Many Americans are struggling financially due to factors such as high inflation and correspondingly high interest rates, which increase the costs of financing. You may find it difficult to get out of debt because you not only have to save or borrow money to pay off the principal amount, but you also have to pay interest on the debts you have been carrying.

At the same time, inflation has caused other important bills, like food and housing, to go up recently, which has put some people even further behind on their debt payments. For example, the number of credit card and auto loan delinquencies has been on the rise recently, according to the Federal Reserve Bank of New York.

If you don’t pay your debts on time or stop paying altogether, you may be contacted by debt collectors. If you don’t respond, they may take legal action against you and take your property. The good news, however, is that if you have debts in collections, you can often settle with debt collectors for less than the full amount owed.

Falling behind on debt payments can happen to anyone. Times get tough expenses pile up and before you know it, you’ve missed a few credit card or loan payments. That’s when those dreaded debt collectors start calling.

If you find yourself in this situation, take a deep breath. Yes, dealing with debt collectors can be stressful, but there are options – including negotiating a settlement And many people wonder, will debt collectors settle for 30%?

Debt collectors may sometimes agree to settle for 30% or even less of the total amount owed, but there are many things that affect how low they’ll go. Keep reading to find out what goes into debt settlement negotiations and how you may be able to settle your debt for 30% or less of the total amount owed.

How Debt Collectors Work

First, it helps to understand what debt collectors do. People who owe money on things like credit cards or auto loans will try to get it back from you for 6 to 9 months. If you still don’t pay, they’ll often give the debt to a debt collector.

The collection agency then contacts you to try to get you to pay. They might call you, send letters, or even reach out on social media. Their goal is to get you to pay back the debt – even if it’s less than the full balance.

Should You Negotiate a Debt Settlement?

Settling debt for less than you owe won’t erase the issue from your credit reports. The collection will still show for up to 7 years. But debt settlement can stop collection calls and letters, provide peace of mind, and reduce what you pay.

Debt collectors buy debts for pennies on the dollar. It’s possible for them to come out on top even if they settle for 30%. That’s why many collectors are open to negotiating a settlement.

What Impacts Debt Settlement Offers?

There are a lot of different situations, but there are some key things that determine whether debt collectors will settle for 30% or less. They include:

-

The collector: Some collectors are more flexible than others when it comes to settlements. Debt buyers who purchase old, written-off debts often have more room to negotiate.

-

Your offer: Collectors expect you to negotiate. Starting with a low offer like 30% leaves room to eventually land on an acceptable settlement amount for both sides.

-

Debt details: If the statute of limitations is close to expiring, collectors may settle for less rather than risk getting nothing. The larger the debt, the more opportunity for negotiation as well.

-

Your finances: If you can show financial hardship, collectors may offer a more generous settlement to secure some payment.

-

Payment terms: Lump sum settlements tend to result in bigger discounts than payment plans. But extended plans let you settle debt over time if you can’t pay in full.

