A good credit score can help you get lower interest rates on credit cards and loans, increase your approval odds when applying to rent a house and potentially even lower your insurance premiums.

To get the benefits of good credit, though, you’ll need to work on it and stay away from mistakes that can hurt it. Key takeaways.

Hey there fam! If you’re readin’ this, chances are you’re either curious ‘bout your credit score or you’ve already got a sneaky feelin’ you might’ve messed it up. Well I’m here to lay it out straight—no fluff, just real talk. At [Your Company Name], we’ve seen folks struggle with their credit, and lemme tell ya, it ain’t fun when you’re stuck with a lousy score. It can mess with your dreams of buyin’ a house, gettin’ a car, or even just snaggin’ a decent credit card. So, what are two surefire ways to hurt your credit? I’m gonna break it down for ya right now, then we’ll dive deeper into why these suck so bad and how to dodge ‘em.

The Big Two: How to Wreck Your Credit Score Fast

Let’s not beat around the bush. Here are the two worst things you can do to your credit score faster than you can say “late payment”:

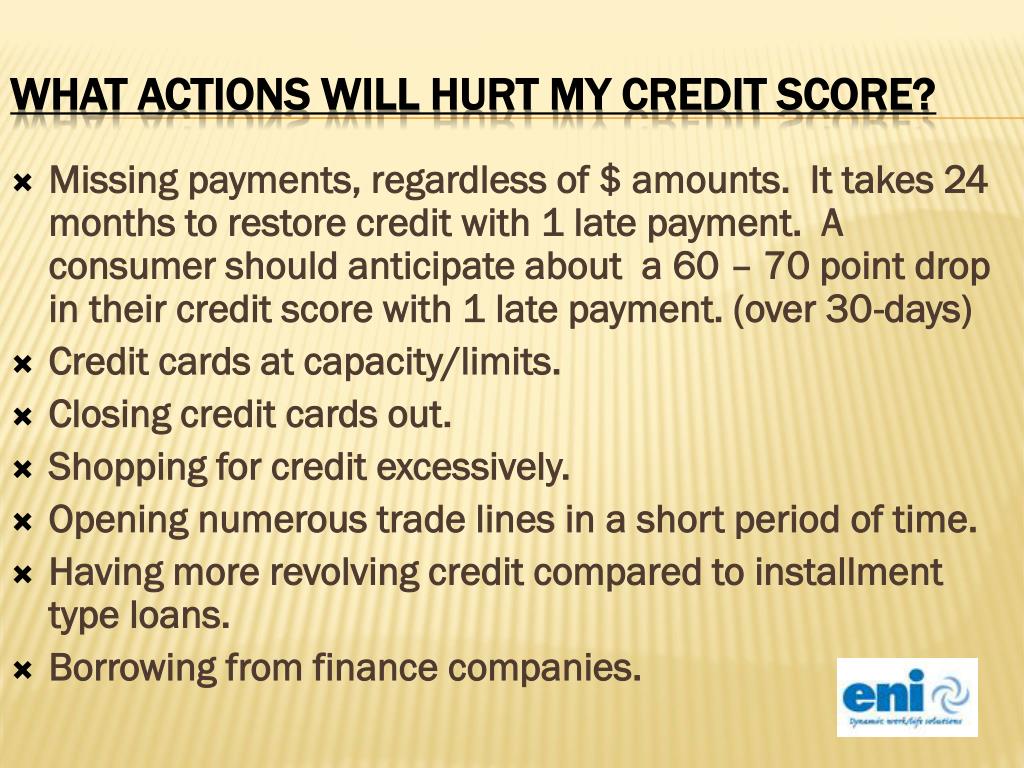

- Missing or Making Late Payments: Forget to pay your bills on time? Yeah, that’s a massive no-no. Even one late payment can slap a dent in your score, and it sticks around on your record for a long, long time.

