If you have no credit history, you have no credit score — but not a zero credit score.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

Some people find it frustrating that getting credit is like putting two eggs in one basket: no one wants to give you credit if you haven’t used credit before.

You don’t have a zero credit score if you’ve never had credit and don’t have a credit score. You have the absence of a score: You’re “credit invisible. ”.

Not having a credit score after 6 months of getting your first credit card can be confusing and concerning. You likely applied for a card expecting to start building credit only to find you still don’t have a score several months later. Don’t worry – there are some common reasons why you may not have a credit score yet. With a bit more time and strategy, you can establish credit and get the score you’re looking for.

When Credit Scores Are Generated

Credit scores are calculated based on the information in your credit reports at the three major credit bureaus – Experian, Equifax, and TransUnion. These reports include details on any credit accounts opened in your name your payment history, credit utilization, and more.

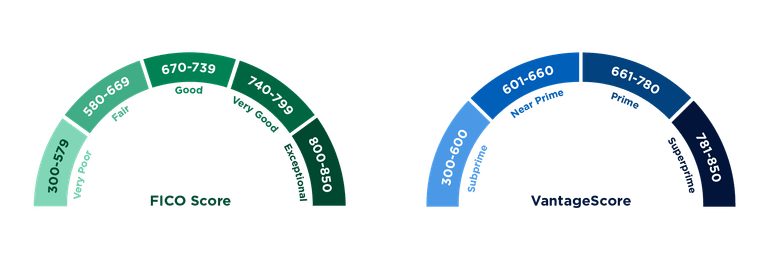

Credit scoring models use algorithms to analyze this data and generate a three-digit credit score, most commonly using a FICO or VantageScore model. Scores range from 300 to 850.

So when do the credit bureaus have enough data to actually calculate your score?

Initial Score Generation

Usually, you need at least one credit account that has been open for 6 months and been reported to the credit bureaus. This is because many credit scoring models need 6 months of history before they can figure out a score.

Algorithms can use this time frame to see how well you handle your credit by looking at your monthly payment history for 6 months. The most important thing that affects your scores is making payments on time.

Ongoing Score Updates

Once you have an initial score, the bureaus don’t wait another 6 months to update it. Instead, your scores are recalculated whenever new information is added to your credit reports.

This happens every month when your creditors send you a report with your most recent account balances and payment statuses. Your credit score changes over time based on how well you handle credit now and in the future.

Common Reasons for No Score After 6 Months

Most people get their first scores after 6 months, but sometimes you may have to wait longer. Potential reasons include:

Insufficient Credit History

Thin credit files with very few accounts or limited information provide insufficient data for scoring models. If you only have one new credit card and very little other credit history, you may not have enough trade lines for an accurate score.

Opening another credit account and continuing to build your history can help generate a score. Just be sure not to open too many new accounts too quickly – multiple new accounts can lower your scores.

Recent Account Opening

It takes time for new accounts to be reported to the bureaus and populate your reports. If you just opened your first card, it may take over a month for the new account details to appear in your file.

And since most scoring models need 6 months of history, it will then take another few months before there’s enough data to calculate a score. Be patient and continue using credit responsibly.

Authorized User Accounts

Being added as an authorized user on someone else’s credit card can be a quick way to build credit. However, not all creditors report authorized user status. And even if reported, those accounts may not always count towards the 6 months of history needed for a score.

Check your credit reports to see if your authorized accounts are being reported. If not, you may need to wait until you have 6 months of primary account history.

Credit Inactivity

Actively using credit accounts – even making small purchases here and there – creates the payment history needed to generate a score. If you open a card but don’t actually use it for 6 months or longer, you may not have enough recent account updates.

Try charging a small purchase every few months and paying it off. Ongoing activity provides more data and can help create a score sooner.

Reporting Issues

Another potential problem is inconsistent credit reporting by your creditors. If the bank for your new card doesn’t properly report your account details and status each month, the credit bureaus won’t get the updates needed to calculate your score.

Double check your credit reports to make sure your new account is being accurately reported. If not, you may need to wait until the reporting issues are resolved.

How to Check for Credit Scores

Since scoring models generate credit scores “behind the scenes” based on your credit reports, the easiest way to check for a score is to get your reports.

You’re entitled to a free copy of your reports from each bureau once every 12 months. You can request them at www.annualcreditreport.com.

Checking reports from one bureau is a good start. But keep in mind each bureau may have slightly different information based on when creditors report to them. Checking all three reports provides a more complete view of your credit history and score.

Many banks and lenders also provide free credit scores on their websites or mobile apps. For example, major card issuers like Chase, American Express, and Discover offer free scores to cardholders. This can be a convenient option if you already have an account.

Finally, you can purchase scores directly from consumer reporting agencies. For example, you can get your FICO Score from Experian. Just be aware you’ll have to pay for access to your scores.

