FICO Score 8 is one of the many different versions of FICO credit scores. Since FICO Score 8 was launched, two newer versions of base scoresâFICO Scores 9 and 10âhave been released. However, FICO Score 8 remains one of the most widely used FICO credit scores.

Find out more about FICO 8, such as how it’s made, when it’s used, and how it’s different from other credit scores.

Hey there! If you’ve ever wondered why some people get loans faster than others or why your credit card application was turned down for no reason, it’s all because of your credit score. And not just any score—today we’re going to learn a lot about the FICO Score 8, which is one of the most important credit scores. This is something I’ve done myself: I’ve stressed over numbers that seemed hard to understand. So I’m here to make it easy for you. Keep reading if you want to learn more about money, even if you’re new to the game. We’ll talk about what FICO Score 8 is, why it’s important, and how you can change it to help you.

Why Should You Care About FICO Score 8?

Let’s talk about the real world for a moment before we get down to business. Your credit score isn’t just a number; it’s like a report card for your money. Banks, lenders, and even some landlords look at it to see if they can “trust” you to borrow money or rent an apartment. I remember getting a crazy high interest rate when I tried to get a car loan a few years ago. Why? ‘Cause my score wasn’t up to snuff. That’s when I started to look into this, and let me tell you, knowing about FICO Score 8 changed everything.

Here’s the kicker FICO Score 8 is one of the most widely used scores by lenders It’s been around since 2009, and even though there are newer versions out there, tons of banks and credit card companies still rely on it to size you up So, knowing what it is and how it works can straight-up save you from bad deals or missed opportunities. Let’s get into what makes this score tick.

What Exactly Is FICO Score 8?

Alright, let’s keep this simple. FICO Score 8 is a credit scoring model created by a company called FICO (stands for Fair Isaac Corporation if you’re curious). It’s basically a number between 300 and 850 that tells lenders how likely you are to pay back what you borrow. The higher your score, the better you look in their eyes. Think of it like a video game score—the closer you are to 850 the more “points” you’ve racked up for being financially responsible.

Now, FICO has a bunch of different scoring models, some tailored for specific things like auto loans or credit cards, but FICO Score 8 is what they call a “base score.” That means it’s not tied to one type of credit—it’s a general snapshot of your credit health. Introduced over a decade ago, it’s still super popular ‘cause it strikes a good balance between being strict and fair when judging your money habits.

Wanna know the best part? It’s based on info straight from your credit reports, those files that track how you’ve handled debt over the years. So, it’s not some random guess—it’s built on real data about you. But how do they turn that data into a number? Hang tight, we’re getting there next.

How Is FICO Score 8 Calculated?

