A FICO auto score is a credit score that is specific to the auto industry and is used by lenders to decide whether to give loans for buying new or used cars. FICO auto scores, like regular FICO scores, range from 300 to 850 and show how creditworthy a person is. But what does a good FICO auto score look like? This detailed guide looks at what makes up your auto credit score, how it’s calculated, and how to raise a low score.

What is a FICO Auto Score?

When you apply for a car loan or lease, auto lenders will look at your FICO auto score. This is a type of credit score that is just for them. Auto scores look at your credit report from Experian, Equifax, and TransUnion, which are the three main credit bureaus. But compared to general FICO scores, they pay more attention to things like how well you’ve paid back your auto loans.

While regular FICO scores are heavily weighted on payment history and amounts owed a FICO auto score prioritizes

- Auto loan payment history (40%)

- Amounts owed on auto loans (30%)

- Length of credit history (15%)

- New credit applications (10%)

- Credit mix / types of credit (5%)

So even if you have good credit in general, past late payments on your auto loan can hurt your score. On the other hand, paying off your car loan on time can help your credit score even if you are late on other accounts or credit cards.

FICO Auto Score Ranges

For both types of scores, FICO auto scores are between 300 and 850. The higher the number the lower the perceived credit risk. Here’s how the score ranges generally compare for creditworthiness .

- 800-850 – Exceptional

- 740-799 – Very Good

- 670-739 – Good

- 580-669 – Fair

- 300-579 – Very Poor

A score below 580 is usually considered subprime. Many lenders view applicants with scores in the fair range (580-669) as risky. Prime borrowers have good to exceptional credit, with FICO scores of 670 or higher.

What is a Good FICO Auto Score?

So what’s a good FICO auto credit score? The short answer – a score of 700 or above is considered good for auto loan approval. But the auto score you need depends on many factors:

Your Down Payment

The size of your down payment makes a big difference. You can qualify for an auto loan with bad credit and a score as low as 550 with a sizable down payment of 20% or more. With an excellent credit score of 750+, you could get approved with little or no money down.

New or Used Car

New cars typically require a higher score. Used car interest rates are usually higher overall, but lenders are a bit more flexible for borrowers with fair credit – you may be approved with a score around 600.

Loan Amount

If you want to finance an expensive luxury vehicle, you’ll need pristine credit. Lenders will approve smaller loans of a few thousand dollars more readily.

Interest Rates

The higher your score, the lower your interest rate. With a score under 600, expect double-digit APRs. Prime borrowers enjoy rates under 5%.

Here are general credit score recommendations for auto loan approval:

- Prime – 670+

- Non-Prime – 620-659

- Subprime – 550-619

- Deep Subprime – Under 550

According to Experian data, over 30% of auto loans go to subprime borrowers, so lenders are sometimes willing to work with credit challenges. But interest rates are higher for increased risk.

How is a FICO Auto Score Calculated?

As mentioned earlier, FICO auto scores weigh your credit information differently than base FICO versions:

- Payment History – 40%

- Amounts Owed – 30%

- Length of Credit History – 15%

- New Credit – 10%

- Credit Mix – 5%

Payment history on auto loan accounts and amounts owed on car financing carry the most weight. FICO also analyzes the age of your credit accounts, new applications, and your mix of credit types – but these factors have less impact on your score.

Negative factors like late payments, maxed out cards, and collection accounts lower your score. A short credit history also hurts. You’ll benefit from having credit cards and loans open for several years with on-time payments.

How to Check Your FICO Auto Credit Score

Wondering where to check your FICO auto score? You have a few options:

Directly from FICO – For a fee, you can sign up for FICO’s website and access your auto score. Plans start at $19.95 per month.

From Experian, Equifax or Transunion – The three credit bureaus sell FICO auto scores directly to consumers. Expect to pay around $20-25 for your score.

From an Auto Lender – Many auto lenders provide free pre-qualification tools on their websites, allowing you to view your credit score from a soft inquiry. No damage to your credit.

From a Credit Card Company – Some credit card issuers like Discover offer free FICO scores on monthly statements or via online account access. General FICO scores, not auto-specific.

When checking scores from various sources, keep in mind they may use different credit score versions and have slight variations.

6 Tips for Improving Your FICO Auto Credit Score

Need to increase your auto credit score? Here are 6 effective ways:

1. Pay all bills on time. Payment history is the biggest factor in your score. Set up autopay, alerts and reminders to avoid missed or late payments.

2. Pay down credit card and revolving debt. Owing a lot of money across multiple accounts drags down your score. Pay down balances below 30% of the credit limit.

3. Limit new credit applications. Each application causes a hard inquiry, which dings your score a few points. Only apply for credit when needed.

4. Allow credit history to age. FICO rewards longevity. Having long-open accounts improves your score over time. Avoid closing old cards.

