Having a strong credit score is crucial for getting approved for loans and credit cards with good terms. But not everyone has excellent credit. In fact, a significant percentage of Americans have lower tier credit scores.

If you have bad or fair credit, understanding what a tier 4 credit score is can help you figure out where you stand and start improving.

In this complete guide we’ll explain everything you need to know about tier 4 credit scores including

- What tier 4 credit scores are

- What causes tier 4 credit

- The credit score ranges

- How to improve a tier 4 score

- Funding options for tier 4 credit

- And more

What Is a Tier 4 Credit Score?

Your credit score falls into one of four main tiers, ranging from exceptional to poor:

- Tier 1 – Exceptional (800-850)

- Tier 2 – Very Good (740-799)

- Tier 3 – Good (670-739)

- Tier 4 – Fair/Poor (300-669)

A tier 4 credit score is considered a lower or bad credit score This tier includes both fair and poor credit

Specifically, a tier 4 credit score falls between 300 to 669. The closer you are to 300, the lower your score. Anything under 579 is usually considered very poor credit.

Having lower tier 4 credit makes it harder to qualify for prime loans and credit cards. You’ll likely pay higher interest rates and fees too.

But the good news is that you can take steps to boost your tier 4 credit score over time.

What Causes a Tier 4 Credit Score?

There are a few common reasons your credit score may fall into the tier 4 range:

-

Missed payments – Paying late or having accounts sent to collections tanks your score.

-

High credit utilization – Using too much of your available credit limits your score.

-

Applying for lots of new credit – Too many hard credit check inquiries has a negative impact.

-

Short credit history – Not having enough accounts open long enough can limit your score.

-

Inaccuracies or errors – Mistakes on your credit reports drag down your score if not fixed.

-

Credit rebuilding after bankruptcy – It takes time to improve your score after bankruptcy.

-

Predatory lending – Payday loans and other risky credit can devastate your score.

-

Financial hardships – Things like job loss, medical debt, divorce, etc. can ruin your credit.

The good news is that with time and effort, you can start to improve a tier 4 credit score caused by any of these issues.

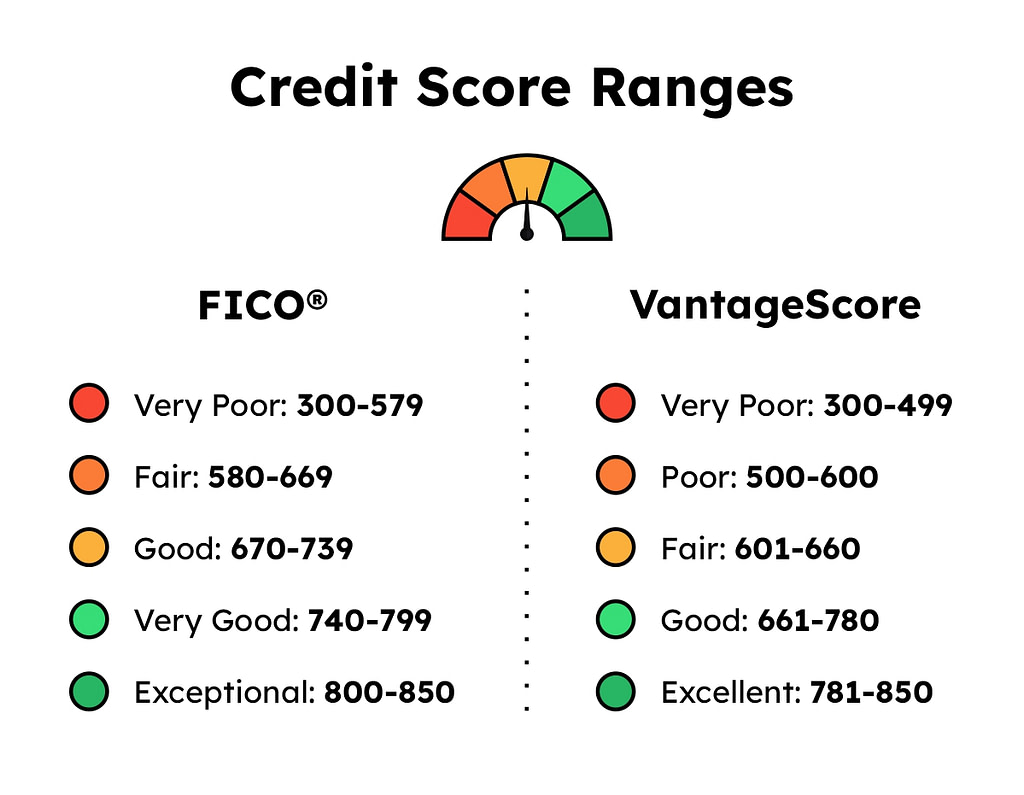

Credit Score Ranges Within Tier 4

There is a big range of credit scores in Tier 4, from fair to very poor. Here is a list of the credit score ranges in Tier 4:

- 300-499 – Very poor

- 500-579 – Poor

- 580-669 – Fair

The lower your score within tier 4, the worse shape your credit is in.

For example, someone with a credit score of 550 is going to have a harder time getting approved for credit and loans than someone with a score of 620.

But folks in the mid to higher end of tier 4 (580-669) can likely still qualify for credit, just at less ideal terms than those with good or better credit.