6 Steps to Negotiate With Debt Collectors

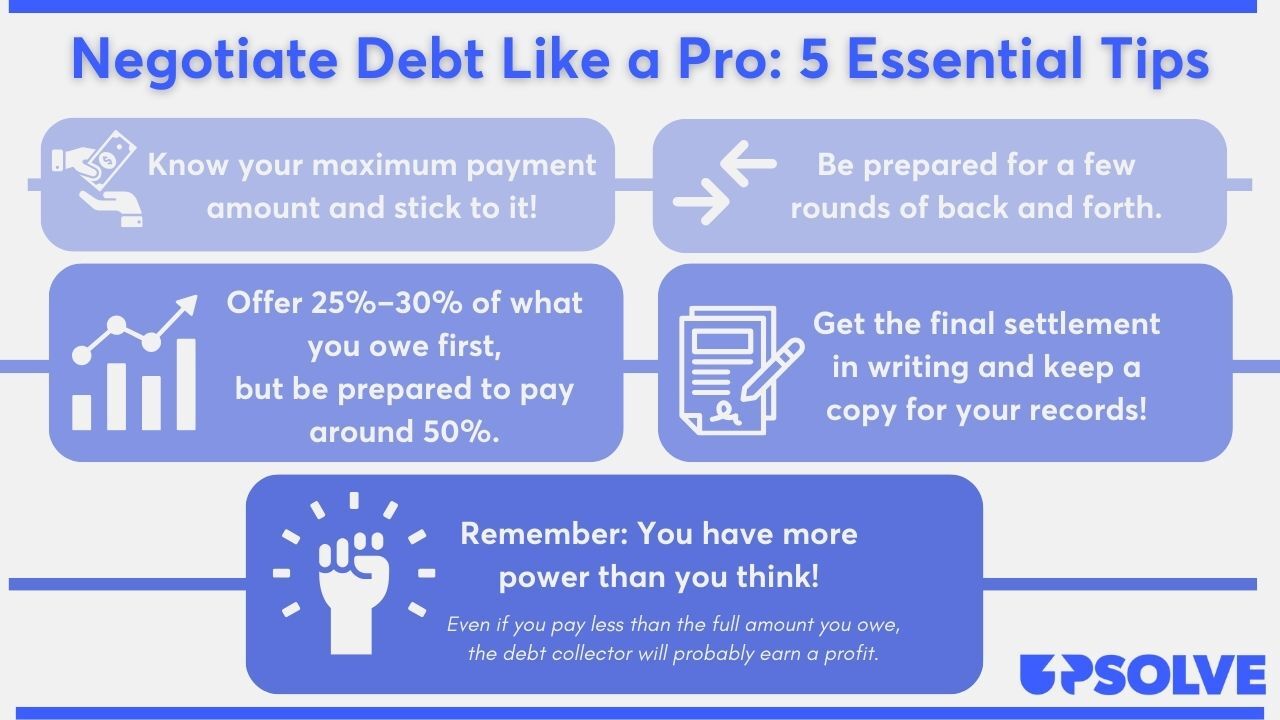

If you want the best shot at settling debt for 30% or less, follow these steps:

-

Validate the debt: Make sure it’s legit and yours before paying or negotiating. Ask for proof in writing.

-

Review your budget: Know what you realistically can afford to offer based on your income and expenses.

-

Start low: Aim for 30% or less as an opening offer, so you have room to negotiate up if needed.

-

Get agreements in writing: Document any settlement terms and conditions to prevent misunderstandings.

-

Pay as agreed: Follow through on whatever you settle on. Defaulting could invalidate the agreement.

-

Watch for violations: If collectors harass you or break laws, report them to the Consumer Financial Protection Bureau.

Alternatives to Settling Debt

Settling isn’t your only option when dealing with collectors. Other potential strategies include:

- Debt management plans through nonprofit credit counseling agencies

- Debt consolidation loans to pay off what you owe at lower interest

- Bankruptcy as a last resort if you truly can’t repay your debts

The right approach depends on your specific situation. Talk to a credit counselor if you need guidance navigating debt and dealing with collectors.

The Bottom Line

Will collectors settle for 30%? There’s a good chance, but it depends on your unique circumstances. With some preparation and negotiation skill, you may be able to settle debt for 30 cents on the dollar or potentially even less.

Just remember – get validation and documentation, start low with offers, and don’t agree to payments you can’t realistically afford. Handled carefully, debt settlement can help resolve collection accounts so you can focus on rebuilding your financial health.

What is the lowest amount debt collectors will settle for? What experts say

The short answer is that theres no universal settlement amount that debt collectors will accept. Every situation is unique. However, there are some factors that help dictate the lowest amount debt collectors will take as a settlement, including the following:

The validity of the debt

Just because youre dealing with debt collectors doesnt necessarily mean you owe the full amount they claim. And, in some cases, they might not be able to prove you owe that debt.

Roberts says that the Fair Debt Collection Practices Act (FDCPA) gives people the right to ask for proof of a debt and/or dispute the debt. And depending on what the results are, that could affect your negotiations.

“On the off chance that the debt is real and the debt collector has everything in order, “If the debt collector’s verification shows that the debt isn’t real or that the customer doesn’t owe the money, then the customer may have settled the debt for a little more,” says Roberts.

“In the latter scenario, perhaps the consumer has better leverage to not pay the debt or to pursue a case against the debt collector under the FDCPA,” Roberts adds.

Ideally, though, you can verify debt before it ends up in collections. With medical debt, for example, you might request an itemized receipt to make sure youre being charged for the right medical services.

“A percentage of medical bills contain errors, so before a bill is sent to collections, its important to look it over carefully and make sure it matches the care you received. If your employer offers care navigation, checking a bill for errors may be part of the services that are included,” says Nick McLaughlin, strategic advisor at Emry Health.

Getting Sued By A Debt Collector? DO THIS FIRST!

FAQ

What percentage will a debt collector settle for?

According to the American Association for Debt Resolution, the average settlement amount is 50. 7% of the balance owed. So yes, if you owed a dollar, you’d get out of debt for fifty cents. But the average amount of debt enrolled is $4,500. That means you should still expect to pay a hefty sum to get out of debt.

What is the lowest a creditor will settle for?

The lowest a creditor will settle for varies significantly depending on the circumstances. While there’s no fixed minimum, it’s common for debts to settle for 20-30% of the original amount owed, especially when the debt is old or the debtor demonstrates financial hardship.

Will creditors accept 50% settlement?

Not all lenders accept partial settlement offers. They are more likely to do this if: You can’t pay them back in a reasonable amount of time; or You may never be able to pay them back in full.

What is the lowest amount a debt collector will sue for?

A debt collector can sue for any amount, no matter how small. There’s no legal minimum debt size for a lawsuit.