Since identity theft is a big problem right now, it’s not surprising that a lot of people are hesitant to give out personal information. That is especially true as we enter a time when working remotely is becoming more common.

Employers you’ve never seen ask you to email private information but remember that knowledge is power. If you want to start working from home, you need to know what your boss can legally ask you to send. This will help you spot and avoid phishing scams.

When applying for a new job or rental property, undergoing a background check is common. Background checks allow employers and landlords to verify information and evaluate candidates. But how much of your financial information can background checks access? Specifically, can background checks see your bank account details?

This is an important question to understand, as bank accounts contain sensitive personal and financial information The extent of what background checks can uncover depends on federal, state, and local laws.

We will talk about what background checks are, what financial information they can legally get, and how to keep your privacy safe during the screening process.

What Do Background Checks Look For?

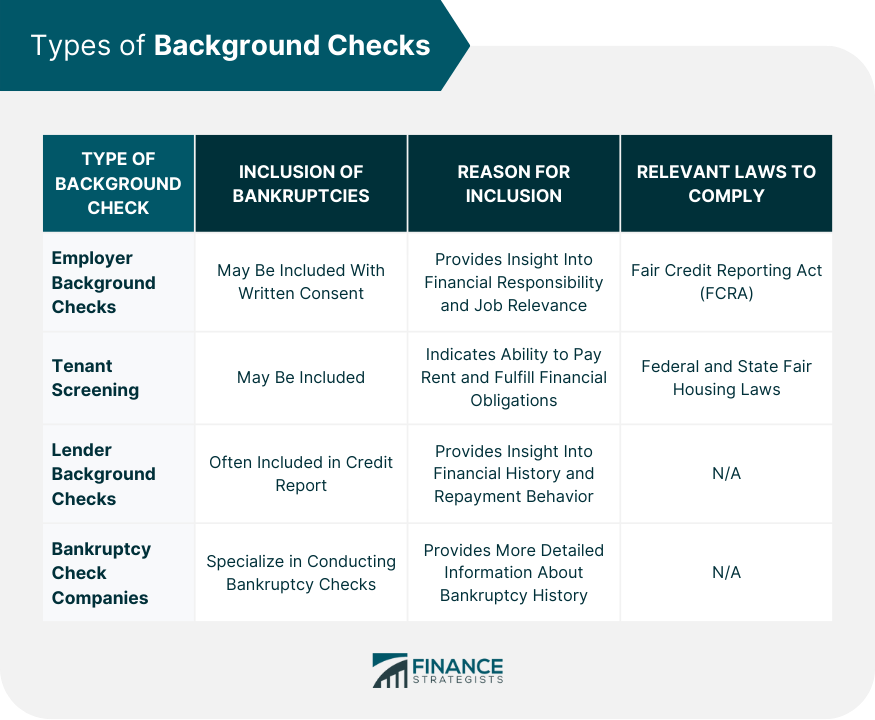

Background checks allow employers landlords lenders and other organizations to confirm a candidate’s identity, qualifications, criminal history, and other details. Several types of background checks exist, with varying levels of depth

-

Identity verification – Confirms details like full legal name, date of birth, and Social Security number.

-

Employment verification – Checks past employers, positions held, dates of employment, salary, and eligibility for rehire.

-

Education verification – Confirms academic credentials like degrees, schools attended, and graduation dates.

-

Criminal history – Searches court records for any criminal convictions.

-

Sex offender registry – Checks state and national databases for sex crime convictions.

-

Driving records – Accesses motor vehicle records to identify any license suspensions, at-fault accidents, DUIs, and traffic violations.

-

Credit check – Provides a credit report summarizing your payment history, outstanding debts, bankruptcies, and other financial details.

So what about bank accounts – can background checks access those too?

Are Bank Accounts Included in Background Checks?

Generally speaking, a standard background check will not provide any details about your bank accounts, including balances, transaction histories, or account numbers.