When to Take Action

In most cases, simply waiting additional months and continuing to use credit responsibly will eventually generate a score. But if you’ve already had an account open for more than 6 months, it’s reasonable to investigate further.

Check your credit reports closely for:

- New accounts you don’t recognize (signs of identity theft)

- Missing account details or status updates from your creditors

- Other suspicious information that seems inaccurate

Dispute any errors with the bureaus. This can help improve your credit data to allow for accurate score calculation.

You can also contact your creditors directly if they are not properly reporting your accounts each month. Ask them to verify your account details with the bureaus.

Lastly, consider adding another credit account if you only have a single new card reporting. Just don’t open too much new credit too quickly. A new installment loan or second card can provide additional trade lines without excessive inquiries.

Give It Time and Practice Good Habits

While having no credit score after 6 months can be frustrating, try not to get too concerned. In most cases, it just takes a bit more time for your new accounts to be properly reported and create enough history for scoring models.

The most important thing is using whatever credit you have responsibly. Pay all bills on time, keep balances low, and let your accounts age. Maintaining good habits will ensure you have great credit and scores for years to come.

With patience and prudent account management, you’ll be rewarded with the solid credit profile and scores you deserve. Keep practicing good habits and check your credit reports every few months. Before you know it, that elusive credit score will appear!

Why you don’t have a credit score

Nobody has a credit score of 0 no matter how badly they’ve used credit in the past.

The most widely used credit scores, FICO and VantageScore, are on a range from 300 to 850.

Tommy Lee, a senior director at FICO, said scores of 300 are “extremely rare.”

Reasons you might not have a score are:

- You’ve never been listed on a credit account.

- You haven’t used credit in at least six months.

- You just recently asked for credit or were added to an account.

What’s the starting point for your score?

Just as being new to credit doesn’t mean you start at zero, it also doesn’t mean you begin in the basement at 300. After all, if you’ve never had credit, you’ve never made score-devastating mistakes.

When you have no credit history, the credit bureaus just don’t know enough about you to guess whether you’ll pay back borrowed money. And that’s all a credit score is — an estimate of the likelihood you’ll pay back the next credit you’re granted, based on the data in your credit reports.

Once you begin using credit, scores can be calculated. You likely wont start with a good credit score but you won’t be at the bottom of the scale, either.

How To Fix A BAD Credit Score ASAP

FAQ

Why do I not have a credit score?

Why Don’t I Have a Credit Score? Lack of a credit score can be the result of insufficient information in your credit history or because you don’t have any credit accounts. If you don’t have a credit score, it may be because there isn’t enough information in your credit history, or because there aren’t any records there at all.

What happens if you don’t have enough credit history?

If you don’t have enough credit history, the algorithm won’t be able to fairly judge you and probably won’t be able to give you a credit score. There are a number of reasons you may not have enough credit history to generate a credit score, which can include: You have never used traditional credit accounts.

What happens if you have a low credit score?

A person with bad credit is more likely to not pay back a loan or pay it late. When you have no credit score, it means that you’ve never opened a credit account, like a loan or credit card. Young adults often don’t have a credit score because they don’t have any credit in their name.

Does having no credit score mean you have bad credit?

4. You don’t have bad credit just because you don’t have a credit score. Not having a score could mean you haven’t needed to use credit yet, which isn’t always a bad thing. And it’s not an indicator that you have poor credit, either. In fact, once you get a score, it may be better than you think.

What if I don’t have credit?

You’re young and have no experience with credit. Many young people don’t have credit and may have no idea where to start. Since your credit history begins only when a creditor reports a new account to the credit bureaus, starting early is key to having a top score later in life.

Do you have a credit score if you’ve opened a account?

So if you’ve opened a credit account in the past, you probably already have a credit report. But you’ll only see a score if your report shows recent activity — generally within the last 24 months. If you have reports, be sure to check them on a regular basis even if you don’t have scores yet.

Why don’t I have a credit score after 6 months?

Your credit score will typically drop when you seek new credit (inquiries) and when you get new credit (new account added to your report). Let the accounts age, your score will heal. It’s common to see your score rebound at 3 and 6 months, and again when your newest account ages to 1 year.

Why do I suddenly have no credit score?

If you’ve had credit in the past but no longer use credit cards, or you have closed accounts on your report, there won’t be recent activity to produce a score …Mar 20, 2025

What credit score does an 18 year old start with?

A 600 FICO score, which is considered “fair,” is below the average credit score of individuals ages 18 to 26. The average 18-year-old has a 681 score.Dec 2, 2024

Why has my credit score stayed the same for 4 months?

Some reasons that your score hasn’t changed (or gone up) could be that the bureaus haven’t updated your credit profile yet, a bad credit utilization ratio, serious negative items outweighing recent good behavior, or errors on your credit.