Let’s face it – saving for retirement can sometimes feel like a puzzle with missing pieces One question that often pops up is whether you can dump a large chunk of money into your Roth 401(k) all at once Maybe you received a bonus, sold some property, or have extra cash sitting around. Whatever the reason, understanding how lump-sum contributions work with Roth 401(k) plans is super important for maximizing your retirement savings.

The Short Answer: It’s Complicated

No, you typically cannot make a direct lump-sum contribution to your Roth 401(k) from external funds

According to the information available, 401(k) contributions (including Roth 401(k)s) must come from payroll deductions through your employer. This means the money has to flow from your regular paychecks – not from your personal bank account or other sources.

As one financial expert mentioned, “Lump-sum contributions are usually allowed by employer plans and usually must come from another qualified account or qualified employer plan.” This means you could potentially transfer money from an existing IRA, Roth, 401(k), 403(b), 457, Simple, SEP, or similar qualified plan into your current employer’s plan.

Why Can’t I Just Add Money Directly?

The answer lies in how 401(k) plans are structured. These are employer-sponsored retirement accounts that operate through payroll systems. The IRS rules require that:

- Contributions must be made through payroll deduction

- You can’t add outside money directly to boost your tax advantages

- The money must come from earned income through your employer

As one source plainly states: “401(k) plans are sponsored by employers and must be done through payroll.”

The Workaround: Adjusting Your Contribution Rate

If you have a lump sum of cash (like from selling a rental property) and want to funnel it into your 401(k), there is a legitimate workaround:

- Increase your contribution percentage dramatically (some plans allow up to 100% of your paycheck)

- Live off your cash surplus while most or all of your paycheck goes to your 401(k)

- Stay within annual limits ($23,500 for 2025, or $31,000 if you’re over 50)

For example, if you have $20,000 from selling an asset and want to get it into your 401(k), you could:

- Increase your 401(k) contribution to 75-100% of your paycheck

- Use your $20,000 cash to pay bills and expenses

- Effectively “convert” your lump sum into 401(k) contributions

Some plans allow you to contribute as much as 100% of your salary (up to annual limits), meaning you could potentially redirect your entire paycheck to your 401(k) for a period of time.

What About Rollovers and Transfers?

Here’s where things get a bit more flexible. While you can’t directly contribute external funds as a lump sum, you CAN typically roll over or transfer money from other qualified retirement accounts. This includes:

- Traditional IRAs

- Other 401(k) plans from previous employers

- 403(b) plans

- 457 plans

- SEP IRAs

- SIMPLE IRAs

These transfers aren’t technically “contributions” but rather movements of already tax-advantaged money between qualified accounts.

Special Considerations for Roth 401(k)s

When specifically looking at Roth 401(k)s, there are some additional things to keep in mind:

-

Employer matches don’t go into the Roth portion. Even if you contribute to a Roth 401(k), your employer’s matching contributions go into a separate traditional 401(k) account.

-

Income limits don’t apply. Unlike Roth IRAs, there are no income limitations for contributing to a Roth 401(k).

-

Changes coming in 2026. The SECURE 2.0 Act will require higher earners (making more than $145,000) who are 50 or older to put their catch-up contributions in a Roth 401(k) rather than a traditional 401(k).

Catch-Up Contributions: An Additional Opportunity

If you’re 50 or older, you can take advantage of catch-up contributions to boost your retirement savings. For 2025:

- The regular contribution limit is $23,500

- The catch-up contribution is an additional $7,500

- This gives a total potential contribution of $31,000

And starting in 2026, the catch-up amount will increase to $11,250 for those aged 60-63.

I should mention that, as of February 2025, if you’re a higher-income earner (over $145,000), beginning in 2026, you’ll need to make any catch-up contributions to a Roth 401(k) rather than a traditional 401(k). This change was originally supposed to take effect in 2024, but the IRS granted a two-year extension.

Alternative Strategies If You Have Extra Cash

If you’ve got extra money and can’t directly contribute it to your Roth 401(k), consider these alternatives:

1. Maximize your regular contributions

If you haven’t been contributing the maximum to your 401(k), now’s the time to crank it up. Set your contribution percentage as high as you can afford (up to 100% in many plans) and use your lump sum to cover living expenses.

2. Consider a Roth IRA

If you’re eligible based on income, you could contribute to a Roth IRA ($8,000 in 2025 if you’re 50 or older). This gives you tax-free growth and withdrawals in retirement.

3. Backdoor Roth conversion

If your income is too high for direct Roth IRA contributions, consider the backdoor Roth strategy:

- Contribute to a traditional IRA (non-deductible)

- Convert those funds to a Roth IRA

- Pay taxes on any earnings that occurred before the conversion

4. Invest in a taxable brokerage account

Don’t overlook regular investment accounts. While they don’t offer the same tax advantages, they provide flexibility and can be quite tax-efficient if you focus on long-term capital gains and tax-efficient investments.

