People with credit scores between 300 and 850 have good credit. Scores between 670 and 739 are bad. Credit scores of 740 and above are very good while 800 and higher are excellent.

Credit scores between 300 and 850 are good, with a score in the mid to high 600s or higher being the best. A score in the high 700s or 800s is considered excellent. About a third of consumers have FICO® ScoresÎ that fall between 600 and 750âand an additional 48% have a higher score. In 2023, the average FICO® Score in the U. S. was 715.

Lenders use their own criteria for deciding whom to lend to and at what rates. But if your credit score is higher, you may be able to get a credit card or loan with better terms and a lower interest rate. The most common credit scores are the FICO® Score and the VantageScore® Credit Score. Their ranges are a little different, but their scoring factors are the same.

Your credit score is one of the most important numbers in your financial life. It determines whether you can get approved for credit cards, loans, mortgages, and other products – and what interest rates you’ll pay. So where does a 743 credit score stand? Is it good or bad? Here’s a comprehensive look.

What is a Credit Score?

Let’s start by agreeing on what a credit score is and how it works.

Your credit score is a three-digit number that is based on the information in your credit report. It shows how creditworthy you are, or how likely you are to pay back loans.

The most commonly used credit score model is called FICO. FICO scores range from 300 to 850. Lenders are less likely to lend you money if your score is high.

Experian, Equifax, and TransUnion are the three main credit bureaus. Each of them keeps a credit report on you that is based on how much you’ve borrowed and paid back. To figure out your FICO score, they look at the information in your credit report.

While you have multiple credit scores from each bureau, lenders generally look at your FICO score from one bureau when making lending decisions

