According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time. 1 It can be an important part of building your financial confidence and security. 1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home. 1 You may also be able to access more competitive interest rates. 1.

There are two main credit bureaus in Canada: Equifax and TransUnion. 1 These are private companies that keep track of how you use your credit. 1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score. 1.

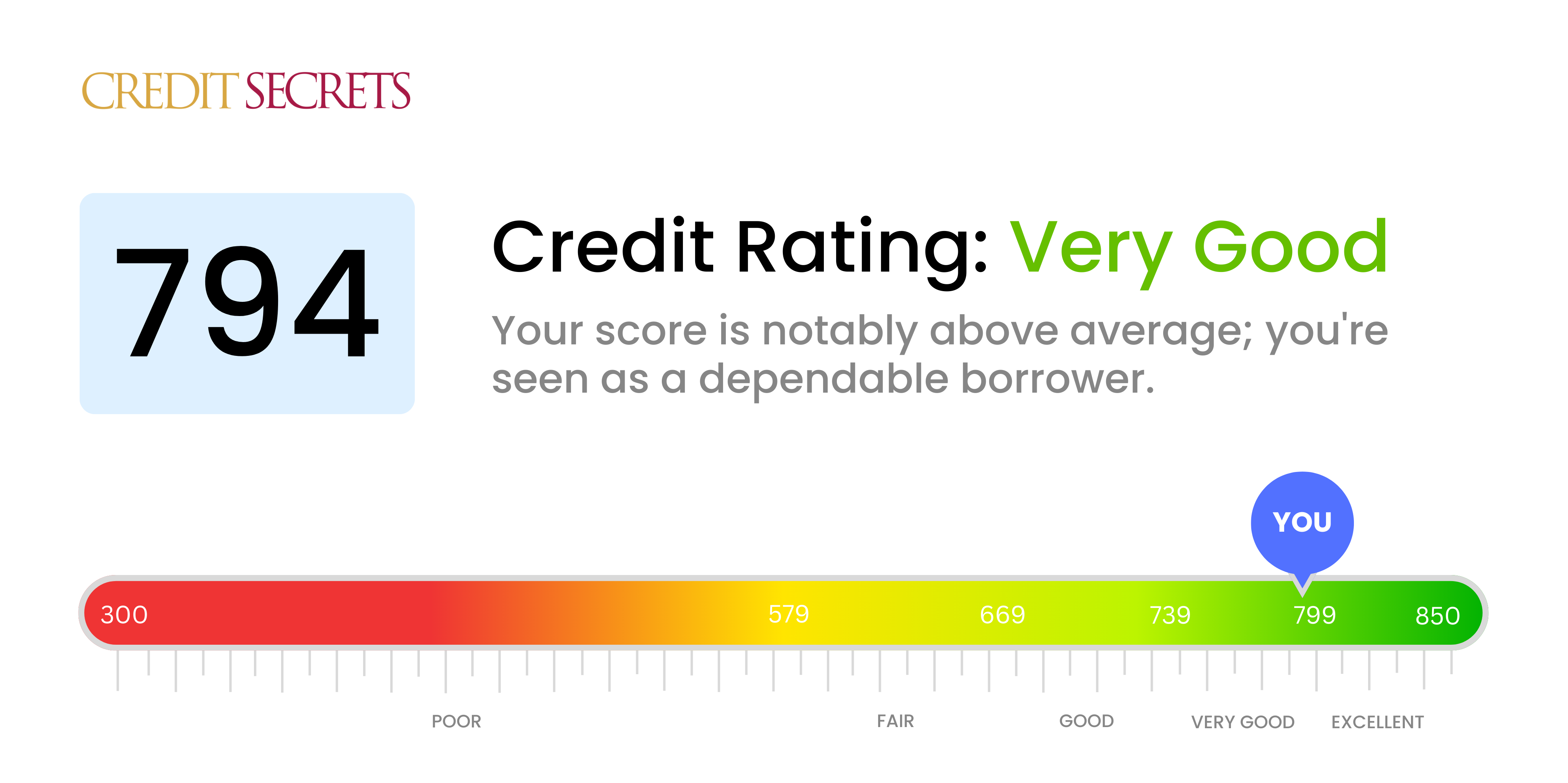

Having a credit score of 794 puts you in rarefied air when it comes to your credit standing. But is a 794 credit score considered good, and how can you make the most of it? This article will explain what a credit score of 794 means, why it’s an excellent score, and how you can leverage it to get the best rates and terms on lending products.

What is a Credit Score of 794?

A credit score is a three-digit number calculated from the information in your credit reports. It’s meant to represent your creditworthiness – or how likely you are to pay back debts on time.