Common Questions About Roth 401(k) Contributions

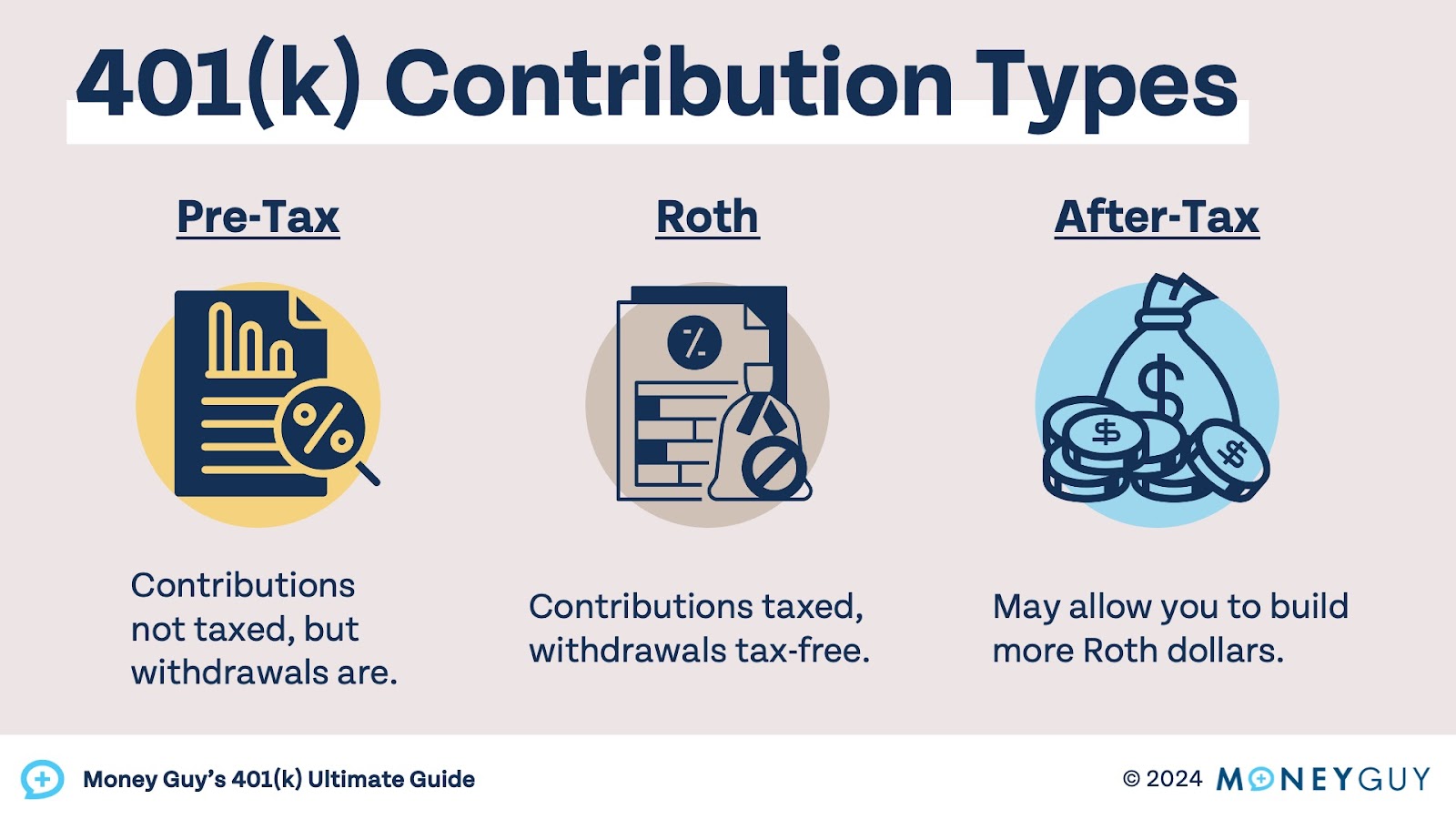

Can I contribute to both a traditional and Roth 401(k)?

Yes! You can split your contributions between traditional and Roth 401(k) accounts. Your combined contributions still need to stay under the annual limit.

Should I choose Roth or traditional 401(k)?

It depends on your tax situation. If you expect to be in a higher tax bracket in retirement, a Roth 401(k) might make more sense. If you’re in a high tax bracket now and expect lower income in retirement, traditional might be better.

Can I contribute to a 401(k) and an IRA?

Absolutely. You can contribute to both a 401(k) through your employer and an IRA on your own. If your income is too high, you might not be able to deduct traditional IRA contributions, but you could still make non-deductible contributions.

Final Thoughts

While you can’t directly make a lump-sum contribution to your Roth 401(k) from external sources, you can achieve similar results by increasing your payroll contribution percentage and living off your extra cash. Remember that retirement savings is a marathon, not a sprint – consistent contributions over time will help you build a solid nest egg.

The key takeaways:

- 401(k) contributions must come from payroll deductions

- You can increase your contribution percentage dramatically and live off your lump sum

- Consider spreading your investments across different account types for tax diversity

- Don’t forget about catch-up contributions if you’re 50 or older

We all want to maximize our retirement savings, and understanding the rules and workarounds for 401(k) contributions is an important part of that journey. By being strategic with your contributions and considering all your options, you can make the most of your lump sum and set yourself up for a more secure retirement.

Have you faced this situation before? What strategy did you use to get extra money into your retirement accounts? The rules can be frustrating sometimes, but with a bit of planning, you can still achieve your retirement savings goals!