Are you stressing about your financial timeline? Wondering if you’re behind on paying off those loans? I’ve been researching this topic extensively, and the answer isn’t as straightforward as you might think. Let’s dive into the real story about debt freedom and age milestones that financial experts actually recommend.

The “Ideal” Debt-Free Age – Is There Such a Thing?

According to “Shark Tank” investor Kevin O’Leary, being debt-free by age 45 puts you on the early path to success. His reasoning? Most careers start in your early 20s and end in your mid-60s, so by 45, “the game is more than half over.” He believes you should be debt-free by then to focus on building wealth for retirement.

But here’s where it gets interesting – not all financial experts agree with this timeline!

If you manage to pay off by then, you’ll have several years to put your savings to your retirement funds, laying the groundwork for a comfortable life once you quit working By the age of 50 it is ideal to be debt-free, and your retirement savings should be enough to give you a comfortable life

Reality check though? Research shows most Americans don’t become debt-free until around age 58. That’s the standard route that credit companies and lenders typically expect.

Why One-Size-Fits-All Advice Doesn’t Work

The truth is, there are valid reasons why a rigid age target might not make sense for everyone:

- Interest rates matter: If your debt has a lower interest rate than what you could earn investing (like a 3% mortgage vs. 7-10% stock market returns), paying off debt super-early might actually leave money on the table

- Gender wage gap considerations: Women’s salaries tend to peak around age 40, while men’s peak around 55 – this impacts optimal debt payoff strategies

- Different types of debt: Not all debt is created equal – mortgage debt at 3% is very different from credit card debt at 20%

What Age Do Most People Actually Become Debt-Free?

Let’s look at what actually happens in real life:

- According to the data, most people become debt-free around age 58

- The standard debt repayment route takes about 36 years to complete

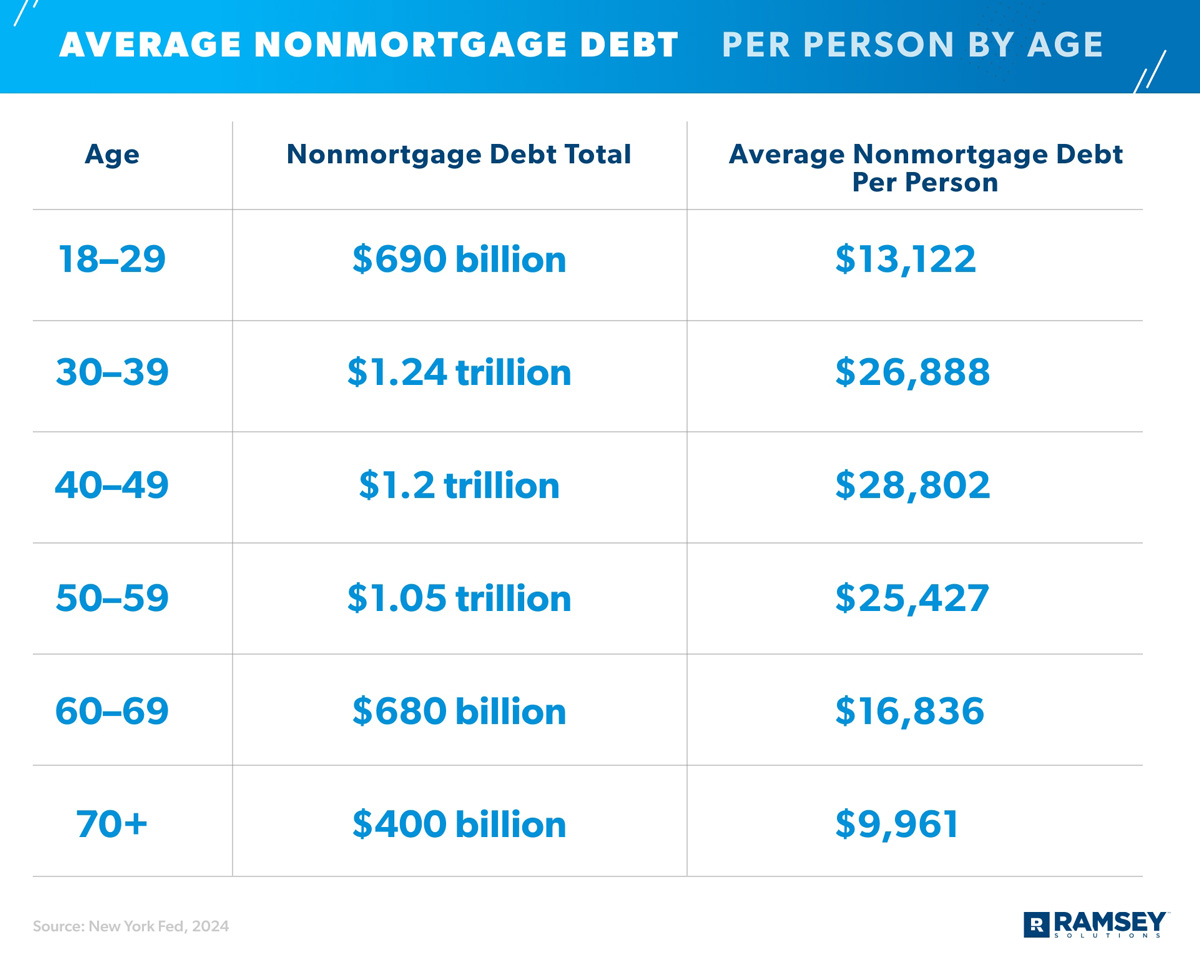

- People aged 40-49 hold the largest total debt at $4.21 trillion

- People aged 50-59 have the most credit card debt

- People aged 30-39 have the most student loan debt

By age group, here’s the average debt Americans carry:

- Gen Z (18-23): $9,593

- Millennials (24-39): $78,396

- Gen X (40-55): $135,841

Is O’Leary’s Advice Realistic For Everyone?

Rachel Sanborn Lawrence, a certified financial planner at Ellevest, disagrees with O’Leary’s rigid timeline. She believes aiming to be debt-free by 45 might be unrealistic for many and could actually mean leaving money on the table.

“If you are borrowing money at a lower rate than you’re able to make on that money, you’re going to end up net positive,” says Sanborn Lawrence.

She points out that women and especially women of color should be cautious about this advice due to the “salary curve gap”

- Men’s salaries typically peak around age 55

- Women’s salaries often peak around age 40

This means women may need to save more earlier in their careers rather than focus solely on debt payoff.

The House Payoff Question

A major consideration in the debt-free timeline is your mortgage. When should your house be paid off?

Financial experts suggest:

- If you’re under 45, it’s usually better to invest extra money rather than aggressively pay down a low-interest mortgage

- After age 45, you can begin thinking more seriously about pre-paying your mortgage

- You should aim to be completely debt-free by retirement

How Much Debt is Actually “Normal”?

I know we all wonder if our debt level is “normal.” Here’s what the data shows:

- A good debt-to-income ratio is less than or equal to 36%

- Nearly 25% of U.S. consumers owe more than $5,000 on credit cards

- $20,000 in credit card debt is considered a lot

- $30,000 is approximately the average amount of debt for many Americans

Is Being Debt-Free the New Rich?

There’s a common misconception that being debt-free equals being wealthy. That’s not necessarily true! Being debt-free simply indicates sound financial management, not necessarily an overflowing bank account.

Interestingly, many millionaires stay away from debt. If they want something they can’t afford, they save and pay cash for it later. Car payments, student loans, and financing plans aren’t part of their vocabulary.

But about 23% of Americans are completely debt-free, according to Federal Reserve data. So while it’s not super common, it’s definitely achievable!

A More Balanced Approach to Debt Freedom

Instead of fixating on a specific age, consider these more practical guidelines:

-

Prioritize high-interest debt first – Credit cards and personal loans should go before low-interest mortgages

-

Use the 50/30/20 rule – 50% of income toward needs, 30% toward wants, and 20% toward savings and debt repayment

-

Aim to be debt-free by retirement – This is when having fixed payments can really hurt your financial security

-

Consider the debt type – Some debt (like mortgages) can be strategic, while high-interest consumer debt is almost always harmful

-

Balance debt payoff with investing – Don’t neglect retirement accounts just to pay off low-interest debt

What Should You Pay Off Before Retirement?

Financial experts recommend paying off these 3 things before retirement:

- Personal loans

- Credit cards

- Auto loans

These typically have higher interest rates and lack the potential tax benefits that some mortgage debt might provide.

