People with credit scores between 300 and 850 have good credit. Scores between 670 and 739 are bad. Credit scores of 740 and above are very good while 800 and higher are excellent.

Credit scores between 300 and 850 are good, with a score in the mid to high 600s or higher being the best. A score in the high 700s or 800s is considered excellent. About one-third of consumers have FICO scores between 600 and 750, and another 18% have a higher score. In 2023, the average FICO® Score in the U. S. was 715.

Lenders use their own criteria for deciding whom to lend to and at what rates. But a higher credit score can generally help you qualify for a credit card or loan with a lower interest rate and better terms. The two main types of credit scores, the FICO® Score and VantageScore® credit scores, vary slightly in their ranges but have similar scoring factors.

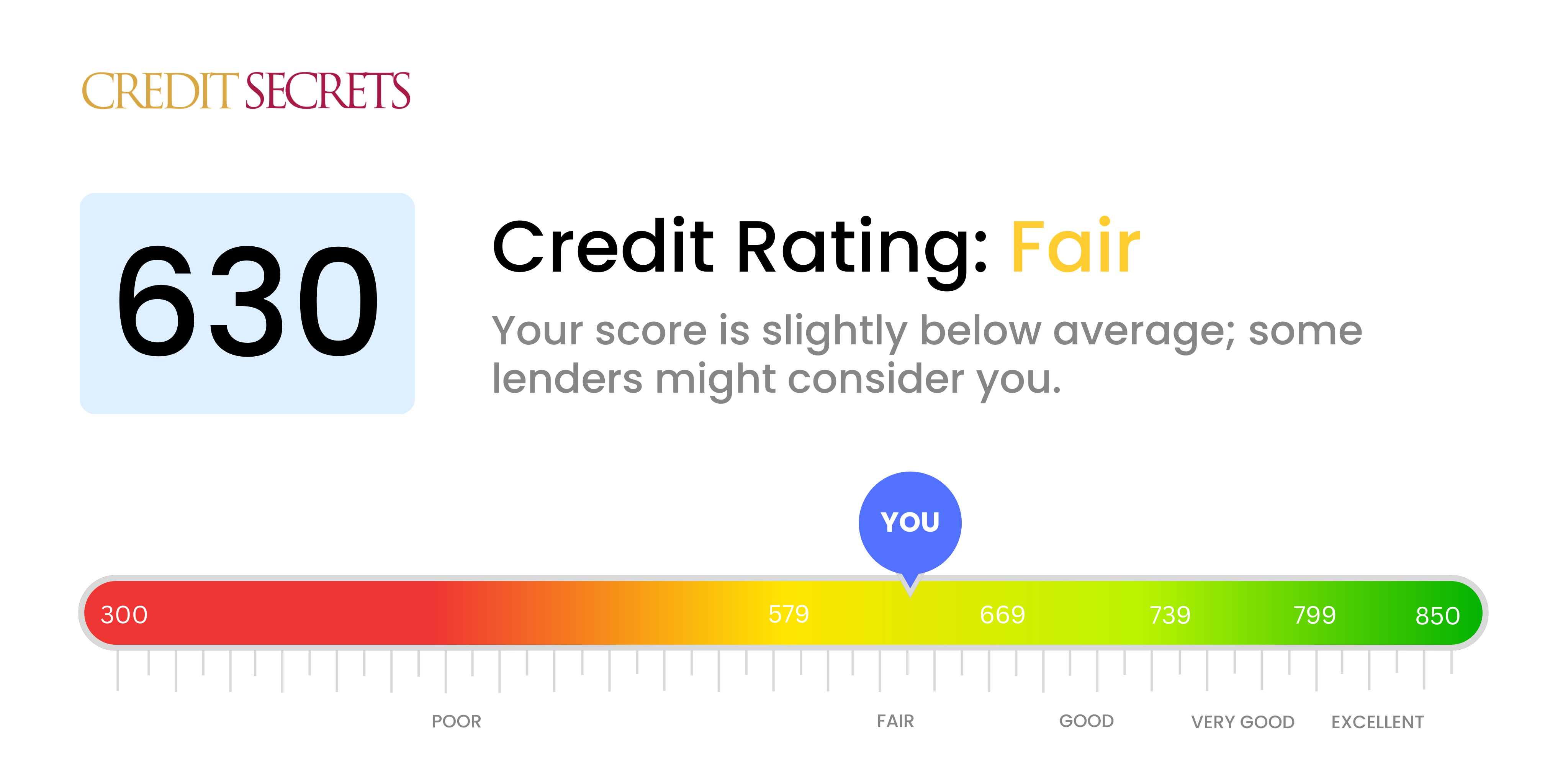

In terms of money, your credit score is one of the most important numbers. It changes everything, from the interest rates on loans and insurance to job prospects. What does a credit score of 630 mean? Is it good or bad? Let’s find out.

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness It’s calculated based on the information in your credit reports from the three major credit bureaus – Experian, Equifax and TransUnion

The most commonly used credit score model is the FICO score, developed by Fair Isaac Corporation. FICO scores range from 300 to 850. Other credit scoring models like VantageScore also exist. They may have different score ranges.

Higher scores indicate lower credit risk. If your score is over 700, that means you have good credit and are likely to be approved for credit at good rates. Scores below 630 are usually seen as bad, and they make it hard and expensive to get credit.

What is a Good Credit Score?

While there is no single credit score threshold for “good” credit, FICO generally groups scores as follows:

- Exceptional: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: Under 580

So a score over 670 is considered good. But even within the good credit band, a higher score gets better terms.

What Does a 630 Credit Score Mean?

A 630 FICO score falls in the fair credit range. It is below the average credit score of 716.

According to Experian data, a 630 credit score means:

