This article contains general information and is not intended to provide information that is specific to American Express products and services. Similar products and services offered by different companies will have different features and you should always read about product details before acquiring any financial product.

Understand how closed accounts on credit reports may impact your credit score. Find out how to manage and remove a closed account.

No matter how closely you pay attention to your financial history, closed accounts can appear on anyone’s credit report. It could be a credit card you haven’t used in a long time, a loan you paid off, or even a mistake made by a lender or credit bureau. Not matter the reason, closing an account can have a good or bad effect on your credit score, depending on the account. But there are often ways to manage closed accounts – or even remove them from your credit report.

If you want to get loans and credit cards with the best terms, you need to have a good credit score. The question of whether paying off old debts will help your credit score comes up a lot. Before you make a choice, read this article to learn more about how paying off closed accounts affects your credit.

What Are Closed Accounts?

First, let’s define what closed accounts are. Closed accounts refer to credit cards or loans that are no longer active This usually happens for a few reasons

-

You close the account – You voluntarily close the credit card or loan This can happen if you want to consolidate accounts or no longer need that line of credit

-

The lender closes the account—When an account isn’t used for a while or there’s a chance of default, the bank or lender closes it.

-

The account is charged-off – After several months of non-payment, the lender writes the account off as a loss, closing it.

Does Paying Off Closed Accounts Help Your Credit Score?

Most of the time, paying off a closed account won’t raise your credit score right away. But it can help in the long run by getting rid of bad information from your credit history. Here are some key points .

-

Paying a charged-off account – If the account has been charged off but not sold to collections, paying it off removes the negative status. But it takes time for your scores to reflect the change.

-

Payment for sold debt: If the debt was sold to a collection agency, you need to pay them. The status will now say “paid collection,” which is better but still bad.

-

Eliminating debt – Less revolving debt improves your credit utilization ratio, a key factor in credit scores. This helps over time.

-

Won’t change account status – Paying a closed account does not change the fact that the account was closed, which remains negative.

Other Ways Closed Accounts Impact Your Credit

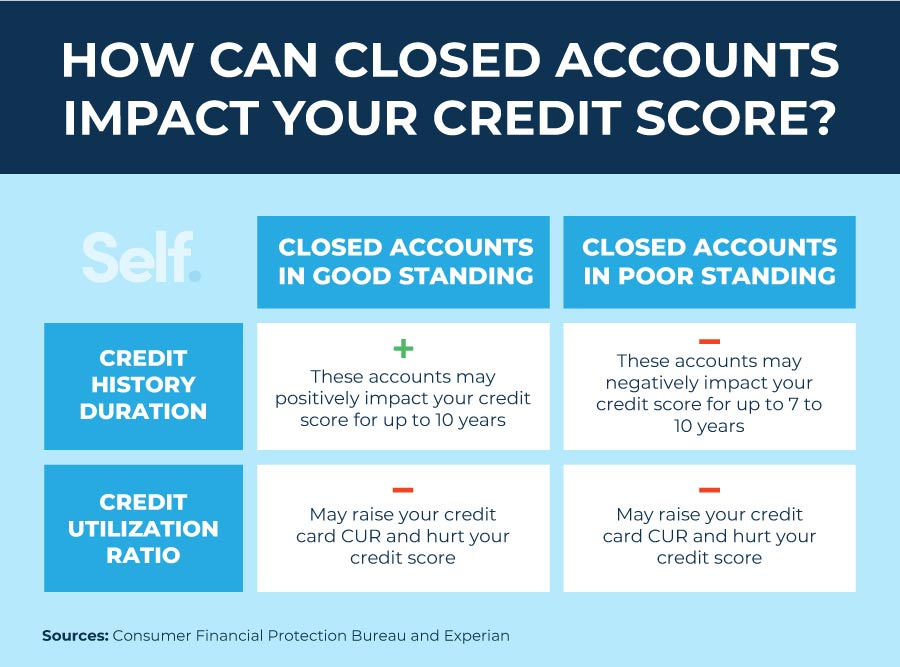

Beyond whether paying off the balance helps, closed accounts can impact your credit in other ways too:

-

Credit history – Closed accounts remain on your credit reports and contribute to length of credit history for 10 years. This is generally positive.