- Using Too Much of Your Available Credit: Maxin’ out your credit cards or hoverin’ close to your limit makes lenders think you’re in over your head. It’s a red flag, and your score takes a hit big time.

These are not small mistakes; they are big deal mistakes that affect a big part of your credit score. Let’s break down each one so you know why they’re such a problem and what you can do about it.

1. Late Payments: The Silent Credit Killer

Alright, let’s start with the numero uno way to hurt your credit—bein’ late on payments. I’ve been there, man, thinkin’ “oh, I’ll pay it tomorrow,” and before ya know it, tomorrow turns into a month. Here’s the deal: your payment history is like the backbone of your credit score. It’s a whopping 35% of how that number gets figured out. So, when you miss a payment or pay after the due date—usually by 30 days or more—it gets reported to the credit bureaus. Bam! Your score drops faster than a hot potato.

Why It Hurts So Bad

- Long-Lasting Damage: Once that late payment hits your credit report, it ain’t goin’ nowhere for seven years. Seven! That’s a long time to carry around a financial oopsie.

- Instant Impact: Even just one missed payment can knock points off your score. The better your credit was before, the harder the fall. If you had a shiny high score, you might lose more than someone already in the dumps.

- Ripple Effect: Late payments don’t just hurt your score; they can lead to fees, higher interest rates, and sometimes even a lower credit limit from your lender. It’s a downward spiral, y’all.

Real Talk Example

Picture this you’ve got a credit card bill due on the 15th Life gets crazy, maybe you forgot or didn’t have the cash, and you miss it By the time you pay on the 20th of next month, it’s over 30 days late. That gets flagged, and your score might dip by 50 points or more if you had good credit to start with. I’ve seen friends go through this, and it sucks watchin’ ‘em stress over somethin’ so avoidable.

How to Dodge This Bullet

- Set Reminders: Use your phone, sticky notes, whatever—just don’t forget. I’ve got calendar alerts for every bill, and it’s saved my butt more than once.

- Autopay Is Your Friend: Set up automatic payments for at least the minimum due. Yeah, it feels weird handin’ over control, but it beats a late mark on your record.

- Reach Out Early: If you know you can’t pay, call your lender before the due date. Sometimes they’ll work with ya on a new plan or waive a fee. Don’t wait ‘til it’s too late.

Missin’ payments is like steppin’ on a financial landmine. It’s avoidable if you stay on top of things, so let’s make sure that don’t happen to us, alright?

2. High Credit Utilization: Maxin’ Out Ain’t Cool

Now, onto the second biggie—usin’ too much of your available credit. This one’s sneaky ‘cause you might think, “Hey, I’ve got a $10,000 limit, why not spend $9,000 of it?” Well, hold up. That’s called high credit utilization, and it’s 30% of your credit score. Basically, it’s how much of your credit limit you’re usin’ compared to what you’ve got total. Lenders wanna see you usin’ less than 30%—ideally under 10%—’cause goin’ over makes ya look risky, like you’re livin’ beyond your means.

Why It’s a Problem

- Signals Desperation: If you’re close to maxin’ out your cards, lenders think you’re strugglin’ to keep up. It’s like walkin’ around with a sign sayin’ “I might not pay ya back.”

- Big Score Drop: Since it’s 30% of your score, a high utilization rate can cost ya tons of points. I’ve heard of folks losin’ over 100 points just from maxin’ out a single card. Yikes!

- Hard to Fix Quick: Unlike a late payment that’s a one-time thing, high utilization sticks around ‘til you pay down them balances. It’s a slow grind to recover.