-

17% of consumers have scores in this range

-

It is near the low end of the fair range

-

Lenders may see it as unfavorable credit

-

Interest rates and fees will be higher than for good credit

-

The likelihood of serious delinquency is 27%

Even though a score of 630 isn’t terrible, it does make it harder to get credit that you can afford. Lenders who work with people who have fair credit will give loans to people with a 630 score, but they will charge higher rates and fees.

Is 630 a Good Credit Score for a Mortgage?

For a mortgage, a score of 630 is usually thought to be the bare minimum. There will be more interest than if you had good credit, though.

According to myFICO’s data, borrowers with a 630 FICO score pay average mortgage rates around 0.5-0.75% higher than those with scores of 760 or above. This can add over $100 to the monthly payment on a $250,000 home loan.

While 630 meets the minimum, a score closer to 700 is ideal for the best mortgage rates. If your score is below 650, it becomes very hard to get approved.

Is 630 a Good Credit Score for an Auto Loan?

630 is also typically sufficient to get approved for an auto loan. But again, it will mean higher interest rates.

For example, Bankrate data shows that on a $25,000 new car loan:

- With a 780 score, rates average around 4% APR

- With a 680 score, rates jump to 6% APR

- With a 630 score, rates are about 9% APR

So while 630 meets the minimum requirement, a higher score saves substantially on interest. Used car loans also have higher rates, often over 20% APR for borrowers with scores below 650.

How to Improve a 630 Credit Score

The good news is that there are clear steps you can take to boost your 630 credit score. It will take time and discipline, but you can gain access to better credit terms. Tips include:

-

Pay bills on time – Set up autopay or reminders to avoid late payments. This alone can add over 100 points.

-

Lower credit utilization – Keep balances below 30% of limits on each card and overall. High utilization hurts scores.

-

Don’t close old accounts – Having long, positive histories helps your score.

-

Limit hard inquiries – Each new application causes a hard inquiry that dings your score. Only apply for needed credit.

-

Correct errors – Dispute and remove any errors on your credit reports.