-

Credit mix – Having different types of credit (credit cards, loans, mortgages, etc.) helps your credit mix. Closing accounts impacts this mix.

-

Lowered credit limits – Since closed accounts no longer count towards your total credit limit, this can negatively impact your utilization ratio.

-

New credit applications – Applying for new credit to replace closed accounts causes hard inquiries, which temporarily lower your scores.

As you can see, closed accounts can positively or negatively influence your credit in direct and indirect ways. The impact depends on your specific credit situation.

Tips for Managing Closed Accounts

If you have closed accounts that you want to pay off, here are some tips:

-

Pay charge-offs directly to the original creditor if possible, or get validation of the debt if sold.

-

Make sure payments are recorded properly by checking your credit reports regularly.

-

Consider asking creditors to “re-age” accounts to erase some negative history once paid off.

-

Don’t close old accounts as these help your length of credit history.

-

If you do close an account, reduce balances on other cards to minimize utilization effects.

-

Be cautious about opening new accounts and inquiries. Space these out over time.

-

Maintain low balances and make all payments on time going forward to offset negative impacts.

With some diligence, you can minimize damage from closed accounts and work toward rebuilding your credit over time. Paying off closed account balances is one small piece of the overall puzzle.

The Bottom Line

How to Get Rid of Closed Accounts on Your Credit Report

There are a few ways to go about getting a closed account off your credit report. The credit bureaus and information providers must fix the information on your credit report if the closed account was a mistake or fraud. If the closed account is verifiable and legitimate – and has negative information like an outstanding balance or a history of late or missed payments – you still have a few options to remove it:

- Pay to have the bad information taken off your credit report: If you pay off the rest of the debt, either all at once or over time, the lender may agree to do so. However, lenders aren’t obligated to do so.

- Goodwill deletion: You ask the person who gave you the information to get rid of the negative item out of kindness. This choice doesn’t always work, but it’s worth trying because the furnisher might take away the bad thing if you give them a good enough reason to think the bad behavior won’t happen again. For instance, if you have an otherwise clean credit history.

- Wait: While not the quickest solution, it’s always successful. Most people, though, can’t wait that long. This is especially true if they need to take steps to improve their credit quickly. But if you decide to wait, the data will be lost.

How Closed Accounts Affect Your Credit Score

How closed accounts affect your credit score can seem a bit contradictory to what you might think. For instance, paying off an auto or home loan is considered a good thing, financially. But because it makes you less likely to have different types of credit, it can temporarily lower your score. Lenders usually prefer borrowers who have learned to handle a good mix of loans and credit lines. If you don’t use a credit card, it may seem logical to close the account. But closing a credit card would lower your overall credit limit, which can raise your credit utilization and that, in turn, could negatively affect your credit score. Closed accounts with remaining balances – like a canceled credit card account with an outstanding balance – can also affect your score negatively. If the account defaulted, it could be transferred to a collection agency. Paying off closed accounts like these should improve your credit score, but you might not see an increase right away.

Paying Collections – Dave Ramsey Rant

FAQ

Will my credit score go up if I pay off a closed account?

Paying off a closed account can improve your credit score, but the impact might not be immediate. While paying off a closed account won’t necessarily remove it from your credit report, it can positively affect your credit utilization ratio and overall debt, which can lead to a score increase over time.

Can paid closed accounts be removed from a credit report?

There are some things that can make closed credit card accounts stay on your credit report for up to ten years. You can try to get closed accounts off of your credit report by disputing any errors, sending a “goodwill letter,” or just waiting for the account to be taken off by itself. May 22, 2025.

Is it good to pay a closed account?

Remember to pay off your closed accounts. One of the fastest ways to raise your credit score is to pay off all of your credit card debt, even the debt from accounts that have been closed. If you aren’t sure if you have any closed accounts on your report, a credit-tracking app can help.

Will paying off and closing a credit card improve my score?