Roughly 66% of cars financed go to borrowers with scores of 661 or higher, but those with lower scores have options.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

If youre looking to buy a car, the process could get more expensive soon. The Trump administrations tariffs could affect the auto industry, driving up prices. Knowing your credit score now can help you enter the buying process on strong footing.

A first-quarter 2025 report by credit bureau Experian found that roughly 66% of cars financed were for borrowers with credit scores of 661 or higherExperian Information Solutions . State of the Automotive Finance Market Q1 2025. Accessed Jun 9, 2025. View all sources. The average credit score for a new-car loan was 756, while the average credit score for a used-car loan was 684.

Hey there, folks! If you’re sittin’ there wondering, “How much of a car loan can I get with a 620 credit score?” then ya came to the right place I’m here to break it down for ya, no fancy jargon, just straight-up talk A 620 credit score is what we call “fair”—it ain’t the best, but it sure ain’t the worst neither. You can likely score a car loan, but the amount and terms? They gonna depend on a bunch of stuff like interest rates, your income, and how much ya got for a down payment. On average, you might be lookin’ at somethin’ between $15,000 to $25,000 for a loan, though that’s a rough guess and could swing based on your situation. Stick with me, and we’ll dig into every lil’ detail to get ya rollin’ toward that new ride.

What Does a 620 Credit Score Even Mean?

First things first let’s chat about what a 620 credit score tells lenders about ya. Credit scores usually range from 300 to 850 and 620 falls into the “fair” category. It means you’ve probably paid most bills on time, but maybe ya got a few late payments or some debt hangin’ around. Lenders see this as a middle-of-the-road risk—not a slam dunk, but not a total nope either.

Here’s the deal:

- Above 620? You’re edging closer to “good” credit, where terms get sweeter.

- Below 620? Things get trickier, and loans might be harder to grab.

- At 620? You’re in a spot where lenders will likely work with ya, but they gonna charge higher interest to cover their risk.

I’ve seen buddies with scores around this number get approved for car loans, but they had to jump through a few extra hoops. So, don’t sweat it too much—there’s hope!

How a 620 Credit Score Affects Your Car Loan Amount

Now, let’s get to the meat of it—how much loan can ya actually get with that 620 score? Truth is, there’s no magic number carved in stone. The loan amount ain’t just about your score; it’s tied to how much ya can afford to pay back each month. But, your credit score plays a big role ‘cause it decides the interest rate you’re slapped with, and that rate messes with how big of a loan ya can handle.

Check out this table I whipped up to show average interest rates for different credit score ranges (based on real data from late 2024):

| Credit Score Range | New Car Loan APR | Used Car Loan APR |

|---|---|---|

| 781-850 | 4.77% | 7.57% |

| 661-780 | 6.40% | 9.95% |

| 601-660 (your range) | 9.59% | 14.46% |

| 510-600 | 13.08% | 19.38% |

| 300-500 | 15.75% | 21.81% |

See where you stand? With a, you’re looking at around 959 percent APR for a new car or a hefty 1446 percent APR for a used one. If the rate is higher, the monthly payment for the same loan amount will be higher. This may limit how much you can borrow. For example, a $20,000 loan at 9. It could cost you about $420 a month to pay 59% over 12 months. That person would pay about $375 for the same loan if they had a prime score. That difference adds up, and lenders may cut the size of your loan to make payments more manageable.

So, ballpark figure? If your income is decent—say, $40,000 a year—and ya got no crazy debts, you might qualify for $15,000 to $25,000. But if your debt-to-income ratio (that’s DTI, how much ya owe versus earn) is high, it could drop to $10,000 or less. We’ll talk more about them other factors next.

What Else Do Lenders Look At Besides Credit Score?

Lenders look at more than just your credit score to decide how much of a car loan to give you. They want to know if you can really pay it back without going into default. Here’s what else they’re snoopin’ on:

- Your Income: How much dough ya bringin’ in each month? Lenders wanna see a steady paycheck. If ya make $3,000 a month, they might be cool with a $400-$500 car payment, but not if half your income’s already goin’ to rent or other loans.

- Debt-to-Income Ratio (DTI): This is a biggie. If ya got credit card debt, student loans, or other payments eatin’ up your income, lenders might cut down your loan amount. They usually like DTI under 40%—meanin’ less than 40% of your income goes to debt.

- Down Payment: Got some cash to put down upfront? Even 10% on a used car or 20% on a new one can make lenders more willing to approve a bigger loan. It shows ya got skin in the game.

- Loan Term: How long ya wanna stretch the payments? A 36-month term means higher monthly payments but less total interest. A 60- or 72-month term lowers monthly costs but jacks up the interest ya pay over time. Lenders might offer more money on longer terms, but watch out—ya could end up owing more than the car’s worth.

- Trade-In Value: If ya got an old ride to trade in, its value can cut down the loan ya need. I had a pal with a 620-ish score who traded in a beat-up sedan worth $3,000, and it helped him snag a bigger loan for a nicer whip.

