You’re ready to take the plunge into home ownership. Now what? There’s a lot to do before you can start picking out new furniture. Knowing what to expect, and what steps to take, can make the process easier. Read on to learn how to start the home-buying process.

Buying a home is an exciting milestone, but navigating the mortgage application process can feel daunting for first-time homebuyers Knowing what to expect can help you prepare and avoid surprises along the way Here are the seven key stages of applying for a mortgage

1. Preapproval

The first step is getting preapproved for a mortgage by a lender Preapproval involves the lender reviewing your credit, income, assets, and debts to determine the loan amount you qualify for

You can start looking for homes in your price range once you have a preapproval letter. Also, sellers like buyers who have already been approved because it shows that you are a serious and qualified buyer.

2. House Hunting

Now the fun part begins – searching for your dream home! Work with a real estate agent to view listings and attend open houses

When you find a home you want to buy, your agent will help you submit an offer and earnest money deposit to the seller. Make sure you have a mortgage preapproval letter to strengthen your offer.

3. Selecting a Lender

You don’t have to go with the lender who preapproved you, but it’s a good idea to get quotes from a few different lenders to compare rates and fees. Get mortgage offers from different lenders and compare all the costs, not just the interest rates.

4. Completing a Mortgage Application

Once you’ve decided on a lender, you’ll need to fill out a full mortgage loan application and send in proof of your income. Required documents typically include:

- Income statements like W2s and paystubs

- Bank account statements

- Tax returns if self-employed

- Debt information like credit card statements

Respond promptly to any additional requests from your lender during the application process.

5. Home Appraisal

Your lender will order a home appraisal to ensure the home’s fair market value matches the sale price. An appraiser will visit the property and evaluate the home’s condition and features.

Low appraisals can slow down or stop mortgage approvals, so look over the appraisal very carefully. If you don’t agree with the value, you can give more comps.