Under federal law, consumer reporting agencies cannot share certain financial information without your consent. This includes:

- Bank account numbers

- Credit and debit card numbers

- Brokerage account details

- Balance information

- Records of deposits and withdrawals

There are a few scenarios where your bank account details could appear in a background screening:

-

You provide this information voluntarily – For example, submitting bank statements to support an income claim.

-

Applying for jobs handling money – Account records may be requested to assess financial responsibility.

-

High government security clearance – Very extensive checks delve into all records.

However, most routine employment and tenant screenings will not contain your confidential bank account activity and information. Disclosing this is illegal without consent in most cases.

Key Laws that Protect Bank Account Privacy

Several federal consumer protection laws help safeguard your bank account privacy during background checks:

Fair Credit Reporting Act (FCRA)

This regulates what consumer reporting agencies, like background check companies, can include in their reports. The FCRA prohibits providing information related to:

- Bankruptcies older than 10 years

- Civil suits, judgments, and arrests older than 7 years

- Paid tax liens older than 7 years

- Accounts placed for collection older than 7 years

- Any other negative information (besides criminal convictions) older than 7 years

Most importantly, the FCRA also bans the inclusion of bank account and credit/debit card numbers. This helps keep your accounts private.

Gramm-Leach-Bliley Act (GLBA)

The GLBA establishes privacy rules for financial institutions regarding consumer data. It prohibits banks from disclosing your financial account information to third parties like background check firms and potential employers.

Exceptions may include suspected fraud investigations or situations where you’ve specifically consented to the release of your records.

Right to Financial Privacy Act

This means that banks and credit unions can’t give out your financial information, like account records and statements, in response to searches or investigations.

Police can only get this information with a subpoena or a formal written request that has been approved by a court. This adds a layer of privacy protection for your accounts.

How to Keep Bank Accounts Private During Background Checks

While laws prohibit disclosing bank account details in reports, here are some additional tips to keep your information private:

-

Carefully review consent forms – Don’t authorize release of more info than legally required.

-

Ask questions – Understand why certain information is being requested.

-

Avoid including statements – Don’t volunteer extra financial records not specifically required.

-

Limit account access – Only provide joint account details if essential for the position.

-

Review full reports – Scan completed background checks to ensure they don’t contain unauthorized financial info.

-

Dispute mistakes—If a check does include activity from your private account, you have the right under the FCRA to ask that it be fixed.

The Takeaway

Background checks allow assessment of candidates, but not at the expense of your financial privacy. Federal laws prohibit the inclusion of confidential bank account numbers, balances, transactions, and statements without your permission.

While very extensive checks for positions like government security may dig deeper, routine employment and tenant screenings won’t expose your sensitive account information. However, stay vigilant in protecting your rights throughout the background check process.

Loans and credit accounts

The information about your loan and credit accounts includes accounts within the past seven to ten years. The name of the creditor or lender, open and close date, status, credit limit, balances, and payment history are all made available during the employer credit check.

The public records shown on your credit report are bankruptcies, liens, foreclosures, and any civil suits and judgments.

Will an employer see my bank accounts in a credit check?

Your employer can see your credit history but not your bank accounts on their employer credit check. If there are special circumstances in which you want the employer to have access to your information, you will have to give permission in writing for them to have access.

Do Banks Check Your Criminal Record When You Open An Account? – Jail & Prison Insider

FAQ

Does financial information show up on a background check?

A summary of what’s on your credit report is usually part of a background check, if they include any financial information at all. Certain groups and companies can request to see your credit report.

What disqualifies you from working at a bank?

Laws Specific to Financial Services Background Checks: The Federal Deposit Insurance Act (FDIA) Section 19 prohibits individuals with certain criminal convictions (such as financial fraud) from working at FDIC-insured banks without FDIC approval.

Can felons have bank accounts?

Can ex-prisoners have a bank account? Yes, ex-prisoners can open bank accounts. However, their banking options may be limited if they have a negative ChexSystems report. Former inmates may consider second chance checking accounts if they’re unable to meet the requirements for a regular checking account.

Can police see bank accounts?

A grand jury subpoena is the first thing a government official must get before they can look at a customer’s bank records. An administrative subpoena or summons. A search warrant.