at 5% interest, just $100 extra monthly could cut nearly 5 years off and save over $25,000 in interest. Bump it to $200, and you’re lookin’ at savin’ over $40,000 and slicin’ off 8 years!

- Make It Regular: Set up a plan to pay extra every month. Automate it if you can, so you don’t even think twice.

- Label It Right: When you send that extra payment, make sure your lender knows it’s for the principal, not next month’s bill. Some banks are sneaky and might apply it wrong if you don’t specify.

- Check for Penalties: Most lenders let you pay extra without a hitch, but double-check if there’s a prepayment penalty. Ain’t nobody got time for surprise fees.

I’ve seen folks start with whatever they can spare, then ramp it up as they get raises or cut expenses. That’s the mindset—every lil’ bit helps.

Strategy #2: Switch to Biweekly Payments for Sneaky Speed

Here’s a slick trick that don’t require much extra cash upfront: biweekly payments. Instead of payin’ once a month, you pay half your monthly amount every two weeks. Sounds basic, but it’s powerful. Let’s break it down:

- How It Works: There’s 52 weeks in a year, right? Payin’ biweekly means 26 half-payments, which equals 13 full payments instead of the usual 12. That’s like sneakin’ in an extra month’s payment without feelin’ the pinch.

- Time Saved: On a 15-year mortgage, this can knock off a couple years or more, dependin’ on your loan. For some folks, it’s been like cuttin’ 4 years and change off the term.

- Interest Savings: That extra payment each year hits the principal sooner, savin’ you thousands in interest over time.

- Watch Out: Some lenders charge fees for biweekly setups. Don’t fall for that nonsense—set it up yourself by dividin’ your payment and sendin’ it manually if needed.

We’ve played this game ourselves, and it’s like a cheat code. You barely notice the difference in your budget, but the payoff timeline shrinks like magic.

Strategy #3: Refinance to Turbocharge Your Payoff

It may seem like a hassle to refinance, but if the numbers work out, it can make all the difference. You should get a new loan with better terms so that you can pay it off faster. Here’s the scoop:

- Lower Interest Rate: If rates have dropped since you got your 15-year mortgage, refinancin’ to a lower rate means less interest over time. Even a 1% drop can save you big bucks.

- Shorter Term (Maybe): Since you’re aimin’ for 5 years, you might already be on a short term, but check if a tweak makes sense. Just know shorter terms mean higher monthly payments.

- Costs to Consider: Refinancin’ ain’t free—there’s closin’ costs and fees. Make sure the savings outweigh the upfront hit.

- Fake It ‘Til You Make It: If rates ain’t better right now, just pretend you refinanced by uppin’ your monthly payment as if you had a shorter term. Same effect, no fees.

I remember a buddy who refinanced when rates dipped, and it was like givin’ his payoff plan a rocket boost. Crunch your numbers with a mortgage calculator to see if it’s worth it for ya.

Strategy #4: Slash Your Budget to Free Up More Dough

Payin’ off a mortgage in 5 years means you gotta find extra cash somewhere, and that often starts with your budget. We ain’t talkin’ about livin’ on ramen forever, just gettin’ smart with your spendin’. Here’s where to look:

- Cut the Fat: Look at your monthly expenses. Them streaming subscriptions addin’ up? Cancel a couple. Eatin’ out too much? Cook at home more often, it’s cheaper.

- Grocery Hacks: Shop sales, buy in bulk, or switch to a less pricey store. Savin’ even $50 a month on food can go straight to your mortgage.

- Ditch Unneeded Stuff: Got a gym membership you never use? Say bye-bye. Online shoppin’ got ya in a chokehold? Cool it for a bit.

- Insurance Check: Shop around for better rates on car or home insurance. A quick call to a broker might save ya hundreds a year.

When we tightened our belt a few years back, it was surprisin’ how much extra we could throw at the house. Little changes add up, trust me.

Strategy #5: Use Windfalls and Extra Income Wisely

Got a bonus comin’? Tax refund? Side gig payin’ off? Don’t blow it on a fancy vacay—throw it at your mortgage! Here’s why this works:

- Big Chunks Matter: A one-time payment of, say, $5,000 on a $200,000 loan could knock off months or even a year, dependin’ on your interest rate.

