This content may include information about products, features, and/or services that SoFi does not provide and is intended to be educational in nature.

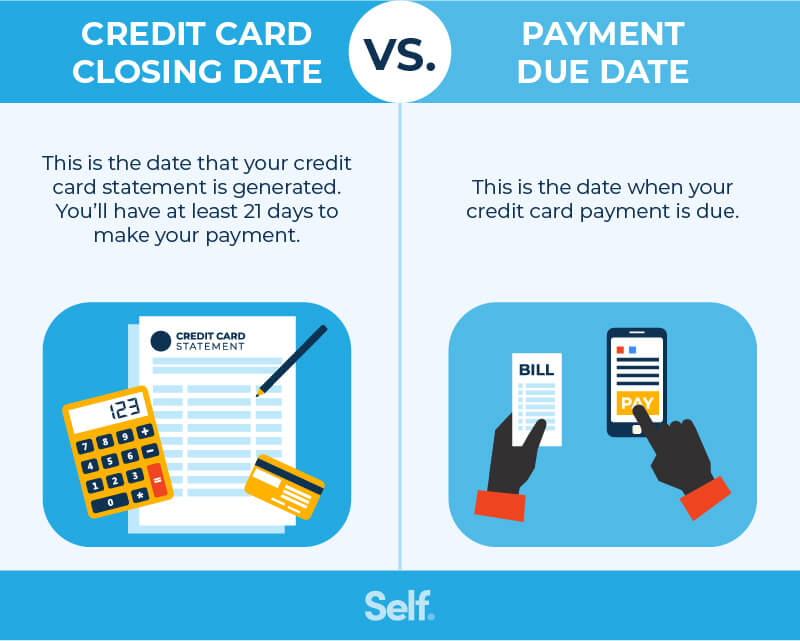

Your credit card closing date marks the end of your billing cycle, which determines how much you’ll owe when your credit card payment comes due. On the other hand, you need to make at least the minimum payment on your credit card by the due date to avoid a late fee.

By understanding the implications of both your credit card closing date and your credit card due date, you can better strategize to make purchases and also ensure you make on-time payments.

Hello, hello! How are you? It’s nice to talk to you, but let’s get right to the good stuff you asked for. I wrote a great blog post for you about credit cards and the question “is the closing date the due date?” It’s full of useful information, easy to read, and written in markdown format so you can quickly copy and paste. Check it out below!.

Hey there, money-savvy fam! If you’ve ever stared at your credit card statement and scratched your head wondering, “Is the closing date the due date?”, you ain’t alone. At CashFlow Crew, we’ve seen tons of folks trip over these two dates, and trust me, mixing ‘em up can cost ya—big time. So, let’s clear the fog right now, no fluff, just straight-up facts with a side of real talk.

Spoiler alert: Nope, the closing date and the due date are not the same thing. They’re two different beasts, and knowing the difference can save you from late fees, nasty interest charges, and even a hit to your credit score. Stick with me, and I’ll break it down so simple, you’ll be schooling your buddies on this by tomorrow.

What’s the Closing Date on a Credit Card? Let’s Get It Straight

Now picture this: the billing cycle for your credit card is like a little monthly chapter of your spending story. It lasts between 28 and 31 days, but this depends on the company that issued your card. The closing date is the last day of that chapter. When your credit card company closes the books on that cycle, adds up all the money you’ve spent, plus any past due balances or interest, and sends you a bill. Boom, that’s your bill for the month.

- Key point: Any purchases you make after the closing date? They don’t show up on this statement. They roll over to the next cycle. So, if you splurge on a new gadget the day after your closing date, it won’t haunt this bill.

- Why it matters: This date is also when your balance gets reported to the credit bureaus (think Experian, Equifax, and TransUnion). More on why that’s a big deal in a sec.

Basically, the closing date is the cutoff for what you owe right now. It’s like the finish line for that month’s spending spree.

What’s the Due Date Then? Don’t Miss This One!

Now comes the due date—this is when you need to pay at least the minimum amount by to avoid getting charged a late fee. Not only is it 21 to 25 days after the closing date, but it’s also the same date every month. Every month, your bill is due on the 15th. Next month, it will also be due on the 15th (or the next business day if it’s a weekend).

- Why it’s clutch: Miss this date, even by a day, and you’re looking at fees, possible interest rate hikes, and a ding to your credit if it’s super late (like 30+ days). Yikes.

- Pro tip: You don’t gotta wait ‘til the due date to pay. You can toss money at your balance anytime—online, by mail, whatever. Just make sure it hits by the due date if you’re mailing a check, ‘cause snail mail ain’t always speedy.

So, to hammer it home: closing date is when your bill gets made, due date is when you gotta pay at least a chunk of it. Got it? Good, ‘cause this next part gets juicy.

