If you are a homeowner with a conventional mortgage who makes monthly payments on your home, you may have heard about biweekly mortgage payments as an alternative to traditional payment plans. The logic is that increasing the frequency of the payments reduces the interest that builds up and, over the course of a 30- or 15-year mortgage, that can equal years of payments eliminated from your loan. However, biweekly mortgage payment programs typically carry additional fees and require agreeing to a larger repayment amount.

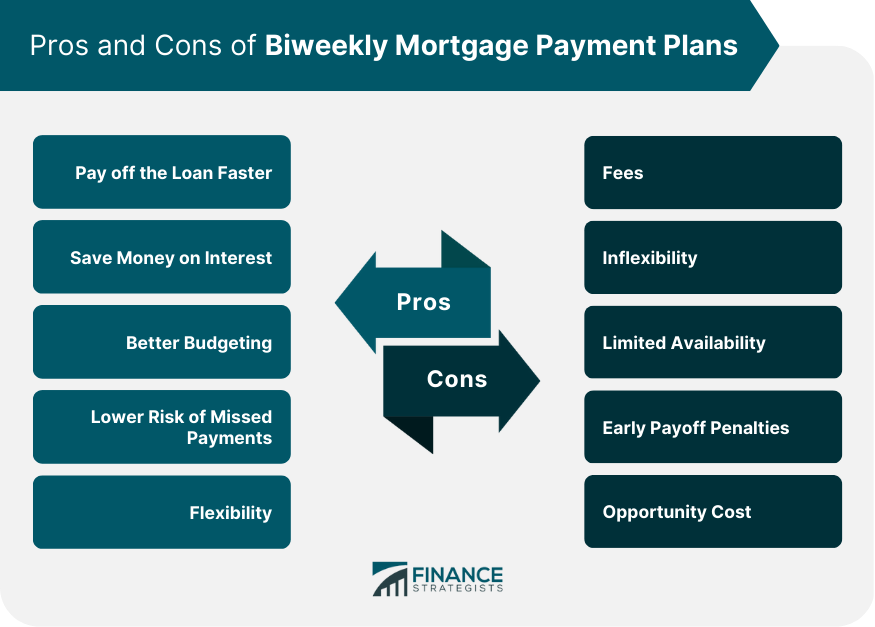

Before you sign up for biweekly payments, itd be wise to weigh the advantages and disadvantages of this type of program to determine whether it will actually save you any money.

Some homeowners pay their mortgages off faster and save money on interest by making payments every two weeks instead of every month. Making payments every two weeks can help you pay off your mortgage faster, but there are some things you might not like about this payment plan that you should think about before committing to it.

What Are Biweekly Mortgage Payments?

When you pay your mortgage every month, you make 12 payments each year. When you pay every two weeks, instead of once a month, your monthly payment is split in half. 26 payments every two weeks are the same as 13 monthly payments over the course of a year.

By making one extra mortgage payment each year, you end up paying down your mortgage principal faster. This can shave years off the life of your loan and save you thousands in interest.

The Pros of Biweekly Payments

There are some appealing benefits to biweekly mortgage payments:

-

Your mortgage will be paid off faster if you make payments every two weeks. Depending on the size of your loan and interest rate, you could pay off your 30-year mortgage 6 to 8 years early.

-

Build home equity more quickly: Since you’re paying extra principal every year, you build equity faster with biweekly payments.

-

Possible interest savings: Paying extra principal annually can lead to interest savings in the thousands over the life of your loan.

-

Easy to budget: If you’re paid biweekly, mortgage payments from each paycheck can simplify budgeting.

The Potential Downsides of Biweekly Payments

While biweekly mortgage payments have some pros, there are also some potential cons to evaluate:

-

There may be fees: Some lenders charge fees to set up and keep up payment plans every two weeks. Fees could minimize your interest savings.

-

Inflexible commitment: Biweekly plans require an ongoing commitment to pay extra every year. This can be difficult if your finances change.

-

Payments aren’t applied immediately: Even though you pay biweekly, the extra payments may only be applied annually or semi-annually.

-

Can be a budget strain: Committing to higher payments in perpetuity may be challenging, especially if money gets tight.

Weighing the Pros and Cons

When deciding if biweekly mortgage payments are right for you, weigh the advantages against the potential disadvantages:

Consider your budget: If you have room to comfortably make biweekly payments long-term, the benefits may make it worthwhile. But if it would strain your budget, it may not be sustainable.

Look at your other goals: Putting extra cash toward other priorities like debt payoff or retirement savings could be a better use of funds than biweekly mortgage payments.

Check for fees: Lender fees could diminish the interest savings, so run the numbers to see if biweekly payments still pay off.

See if you need to commit: You can send one extra principal payment annually on your own without a formal biweekly agreement.

