So, you’re struggling with debt and starting to catch up, one payment at a time. But how long does it take for debts that you’ve fully paid off to be taken off your credit report? A lot of people think that once a debt is paid off, it goes away right away. However, the reality is a bit more complex.

This article will explain how different types of debt are reported, how long they stay on your credit report after being paid off, and what you can do to ensure your credit report accurately reflects your financial situation.

Paying off debt is a major accomplishment. After months or years of making payments, it feels great to finally be free of credit card, medical, or student loan debt

However, even after paying off a debt completely, it doesn’t instantly disappear from your credit report. This can be frustrating if you were hoping to see an immediate improvement in your credit scores.

In this comprehensive guide, we’ll explain:

- How long it takes for paid debts to be removed from your credit reports

- The factors that determine how paid collections impact your credit

- Steps to take if a paid collection remains on your report

- Ways to start rebuilding credit even before negative items drop off

How Soon Do Paid Debts Fall Off Your Credit Report?

In most cases, it takes one to two billing cycles after you pay off a debt for your credit report to be updated. This reflects the timing of billing cycles and monthly reporting processes used by most lenders and creditors.

For example:

- You pay off a credit card on March 15th.

- Your credit card’s billing cycle closes on the 20th of each month.

- The credit card company doesn’t report your zero balance to the credit bureaus until after the April 20th billing cycle.

- It takes the credit bureaus another couple of weeks to update your credit report.

- By early May, your credit report should show the credit card balance as paid in full.

Most debts, like credit cards, installment loans, medical bills, and collections accounts, take this long to get paid.

Some bad credit events, like bankruptcies, foreclosures, and public records, stay on your report for seven to ten years. Paying off the debts that are linked to these marks will not get rid of them faster.

How Do Paid Collection Accounts Impact Your Credit?

Paying off a debt that has gone into collections is certainly better than leaving it unpaid. However collection accounts can remain on your credit report for up to seven years, even after you settle the debt.

Here are some key points about paid collections:

-

The collection account will remain on your credit reports for seven years from the date the debt first became delinquent. This is true whether it shows as “paid” or “unpaid”.

-

Paid collections have less of a negative impact on your credit scores than unpaid collections.

-

Under newer scoring models like FICO® 9, 10 and VantageScore 3.0, paid collections are completely disregarded.

-

Many lenders still use older models like FICO® 8 where paid collections lower your scores.

-

Paying less than the full amount on multiple collection accounts can hurt your credit score more than paying the full amount.

In general, paid collections will stay on your credit report for seven years. However, that shouldn’t stop you from paying them. Even though it says “paid,” the status still helps your credit score more than leaving collections unpaid.

Removing Legitimate Paid Collections Early

Since paid collections typically remain on your reports for seven years, is there any way to get them removed early? There are a few options:

Goodwill deletion requests – Write the collection agency a goodwill letter emphasizing your years of otherwise perfect credit. They have the discretion to delete the account but are not obligated.

Negotiate pay-for-delete – When first attempting to pay a collection, try negotiating pay-for-delete, where the agency agrees in writing to remove the account upon payment. Many are reluctant to make this agreement.

Wait for the collection to expire – This passive approach takes patience, but legally the item must come off your report after seven years. Maintain good credit habits in the meantime.

Credit repair companies – Debt settlement and credit repair firms promise to remove collections through proprietary methods. Success rates and costs vary widely between companies.

If steps to remove a legitimate paid collection early all fail, don’t worry. As explained above, once it shows paid, the damage to your credit is limited compared to unpaid collections. The most important thing is keeping up positive credit habits going forward.

How to Start Rebuilding Credit With Negative Marks

Don’t put your credit-building plans on hold just because you have collections or other negative items on your credit reports. Here are some ways to start improving your credit right away:

Review credit reports and dispute errors – Mistakes do happen, so scan all three credit bureaus for any inaccuracies you can dispute.

Pay bills on time – Your payment history is the biggest factor in your credit scores, so stay on top of all monthly credit and loan bills.

Lower credit utilization – Owing less than 30% of your total available credit limits can boost credit scores quickly.

Become an authorized user – Ask a friend or relative with good credit to add you as an authorized user on a long-held credit card. Their good history can raise your scores.

Limit new credit applications – Each application causes a hard inquiry that dings your credit temporarily. Space out new accounts over time.

Let closed accounts age – Keep old credit cards open even if not in use. Having long average age of accounts helps scores.

Add alternative credit data – Utilities and rent that appear on your credit reports can offset negative marks. Enroll in programs that report them.

Sign up for credit monitoring – Ongoing monitoring ensures any new report mistakes or suspicious activity gets caught right away before harming your credit.

The Takeaway

It typically takes one to two billing cycles after paying off a debt for your credit reports to reflect the zero balance. Medical bills and collections can remain for seven years, but will hurt your credit scores less when paid off.

