Understanding how many credit scores you have can be confusing. Most people think they only have one credit score, but in reality, you likely have dozens or even hundreds of credit scores. This is because there are several factors that contribute to the number of credit scores you have. In this article, we’ll break down the main reasons why people have multiple credit scores.

You Have Multiple Credit Reports

You have more than one credit score because you have more than one credit report. There are three main credit bureaus in the United States: Equifax, Experian, and TransUnion. Each bureau maintains their own credit report on every consumer.

Your credit reports contain information about your credit history including

- Payment history

- Amounts owed

- Length of credit history

- New credit accounts

- Credit inquiries

While the information on your three reports should be generally the same, there can be slight differences between them This is because not all lenders report to all three bureaus. For example, that new credit card you opened may show up on your TransUnion report first before it gets reported to the other two Or a late payment may have been reported to Equifax but not the other bureaus yet.

Since these three credit reports are different, the credit scoring model that is used on each of them can give you three different credit scores.

Multiple Credit Scoring Models

In addition to having three credit reports, there are also multiple scoring models that are used to calculate your scores. The two primary models are FICO and VantageScore.

FICO scores were the first credit scores ever made. They are made by the Fair Isaac Corporation. Over 90% of lenders use FICO scores when deciding who to lend money to.

VantageScore is a newer credit scoring model that was made by the three credit bureaus to compete with FICO. VantageScores are becoming more popular among lenders, even though they are not used as much as FICO scores yet.

When your credit reports are scored using the FICO model, you get FICO credit scores. When your reports are scored with the VantageScore model, you get VantageScore credit scores. Since you have three reports, you can potentially have three FICO scores and three VantageScore credit scores.

Multiple Versions of Each Scoring Model

To make matters even more complicated, both FICO and VantageScore have created multiple versions of their scoring models over time.

For example, there are currently 10 different FICO score versions, with the most commonly used being FICO 8 and FICO 9. VantageScore also has 4 different versions, with most lenders using VantageScore 3.0 or 4.0.

In addition to the base FICO and VantageScore models, there are industry-specific models tailored for credit cards, auto loans, and mortgages. Lenders can choose to use one of these industry-specific scores when evaluating you for credit in those areas.

So within the FICO family of scores, you may have:

- FICO Score 8 (most widely used)

- FICO Auto Score

- FICO Mortgage Score

- FICO Bankcard Score

And each of these scores could vary across the three credit bureaus.

Lender-Specific Scores

On top of the dozens of FICO and VantageScore variations, many lenders customize their own credit scoring models. While these lender-specific scores are based on the FICO or VantageScore models, lenders tweak the algorithms to suit their specific credit risk profiles and loan products.

This means that the score a mortgage lender calculates for you will likely differ from the score used by an auto lender, for example.

The Bottom Line

While the array of credit scores you have can seem overwhelming, the most important thing is to focus on the few scores that matter most for your situation:

-

Check your scores from Equifax, Experian, TransUnion. You can get these for free from sites like Credit Karma. This will give you insight into your core FICO 8 or VantageScore 3.0 scores that most lenders consider.

-

When applying for credit, ask the lender which credit scoring model they use. This will provide the most accurate picture of how they will evaluate your creditworthiness.

-

If your score changes from one bureau to another, it could indicate an error or omission in one of your credit reports that should be addressed.

-

Improving your credit across the board will raise your scores with all models and lenders over time. Healthy credit habits apply universally.

While the multitude of credit scores may seem complicated, you don’t need to stress about tracking down every single one. Focus on the most relevant scores for your financial situation and maintaining consistently healthy credit habits. With some diligence, you can feel confident that your credit scores are optimized wherever they matter most.

Esta página solo está disponible en inglés

Selecione Cancele para permanecer en esta página o Continúe para ver nuestra página principal en español.

Why we have multiple scores

There should be only one credit score on each report, so why do they all look different? Here are four reasons.

How long Hard Inquiry Stays on YOUR Credit Report (& how long a Hard Pull affects YOUR credit score)

FAQ

Can you have more than one credit score?