The Different Credit Score Ranges

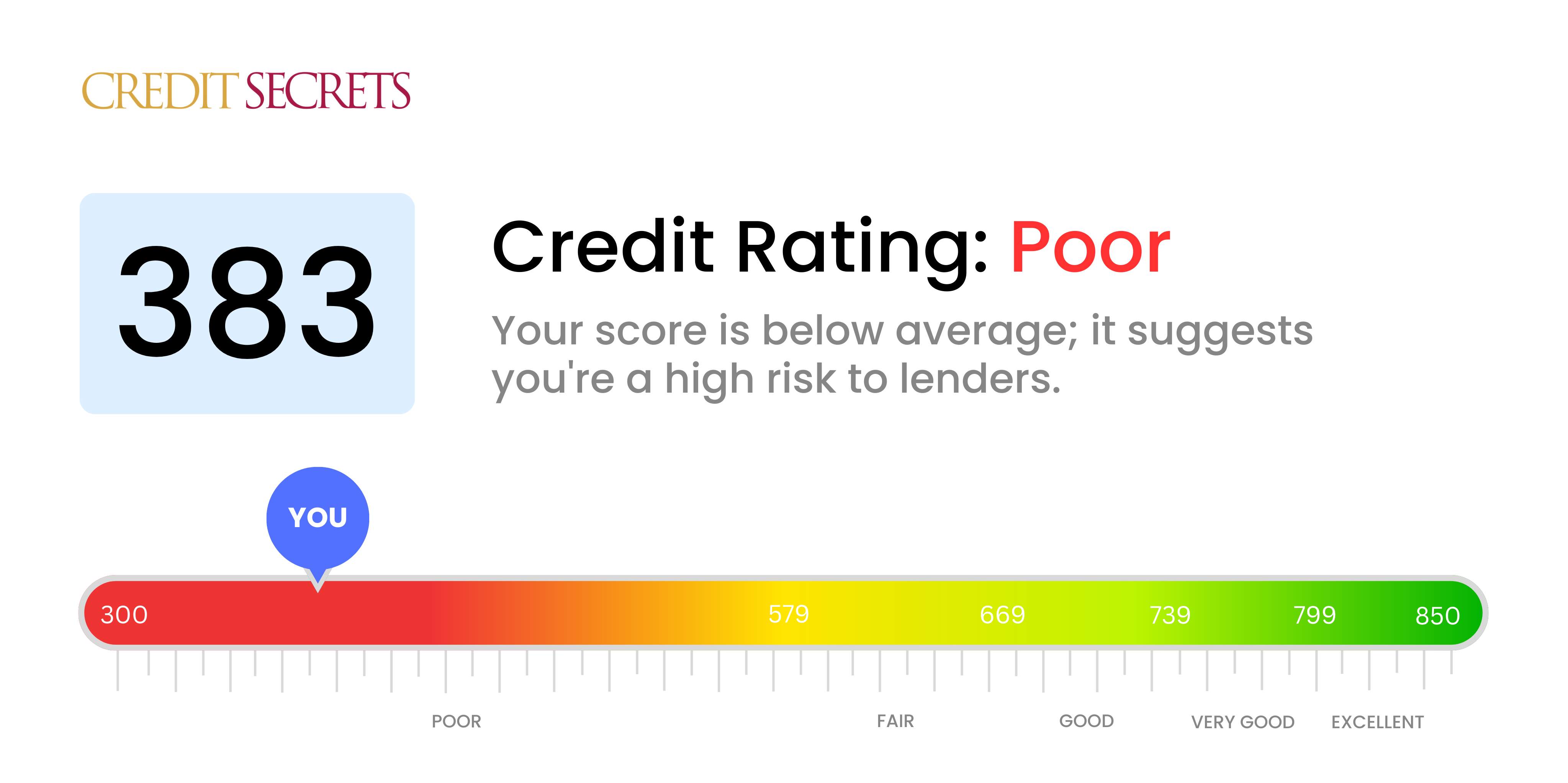

FICO categorizes credit scores into the following ranges:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Poor

So a FICO score of 743 falls into the “Very Good” range.

Here’s a breakdown of how common each score range is, based on the over 200 million consumers with FICO scores:

- Exceptional (800-850): 1%

- Very Good (740-799): 25%

- Good (670-739): 23%

- Fair (580-669): 35%

- Poor (300-579): 16%

As you can see, a 743 score puts you well above average. Only about 1 in 4 consumers have credit scores in the Very Good range.

Is a 743 Credit Score Good or Bad?

Now let’s directly address the question – is a credit score of 743 good or bad?

The short answer: Yes, a 743 credit score is very good. It’s well above the average score of around 700. You have a proven track record of responsible credit usage.

Here are some key facts about a 743 credit score:

-

A 743 credit score is in the top 25% of consumers. Only 1 in 4 people have a score this high.

-

A 743 credit score is over 40 points higher than the average score of 701.

-

FICO considers 743 to be a “Very Good” score. It’s close to reaching the “Exceptional” credit score range.

-

With a 743 credit score, you should qualify for the best loans and credit cards at excellent interest rates. Lenders see you as a very low lending risk.

-

According to FICO, only 1% of people with a 743 score are expected to become seriously delinquent on credit obligations. This demonstrates how reliable you are.

So while there’s still room for improvement, a credit score of 743 is undeniably excellent. You have great credit health compared to most people.

Benefits of a 743 Credit Score

A 743 credit score unlocks many perks and advantages when it comes to accessing credit. Here are some of the key benefits:

Better loan terms: With a 743 credit score, you’ll qualify for the best possible interest rates on all types of loans – mortgages, auto loans, personal loans, student loans. A higher score saves you thousands in interest over the life of a loan.

Higher loan approval odds: Lenders have more confidence approving applicants with Very Good credit scores. You should have no problem getting approved for reasonable loan amounts.

Access to top credit cards: Cards with lucrative rewards, big sign-up bonuses, 0% intro APRs, and other premium perks are within reach with a 743 score. You’ll have your pick of the top offers.

Higher credit limits: Banks will likely approve you for higher borrowing limits on credit cards and lines of credit compared to applicants with lower scores. This helps improve your utilization ratio.

Lower security deposits: Some lenders waive security deposits for renters, utilities, cell phone service, etc. with very good credit. Saves you money upfront.

Better insurance rates: Insurers offer their most competitive car and home insurance rates to customers with excellent credit scores like 743. This can save you hundreds per year.

Improved job prospects: While checking applicants’ credit is illegal in some places, many employers still view it as a measure of responsibility. A 743 score looks very appealing.

Higher likelihood of approval overall: Even if specific credit products don’t have official minimum score requirements, a 743 improves your chances across the board.

Peace of mind: With a Very Good score, you can feel confident in your credit health and abilities to obtain financing when you need it.

How to Improve a 743 Credit Score

While a 743 credit score is excellent, there are still ways to improve it even further. Here are some tips:

Lower credit utilization: Keep balances low on credit cards and other revolving credit below 30% of the limit, and optimize utilization on each card.

Pay bills on time: Pay all bills by the due date every month. Setting up autopay can help. One late payment can drop your scores.

Don’t close old accounts: Keep your longest-open credit accounts active. The average age of accounts factors into your scores.

Limit hard inquiries: Only apply for credit when you need it to avoid too many inquiries. This indicates lower risk.

Check reports for errors: Dispute any inaccurate or unverified information on your credit reports that may be artificially lowering your scores.