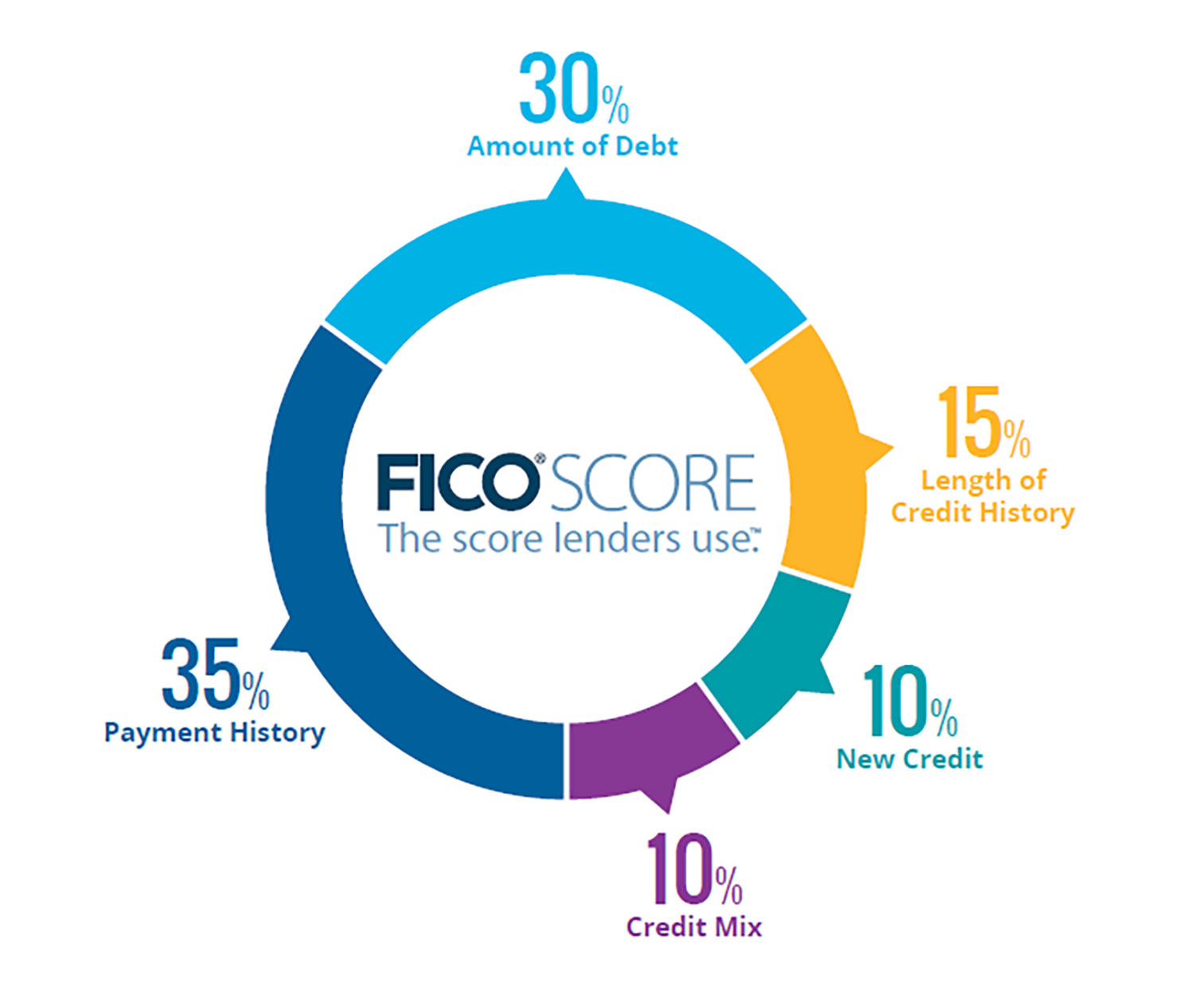

Okay, let’s pop the hood on this thing and see how FICO Score 8 gets cooked up. It’s not magic, but it is a recipe with five main ingredients, each weighted differently. They pull info from your credit history and crunch it into a score. Here’s the breakdown, nice and clear, with the percentages showing how much each part matters:

| Factor | Weight | What It Means |

|---|---|---|

| Payment History | 35% | Do you pay your bills on time? Missed payments can ding ya hard here. |

| Amounts Owed | 30% | How much debt you got? And how much of your available credit are you using up? |

| Length of Credit History | 15% | How long you’ve had credit accounts? Older accounts usually help your score. |

| Credit Mix | 10% | Got a variety of credit types, like cards and loans? Diversity looks good. |

| New Credit | 10% | Applied for a bunch of new accounts lately? Too many can make you look risky. |

Let me go over each one a little more, because this is where you can start to learn how to play the game better.

- Payment History (35%): This is the big dog. If you’re late on payments—credit cards, loans, whatever—it’s gonna hurt. Lenders wanna see you’re reliable. I’ve slipped up once or twice myself, forgot a bill during a hectic month, and man, it stung my score for a while. Pay on time, every time, if you can.

- Amounts Owed (30%): This ain’t just about how much you owe total, but also your “credit utilization”—that’s the fancy term for how much of your available credit you’re using. Max out your cards? Bad news. Keep it under 30% if possible. I learned this the hard way when I racked up a card during a holiday spree.

- Length of Credit History (15%): The longer you’ve had credit, the better, ‘cause it shows you’ve got experience. Don’t close old accounts just ‘cause you don’t use ‘em—they help here. I’ve kept an old card open for years just for this reason.

- Credit Mix (10%): Lenders like seeing you can handle different kinds of credit—think credit cards, a car loan, maybe a mortgage. Don’t sweat this too much if you’re just starting out, though.