- Raises and Bonuses: If your job gives ya a bump in pay, don’t inflate your lifestyle. Funnel that extra straight to the principal.

- Side Hustles: Pick up a gig—freelancin’, drivin’ for rideshares, whatever. Every dollar from that hustle can speed up your payoff.

I’ve had times where a random chunk of cash came my way, and instead of splurgin’, I dumped it on the mortgage. Felt like I was winnin’ every time.

A Quick Look at the Numbers: How Much Extra Do You Need?

To pay a 15-year mortgage in 5 years, you’re basically triplin’ the speed. Let’s sketch this out with a rough example for a $300,000 loan at 5% interest:

| Scenario | Monthly Payment | Total Interest Paid | Payoff Time |

|---|---|---|---|

| Standard 15-Year Mortgage | ~$2,372 | ~$127,000 | 15 Years |

| Aggressive 5-Year Plan | ~$5,775 | ~$46,500 | 5 Years |

To hit that 5-year mark, you’d need to pay roughly 2.5 times the standard monthly amount (or find ways to hit that equivalent with lump sums and extras). That’s a heavy lift, no doubt, but strategies like biweekly payments and windfalls can ease the burden.

Watch Out for These Gotchas

Payin’ off early is awesome, but there’s a few traps to dodge. Keep your eyes peeled for these:

- Prepayment Penalties: Some lenders hit ya with fees for payin’ early. Check your loan docs or call ‘em up to confirm.

- Liquidity Crunch: If you dump all your cash into the mortgage, you might be strapped if an emergency hits. Keep a solid emergency fund—3 to 6 months of expenses—before goin’ all-in.

- Tax Deduction Loss: Payin’ off early means losin’ the mortgage interest deduction on taxes. But honestly, the interest you save usually outweighs the tax perk.

- Opportunity Costs: Could that extra cash earn more in investments? If your mortgage rate is low, like 3%, and you could make 8% in the market, it might be smarter to invest instead. Think it through.

We’ve learned the hard way to balance speed with safety. Don’t leave yourself high and dry just to hit that 5-year mark.

Mindset Matters: Stayin’ Committed to the Grind

This ain’t just about numbers—it’s a mental game too. Payin’ off a mortgage in 5 years takes grit. Here’s how to keep your head in it:

- Set Mini-Goals: Celebrate every $10,000 or year you knock off. Little wins keep ya motivated.

- Track Progress: Use a mortgage payoff calculator online to see how your extra payments move the needle. It’s like a scoreboard for your debt.

- Avoid Lifestyle Creep: When you get more income, don’t spend more. Keep livin’ lean and throw the extra at the house.

- Get a Cheerleader: Tell a buddy or family member your goal. They’ll keep ya accountable when you’re tempted to slack.

I’ve found that keepin’ my “why” in mind—like wantin’ to retire early or just hate debt—fuels me through the tough months.

What If 5 Years Feels Too Crazy?

If triplin’ your payments feels outta reach, don’t sweat it. Even payin’ off in 7 or 10 years is a huge win over the full 15. Adjust these strategies to fit your life:

- Aim for 7 Years: Add an extra $300-$500 a month instead of goin’ full throttle. Still saves a ton of interest.

- Mix and Match: Combine biweekly payments with occasional lump sums when you can. Slow and steady still beats the standard pace.

- Reassess Yearly: Life changes—revisit your plan annually to see if you can ramp up or need to dial back.

We’ve had to tweak our own goals when unexpected bills popped up. Flexibility is key, but keep pushin’ forward.

Tools to Keep You on Track

Don’t do this blind—use some resources to stay sharp:

- Budget Apps: Track your income and expenses to find extra cash. Apps are a lifesaver for stayin’ organized.

- Mortgage Calculators: Plug in your loan details and extra payments to see how fast you can pay off. It’s eye-openin’ to see the impact.