Monitor your credit: Stay on top of your scores and reports using a service like Credit Karma to identify any sudden changes.

Practice good habits: Using credit responsibly over time continues to strengthen your scores as you build a longer credit history.

With excellent financial habits, you can push your credit score into the Exceptional range of 750 and above. But for most lending purposes, a 743 already qualifies you for the cream of the crop when it comes to interest rates, approval odds, and terms.

Is a 743 Credit Score Good for a Loan?

A 743 credit score is considered excellent for any type of loan application, from mortgages to personal loans to credit cards.

Here’s a look at how competitive a 743 credit score is for different loan types:

Mortgages – A 743 score makes you a prime mortgage borrower who will qualify for low published interest rates and the best terms from lenders. Rates and fees are based on credit tiers, and 743 puts you in top tiers.

Auto Loans – Your 743 score exceeds the requirements for the best auto loan rates from most lenders by a wide margin. You can expect to save significantly on interest costs.

Personal Loans – A 743 credit score opens the door to the largest loan amounts with the lowest APRs. You should have no problem securing a personal loan from online lenders or credit unions.

Student Loans – Private student loan lenders will offer you their very lowest interest rates reserved for borrowers with excellent credit. Big win on saving money.

Credit Cards – Nearly any card you apply for will approve you with a 743 credit score. You’ll also get higher limits to keep utilization low.

Your 743 score gives lenders confidence in your ability to handle repayment of a loan responsibly. Take advantage of this strong score to save money.

Is a 743 Credit Score Good for an Apartment?

If you’re apartment hunting, a 743 credit score will make you an extremely attractive prospective tenant. Most landlords and property managers require credit scores of 650 or higher.

Here are some key benefits of having a 743 credit score when renting an apartment:

-

You’re nearly guaranteed to be approved by landlords. A 743 score vastly exceeds requirements.

-

You’ll likely avoid paying extra security deposits or fees. Landlords often waive them for tenants with very good credit.

-

You may qualify for lower required renter’s insurance policies. Premiums are cheaper with better credit.

-

If rent payments ever fall behind, landlords will be more willing to make payment arrangements.

-

Strong credit means on-time rent payment history, which helps build your credit further.

-

You won’t have issues meeting requirements for utilities like electricity, cable/internet, etc. either.

Apartment hunting is much less stressful when you have the excellent credit profile of a 743 score. You look like a highly responsible tenant who will pay rent reliably every month.

Is a 743 Credit Score Good for a Car?

Yes, a 743 credit score is considered excellent for getting approved for auto loans and leases. It meets or exceeds most lender requirements.

Here are some key points on how a 743 credit score helps with qualifying for car financing:

-

You’ll qualify for the very lowest interest rates from car dealers and lenders. Rates are tiered based on credit, and 743 is top tier.

-

You can expect easy loan approval up to competitive amounts. Lenders have confidence in your creditworthiness.

-

A 743 FICO score exceeds requirements for leasing a car. Leasing is contingent on credit just like financing.

-

Your excellent score gives you leverage to negotiate the overall price of a car purchase. Dealers want your business.

-

Refinancing a current auto loan at a lower rate should be no problem with your high score.

-

You may qualify for bigger auto loan amounts thanks to your strong credit history.

A 743 credit score puts you in a great position to save money on your next auto purchase through low rates. Enjoy the car buying benefits of your Very Good score.

Is a 743 Credit Score Good for a Credit Card?

A 743 credit score is considered well into the excellent range by credit card issuers. It will qualify you for the most rewarding cards with lucrative bonuses and benefits.

Here are some key facts on how a 743 credit score helps you get approved for the best credit card offers:

-

Top rewards cards from issuers like Chase, Amex, and Capital One are within reach. These often require 700+ scores.

-

You’ll be approved for the highest sign-up bonus amounts, which can be $500+ in value.

-

Premium travel perks like airport lounge access, Global Entry fee credits, and airline status boosts are open to you.

-

Issuers will trust you with their highest credit limits, allowing you to keep utilization low.

-

Excellent approval odds for balance transfer cards with lengthy 0% intro APRs to save on interest.

-

Better chance at being approved for elite cards with super premium perks and high annual fees.

-

Can qualify for exclusive cardholder offers not available to the general public.

Your 743 score puts you in a prime position to earn credit card rewards and take advantage of great benefits. Getting approved for premium cards is very attainable.

How to Monitor and Maintain a 743 Credit Score

Once you’ve achieved excellent credit, you’ll want to monitor your score regularly and maintain your standing through good financial habits:

-

Check your credit reports frequently and dispute any errors immediately. This ensures accuracy.