Compare early repayment options: Other alternatives like mortgage refinancing or recasting may let you pay off your mortgage faster too.

Tips for Making Extra Mortgage Payments

If you want to make extra payments but avoid the potential downsides of a formal biweekly plan, consider these tips:

-

Make one extra principal-only payment yearly from your tax refund or a windfall.

-

Divide your monthly payment by 12 and add that amount to each monthly payment.

-

Set up automatic additional principal payments through your lender.

-

Recast your mortgage after making a large lump-sum payment.

-

Compare mortgage refinance rates to lower your interest rate and monthly payment.

The Bottom Line

While biweekly mortgage payments can accelerate payoff, make sure the benefits outweigh the costs and commitment involved. Running the numbers for your specific mortgage and budget situation can help determine if biweekly payments are the right choice or if other payoff strategies may work better for you. Evaluating all your options will let you make the most informed decision.

What’s Wrong with Biweekly Mortgage Payments?

There are potentially two problems with going with a lenders biweekly payment program:

- There are often fees attached to this payment plan. That eats into the amount youre saving by accelerating your repayment schedule.

- You may, like most American consumers, already have enough contractual payment obligations in your life. Unless you have significant financial reserves, you might want to keep some flexibility in your budget rather than committing to biweekly payments.

Remember, you can always make an extra payment when you get three paychecks in a month, receive a tax refund, or come into a windfall. You dont have to contractually obligate yourself to do it every month.

How Does the Math Work on Biweekly Mortgage Payments?

It works like this: Biweekly payments are equal to 13 monthly payments in a year, while traditional monthly payments are equal to 12 payments each year.

By paying an extra month every year, youre paying extra principal, which shaves six to eight years off the life of the loan over time.

But do you have to make biweekly payments to do that? Instead, you could divide the total of one months payment by 12 and add that amount to your monthly mortgage payment.

If youre paying $1,500 per month, divide 1,500 by 12 and make your monthly payment $1,625. Talk to your mortgage company first to make sure there isnt something more you have to do to make sure the extra money is applied to the principal amount of your loan.

Pros and Cons of a Bi-weekly Mortgage Payment | Is this for you?

FAQ

Should you pay a mortgage biweekly?

Pay less interest. The higher your interest rate and the more you’ve borrowed, the more you could save. If you have a $300,000 mortgage at 4% for 30 years, biweekly payments will save you $35,000 in interest payments. If you have a $200,000 mortgage at 3% for 30 years, biweekly payments will save you $14,280. Repay your mortgage faster.

What are the pros and cons of a biweekly mortgage plan?

Lets consider the pros and cons of entering a biweekly mortgage plan. By making one extra payment a year, your mortgage will ultimately be paid off faster. For example, if you’re buying a $100,000 home and you put 20% down, you’ll have an $80,000 mortgage. With a 30-year mortgage, it will normally take you 30 years to pay this off.

What is a biweekly mortgage payment?

Making biweekly mortgage payments means paying half of your monthly mortgage payment every two weeks. Instead of making one payment each month, you’ll ignore the calendar months and go by weeks— 26 half-payments over the course of the 52 weeks in a year.

Should you switch to a biweekly mortgage payment?

If your mortgage payment is due once a month, switching to payments every two weeks can lower the amount of interest you pay and even help you own your home faster. But making payments every two weeks doesn’t guarantee these results; how well you get these benefits depends on how your lender handles payments every two weeks.

What happens if I miss a biweekly mortgage payment?

Missing a biweekly payment or any mortgage payment could involve late fees and harm your credit score. To avoid these risks, reach out to your lender as soon as possible to discuss options. Photo credit: iStock/anchiy.

Do biweekly mortgage payments affect your credit score?

Your payment activity gets reported to credit bureaus each month, and biweekly payments fall within the 30-day window just like monthly payments. Timely payments are of critical importance to your credit score, whether you make monthly or biweekly payments. Do biweekly mortgage payments lower your interest rate?.

Are biweekly mortgage payments a good idea?

Most homeowners dream of paying off their mortgage early. One way to achieve this goal is to pay half your monthly mortgage every other week. Making biweekly mortgage payments can shave years off your loan and save you thousands of dollars in interest.

How much faster do you pay off a mortgage with biweekly payments?

How do I pay off a 30-year mortgage in 15 years?

To pay off a 30-year mortgage in 15 years, you can either refinance to a 15-year loan or make extra payments toward the principal.

What is the 10/15 rule for mortgages?

The 2010–15 Mortgage Rule: Make an extra payment each week equal to 10% of your monthly mortgage payment, payable to the principal. For example, if your monthly mortgage payment is $2,000, you ought to pay an extra $200 every week, and by doing that, reduce your loan term by 15 years.