Credit scores are an important part of your financial picture because they show lenders how responsible you are with money. You may, however, find that the credit scores you see on Credit Karma don’t always match up with other credit scores you see. This might make you wonder: How far off is Credit Karma?

There are a few key reasons why your Credit Karma score may differ from scores used by lenders:

Credit Bureaus

Elean, Equifax, and TransUnion are the three main credit bureaus in the US. Credit Karma shows your VantageScore from TransUnion. However, lenders may pull your scores from a different bureau. They don’t all get the same information about you, so your scores can be different between bureaus.

Credit Score Models

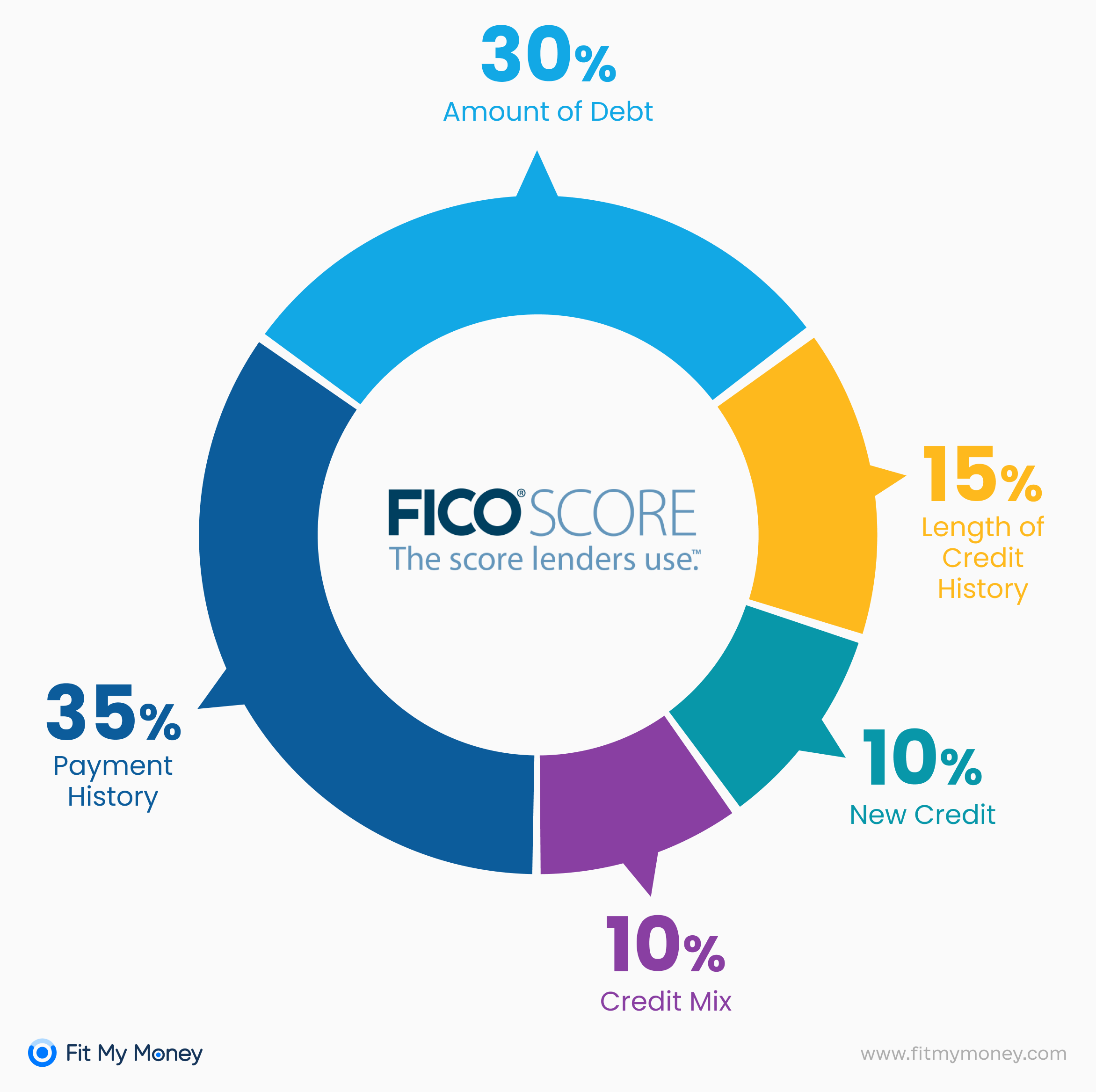

Along with different bureaus there are different scoring models. Credit Karma uses the VantageScore 3. A lot of lenders use the FICO score model instead. FICO and VantageScore use different methods to compare things like payment history and credit use, which causes differences.