My Personal Take

I’ve worked with many clients on their debt freedom journeys, and I’ve noticed that those who are most successful don’t obsess over a specific age deadline. Instead, they focus on building sustainable financial habits and making consistent progress.

The most important thing isn’t whether you’re debt-free by 45, 50, or 58 – it’s whether you’re making intentional choices that align with your personal goals and circumstances.

If you have a low-interest mortgage that’s allowing you to invest more for retirement, paying it off by 45 might not be the best move. On the other hand, if high-interest debt is keeping you up at night, aggressive payoff might bring peace of mind that’s worth more than potential investment returns.

Action Steps to Take Today

No matter your age or debt situation, here are some practical next steps:

-

Calculate your debt-to-income ratio – Aim for 36% or less

-

List all debts by interest rate – Focus on paying off highest-interest debt first

-

Review your retirement savings – Are you on track? This affects how aggressively you should pay down debt

-

Check your mortgage terms – Could refinancing help you pay it off sooner?

-

Create a realistic debt payoff timeline – Based on your personal circumstances, not someone else’s arbitrary age target

Final Thoughts

While becoming debt-free by mid-40s or 50 is a worthy goal, don’t beat yourself up if your timeline looks different. Your financial journey is unique, and what matters most is consistent progress toward financial freedom.

Remember that even financial experts disagree on the “ideal” age to be debt-free. The best approach is the one that works for your specific situation, goals, and values.

What’s your target age for becoming debt-free? Have you created a specific plan to get there? I’d love to hear about your journey in the comments below!

Disclaimer: This article contains general financial information and should not be considered personalized financial advice. Always consult with a qualified financial professional regarding your specific situation.

By What Age Should You be Debt Free? | SUBSCRIBER $ REVIEW

FAQ

What is the ideal age to be debt-free?

As for the ideal age to debt-free, don’t get too caught up in the comparison game, says Sanborn Lawrence. A good goal is to be debt-free by retirement age, either 65 or earlier if you want. If you have other goals, such as taking a sabbatical or starting a business, you should make sure that your debt isn’t going to hold you back.

How old do you have to be to get out of debt?

People 18-24 are the most optimistic, predicting debt freedom at about age 33; but the prediction keeps advancing, as 25-34 year olds predict age 38; 35-49 year olds predict age 56; 50-64 year olds predict age 62; and at age 65-plus, debt freedom is expected at age 77.

Should you be debt-free by 45?

Kevin O’Leary says you should be debt-free by 45. This financial planner disagrees Ellevest’s Rachel Sanborn Lawrence weighs in on why you shouldn’t necessarily try to be debt-free by age 45. “Shark Tank” investor Kevin O’Leary has said the ideal age to be debt-free is 45, especially if you want to retire by age 60.

What is the best age to pay off debt?

It’s not all that surprising that consumers in their 30s and 40s — who are growing families, buying homes and generally facing more expenses — would have more debt. But if taking on debt in your younger years is considered the status-quo, what’s the best age to pay it off by? The answer, CNBC Select found, depends on a few things.

What is the age of predicted debt freedom?

The age of predicted debt freedom was 53 on average. People 18-24 are the most optimistic, predicting debt freedom at about age 33; but the prediction keeps advancing, as 25-34 year olds predict age 38; 35-49 year olds predict age 56; 50-64 year olds predict age 62; and at age 65-plus,

Should you be debt-free if interest rates are below 5%?

But mathematically, there’s not always an incentive to be debt-free so soon, argues Sanborn Lawrence. If the interest rates on your debt are below 5% to 10%, it often makes most sense to invest your extra cash in the stock market, which has historically earned at above this rate, rather than rushing to pay off debt.

At what age should I be debt free?

By the age of 50 it is ideal to be debt-free, and your retirement savings should be enough to give you a comfortable life.

How much debt is normal at 35?

How many 40 year olds are mortgage-free?

In 2023, two-thirds of the mortgage-free homeowners are baby boomers aged 60 years and over. In contrast, only 5% of mortgage-free homeowners are under 35 years old, 8% are between 35 and 44 years old, 11.9% are aged 45 to 55, and 8.9% are between 55 and 59.

What age should you be financially free?

Parents’ answers vary based on the age of the child. Most (62%) of those answering about a child age 30 to 34 say their child is completely financially independent. This compares with 54% of parents answering about a child age 25 to 29 and just 23% of those answering about an adult child younger than 25.