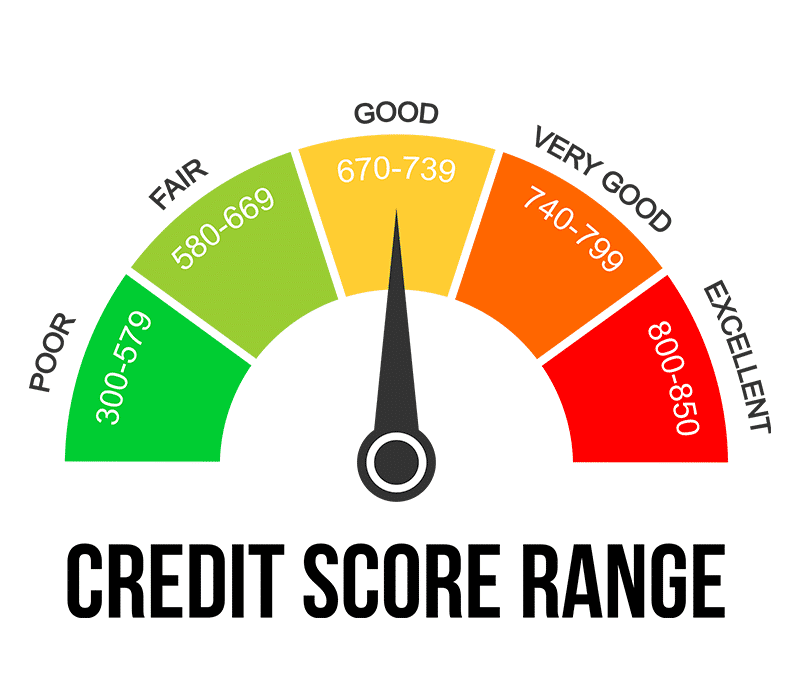

Many scores range from 300 to 850, but different companies use different ranges. There is more than one score you can have. For instance, your credit card score and home loan score might be different, and any scores you buy online might be different from both of those. For some people, these differences aren’t that big.

How many versions of a credit score are there?

There are three versions of every credit score. This is because credit scores are based on what’s in people’s credit reports, and each of us has three reports, one from each of the three main credit bureaus (Equifax, Experian, and TransUnion).

What is the average credit score?

The average credit score is 715. Older Americans have higher average credit scores. The average credit score for baby boomers is 746, while the average credit score for millennials is 691. 24% of Americans have an “exceptional” credit score of 800 or above.

What is a good credit score?

Twenty-four percent have a FICO® Score between 750 and 799, making the “very good” bracket. Data source: FICO (2024). Nearly half of Americans score between 750 and 850, in the very good to exceptional range, while 25% of Americans have a score between 300 and 649, the poor to fair credit score range.

What is the truth about the number of credit scores?

A common assumption is that since there are three credit bureaus, each individual must have three credit scores. But that implies there’s just one type of credit score, which is far from the truth.

How much credit do you need to get a good credit score?

Experts advise keeping your use of credit at no more than 30 percent of your total credit limit. A long credit history helps your score. Credit scores are based on experience over time. Your score improves the longer you have credit, open different types of accounts, and pay back what you owe on time. Be careful closing accounts.

How rare is it to have an 800 credit score?

Twenty-four percent of Americans have a credit score between 800 and 850, considered “exceptional” by FICO. A credit score at the top of that range — 850 — is perfect. Twenty-four percent have a FICO® Score between 750 and 799, making the “very good” bracket. Data source: FICO (2024).

Has anyone got a 900 credit score?

Credit card companies and auto lenders that still use the older FICO® Bankcard Score model are the only ones who can usually give you a 900 credit score. Mar 28, 2025.

How common is a 700 credit score?

What credit score does the average person have?

The average FICO credit score in the US is 717, according to the latest FICO data. The average VantageScore is 701 as of February 2025.May 1, 2025