Credit scores range from 300 to 850. Credit scoring models like FICO and VantageScore put a 794 credit score in the top tier, calling it “very good” or “excellent.”

Specifically a credit score of 794 falls in the following credit score ranges

- FICO Score Range: 740-799 (“Very Good”)

- VantageScore Range: 781-850 (“Excellent”)

Credit scores this high are only found in a small group of people. The credit score company FICO says that only 2014% of consumers have scores above 100.

Why is a 794 Credit Score Good?

A 794 credit score is excellent for several reasons

1. Low Credit Risk

First and foremost, a 794 credit score indicates you are at very low risk for not repaying debts. Credit scoring models like FICO and VantageScore are designed to predict your credit risk. The higher the score, the lower the risk you pose to lenders.

With a score in the 794 range, you have an extensive and positive credit history that demonstrates responsible credit management over time. Late or missed payments are likely rare or nonexistent for you. This makes you look highly attractive to potential lenders.

2. Access to the Best Rates and Terms

Your 794 credit score means you have earned access to the most favorable interest rates and terms when borrowing money or getting approved for new credit. Lenders reserve their very best offers – like low interest rates, high credit limits, and minimal fees – for consumers with excellent credit.

For instance, if you want to borrow money for an auto loan, the interest rate might be more than 2% lower than the average rate. If you get a mortgage, you may be able to get the best rates from lenders and not have to pay mortgage insurance.

3. More Likely to Get Approved

It’s more likely that you’ll get approved in the first place if your credit score is 794. You may also get better terms. Lenders have strict approval criteria based on credit scores. If your credit score is “very good,” you should be able to get most types of credit.

Your strong credit score signals low default risk and gives lenders confidence you can manage additional credit responsibly. This makes them more willing to approve your applications.

4. Rewards and Perks

A 794 credit score also opens the door to the most rewarding credit cards. Cards geared toward consumers with excellent credit offer lucrative ongoing rewards, like high cash back rates on purchases and generous travel perks.

Premium travel rewards cards only approve applicants with great credit. These cards carry valuable benefits, such as airport lounge access, travel credits, and bonuses worth hundreds of dollars in free travel.

How Does a 794 Credit Score Compare?

Although a 794 credit score is excellent, it’s helpful to understand how it stacks up to other credit scores. This table summarizes key differences:

| Credit Score | Category | Likelihood of Getting Approved | Interest Rates | Fees | Credit Limits |

|---|---|---|---|---|---|

| 300-639 | Poor to Fair | Low | High | High | Low |

| 640-724 | Good | Average | Average | Average | Average |

| 725-739 | Very Good | High | Below Average | Low | High |

| 794 | Very Good | Very High | Low | Low | High |

| 800-850 | Exceptional | Very High | Lowest | Lowest | Highest |

As you can see, 794 holders can expect easy approval odds paired with the most competitive interest rates, fees, and borrowing power. But it’s still short of the coveted “exceptional” credit category above 800.

How to Make the Most of Your 794 Credit Score

Scoring 794 is an impressive credit accomplishment. But now is not the time to rest on your laurels. Here are steps to make the most of your 794 credit score:

-

Check your reports and keep the score updated. Errors could be needlessly dragging down your score. Regularly check your credit reports from Experian, Equifax, and TransUnion and dispute any mistakes. Monitoring services can also alert you to suspicious activity.

-

Get preapproved for credit. With your excellent 794 score, get prequalified or preapproved before applying for mortgages, auto loans, or credit cards. This shows lenders you’re a serious, low-risk borrower and could strengthen your bargaining position.

-

Compare offers and negotiate. Don’t settle for the first offer from one lender. Shop around and leverage your 794 score to negotiate the best possible rates and terms on loans and credit cards. A little extra effort can save you thousands.

-

Practice excellent credit habits. Payment history and credit utilization account for 65% of your credit score. Stay diligent about paying all bills early or on time, keeping balances low, and only applying for credit when needed.

-

Consider score-boosting tactics. It takes time, but you could potentially inch up to that “exceptional” credit tier. Try things like increasing your total available credit or becoming an authorized user on someone else’s old account.

-

Leverage your score. That 794 score gives you leverage – use it! Ask lenders to waive annual fees, lower your interest rates, or increase credit limits. See if you qualify to convert existing balances into lower-rate products.

The Downside of an Excellent Credit Score

Aside from the benefits, there are some potential drawbacks of having top-tier credit:

- Pre-approvals inundate your mailbox constantly

- You receive many offers to open new credit cards

- Lenders aggressively want your business and may push expensive products

- Scammers and hackers target you, trying to exploit your good credit

The key is not to give into temptation simply because you can qualify for more credit. Only apply for what you reasonably need and can manage responsibly. Also be vigilant about protecting your identity.