While frustrating if you want immediate results, focus on continuing positive credit habits, not the presence of old negatives. With time and perseverance, those paid-off debts will drop off, and your credit can fully recover.

Factors Affecting Removal Time

Several factors can influence how quickly paid-off debt is removed from your credit report:

- Type of debt: As we’ve already seen, the due dates for different types of debt are different.

- Credit bureau rules: The three main credit bureaus generally follow the same rules, but sometimes their rules are a little different.

- Creditor reporting: The due date is also based on when and how creditors send reports to the credit bureaus. Some may change information once a month, while others may do it less often.

- Errors or disputes: If there are mistakes in how the debt is reported, a formal dispute could speed up the process of getting rid of it.

Understanding Credit Reports and Debt Reporting

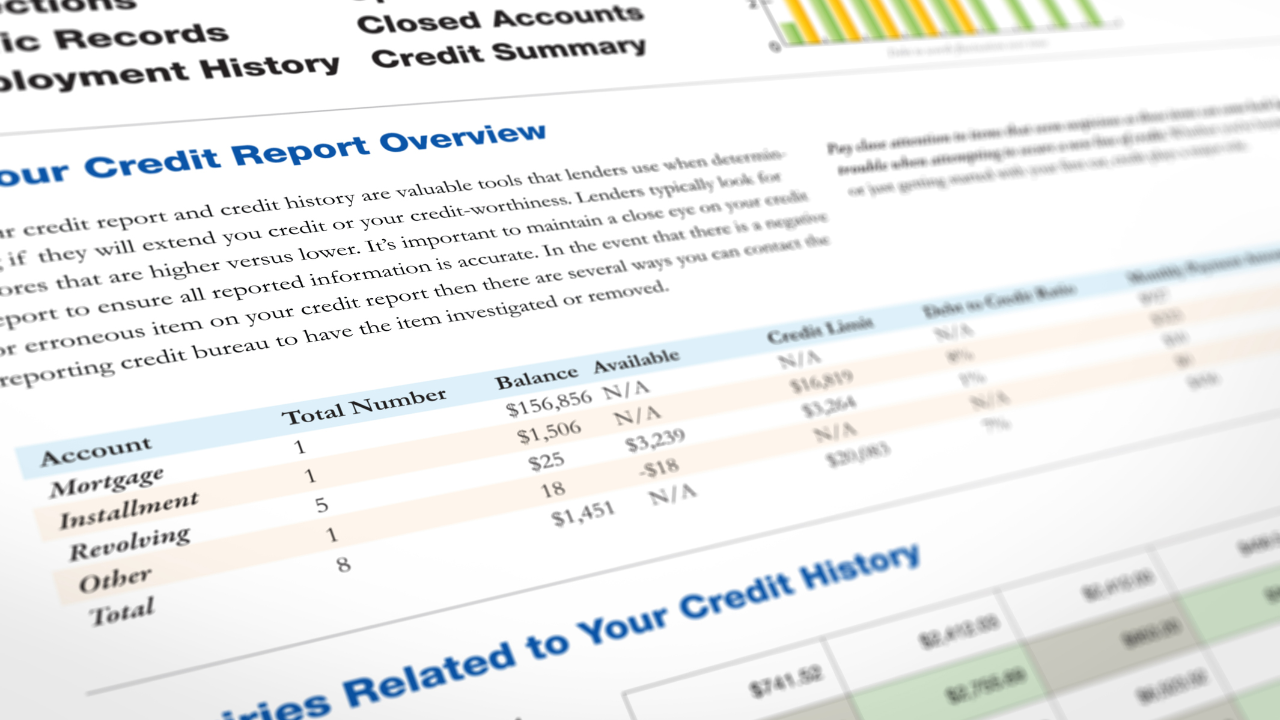

Before diving into the specifics of debt removal, it’s essential to understand how credit reports work:

- Credit bureaus: Equifax, Experian, and TransUnion are the three main credit bureaus in the United States. These agencies collect and maintain consumer credit information.

- Types of data: Credit reports contain different kinds of financial data, like credit accounts, payment history, public records (like bankruptcies), and inquiries.

- Reporting time: Most bad things can stay on your credit report for up to seven years, but there are some exceptions.

Will Your Credit Score to Go Up After Paying Off Debt?

FAQ

How long does it take for a credit report to update after paying off debt?

CreditNinja says it can take anywhere from 30 to 60 days for a debt to show up on your credit report. Sometimes it can take even longer. Credit bureaus update reports every 30-45 days, but the exact timing depends on the lender and the specific credit bureau.

Can paid off debt be removed from credit report?

If you’ve paid off the debt, you might want to write the credit bureau a “goodwill” letter to get the item taken off your report. May 30, 2025.

What is the 7 7 7 rule for debt collection?

In particular, the rule says that a debt collector can’t: Call a customer more than seven times in seven days about the same debt;

Is it true that after 7 years your credit is clear?