- Financial Advisor: If you’re unsure about opportunity costs or big moves like refinancin’, chat with a pro for a reality check.

I’ve leaned on calculators myself to map out what-if scenarios. They take the guesswork outta the equation.

Wrappin’ It Up: You Got the Power to Do This

Payin’ off a 15-year mortgage in 5 years is a bold, badass goal, and I’m rootin’ for ya every step of the way. It’s about makin’ extra payments whenever you can, switchin’ to biweekly to sneak in more, refinancin’ if the stars align, cuttin’ your budget to free up funds, and usin’ any windfalls to hit that principal hard. Yeah, there’s challenges—like potential fees or missin’ out on other investments—but the reward of ownin’ your home free and clear is worth the grind.

Start today. Look at your budget, figure out what extra you can pay this month, and call your lender to make sure them payments go to principal. Use a calculator to see how fast you can go, and keep that vision of a debt-free life front and center. We’re in this together, and I know you’ve got the guts to make it happen. Let’s get that mortgage gone, fam! Drop a comment if you’ve got tricks or questions—I’m all ears.

Clear Other Debts, Then Attack Your Mortgage

If you have other debts, use the debt snowball method (paying off the smallest debt first, regardless of interest rate) to eliminate them. Then, throw all that freed-up money at your mortgage. This gives you quick wins and keeps you motivated.

Cut Costs and Boost Income to Fuel Your 7-Year Mortgage Payoff

Scrutinize your budget and trim the fat. Look for ways to earn more — a side gig, a raise, anything! Every extra dollar goes towards your mortgage. More money in, less money out — it’s simple math!.

How I Paid Off My Mortgage in 5 Years!

FAQ

How much money can you save with a 15-year mortgage?

If you kept the 30-year mortgage and made all your payments on schedule for those three decades, you’ll pay about $335,000 in total interest over the life of the loan. But if you switch to a 15-year mortgage with a lower rate of 6. 5%, you’ll save close to $200,000—and you’ll pay off your home in half the time!.

How often should you make a mortgage payment?

Make biweekly payments – Most homeowners make their mortgage payments on a monthly basis. However, some savvy borrowers pay half of their mortgage payment every two weeks to make an extra payment every year. This bi-weekly mortgage payment accelerates your loan payoff and reduces the overall interest that you’ll pay on your loan.

How do I pay off my mortgage in 5 years?

The following are some the most common strategies homeowners use to pay off their mortgage in five years or less. Step One is simply figuring out how much extra to pay each month to hit your goal. There are many free online mortgage calculators that will help you calculate your new payment.

How do I pay off a 150K mortgage in 5 years?

You’d have to pay an extra $2,025 a month on top of your regular mortgage payments to get rid of a $150,000 loan in 5 years. How can I pay a $200,000 loan in 5 years?

Should you knock out your mortgage in less than 15 years?

There is less risk of not being able to make payments if you pay off a 15-year mortgage early. When you pay half your monthly mortgage payment every two weeks, you make 13 full payments on your mortgage every year, instead of only 12.

Should I pay off my mortgage in less than 15 years?

Paying off your mortgage in less than 15 years has several benefits. You end up paying less in interest and have less debt to worry about and less risk of not being able to make the payments on your home.

Can I pay off a 15-year mortgage in 5 years?

Paying off your mortgage in 5 to 7 years is possible with the right strategies and commitment. Making bi-weekly payments can significantly reduce your loan term. Refinancing to a shorter-term loan can accelerate payoff but may increase monthly payments.

What happens if I pay two extra mortgage payments a year on a 15-year mortgage?

As low as the interest rates are and the loan term is only 15, making extra payments can save you money on interest. By paying down the principal faster, you lower the interest that is charged, which saves you money that you can use for other financial goals.

What happens if I pay an extra $100 a month on my mortgage?

What is the 2 rule for paying off a mortgage?

The 2% rule for a mortgage payoff involves refinancing your mortgage. Refinancing is when you take out a new loan to pay off your existing loan—ideally at a lower interest rate. The 2% rule states that you should aim for a new refinanced rate that is 2% lower than your current rate on the existing mortgage.