- New Credit (10%): Applying for a bunch of new accounts in a short time can spook lenders. It looks like you’re desperate for cash. I made this mistake when I was younger, applying for three cards at once. Big oof.

Here’s a little secret about FICO Score 8: if you use a lot of your available credit, it hits you harder than older models did. It’s also easier to get by with if you’re late on just one payment. So, it’s got its quirks, but knowing ‘em helps.

Who Actually Uses FICO Score 8?

Now you might be wondering, “Who’s even looking at this score?” Well, a lotta folks, actually. Most lenders—think banks, credit unions, credit card companies—use FICO Score 8 to decide if they wanna lend to ya. It’s like the go-to standard for checking your credit risk. Sure, some might use newer versions like FICO 9 or 10, or even a different system altogether, but FICO 8 is still the heavyweight champ in many circles.

Why’s it so popular? ‘Cause it’s been around long enough to be trusted, and it gives a solid picture of whether you’re gonna pay back a loan. Whether you’re applying for a mortgage, a personal loan, or just a new card to rack up some rewards, there’s a good chance FICO Score 8 is part of the decision. I remember checking with a lender once, asking what they used, and they straight-up said FICO 8 was their benchmark. It’s that common.

How’s FICO Score 8 Different from Other Scores?

Alright, let’s get into how FICO Score 8 stands out from the crowd, ‘cause FICO’s got a whole family of scores, plus there’s other models out there too. First off, compared to older FICO versions, Score 8 made some tweaks when it rolled out. Here’s a quick rundown of what changed:

- It puts more weight on high credit utilization. If you’re using up a big chunk of your credit limit, it’s gonna hit your score harder than before.

- A single missed payment? It might not tank your score as bad as older models did. That’s a small win if you mess up once.

- Got a collections account? If the original balance was under a hundred bucks, FICO 8 ignores it. Pretty sweet, right?

Now, let’s compare it to the newer kids on the block. FICO Score 9, which came out a few years later, eased up on medical debt collections—those don’t hurt as much. It also doesn’t count paid-off collections against ya, which is nice. And if you’ve got rental payment history, that can factor in. FICO Score 10, the latest and greatest, looks at your credit trends over time, so it’s a bit more “dynamic.” But here’s the thing: even with these updates, many lenders stick with FICO 8 ‘cause it’s tried and true.

There’s also other scoring systems, like VantageScore, which competes with FICO. It’s got its own rules and might weigh stuff differently, but FICO 8 remains a top dog ‘cause so many big players use it. Oh, and one more thing—FICO also has industry-specific scores for stuff like auto loans or credit cards, and those range from 250 to 900 instead of 300 to 850. They’re more tailored, but FICO 8 is the general all-purpose one.

Why Does FICO Score 8 Matter to You?

Let’s bring this home. Why should you give a hoot about FICO Score 8 specifically? ‘Cause it’s likely the score a lender’s checking when you apply for something big. A good score—say, above 700—can get you better interest rates, bigger loans, and just more “yes” answers. A low score? You’re stuck with high rates or flat-out rejections. I’ve been on both sides of that fence, and trust me, you wanna be in the good zone.

Plus, even if a lender uses a different model, the stuff that boosts your FICO 8—paying on time, keeping debt low—helps across the board. It’s like training for one sport but getting fit for all of ‘em. Understanding FICO 8 gives you a solid foundation to manage your credit, no matter what system someone’s using.

Tips to Boost Your FICO Score 8 (From Someone Who’s Been There)

Alright, now that you know what FICO Score 8 is and how it works, let’s talk about making it better. I ain’t no financial guru, but I’ve picked up some tricks over the years after bumping my own score up from “meh” to “pretty darn good.” Here’s what worked for me, and I bet it can help you too:

- Pay on Time, Every Time: I can’t stress this enough. Set reminders, use auto-pay, do whatever it takes. Even one late payment can stick around on your report for years. I started using calendar alerts on my phone, and it’s saved my butt more than once.

- Keep Your Credit Usage Low: Don’t max out your cards, y’all. Try to use less than 30% of your limit. If you got a $1,000 limit, keep the balance under $300. I had to cut back on impulse buys to make this happen, but it paid off.