Closing Date vs. Due Date: The Big Differences Laid Bare

Let’s slap these two side by side so there’s no confusion left Here’s a quick table to show ya how they stack up

| Aspect | Closing Date | Due Date |

|---|---|---|

| What it is | End of your billing cycle, statement created | Deadline to make at least minimum payment |

| Timing | Last day of cycle (28-31 days) | 21-25 days after closing date, same each month |

| Impact on Bill | Determines what you owe for that cycle | Determines if you’re late on payment |

| Credit Score Connection | Balance reported to bureaus on this date | Late payment (30+ days) hurts score |

See the diff? One’s about wrapping up your spending, the other’s about settling the tab Mixing these up is like confusing the oven timer with the dinner party start time—disaster, fam

Why Does This Matter to Your Wallet and Credit Score?

Alright, let’s talk turkey. Don’t just pay your bill; pay attention to these dates because they can mess with your money and credit in sneaky ways. I know what you mean when you think everything is fine until a fee pops up out of the blue. Here’s the breakdown:

Closing Date and Your Credit Score

On the closing date, your card issuer usually sends your balance info to the credit bureaus. This ties directly to your credit utilization ratio—fancy term for how much of your available credit you’re using. Say you got a $5,000 limit and your balance is $4,000 on the closing date. That’s 80% utilization, which looks bad to lenders and can tank your score.

- Hack: Pay down your balance before the closing date if you can. If you drop that $4,000 to $1,000 before they report it, your utilization is just 20%—way better for your score. Keep it under 30% if you wanna look like a credit rockstar.

- Real talk: I used to wait ‘til the due date to pay, thinking I was fine. Nope. My score took a hit ‘cause the bureaus saw a high balance. Learned that the hard way.

Due Date and Avoiding Fees

The due date is your “don’t be late” warning. Pay at least the minimum by this date, or you’re in for pain. Late fees ain’t cheap—think $25 or more. Plus, if you’re 30 days or more late, it gets reported to the bureaus, and that black mark sticks on your credit report for seven years. Seven! That’s longer than some marriages.

- Worse yet: Miss by 60 days, and your card issuer might jack up your interest rate to a penalty APR—sometimes close to 30%. That makes paying off debt feel like climbing a greasy pole.

- My advice: Set a calendar reminder a few days before the due date. Or, better yet, set up autopay for at least the minimum so you never miss it. Saved my butt more than once.

Grace Period: Your Secret Weapon

Here’s a lil’ bonus between these dates: the grace period. It’s usually those 21+ days from closing to due date where you don’t get charged interest on new purchases—if you pay your full balance by the due date. Not all cards offer this, so check your terms, but if yours does, use it!

- How it works: Pay the whole balance by the due date, and you dodge interest. Only pay the minimum? You’re getting hit with interest on what’s left. I’ve dodged hundreds in interest by paying in full during this window.

- Heads up: Cash advances don’t get a grace period. Interest starts day one on those, so avoid ‘em unless you’re desperate.

When Should You Pay? Strategy Time!

So, when’s the best time to pay your bill? Depends on your goal, fam. We at CashFlow Crew always say there’s two smart moves:

- To boost your credit score: Pay as much as you can before the closing date. Lower that reported balance, and your credit utilization looks sweet. If you’re applying for a loan or new card, this is key.

- To avoid fees and interest: Pay at least the minimum by the due date. Better yet, pay the full balance to skip interest altogether. This keeps your wallet happy.

Here’s a lil’ scenario from my own life. I had a big purchase—say, $2,000 on a new laptop—right before my closing date. My limit was $3,000, so that’s a high balance to report. I hustled to pay it down to $500 before the closing date hit. Result? My credit score didn’t budge. If I’d waited ‘til the due date, that $2,000 woulda been reported, and my score mighta dipped. Timing, y’all, it’s everything.

Can You Change These Dates? Yup, Sometimes!

Not vibin’ with your due date? Maybe it lands right before payday, and you’re always scramblin’. Good news: lots of card issuers let you change it. Just hit up customer service or log into your account online. Pick a date that works with your cash flow—maybe right after you get paid.

- Catch though: Changing the due date might shift your closing date too, since they’re tied together. And no, you can’t skip a payment by doing this. They’ll still expect ya to pay up.

- My take: I switched mine to the 5th of the month ‘cause that’s when my paycheck drops. Made life so much easier, no more stressin’ over timing.

Can you change the closing date directly? Not usually, but since it’s linked to the due date, tweaking one often adjusts the other. Call your issuer and ask—worth a shot.

Other Credit Card Dates You Gotta Watch

While we’re at it, closing and due dates ain’t the only ones to keep an eye on. There’s a few more sneaky dates that can bite ya if you’re not careful:

- Annual Fee Date: Got a card with a yearly fee? It’ll pop up on your statement like a regular charge, usually in the first month after signup and every 12 months after. Don’t let it surprise ya.

- Introductory Offer End Date: Some cards hook you with a 0% APR or bonus rewards for a set time. Know when that promo ends, or you might get hit with a higher rate outta nowhere. I’ve marked these on my calendar to plan big buys before the deal’s up.

- Card Expiration Date: Your physical card’s got a month and year it expires. Don’t worry, your account stays open, and a new card usually shows up in the mail beforehand. Just activate it and shred the old one.

- Transaction vs. Posting Date: The day you buy something ain’t always when it hits your account. Sometimes it’s “pending” for a few days. Keep track so you don’t overspend thinking you got more room than ya do.