How to Improve Your Tier 4 Credit Score

The good news is that if you work hard and don’t give up, you can eventually get your credit score from 300 or 400 to good credit.

Here are some tips on how to improve a bad tier 4 credit score:

-

Pay all bills on time – Set up autopay and reminders if needed. On-time payment history is very important.

-

Get current on any past due accounts – Bring any delinquent accounts current if possible.

-

Pay down credit card balances – Get balances below 30% of the limit.

-

Limit hard credit inquiries – Too many credit applications in a short timeframe hurts.

-

Check credit reports for errors – Dispute and fix any incorrect information.

-

Become an authorized user – Get added as an authorized user on an account in good standing.

-

Sign up for credit builder products – Secured cards and credit builder loans can help.

-

Let time pass – Improvements take time, so be patient and persistent.

With diligence and effort, you can steadily work to improve your tier 4 credit score over time.

Funding Options With Tier 4 Credit Scores

As you work to boost your credit, you may still need access to financing options if an unexpected expense comes up.

Here are some forms of credit you may be able to qualify for even with fair or poor tier 4 credit:

-

Secured credit cards – Require a refundable security deposit. Help build credit.

-

Credit builder loans – Installment loans designed for credit rebuilding.

-

Co-signer loans – A co-signer with better credit improves your chances.

-

Subprime personal loans – Specifically for borrowers with bad credit, but have very high rates.

-

Credit union payday alternative loans – Better terms than payday loans if you qualify.

-

401k or pension loans – Borrow against your own retirement savings.

-

Buy here pay here auto financing – For purchasing used cars with bad credit.

The key is that as you work to improve your credit, only use credit when absolutely necessary and avoid lenders charging overly high fees or rates. Stick to reputable sources of credit like credit unions.

The Bottom Line

A tier 4 credit score falls between 300 and 669, which is considered fair or poor credit. The causes are often things like missed payments, high utilization, or credit damage after financial hardship.

The good news is that anyone can slowly raise their tier 4 credit score if they put in the time and work. Paying on time, lowering balances, and fixing mistakes are all things that can help.

You may not have many credit options if you have bad credit, but secured cards and credit builder loans can help you get better. Avoid predatory lenders charging excessive fees and rates. Getting your credit back to good can be done if you are patient and don’t give up.

Digging your financial well

Think of capitalizing your business as digging a well. The wise business owner won’t dig a well that only satisfies short-term needs, but will dig the well as deep as possible (or at least lays the groundwork for doing so) to accommodate their long-term needs.

There are at least five layers of the financial well for your business.

It starts with the personal assets of the principals — you and your co-founders, if you have any. To me, this is the worst possible layer to rely on, though it is the most commonly used. Sometimes there is no other choice, but my preference is to build businesses using other people’s money, not my own assets.

The second layer is the three F’s: “Friends, Family, and Fools. ” This is another commonly exploited source of funds.

The next three layers are where we’ll focus on, since they’re the three that allow you to tap into other people’s money (“other people’s money” is an important term in finance):

Here should be some order, but most of the time, business owners have different ideas about what’s deeper in the well. The biggest tragedy is when business owners wait until it is too late to look for capital. They usually end up out of luck.

The harsh reality is that no one wants to give you money if they know you need it. Your best bet is to dig your well before you need the water. In other words, look for funding sources before you’re desperate.

Not all money is created equal

The most important lesson I can impart to you is the fact that all money is NOT created equal. As you look at sources of capital for your business, you need to consider the following:

- Debt vs. equity. No matter what kind of capital you get, it will be stock or debt. Equity requires the surrendering of ownership. It’s important to know what kind of money you’re getting. Bonds are what banks and businesses deal with, while stocks are what investors deal with. Equity gives the investor a percentage of future profits. Even though it seems like free money, this is the most expensive capital you can get for your business (if it works!)

- Control. Does the money make you less in charge? Getting investors or partners will make you less in charge. A lender may request financial oversight or independent audits. You should know what you’re giving up.

- Security. How is the lender or investor protecting their money? Are you personally guaranteeing it? Is there a general lien on your property? If you don’t pay back the loan, who will they go after?

- Transferability. Is the capital for you or for the business? It won’t help you sell a business if all the working capital is still tied to you.

- Ease of attainment. How easy is it to get the money you need? How long will it take? With this money, are you building a team of people who care about your success? Pierre Omidyar went after venture capital money for eBay not because he needed it, but because he wanted help putting together a world-class team. Getting investors and giving up control is sometimes the right thing to do.

What Is Tier 4 CREDIT? – CreditGuide360.com

FAQ

What is tier 4 credit score?

What does 4 mean in credit score?

4 is usually indicative of no credit score. 300-850 is indicative of you having credit, with 300 being really bad and 850 being really good. A credit score of 4 means No Credit.

What are the 5 tiers of credit scores?

Credit score ranges—what are they?800 to 850: Excellent Credit Score. Individuals in this range are considered to be low-risk borrowers. 740 to 799: Very Good Credit Score. 670 to 739: Good Credit Score. 580 to 669: Fair Credit Score. 300 to 579: Poor Credit Score.

Is Tier 3 credit good?

Tier One – Considered exceptional credit, scores ranging from 800 – 850. Tier Two – Considered very good credit, scores ranging from 740 – 799. Tier Three – Considered good credit, scores ranging from 670 – 739. Tier Four – Considered fair/poor credit, scores ranging from 300 – 669.