Maintaining Your 794 Credit Score

Scoring 794 demonstrates your credit prowess. Follow these tips to keep your score in the same stratosphere long-term:

- Review all 3 credit reports annually and dispute inaccuracies

- Pay all bills on time, every time

- Keep credit utilization below 30% on each card and overall

- Limit credit inquiries by only applying for needed credit

- Monitor your credit and be alert for signs of fraud

Also, consider signing up for credit monitoring if you don’t already use a service. The monitoring can alert you to suspicious activity and provide monthly updates on your scores.

Is a 794 Credit Score Good?

In short – yes, a 794 credit score is very good! It gives you access to the most attractive borrowing terms and puts you in an elite group of top credit scorers. Maintain your excellent habits to reap the benefits.

Just remember, even with pristine credit, you should only take on loans or credit cards you actually need. And be sure to leverage your 794 score for the best possible rates and terms. Your credit score is a powerful asset when used wisely.

What’s a utilization ratio or debt-to-credit ratio?

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that you’re a higher-risk borrower.5 That’s because lenders see borrowers who use a lot of their available credit as a greater risk.5

Let’s say you have two credit cards, a line of credit, and a total of $14,000 in debt. The total amount you can borrow is $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

What’s a good credit score?

It depends on the scoring model used. In Canada, according to Equifax, a good credit score is usually between 660 to 724. If your credit score is between 725 to 759 it’s likely to be considered very good. A credit score of 760 and above is generally considered to be an excellent credit score.2 The credit score range is anywhere between 300 to 900.2 The higher your score, the better your credit rating.2

Your credit score helps lenders to assess your credit capacity. 1 The higher your score, the more likely you are to get approved for loans and credit. 1 It may also be checked when applying to rent a property or when applying for certain jobs. 1 However, everyone’s financial situation is different and your credit score will change over time based on your credit history and the amount of debt you owe.

According to the Government of Canada, your credit history is a record of your debt repayments on credit cards, loans and lines of credit.1 Your credit history helps determine your credit score.1 That’s why it’s important to be smart about how you use and manage your credit.

How to check your credit score

The federal government says it’s important to check your credit score so you know where you stand financially. Both Equifax and TransUnion provide credit scores for a fee.

Check your credit score

You can check your credit score with the TransUnion CreditView® Dashboard in the TD app. Checking in the TD app will not affect your credit score in any way. Learn more.

How to increase your credit score

The Government of Canada states that your credit score will increase if you manage credit responsibly and decrease if you have trouble managing it.1

Here are some tips from the Government of Canada to help improve your credit score:

- Get a credit card and use it to buy things you would have bought anyway to build credit. 3. Getting a credit report from a credit bureau gives you access to and a look at your credit history. Equifax and TransUnion both let you get a free copy of your credit report once a year. This won’t hurt your credit score. You can order the report by phone, email and online. 4.

- To keep a good repayment history and raise your score, try to pay your bills on time and in full. 3. If you can’t pay the whole bill, try to make at least the minimum payment. 3. If you think you might not be able to pay your bill, call your lender. 3.

- Don’t apply for credit or switch credit cards too often. 3. Try not to have too much debt, and don’t let small balances add up. 3.

Also, here’s some advice: make the most of your credit card and don’t miss your payments. Setting up automatic payments from your bank account to your credit card could help you keep up with your payments.

Check out this video that breaks it down in simple terms:

Secret HACKS To Get A 794 CREDIT Score FAST | Boost Credit Score

FAQ

How many people have a 794 credit score?

| Range | Percentage of Consumers |

|---|---|

| Fair (580-669) | 15.8% |

| Good (670-739) | 21.6% |

| Very good (740-799) | 28.1% |

| Exceptional (800-850) | 21.9% |

What can you do with a 794 credit score?

A credit score of 794 is considered excellent and is indicative of a responsible borrower who manages credit and debt well. If you have a credit score of 794 or higher, you are likely to have access to a wide range of financial products and services, including personal loans with favorable terms and conditions.

How to go from 794 credit score to 800?

There are five things that need to be done. Let’s go over each one and see how it helps you reach 800. Pay on Time. It helps to be a perfectionist, but you don’t have to be to join the 800 Club. Limit Credit Use. Mix and Match Methods of Borrowing. Credit History Matters. Don’t Apply for Credit ….

Is 794 a good credit score to buy a house?

“740 is typically the score necessary to qualify for the ‘best’ rate, but there are products and programs out there that will improve interest rates for FICO …Nov 27, 2024.