-

Sign up for credit monitoring services to keep tabs on your scores and activity. Alerts flag changes.

-

Stick to low credit card balances to keep utilization under 30% on all cards. This has a major impact.

-

Always pay all bills, including credit cards, by the due date to uphold your perfect payment history.

-

Apply for new credit judiciously to limit hard inquiries. Space applications out by several months.

-

Hold onto old credit card accounts to sustain the average age of your credit history. Longer is better.

-

Contact issuers for credit line increases periodically to keep up with spending. Bigger limits help utilization.

Staying disciplined is the key to maintaining excellent credit once you’ve achieved a score as high as 743. Monitor closely and keep practicing good financial habits.

The Takeaway

A FICO credit score of 743 is considered well into the “Very Good” range. It’s firmly above average and better than scores of most consumers.

Having a 743 score unlocks access to prime borrowing terms on all types of credit products. You’ll qualify for the lowest interest rates and best offers available.

While there’s still room to improve into the “Exceptional” credit score range, a 743 already demonstrates responsible credit management. Your finances and lending options look very bright with this type of Very Good credit score. Monitor closely and keep up your excellent habits!

What Is a Good Credit Score to Buy a Car?

While there isnt a set minimum credit score to buy a car, a VantageScore credit score of 661 or higher could be a good score. Youll generally qualify for better auto loan terms as your score increases.

Auto lenders see low credit scores as a sign of risk, so someone with bad or fair credit will likely pay more in interest and may not be able to get as much of a loan. If you dont have a good score, try to improve your credit before you buy a car.

Learn more: Average Car Loan Interest Rates by Credit Score

VantageScore’s Different Credit Scores

VantageScore creates a generic tri-bureau scoring model, meaning the score is designed for any type of lender. The same model can evaluate your credit reports from the three major consumer credit bureaus (Experian, TransUnion and Equifax).

VantageScore launched its first modelâthe VantageScore 1. 0, which is no longer offeredâin 2006. In 2017, it released VantageScore 4. 0, which was the first generic credit score to use trended data, such as how your balances or credit utilization rate change over time.

VantageScore announced its VantageScore 4plus⢠model in May 2024. This model is different from the others because it lets creditors ask customers if they want to link a bank account and share their banking information. If the person links an account, VantageScore 4plus; can consider the banking data and recalculate their score.

| VS 3.0 | VS 4.0 | VS 4plus |

|---|---|---|

| Only considers data from a credit report | X | X |

| Can consider additional data with your permission | X | |

| Considers trended data | X | X |

Is 743 A Good Credit Score? – CreditGuide360.com

FAQ

Is a 743 FICO ® score good?

A 743 FICO ® Score is in the Very Good range, with scores falling between 740 and 799. This is above the average credit score. Borrowers with scores in the Very Good range typically qualify for better interest rates and product offers from lenders.

Is a credit score of 743 good?

A credit score of 743 is a good credit score. The good-credit range includes scores of 700 to 749. People with these kinds of scores are likely to be able to get the best mortgages, auto loans, credit cards, and other things.

What is the average utilization rate for a 743 credit score?

The average credit utilization rate for consumers with a FICO ® credit score of 743 is 31. 8%. To determine ways to improve your credit score, check your FICO ® Score and you’ll receive information based on specific information in your credit file.

Can I get a car loan with a 743 credit score?

With a 743 credit score, you should be able to get approved for a car loan. However, it’s important to compare your auto loan options carefully if you want to get a low APR, as more than 60% of all auto loans go to people with credit scores below 740.

Can I get a student loan with a 743 credit score?

Student loans are some of the easiest loans to get with a 743 credit score. More than 70% of student loans are given to applicants with a lower credit score than 743. A new degree may also make it easier to repay the loan if it leads to more income.

What can I do with a 743 credit score?

If you have a credit score of 743, can you get a personal loan, an auto loan, a credit card with rewards, or a credit card with no annual fee?

How rare is a 750 credit score?

A credit score of 750 is considered “very good” and is above the average credit score in the United States. While it’s not as rare as an exceptional score of 800 or higher, it still places you in a relatively strong position with lenders.

What is a respectable credit score?

People with credit scores between 300 and 850 have good credit. Scores between 670 and 739 are bad. Credit scores of 740 and above are very good while 800 and higher are excellent. While credit scores range from 300 to 850, most people think that a score in the mid to high 600s or higher is good.

How to get 800 credit score?

The most significant factor in your credit score is a strong payment history, and Lending Tree found that 100% of people they surveyed with an 800 credit …May 2, 2025