-

Consider credit mix – Having credit cards, loans and a mortgage can help build a stronger score. But don’t take on debt you don’t need.

With time and diligent credit management, you can take steps to move your score towards the good credit range. That opens the door to better loan terms that save substantially on interest.

The Takeaway

A 630 credit score is fair. It meets minimum requirements for approval but leads to higher interest rates. Scores below 650 make getting affordable credit very difficult. With time and work, you can improve a 630 score to good territory, saving money on loans and credit cards. Track your progress by checking your credit score every few months.

Why Having a Good Credit Score Is Important

Having good credit can make achieving your goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. It can also directly impact how much youll have to pay in interest or fees if youre approved.

For example, the difference between taking out a 30-year, fixed-rate $350,000 mortgage with a 620 FICO® Score and a 700 FICO® Score could be $138. 58 a month. Thats extra money you could be putting toward your savings or other financial goals. Over the lifetime of the loan, having the better score would save you $49,889 in interest payments.

Additionally, credit scores can impact non-lending decisions, such as whether a landlord will agree to rent you an apartment.

Your credit reports can also impact you in other ways. Some employers may review your credit reports (but not your credit scores) before making a hiring or promotion decision. In most states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home and life insurance.

| FICO® Score | Interest Rate, 30-Year Fixed-Rate Mortgage | Monthly Payment | Total Interest Cost |

|---|---|---|---|

| 620 | 7.71% | $2,806.11 | $549,199 |

| 700 | 7.13% | $2,667.53 | $499,310 |

| 840 | 6.69% | $2,564.49 | $462,214 |

Source: Curinos LLC, December 6, 2024; assumes a $350,000 mortgage and 30-day rate-lock period

Learn more: Facts About Credit You May Not Know

What Affects Your Credit Scores?

The common factors that can affect all your credit scores fall into several categories:

- Payment history: If you pay your bills on time, it can help your credit scores. But not making payments on time, having an account sent to collections, or going bankrupt can all lower your scores.

- Credit usage: The number of accounts with balances, the amount you owe, and your credit utilization rate (the amount of your credit limit that you use on revolving accounts like credit cards) all play a part in this.

- The length of your credit history shows how old your oldest and newest accounts are, as well as the average age of all your credit accounts.

- What kinds of accounts do you have? This is also known as “credit mix,” and it depends on whether you have installment loans (like a car loan, personal loan, or mortgage) and revolving loans (like credit cards and other types of credit lines). Most of the time, showing that you can responsibly handle both types of accounts will raise your scores.

- Recent activity: This checks to see if you’ve recently opened new accounts or applied for new ones.

FICO and VantageScore take different approaches to explaining the relative importance of the categories.

FICO uses percentages to show how important each category is on a scale of 1 to 100. However, the exact percentage breakdown used to find your credit score will be different for each credit report. FICO considers scoring factors in the following order:

Decoding Creditworthiness: Is 630 a Good Credit Score?

FAQ

What can a 630 credit score get you?

A 630 credit score is considered fair, below the U. S. average of 715. Qualification for some credit cards, car loans, and personal loans is possible, but not with the best terms.

Can I buy a house with a credit score of 630?

Most lenders want to see at least a 620 FICO score for a conventional mortgage. FHA loans are available to people with credit scores as low as 500. However, you can only get one if you can put down 10%.

How can I raise my credit score from 630 to 700?

If your credit score is lower than you’d like, here are some ways to improve your credit score. Check Your Credit Report. Make On-Time Payments. Pay Off Your Debts. Lower Your Credit Utilization Rate. Consolidate Your Debt. Become An Authorized User. Leave Old Accounts Open. Open A Line Of Credit At Your Bank.

Can I get a $20,000 loan with a 630 credit score?

Most lenders require a minimum credit score of 640 to even be considered for any personal loan. A loan of $20,000 is a great deal of money, and lenders may be even more strict about their minimum qualification requirements.