Private mortgage insurance (PMI) is an additional cost many homeowners pay as part of their mortgage if they put down less than 20% as a down payment. PMI protects the lender in case the borrower defaults on the loan.

If you own your own home, paying PMI could cost you hundreds of dollars more each month. Of course, most homeowners want to stop paying PMI as soon as possible. But is it possible to get your money back for PMI payments you’ve already made?

The answer is sometimes yes, you can get your PMI premiums refunded but it depends on several factors. Keep reading to learn more about when and how PMI premium refunds are possible.

What Is Private Mortgage Insurance (PMI)?

PMI stands for private mortgage insurance. It’s an insurance policy that protects the mortgage lender, not you as the borrower.

If you put down less than 20% of the home’s purchase price as a down payment, the lender will probably make you pay PMI. They won’t lose money if you don’t pay your mortgage.

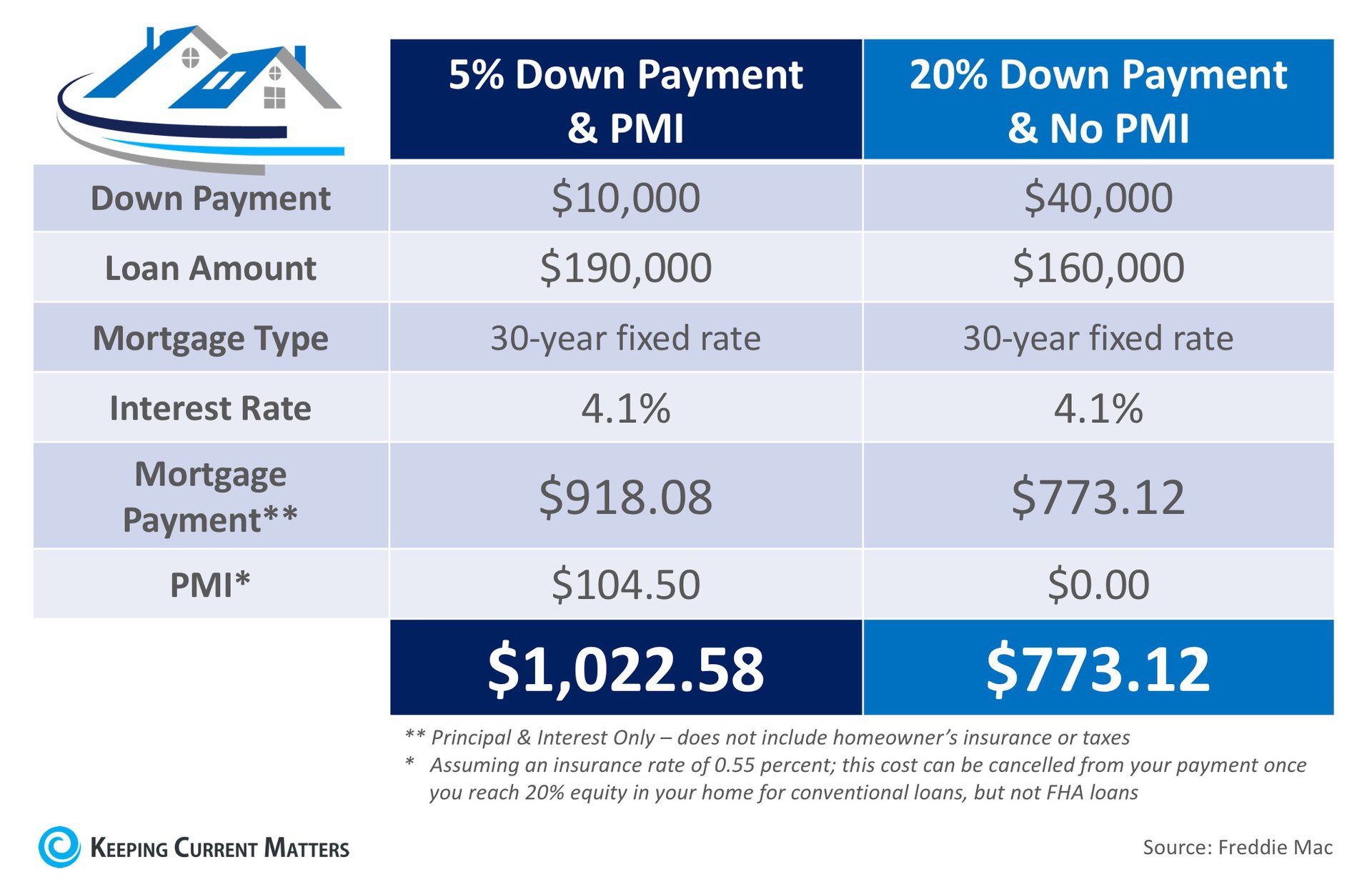

Along with your regular mortgage payment, you have to pay a PMI premium every month. The typical PMI rate is between 0. 5% – 1% of the original mortgage amount per year. That’s an extra $167 to $333 a month on a $200,000 mortgage.