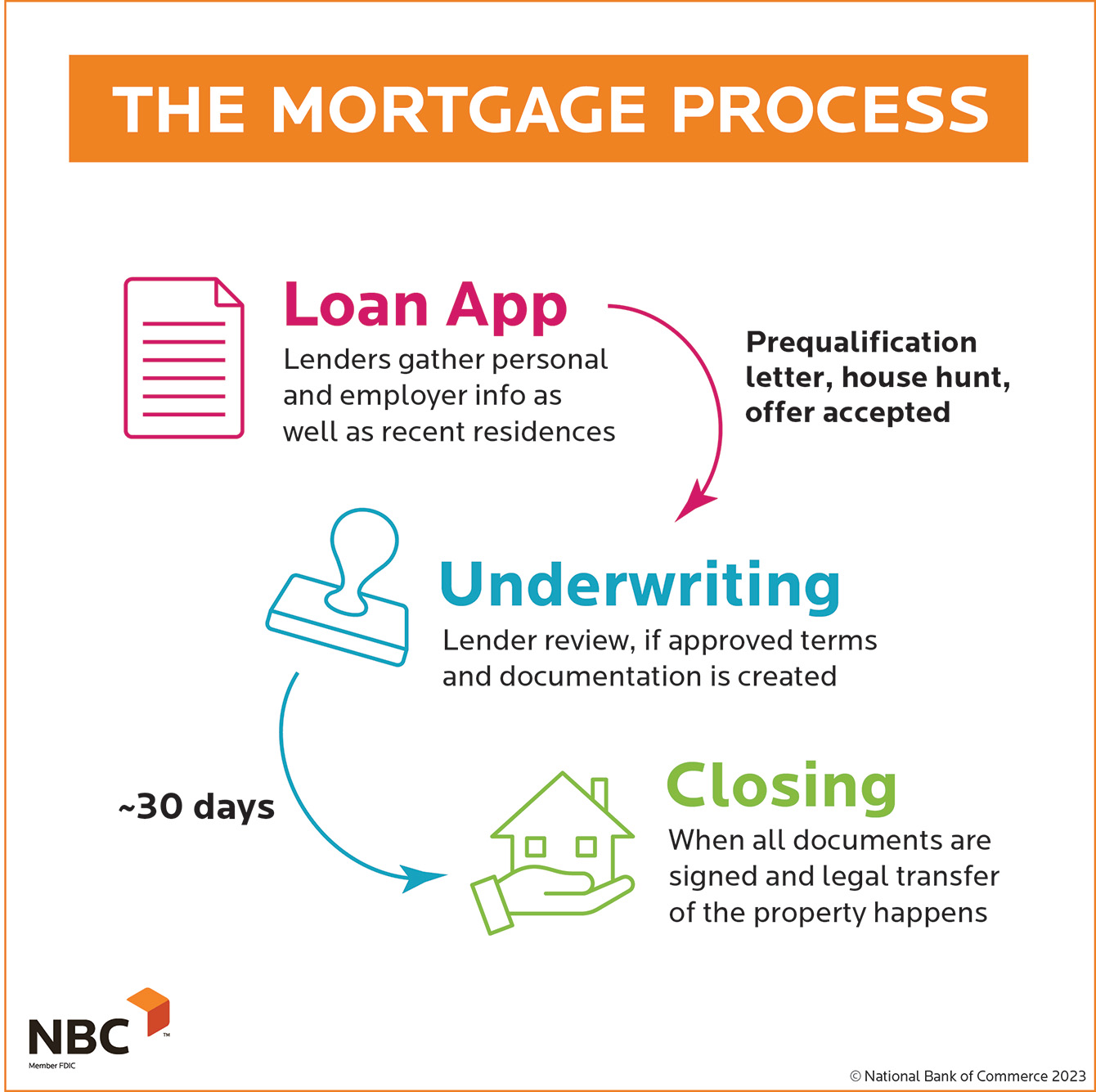

6. Underwriting

Underwriters review your full application package to approve your mortgage request. They analyze your credit, income, debts, and assets to assess loan qualification and risk.

Underwriting typically takes anywhere from a few days to a couple weeks. Provide any additional documentation requested during underwriting to avoid delays.

7. Closing

The final stage is mortgage closing where you review and sign your final loan documents. The closing disclosure details your final loan costs and terms.

Carefully review your closing paperwork before signing. Once closed, your loan documents are finalized and you’ll get the keys to your new home!

The mortgage process has several key steps – from preapproval to underwriting to closing. While it can seem complicated, your lender and real estate agent will help guide you every step of the way. With some preparation and patience, you’ll get through the process smoothly.

A pre-approval allows you to move forward with confidence.

If you want to show sellers you’re serious about making an offer, getting pre-approved is the way to go. It can give you an edge over other buyers in a competitive market and let you move quickly through the process once you find your dream home.

Want to know how to get pre-approved for a mortgage? It takes more paperwork than pre-qualification, like W-2s, pay stubs, bank statements, and tax returns. It also involves pulling your credit score and history. With this information, your lender will be able to determine your loan amount, so you can shop for homes within your price range. A pre-approval only lasts 90 days, so it’s best to wait until you’re ready to start shopping.

Let’s get you closer to your new home.

Prequalification helps you see how much you might be able to borrow.

Home Mortgages 101 (For First Time Home Buyers)

FAQ

What are the steps in the mortgage process?

Nevertheless, the mortgage process can be broken into a number of well-defined steps. As a general rule, people who want to get a new mortgage go through six separate steps: getting pre-approved, house hunting, mortgage application, loan processing, underwriting, and closing. In this guide, we’ll explain everything you need to know about each of these steps.

What are the 6 stages of a mortgage loan?

Most people go through six distinct stages when they are looking for a new mortgage: pre-approval, house shopping, mortgage application, loan processing, underwriting, and closing. In this guide, we’ll explain everything you need to know about each of these steps. How do I get a mortgage loan?.

How many steps do you need to get a mortgage?

Getting a mortgage can seem daunting. You’ll need to make big decisions about mortgage types, lenders, and properties. But the mortgage process is really very simple. There are only six steps: getting pre-approved by mortgage lenders, house hunting, applying for a mortgage, loan processing, underwriting, and closing.

How long does a mortgage application take?

The mortgage application typically takes anywhere from 2-4 weeks until approval. The lender will order an appraisal during the application process. Here’s how appraisals work: An appraiser will visit the home and evaluate its condition and market value. They compare the home to recent sales of similar properties.

What to expect after submitting a mortgage application?

Here’s what to expect after you formally submit your application. Your mortgage lender will look over your application and confirm your income, assets, debts, and property information as part of the underwriting process. Once verification is complete, you’ll receive final approval on your loan application.

How long does a mortgage loan take to process?

Finally, the underwriter will recommend approval or denial of the loan. How long is a mortgage loan in processing? It takes a little under two months from the date you submit your mortgage application and close on the house — the average timeline is 50 days.

What are the 5 stages of mortgage?

- Get pre-qualified. Before you go house hunting, it’s important to get a strong sense of what you can afford. …

- Submit your loan application. …

- Lock in an interest rate. …

- Get your loan approved. …

- Close the deal.

What are the stages of a loan application?

- Stage 1: Application Submission.

- Stage 2: Documentation Verification.

- Stage 3: Credit Evaluation.

- Stage 4: Loan Underwriting.

- Stage 5: Loan Approval and Disbursement.

- Stage 6: Loan Servicing.

At what stage is a mortgage approved?

When it comes to how long does it take to get a mortgage approval, it can typically take 2-4 weeks after submitting your mortgage application to getting a mortgage offer. But it can take longer, for example if issues are thrown up in the mortgage valuation. Read more in our guide on Mortgage valuations explained.

What is the last stage in the mortgage process?

Once your loan is approved and your inspection, appraisal and title search are complete, your lender will set a closing date and let you know exactly how much …