A Quick Peek at the Math

Wanna know how it works? It’s simple. Say you’ve got a credit card with a $5000 limit, and your balance is $2,500. Divide that balance by the limit (2500 / 5,000 = 0.5), then multiply by 100. That’s a 50% utilization rate—way over the 30% sweet spot. Here’s a lil’ table to show ya what’s good and bad

| Balance | Credit Limit | Utilization Rate | Impact on Score |

|---|---|---|---|

| $500 | $5,000 | 10% | Positive ✅ |

| $1,500 | $5,000 | 30% | Neutral, but okay |

| $2,500 | $5,000 | 50% | Negative ❌ |

| $4,500 | $5,000 | 90% | Disaster zone! ❌ |

Real-Life Mess-Up

A friend of mine once thought it was okay to stock up on holiday gifts. He hit like 80% of his limit. His credit score dropped so badly that he couldn’t even get a small loan when his car broke down. He had to pay extra for months in order to get that balance down. Don’t be like him, y’all.

How to Keep It in Check

- Pay More Than Minimum: Don’t just pay the minimum due; throw extra cash at that balance to lower it quick. I try to pay double if I can.

- Spread It Out: If you’ve got multiple cards, split your spendin’ so no single card gets too high. Keeps that ratio lookin’ nice.

- Ask for a Higher Limit: If you’ve been good with payments, call your card company and ask for a bigger limit. Just don’t use it all up, okay?

High utilization is like walkin’ a tightrope—one wrong step, and you’re in trouble. Keep an eye on them balances, and you’ll be golden.

Why Your Credit Score Matters, Anyway

Now that we’ve covered the two big ways to hurt your credit, let’s chat about why this score even matters. Your credit score is like your financial report card. It tells lenders if you’re trustworthy with money. A good score (think 700 or above) gets ya better interest rates, easier loan approvals, and even perks like premium credit cards. A bad score? Well, you’re lookin’ at higher costs, denials, and a whole lotta stress.

Here’s a quick breakdown of what goes into that magic number:

- Payment History: 35% (Pay on time, always!)

- Credit Utilization: 30% (Keep it low, under 30%.)

- Length of Credit History: 15% (Older accounts help.)

- New Credit: 10% (Don’t apply for too much at once.)

- Credit Mix: 10% (A mix of cards and loans is good.)

Check your score. Late payments and high utilization make up more than half of it. That’s why they’re so important. It’s not just a small ding; messing up here is terrible for your financial reputation.

The Fallout: What Happens When Your Score Tanks

Let’s get real for a sec. When your credit score takes a nosedive ‘cause of late payments or high utilization, life gets tougher. Here’s what you might face:

- Higher Interest Rates: Lenders charge ya more ‘cause you’re a “risk.” That car loan or mortgage could cost thousands extra over time.

- Loan Denials: Wanna buy a house? Good luck gettin’ approved with a trashed score. Even small personal loans might be outta reach.

- Credit Card Woes: Forget them fancy rewards cards. You might only qualify for ones with crazy fees or sky-high rates.

- Stress and Shame: I ain’t gonna lie—havin’ bad credit feels personal. It’s like a weight on your shoulders, knowin’ you can’t get what ya need.

I remember feelin’ stuck when my score wasn’t great. Every “denied” notice felt like a punch to the gut. But here’s the good news—you can bounce back. It just takes some grit and smart moves.

Other Sneaky Ways You Might Hurt Your Credit

While we’re focusin’ on the top two, there’s a bunch of other stuff that can ding your score. I ain’t gonna deep-dive, but keep these on your radar:

- Applyin’ for Too Many Cards or Loans: Every application can drop your score a few points. Do it too much at once, and it looks like you’re desperate.

- Closin’ Old Accounts: Shuttin’ down a card might mess with your utilization rate and shorten your credit history. Keep ‘em open if ya can.

- Ignorin’ Bills ‘Til They Go to Collections: If you let debts pile up, they get sent to collectors, and that’s a huge black mark.

- Co-Signin’ for Someone Unreliable: If they don’t pay, it’s on you. I learned that the hard way helpin’ a friend once.

These ain’t as common as missin’ payments or overusin’ credit, but they can still bite ya in the behind if you’re not careful.