Lenders look at all of this along with your credit score to decide how much they are willing to lend you. So, even if you have a 620, you might get a better rate if you have a good job and a big down payment.

Why Interest Rates Matter So Much with a 620 Score

Let’s zoom in on them interest rates ‘cause they’re a huge deal. With a 620 credit score, you’re stuck with higher rates than folks with “good” or “excellent” credit. Why’s that a problem? ‘Cause it bumps up your monthly payment, and that limits how much loan ya can take on without breakin’ the bank.

Lemme paint ya a picture. Say ya want a $25,000 loan for a new car:

- At 9.59% APR over 60 months (that’s 5 years), your monthly payment is roughly $525.

- Now, if ya had a 750 score with a 4.77% APR, that same loan would cost ya about $468 a month.

That $57 difference might not seem like much, but over 60 months, it adds up to $3,420 in interest! Also, lenders may look at your income and decide that $525 a month is too much for you, lowering the loan to $20,000 or less. For a used car at 14. 46%, it’s even worse when you consider that $25,000 could mean monthly payments of almost $620. Yikes!.

Moral of the story? Your 620 score don’t just affect if ya get a loan—it messes with how much car ya can afford. That’s why I always tell folks to crunch them numbers before hittin’ the dealership.

How to Figure Out Your Possible Loan Amount

Alright, let’s get practical. How do ya even estimate what kinda car loan ya can get with a 620 score? Ya don’t need to be a math whiz, just follow these steps:

- Check Your Budget: Figure out what ya can pay each month. A good rule is keepin’ car payments under 15-20% of your take-home pay. If ya bring home $2,500 a month, aim for $375-$500 max.

- Factor in Interest: Remember, at 620, ya might face 9-14% APR dependin’ on new or used. Use a simple online calculator to see what loan amount fits your monthly budget with them rates.

- Add a Down Payment: If ya can toss in $2,000 or more upfront, it cuts the loan ya need. A $20,000 car with a $2,000 down payment means ya only borrowin’ $18,000.

- Think About Term Length: Longer terms (60-72 months) mean smaller monthly hits but more interest. Shorter terms (36-48 months) save on interest but up the monthly cost. Play around with both to see what works.

Here’s a quick example for a $20,000 loan at 9.59% APR with a 620 score:

| Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|

| 36 months | $642 | $3,112 |

| 60 months | $420 | $5,200 |

| 72 months | $363 | $6,336 |

See how stretchin’ it out lowers the monthly but costs ya more long-term? Pick what fits your wallet best.

Tips to Snag a Bigger Car Loan with a 620 Score

Don’t just settle for what lenders throw at ya—there’s ways to boost your chances of gettin’ a bigger loan or better terms, even with a fair score like 620. Here’s what me and my crew at our lil’ financial hangout suggest:

- Shop Around, Man! Don’t stick with the first lender or dealership offer. Check banks, credit unions, and online lenders. Some might see your 620 score and still cut ya a better deal if other stuff looks good.

- Get Preapproved: This is gold. Get preapproved for a loan before ya hit the car lot. It tells ya exactly how much ya can borrow and stops dealers from jackin’ up rates with sneaky markups.

- Save for a Big Down Payment: Even if it’s just 10%, scrapin’ together a down payment shows lenders ya serious. It also means ya borrow less, which lowers payments.

- Consider a Co-Signer: Got a family member or buddy with great credit? If they co-sign, lenders might approve a bigger loan ‘cause they trust the co-signer to pay if ya can’t. Just don’t mess ‘em over, alright?

- Look at Used Cars: New cars got lower rates, but used ones are cheaper upfront. With a 620, a used car loan might be easier to swing, even if the rate’s higher.

- Boost That Score Quick: Pay down credit card balances, don’t miss no payments, and check your credit report for errors. Even jumpin’ to 640 could shave a point or two off your rate.

I remember helpin’ a coworker who had a score right around yours. He saved up a $3,000 down payment and shopped around ‘til he found a credit union that gave him a $22,000 loan at a decent rate for a used SUV. Took some hustle, but he made it work!

Should Ya Go New or Used with a 620 Score?

This is a question I get a ton—should ya buy a new car or a used one with a 620 credit score? Both got pros and cons, so lemme lay ‘em out.

- New Cars:

- Pros: Lower interest rates (around 9.59% for your score), better safety features, no weird repair history to worry ‘bout.

- Cons: More expensive, so ya might not qualify for as big a loan. Plus, they lose value fast—ya could owe more than it’s worth quick.

- Used Cars:

- Pros: Cheaper price tag, so smaller loan needed. Easier to fit into a tight budget.

- Cons: Higher rates (like 14.46%), and ya gotta watch for hidden issues. Might need repairs sooner.

If ya ask me, with a 620 score, used cars might be the safer bet unless ya got a solid down payment for a new one. Just make sure ya get that used ride checked by a mechanic before signin’ anything. I learned that the hard way once—bought a “deal” that turned into a money pit!

What If Ya Can’t Get the Loan Ya Want?

