One of the most important money choices you’ll have to make is how much house you can afford. This is especially true as you get closer to retirement. In retirement, your mortgage payment will probably be one of your biggest monthly costs, so it’s important to get it right if you want to stay financially stable.

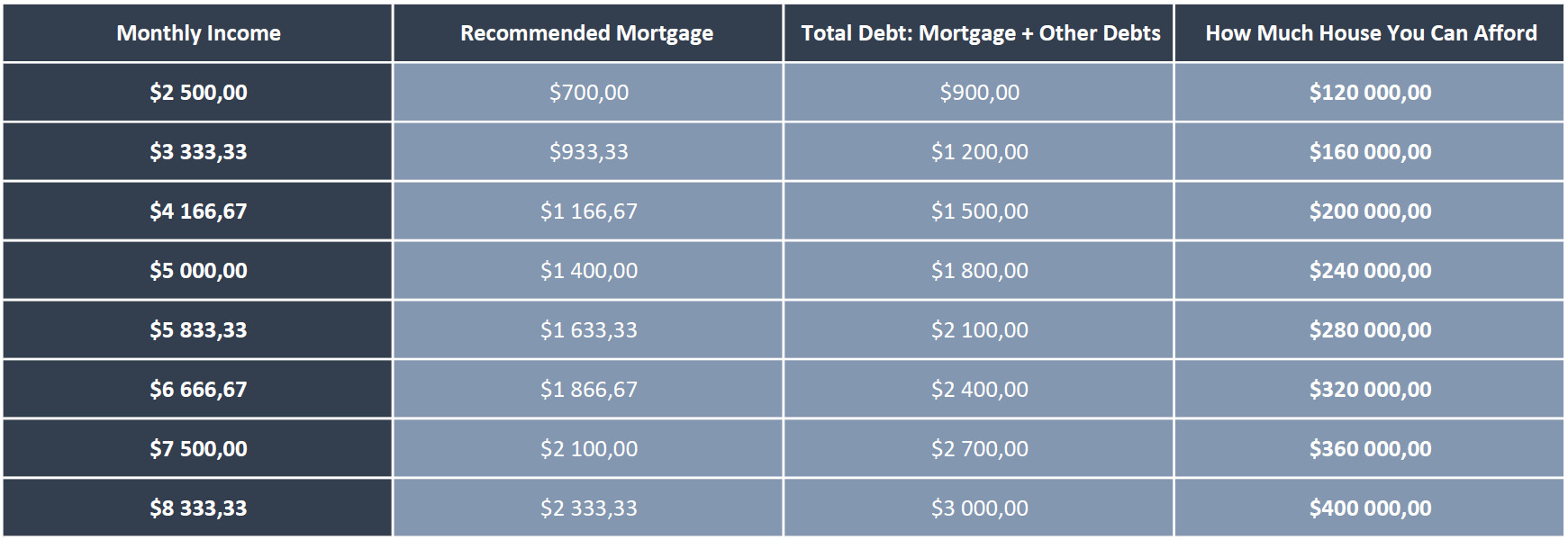

As a general rule, financial experts recommend keeping your total housing costs below 30% of your gross monthly income in retirement But determining exactly how much house payment you can afford requires looking at several factors specific to your situation. Here’s a complete guide to help you find the right home financing fit when you retire.

Calculating Your Target Budget for Housing

The first thing you should do is look at your expected monthly income streams in retirement and figure out what percentage of that total you have saved. This will give you a target budget for housing costs. Income can include:

- Social Security benefits

- 401(k), IRA or other retirement account withdrawals

- Pension payments

- Part-time job earnings

- Investment income like dividends or rentals

- Any other regular income sources

When guessing how much money you’ll make, be conservative. It’s better to have extra money than to spend more than you have. Once you know how much money you make each month, multiply it by 0. 3. This 30% portion is your maximum recommended housing budget.

Factoring In Other Essential Costs

Housing is just one piece of your overall retirement budget. Be sure to account for other living expenses that tend to go up in retirement:

- Healthcare: Premiums, co-pays, medications

- Insurance: Home, auto, medical

- Transportation: Car payments, fuel, maintenance

- Food

- Entertainment and travel

- Personal care

- Emergency savings

Review your current spending and factor in rising costs for healthcare and other services. This will give you a clearer picture of how much you can realistically devote to housing without jeopardizing your other needs.

Key Questions to Ask About Affordability

With your planned housing budget and full retirement spending plan in mind, here are some important things to think about:

-

What mortgage terms can I qualify for? Interest rates are on the rise, so run the numbers for both 15-year and 30-year options. A shorter term usually means higher payments but less interest paid over time.

-

How much do I have for a down payment? The more you can put down, the lower your monthly payment will be. Some lenders may offer better rates if you can put down 20% or more.

-

Can I pay extra each month? Making biweekly or adding extra principal payments can help pay off your mortgage faster and reduce overall interest costs.

-

How much cash reserve will I have? It’s wise to keep 3-6 months of savings on hand for emergencies like home repairs or medical issues.

-

What will future property tax and insurance costs be? Get estimates to determine the total monthly payment you’ll be responsible for.

-

Can I comfortably manage maintenance costs? Owning a home comes with maintenance expenses, so make sure to budget for repairs.

Smart Tips for Reducing Housing Costs

If the home you desire pushes you over that 30% target, look for ways to reduce the financial burden:

- Opt for a smaller home with fewer amenities and maintenance needs.

- Consider relocating to a lower cost-of-living area.

- Buy a condo or townhome with shared maintenance costs.

- Look for senior housing discounts and tax breaks.

- Pay down debts before retirement to reduce monthly obligations.

- Downsize and use home sale proceeds to fund a larger down payment.

- Rent out part of your home for added income.

Partnering With a Financial Advisor

A mortgage is a major, long-term commitment. Consulting an advisor can help provide objective guidance and insights into how much house you can realistically pay for in retirement. An advisor can review your overall financial situation and expected retirement income and expenses to recommend appropriate housing options.

With proper planning, you can find the right home financing solution that allows you to enjoy retirement living while still preserving your nest egg. Carefully weighing affordability considerations well ahead of your retirement date gives you time to make adjustments so you can achieve that balance.

Protect your loved ones with life insurance from Prudential

Discover why millions of families look to us to help plan for the unexpected and protect what matters most.

Get customized solutions to help grow your money & live better

Answer a few questions to uncover financial opportunities for your unique goals.

How Much Of A Mortgage Payment Can We Afford?

FAQ

How much house can I afford if I’m retired?

… your total housing expenses, including mortgage payments, property taxes, insurance, and maintenance, should not exceed 30% of your overall retirement income.

What is the $1000 a month rule for retirement?

The “$1,000 a month rule” for retirement is a simple guideline suggesting that for every $1,000 of desired monthly income in retirement, you should aim to have $240,000 saved. This rule is based on a 5% annual withdrawal rate from your retirement savings.

At what age should you have $1 million in retirement?

There isn’t a single age at which everyone should aim to have $1 million saved for retirement, as it depends on individual circumstances and desired lifestyle. However, financial experts often suggest that a $1 million nest egg, coupled with other income sources like Social Security, can allow some individuals to retire in their 60s with a modest lifestyle.