Common Mistakes and How to Dodge ‘Em

I’ve seen peeps—and yeah, I’ve been guilty too—make some dumb moves with these dates. Here’s what to avoid:

- Waiting ‘til due date to lower balance: Like I said, if you care about your credit score, pay before closing. Due date’s too late for that report.

- Only paying the minimum: Sure, it keeps you “on time,” but you’re rackin’ up interest on the rest. Try to pay more, even if it’s just an extra $20. It adds up.

- Forgetting mail delays: If you’re old-school and mail your payment, send it days early. Post office ain’t always your pal.

- Ignoring statements: Check your statement for the closing and due dates every month. They might shift a lil’, and you don’t wanna miss it.

Wrapping It Up: Master Your Dates, Master Your Money

So, is the closing date the due date? Nah, not even close. The closing date wraps up your billing cycle and sets what you owe, while the due date is your deadline to pay at least the minimum without gettin’ in hot water. Knowing both—and playin’ ‘em right—can keep your finances tight and your credit score shiny.

We at CashFlow Crew wanna see you win, so take this to heart: track those dates like a hawk. Set reminders, pay early if you can, and don’t let sneaky fees or high balances mess with your vibe. Got questions or a tricky card situation? Drop a comment below—I’m all ears and ready to help ya sort it out.

Stay smart with your cash, fam. Catch ya on the next money tip!

There ya go! This blog post is loaded with everything you need to explain the difference between closing and due dates in a way that’s relatable and actionable. If you’ve got more topics or tweaks, lemme know!

How Your Credit Card Closing Date Affects Your Credit Score

Your credit card company usually sends information about your account activity, including your card’s outstanding balance, to Experian®, Equifax®, and TransUnion® on the date your credit card statement ends. With this information, your credit utilization ratio will change. This is the ratio of the credit you are using to the credit you have access to.

Let’s say your closing date is May 20 and you bought something with a credit card for $2,000 on May 15. That purchase will be reported and can increase your credit utilization ratio. A high credit utilization ratio can adversely affect your credit score.

If the purchase isn’t urgent, perhaps you might wait until May 21 to put the charge on your credit card. In this scenario, your $2,000 credit card purchase wouldn’t be reported to the credit bureaus until the end of your next billing cycle. And if you pay it off before then, it might not affect your credit utilization ratio.

Guide to Changing Your Credit Card Due Date

You might find that changing your credit card due date can help you better manage your credit card payments. This might come up if you get paid on a certain date each month and want your due date to fall closer to payday.

Generally, card issuers are willing to work with you on a due date that will help you make regular, on-time payments. However, credit issuers have different restrictions, so talk to your credit card issuer to see whether it’s flexible.

To change your credit card due date, you can either:

1. Call the phone number at the back of your credit card to speak to a customer service associate who can help.

2. Log in to your credit card’s online account and make the change (if available) yourself.

Be aware that it can take one to two billing cycles to see the change on your account.

Credit Cards 101: Statement Dates vs Due Date

FAQ

What is the difference between payment due date and closing date?

Understanding the payment due date vs. closing date on credit cards is important for managing your finances. While the due date is when you need to pay your credit card issuer, the closing date is when your credit card statement closes and your purchases, interest, and balance are calculated.

Is a credit card closing date the same as a due date?

A credit card’s closing date and due date aren’t the same thing; however, they are related. Knowing these dates and how they differ can help you avoid fees, lower your interest rates, and keep track of your credit. Here’s what you need to know about closing dates vs. due dates. What Is a Credit Card Closing Date?.

When is my credit card statement closing date & due date?

The credit card company usually decides when your statement ends and when it’s due. This can change depending on the terms of your card. The statement closing date, on the other hand, usually comes before the due date. This is because the due date is when you have to pay your bill for that billing cycle, and the statement closing date is when the billing cycle ends.

How does a credit card closing date work?

The bank uses your credit card’s statement closing date to determine which purchases are calculated toward the current statement’s total balance and the minimum credit card payment that’s due. Any purchases made after your credit card closing date are applied to the next month’s billing statement.

Where can I find my credit card closing date?

You can usually find your closing date on the first page of your monthly statement, listed in your account online, or you can call your credit card issuer to ask. Any new purchases made after your closing date will be included in your next billing cycle. Do you know the difference between the payment due date and the closing date for a credit card?

What is a statement closing date?

Your statement closing date is also the date that your account’s balance and payment information are transmitted to the major consumer credit bureaus — Experian, Equifax, and TransUnion. Generally, the lower your credit balance is at this time, the better.

Do I have to pay by due date or closing date?

How long after closing date is due date?

Key Takeaways. Your closing date is the last day of your credit card billing cycle. Your credit card statement generates at the end of your closing date, and the due date is at least 21 days later. If you don’t pay your credit card’s minimum payment between the closing date and the due date, you may incur a late fee.

How many days before due date is the closing date?

The statement closing date is generally around 21 days before your payment is due. On the day your billing cycle ends, your lender will: Calculate any interest charges for the month, along with your minimum payment amount. Create your monthly statement, post it to your online account and/or mail it to you.

What does a closing date mean?