Sometimes, even with all the tricks, ya might not get approved for the loan amount ya hopin’ for. Don’t throw in the towel just yet. Here’s what to do:

- Save Up More: Wait a few months, stash some cash, and come back with a bigger down payment. Less to borrow means better odds.

- Work on Your Credit: Focus on payin’ off debts and keepin’ bills current. Even a small bump in your score can make a diff.

- Buy Cheaper: Look for a less pricey car. Ya don’t need a fancy ride to get from A to B. A reliable $10,000 car might be all ya need for now.

- Find a Co-Signer: Like I mentioned earlier, someone with good credit can help tip the scales in your favor.

I had a rough patch a while back where my score was hoverin’ around fair, and I couldn’t get the loan I wanted for a truck. Ended up buyin’ a cheap hatchback instead, and ya know what? It got me through ‘til I fixed my credit. Sometimes, ya gotta play the long game.

Final Thoughts—Get Rollin’ with Confidence

So, how much of a car loan can ya get with a 620 credit score? It’s tough to pin down exact, but you’re likely in the $15,000 to $25,000 range if your income and debts line up right. That fair score means higher interest rates—around 9.59% for new cars and 14.46% for used—so your monthly payments gonna limit the total loan amount. But don’t let that stop ya! Shop around, get preapproved, save for a down payment, and maybe even boost that score a tad before applyin’. Lenders look at more than just your credit—they wanna see the whole picture.

We’re rootin’ for ya here, and I’m bettin’ with a lil’ grit, you’ll be cruisin’ in your new ride sooner than ya think. Got questions or wanna share your story? Drop a comment below—I’d love to chat. And hey, check your credit today and start huntin’ for them loan offers. Let’s get ya on the road!

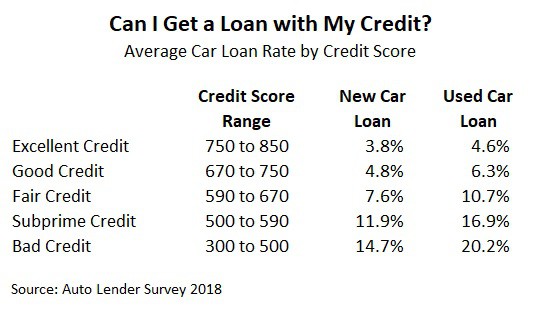

Auto loan interest rates

You can better plan your budget for your car if you know what to expect when it comes to interest rates. Usually, higher scores mean lower interest rates on loans.

According to Experian, a target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6. 70% or better, or a used-car loan around 9. 06% or lower.

|

Credit score |

Average APR, new car |

Average APR, used car |

|---|---|---|

|

Superprime: 781-850. |

5.18%. |

6.82%. |

|

Prime: 661-780. |

6.70%. |

9.06%. |

|

Nonprime: 601-660. |

9.83%. |

13.74%. |

|

Subprime: 501-600. |

13.22%. |

18.99%. |

|

Deep subprime: 300-500. |

15.81%. |

21.58%. |

|

Source: Experian Information Solutions, 1st quarter 2025. |

||

Someone with a score in the low 700s might see rates on used cars of about 9. 06%, compared with 18. 99% or more for a buyer scoring in the mid-500s, according to the data from Experian. Using a car loan calculator illustrates the difference that can make.

That’s about $415 a month for a $20,000 used car loan with no down payment and five years to pay it off. 75 dollars for the buyer with better credit and about $519 for the buyer with worse credit. The buyer with better credit would pay about $4,945 in interest over the life of the loan, while the buyer with lesser credit would pay around $11,122. Plus, in most states, bad credit can mean higher car insurance rates, too.

The differences aren’t quite as steep for new-car loans: Borrowers with scores in the low 700s can expect an average rate of 6.7% compared with 13.22% for borrowers with credit in the mid-500s.

Bring documents showing financial stability

If your credit score is low, potential lenders are less likely to see you as a risk if they can see you have stability in other areas of your financial life. Bringing documentation such as your most recent pay stubs and proof of address to show lenders how long you have lived at your current address and worked at your employer could help you seem more reliable.

Can You Get A Car Loan With 620 Credit Score? – CreditGuide360.com

FAQ

Will I get approved for a car loan with a 620 credit score?

Can I get an auto loan with an 620 credit score? The short answer is yes, but you’re likely to get a significantly higher-than-average interest rate.

What credit score is needed for a $25,000 car loan?

The credit score required and other eligibility factors for buying a car vary by lender and loan terms. Still, you typically need a good credit score of 661 or higher to qualify for an auto loan.

What car can you get with a 620 credit score?

Many brands and their dealers have programs that can help you get financed. Automakers such as Ford, Kia, and Hyundai are known for working with borrowers who have lower credit scores. In addition, CarsDirect has a network of dealers that specialize in bad credit car loans whether you’re considering a new or used car.

Can I get a 30k car with a 650 credit score?

A credit score of 650 is usually thought to be fair. This may not stop you from getting a $30000 used car loan, but approval will depend on a number of factors, including: Lender Policies: Each lender has their own rules for loan approval.