5. Check for errors on credit reports. Incorrect late payments or other mistakes hurt your score. Dispute errors with the credit bureaus to potentially boost your FICO.

6. Become an authorized user. Ask a friend or family member with great credit to add you as a user on a long-open credit card. It can give your credit a boost.

With perseverance and smart credit habits, you can increase your auto FICO score 100 points or more within 12 months. Tracking your score monthly lets you monitor improvement. Aim for at least a 670 FICO score or higher to qualify for the best auto loan rates.

The Bottom Line

Your FICO auto credit score carries more weight than your overall score when applying for a car loan. Auto lenders prefer prime borrowers with good FICO scores of 700 and above for loan approval with the lowest interest rates.

Improving your creditworthiness takes time, but following the tips above and maintaining healthy money management habits will have you cruising around with favorable car loan terms in no time. Monitor your auto credit score regularly and watch it climb higher down the road.

How to Check Your FICO Auto Score

Before you apply for an auto loan, checking your FICO score can help you guess how likely it is that you will be approved and what kind of interest rate you can expect.

Factors Influencing FICO Auto Score Requirements

Most auto lenders will consider other financial factors, such as your income and how large a down payment you are prepared to make, in addition to your FICO score.

Lenders may also change their requirements from time to time based on market factors, like car prices and demand for loans.

What is a good FICO auto score?

FAQ

What is a good FICO score to buy a car?

Most of the time, a FICO score of 670 or higher is good for getting a car loan with good terms. Scores in the 661-780 range are often classified as “prime,” offering better interest rates and loan terms, according to Experian.

What credit score is needed for a $40,000 auto loan?

Quick Answer. No matter what your credit score is, you can get an auto loan. However, for the best terms and rates, most lenders want to see that you have a prime credit score of 661 or higher.

What FICO score do most car dealers use?

Auto loan lenders generally check an applicant’s FICO Auto Score, which ranges from 250 to 900, or their VantageScore, which ranges from 300 to 800. Jul 25, 2024.

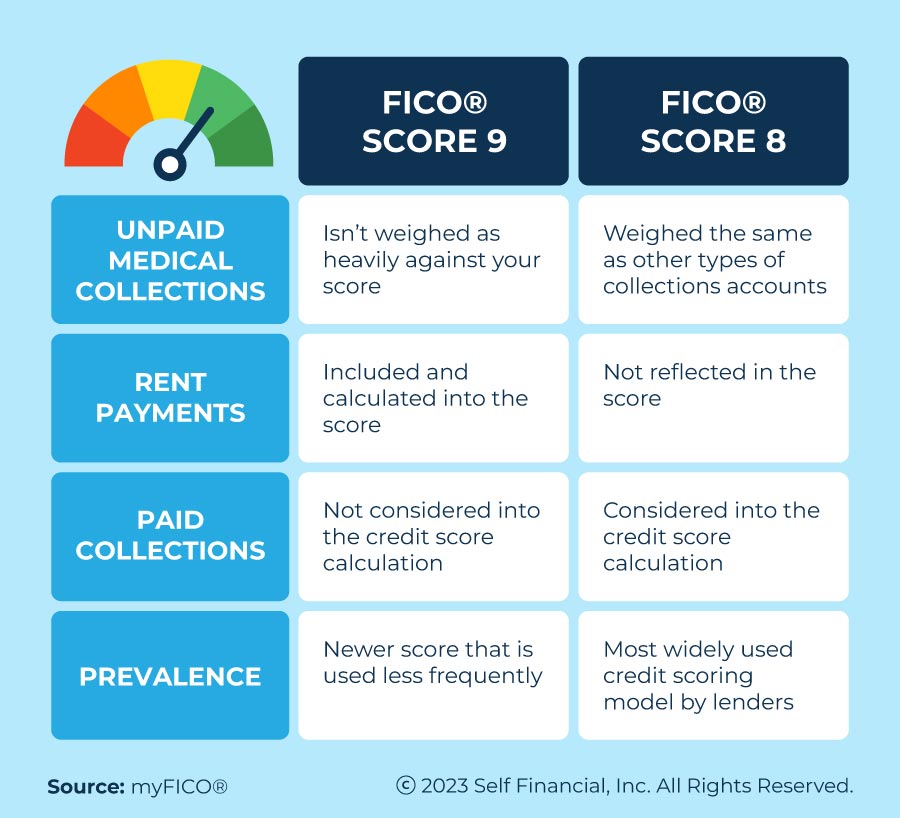

Is a FICO auto score of 8 good?

A good FICO 8 score typically falls between 670 and 739. This range indicates that a borrower is considered low-risk by lenders, which can lead to better loan terms and interest rates. Scores above this range are considered very good or excellent, further enhancing borrowing opportunities and financial benefits.