- Don’t Close Old Accounts: That old credit card you never use? Keep it open. It helps with the “length of credit history” part. I’ve got a card from college I barely touch, but it’s still helping my score.

- Mix It Up (If You Can): If you’ve only got credit cards, maybe look into a small personal loan or something to show you can handle different credit. Just don’t overdo it—only borrow what you can pay back.

- Chill on New Applications: Every time you apply for credit, it can ding your score a lil’. I learned to space out applications—wait a few months between ‘em if you can.

- Check Your Credit Report: Sometimes, there’s errors on there dragging you down. I found an old bill marked as unpaid when I’d settled it ages ago. Fixed it, and my score jumped. You can get free reports from the big bureaus—take a peek.

And hey, if you wanna keep tabs on your score without stressing, there’s free tools out there to monitor it. They might not always show the exact FICO 8 a lender sees, but they give ya a ballpark idea. I check mine every month just to stay on top of things.

Common Myths About FICO Score 8 (Let’s Clear ‘Em Up)

Before we wrap this up, let’s bust a few myths I’ve heard floating around. People get weird ideas about credit scores, and I’ve fallen for some of these myself back in the day.

- Myth #1: Checking Your Score Hurts It – Nah, not true. Checking your own score is what’s called a “soft inquiry,” and it don’t affect nothing. I check mine all the time—no harm done.

- Myth #2: FICO Score 8 Is the Only Score That Matters – Nope. It’s popular, sure, but lenders might use other models. Still, a good FICO 8 usually means you’re golden elsewhere too.

- Myth #3: Closing a Card Always Helps – Wrong again. Closing old cards can shorten your credit history and hurt ya. I almost did this once, but a buddy warned me off it. Glad I listened.

- Myth #4: You Can’t Fix a Bad Score Quick – Well, sorta true, sorta not. Some stuff takes time, like old late payments dropping off after a few years. But small changes—like paying down debt—can bump your score faster than you think. I saw a 20-point jump in a month just by clearing a card balance.

Wrapping It Up: Take Control of Your FICO Score 8

So, there ya have it—everything you need to know about FICO Score 8, straight from someone who’s been in the trenches. It’s just a number, yeah, but it’s a number that can open doors or slam ‘em shut. Whether you’re tryna buy a house, snag a sweet credit card deal, or just get your financial house in order, understanding this score is step one. It’s all about showing lenders you’ve got your act together—pay on time, don’t over-borrow, and keep an eye on your credit habits.

How FICO Score 8 is different from other FICO score versions

When FICO Score 8 was released, it included several changes from previous base FICO score versions, including these:

- High credit utilization ratios could affect your score more.

- One late payment might not hurt your score that much.

- Collections accounts with balances less than $100 are not taken into account.

FICO Score 8 explained

FICO is a popular credit-scoring company. Its credit-scoring models help lenders as they review credit and loan applications from potential borrowers. Like its competitor VantageScore, FICO has multiple versions of its credit-scoring models. FICO Score 8 is one example.

Sometimes called FICO 8 for short, it was launched in 2009. Itâs one of FICOâs base credit scores, which means it isnât designed for a specific type of credit. Like other base credit scores, the scores range from 300 to 850. Like FICO’s other base credit scores, FICO Score 8 is meant to show how likely it is that a borrower will pay back a loan.

FICO 8 Score Explained

FAQ

What is a good FICO 8 score?

A good FICO 8 score generally falls within the range of 670 to 739. According to American Express, this range means that lenders see the borrower as low-risk, which could mean better loan terms and interest rates.

Is FICO 8 or FICO 9 better?

Versions 8 and 9 of FICO scores are similar, but FICO score 9 is generally considered the more forgiving of the two for a few reasons: With FICO 9, third-party collections no longer hurt your credit score once those debts are paid off. FICO 9 treats medical collections differently than other types of debt.

Do banks use FICO score 8?

Capital One says that FICO Score 8 is one of the FICO credit scores that lenders use the most.

Is a FICO score the same as a credit score?

Credit scores and FICO scores are often used to refer to the same thing. However, a FICO score is one type of credit score, not the only one.