When Does PMI Get Refunded?

In most cases, PMI premiums you pay are not refundable. The exceptions are:

-

When you reach 20% equity: Most conventional mortgages require PMI cancellation once you reach 20% equity in the home. At this point, any prepaid PMI premiums would be refunded to you.

-

FHA streamline refinance: If you refinance an FHA loan into a new FHA loan, any prepaid upfront PMI gets credited back to you at closing on the new loan.

-

End of mortgage insurance term: If you prepay PMI for the life of the loan upfront, any unused portion would be refunded when the policy term ends.

These are the only times when you can get your PMI payments back, even if you pay off your mortgage early or sell the house.

How to Get a PMI Refund

If you think you may qualify for a PMI premium refund, here are the steps to request it:

-

Contact your mortgage lender: Ask them to confirm if and when you are eligible for a refund based on your specific loan details.

-

Confirm your home equity: For conventional loans, you must have 20% equity to cancel PMI and get a refund. Your lender can tell you how to verify this.

-

Submit request in writing: Send a formal written request to your mortgage lender asking for cancellation of PMI and a refund of premiums already paid.

-

Provide necessary documentation: You may need to provide proof of current home value through an appraisal and evidence you have 20% equity.

-

Follow up if needed: It may take 30-60 days to process your request. Follow up if you don’t receive your refund within a reasonable timeframe.

Common PMI Refund Issues

While PMI refunds are possible in certain situations, there are also some caveats:

-

Late payments: If you have a history of late mortgage payments, your lender can deny PMI cancellation and any refunds.

-

Loan type: FHA and VA loans have different PMI cancellation rules than conventional loans. Make sure you know the guidelines for your specific loan.

-

High-risk mortgages: Jumbo loans over the conforming limit may be deemed higher risk by the lender, so PMI cancellation is harder to obtain.

-

Rental properties: Investor loans typically require PMI to remain until you reach 20-30% equity.

If you run into issues getting your PMI premiums refunded, you may need to file a complaint with the proper authorities such as the Consumer Financial Protection Bureau.

Other Ways to Cancel PMI

If you aren’t eligible for a PMI refund, focus on the bigger goal of removing PMI from your mortgage entirely. Here are some options:

-

Pay down your loan faster so you reach 20% equity sooner. Make extra principal payments each month.

-

Remodel or upgrade your home to boost its value, increasing your equity stake.

-

Refinance your mortgage at today’s lower interest rates. You can likely end PMI this way.

-

Sell your home and purchase a new one with at least 20% down to avoid PMI altogether.

The bottom line is PMI refunds are possible in limited cases if you reach 20% home equity. Work diligently to cancel PMI so you can stop paying those expensive premiums every month.

Can PMI be removed if home value increases?

Yes! Property values continue to rise, which means you could get to the 80/20 LTV mark much sooner. Certain home improvement projects can also help you ditch PMI ahead of schedule.

What is Private Mortgage Insurance (PMI)?

Private Mortgage Insurance, or PMI, is required by most lenders if the borrower is unable to put down less than 20% of the appraised home value or sale price. In the event that the borrower doesn’t pay back the home loan, this insurance helps protect the lender. The borrower is paying the premiums on the insurance policy, and the lender is the beneficiary.

How to Get a Mortgage Insurance Refund

FAQ

Do you get PMI refunded?

When PMI is canceled, the lender has 45 days to refund applicable premiums. That said, do you get PMI back when you sell your house? It’s a reasonable question considering the new borrower is on the hook for mortgage insurance moving forward. Unfortunately for you, the seller, the premiums you paid won’t be refunded.

Who gets the PMI money?

The PMI (Private Mortgage Insurance) payment is made by the borrower (the homeowner), but the insurance protects the lender, not the homeowner. If the borrower doesn’t pay back the loan, PMI can help pay back some of the remaining balance to the lender. This way, the lender doesn’t lose money on the loan.

Is there a way to get out of paying PMI?

You can get rid of PMI early by refinancing, getting your home appraised again, or paying down your mortgage faster. Jun 6, 2025.

Can PMI be removed if home value increases?

Can PMI Be Removed if Your Home’s Value Increases? Yes, you may be able to have PMI removed if your home’s value increases. But it ultimately depends on whether your home’s LTV is now below 80%.