Specifically, over 90% of lending decisions in the US are based on a FICO score. There are also multiple versions of FICO scores tailored to specific products – so the auto loan FICO score you see may differ from a mortgage FICO.

Score Factors

VantageScore and FICO both look at things like payment history and credit use, but they do so in different ways. As an example, VantageScore looks at your credit history’s length and type of balances more than amounts you owe. FICO, on the other hand, looks more at how much you owe. This leads to inevitable score differences.

Score Versions

Within scoring models there are different versions of scores. Credit Karma provides a VantageScore 3.0. However lenders may use an older or newer version, such as VantageScore 4.0. The same goes for different versions of FICO scores.

Score Ranges

VantageScore and FICO also have different score ranges. VantageScore ranges from 300-850 while FICO scores range from 300-850. A 745 on VantageScore doesn’t correspond to a 745 FICO score. Due to the differing ranges a score may be considered “good” on one model but just “fair” on the other.

Regular Updates

Scores fluctuate constantly based on changes in your credit report. The score you see on Credit Karma may quickly differ from what a lender pulls since they access reports at different times. Regular score monitoring is essential to stay on top of changes.

While an exact equivalence between Credit Karma and FICO scores isn’t possible, there are some general guidelines to keep in mind:

-

VantageScores tend to run 20-30 points higher on average compared to FICO versions. However, the gap can be larger on an individual basis.

-

Those with thin credit profiles often have greater variances between VantageScore and FICO.

-

If your Credit Karma score is under 700, there’s a good chance your FICO is at least 20-30 points lower. The discrepancy shrinks for those with scores over 700.

Checking your credit scores frequently can help you develop an eye for how much they might differ between Credit Karma and other sources. Moving forward, be cautious about assuming your impressive Credit Karma score aligns perfectly with lenders’ versions. Monitoring your reports across bureaus provides a more complete picture as well.

While Credit Karma offers a useful free way to check VantageScores, it should be viewed as just one snapshot of your credit. Consulting multiple sources, including your FICO scores, ensures you aren’t caught off guard the next time you apply for credit. Remember, knowledge is power when it comes to managing your credit profile.

Here’s why there may be credit score differences between what you see on Credit Karma and elsewhere.Updated Thu, Oct 31 2024

On Tuesday afternoon, consumers took to Twitter to express their frustration over their credit scores on Credit Karma, the personal finance company owned by Intuit.

The issue for most wasnt that the credit scores they were finding on the Credit Karma website were low—rather they were too high.

Consumers tweeted about going to apply for a credit card or loan thinking they have good or excellent credit, only to soon find that the credit score that the card issuer or lender pulled was lower than what they saw on Credit Karma.

The specific tweet that started off the conversation can be found here. Twitter users were quick to follow up and joke about how inflated their credit scores looked on Credit Karma.

But they were on to something important when it comes to checking your credit score.

Below, CNBC Select breaks down why you can expect your credit scores to differ, depending on where you check them.

How far off is Credit Karma?

FAQ

How close is Credit Karma to your actual credit score?

Credit Karma provides VantageScore credit scores, which can differ from the FICO scores used by most lenders. Credit Karma’s scores should be correct for Equifax and TransUnion because they use data from those companies. However, FICO scores are made with a different formula and may be off.

Why is my FICO score 100 points lower than Credit Karma?

A FICO score, which is used by most lenders, can differ from the VantageScore provided by Credit Karma due to differences in the scoring models and the credit bureaus used. Credit Karma primarily provides VantageScore 3. 0 from Equifax and TransUnion, while lenders often use FICO scores from various bureaus.

How accurate is a Credit Karma credit check?

Lots of people trust Credit Karma as a source of credit information because it gets its data from two of the three main credit bureaus: TransUnion and

Who is more accurate, Experian or Credit Karma?

Both Experian and Credit Karma provide accurate information about your credit, but they serve different purposes. Experian is a major credit bureau, which means it makes and keeps track of credit reports. These reports are then used by different scoring models to figure out credit scores.