Each year, millions of people miss payments on credit cards, personal loans, mortgages, payday loans, and other kinds of credit.

If you don’t make up these late payments quickly, they could lead to a “default,” which shows up on your credit report.

It might seem impossible to get a default off of your credit report. A default is one of the worst things that can happen to your credit report, and it can hurt your score a lot. But, despite what most people think, there are times when you can ask a company to remove a default. This is a full guide to how defaults work, when they can be removed, and how to ask for their removal.

What is a Default?

If you can’t make your minimum payment on a debt for several months in a row, you’re in default. Credit cards, personal loans, auto loans, and mortgages are all common types of accounts that can go into default. When a loan is 30 to 90 days past due, the lender will report it as a default to the credit bureaus. This tells other lenders that you haven’t been able to pay back a debt.

Defaults can stay on your credit report for up to 5 years During this time, they will damage your credit score and make it more difficult to qualify for new credit Even after a defaulted account is paid off, it will continue reporting as a default until the 5-year period ends.

When Can a Default Be Removed?

Most of the time, defaults can’t be taken off your credit report until 5 years have passed. There are, however, a few situations in which you can ask for early removal:

-

The default was reported in error: If you have proof you were never late on your payments, you can dispute the default with the credit bureaus. The creditor will be required to verify the default, and if unable to, it must be deleted.

-

The debt was victim of identity theft: If someone opened an account in your name and defaulted on it, you can request a removal after filing an identity theft report.

-

You can get a goodwill removal: If the default was due to unusual circumstances that were out of your control, you may be able to get the default taken off your record by talking to the creditor directly. Some examples are serious health problems, being sent to war, or a death in the family.

-

The default should have already fallen off If the default should have already passed the 5-year mark but is still appearing you can dispute it with the credit bureaus to get it removed.

How to Request Removal of a Default

If you believe your default qualifies for removal, here are the steps to make it happen:

-

Contact the creditor: Call the creditor for the account and explain why you think the default should be taken off your credit report. Be polite and honest about your situation. Provide any documentation you have to validate your claims.

-

Dispute the default: If the creditor does not agree to a removal, submit disputes with Equifax, Experian and TransUnion. Explain the situation and your justification for removal. The bureaus are required to investigate.

-

Submit a CFPB complaint: If disputes are unsuccessful, you can file a complaint about the creditor with the Consumer Financial Protection Bureau. This prompts the CFPB to launch an investigation.

-

Consult a credit repair company: Professional credit repair services have experience negotiating with creditors for default removals. They can advocate on your behalf and help craft the necessary documentation.

-

Wait it out: If you’ve exhausted all options, continue paying your bills on time and wait for the default to fall off your report naturally in 5 years. The impact lessens with time.

Getting a default removed requires persistence and patience. But clearing this major black mark can help boost your credit score significantly. With improved credit, you’ll have access to more affordable lending options.

Customer monthly repayments before and after entering a Trust Deed

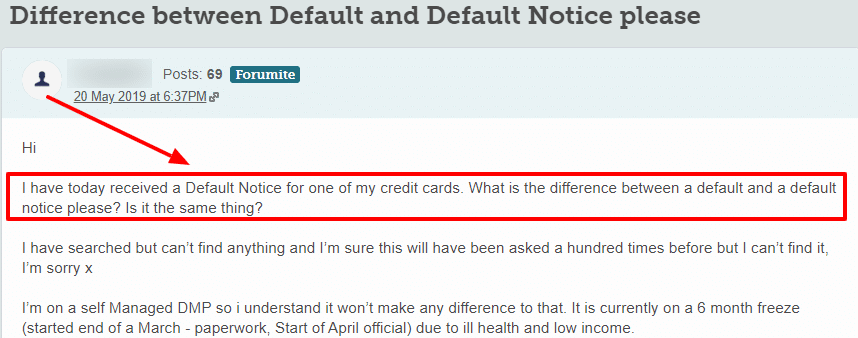

Don’t panic if you’ve just missed a payment or received a default notice. Nothing is immediately recorded on your credit file.

However, if you don’t catch up with what you owe before the notice becomes an actual default, then the account default is recorded with a credit reference agency.

Many times, a default will cause your credit score to go down because your credit history and credit score are linked.

Anyone who looks at your credit history will be able to see this default. This includes lenders, insurers, phone contract providers, letting agents or landlords, and even some employers. This can affect your chances of being offered credit. In some professions, it can even affect your chances of getting a job – although this isn’t common.

A massive thank you

“I’d like to say a massive thank you to Carrington Dean for helping me. It feels like I have control of my life again. ”.

Can I Remove Defaults Without Paying?

FAQ

How do I get a company to remove a default?

Request default removal: If you have a legal right to contest the default, contact the credit reference agency displaying the issue and argue your case with them directly. If the problem is that the debt has been paid off, make sure you have proof of this on hand.

Can you ask for a default to be removed?

Can I get someone to remove a default? You can only get a default removed from your credit report if you can prove that it was an error.

How much does it cost to remove a default?

The fee to remove a default starts at $1650. There are no payment plans, and you only pay us if we do a good job.

Can a default be undone?

… default judgment was appropriately entered against you, you must file a motion with the court asking the judge to “set aside” (void or nullify) the judgment.