Bouncin’ Back: How to Fix a Hurt Credit Score

Alright, so maybe you’ve already made one of these mistakes. Don’t panic—we’ve all been there. Here’s how to start fixin’ things up:

- Get Current on Payments: Catch up on anything late. Set up autopay so it don’t happen again. Consistency is key.

- Pay Down Them Balances: Focus on lowerin’ your credit card debt. Even small extra payments help. I used to toss any bonus cash at my cards, and it worked.

- Check Your Report for Errors: Sometimes, there’s wrong info hurtin’ your score. Get a free report from the big three bureaus and dispute anything funky.

- Be Patient: Credit repair takes time. Late payments fall off after seven years, and utilization improves as ya pay down debt. Keep at it.

Buildin’ credit back up is like plantin’ a garden—it don’t grow overnight, but with steady care, you’ll see results. I’ve seen my score climb after some rough patches, and it felt damn good.

Tips to Keep Your Credit Score Shiny

Prevention’s better than cure, right? Here’s how to keep your credit lookin’ spiffy and avoid these pitfalls altogether:

- Budget Like a Boss: Know what’s comin’ in and goin’ out. I use a simple app to track my spendin’ so I don’t overspend.

- Build an Emergency Fund: Have some cash saved for unexpected stuff. That way, you won’t miss bills or max out cards when life throws a curveball.

- Use Credit Wisely: Only charge what ya can pay off quick. Treat credit like a tool, not a free money machine.

- Check Your Score Regular: Keep tabs on it. Lots of free tools out there let ya see where you stand without hurtin’ your score.

We at [Your Company Name] always say—treat your credit like a prized possession. Guard it, nurture it, and it’ll open doors for ya.

Final Thoughts: Don’t Let Credit Mistakes Define Ya

Look, screwin’ up your credit with late payments or high utilization ain’t the end of the world, even if it feels like it sometimes. What matters is learnin’ from them slip-ups and takin’ action to make things right. I’ve been down that road, and I know how frustratin’ it can be, but with a lil’ discipline, you can turn it around. Remember, your credit score is just a number—it don’t define your worth, but it sure as heck can shape your opportunities.

So, let’s commit to payin’ on time and keepin’ them balances low. Got questions or need a hand figurin’ this out? Drop a comment below or hit us up at [Your Company Name]. We’re here to help ya navigate this financial jungle. Stay savvy, y’all!

Cosigning credit applications

If you cosign on someone else’s loan or credit card, you’re basically taking on the debt and everything that comes with it. This means that if the primary account holder fails to make timely payments on their debt, your credit score will be negatively impacted as well.

The same rule applies if the account holder defaults on their loan or rent, so you’ll want to be careful about cosigning for friends or family members.

Making late payments

Your payment history is the most important part of your credit score, so even one late payment can lower it. Lenders typically report late payments to one or more of the three major credit bureaus once the payment is 30 days past due. For this reason, it’s important to pay your bills on time.

This includes not only debt payments, but also rent and utility bills. Setting up automatic payments can help you avoid missing due dates. Or, if you’re worried about being able to make a payment, reach out to your lender to see if you can arrange a payment plan to avoid impacting your score.

What Goes Into Your Credit Score?

FAQ

How can you hurt your credit?

Here are five ways that could happen:Making a late payment. Having a high debt to credit utilization ratio. Applying for a lot of credit at once. Closing a credit card account. Stopping your credit-related activities for an extended period.

What hurts credit score most?

Late or missed payments hurt your score. Amounts Owed or Credit Utilization reveals how deeply in debt you are and contributes to determining if you can handle what you owe. If you have high outstanding balances or are nearly “maxed out” on your credit cards, your credit score will be negatively affected.

What can ruin your credit score?

Your history of payments: If you have missed, arrears, late, or defaulted payments, lenders and other service providers will report them to credit bureaus. This could have an effect on your credit score. This isn’t limited to mortgage, credit card, loan, car finance and overdraft payments.

What has the 2nd largest impact on your credit score?

Your payment history and how much of your credit limits you use are the two biggest credit scoring factors.