Thinking about hanging up your stethoscope or hospital badge at 55? You’re not alone. Many NHS professionals dream of an early exit from the demanding healthcare world. The good news is that yes, you can retire at 55 with an NHS pension – but there are important conditions, reductions and considerations you need to understand first.

Eligibility for NHS Pension Early Retirement at 55

Let’s get straight to the point – your ability to retire at 55 depends on which NHS Pension Scheme section you belong to

For 1995 Section Members

To retire at 55 with your NHS pension. you must have

- Been an active member of the NHS Pension Scheme between March 31, 2000 and April 5, 2006

- Reached the minimum pension age of 55 (some members who joined before April 6, 2006 can actually retire as early as 50)

If you joined the 1995 section on or after April 6, 2006, your minimum pension age is 55

For 2008 Section Members

- Minimum pension age is 55

- Normal Pension Age is 65

For 2015 Scheme Members

- Minimum pension age is 55

- Normal Pension Age is 65 or state pension age, whichever is higher

Not sure which section you’re in? It’s super important to find out before making retirement plans, as each section has different rules and benefits.

The Cost of Early Retirement: Pension Reductions

Now for the part that might hurt a bit. Taking your NHS pension early comes with a price – your benefits will be reduced. This happens because your pension will be paid for longer than originally planned.

1995 Section Reductions

If you retire early from the 1995 section, both your pension and lump sum get reduced:

| Age at Retirement | Pension Reduction | Lump Sum Reduction |

|---|---|---|

| 59 | 4.3% | 1.7% |

| 58 | 8.3% | 3.3% |

| 57 | 12% | 4.9% |

| 56 | 15.5% | 6.5% |

| 55 | 18.8% | 8.1% |

| 54 | 21.8% | 9.6% |

| 53 | 24.6% | 11.1% |

| 52 | 27.2% | 12.6% |

| 51 | 29.6% | 14.1% |

| 50 | 31.8% | 15.5% |

So if you retire at 55, your pension will be reduced by about 18.8% and your lump sum by 8.1%. That’s a significant hit!

2008 Section Reductions

For 2008 section members, the reductions at age 55 are even higher:

| Age at Retirement | Pension Reduction |

|---|---|

| 64 | 4.7% |

| 63 | 9.2% |

| 62 | 13.5% |

| 61 | 17.3% |

| 60 | 21.1% |

| 59 | 24.3% |

| 58 | 27.4% |

| 57 | 30.4% |

| 56 | 33.1% |

| 55 | 35.7% |

That’s right – a whopping 35.7% reduction if you retire at 55!

2015 Scheme Reductions

For the 2015 scheme, reductions are based on how many years early you’re retiring:

| Years Early | Pension Reduction |

|---|---|

| 1 | 5.2% |

| 2 | 10.1% |

| 3 | 14.5% |

| 4 | 18.5% |

| 5 | 22.3% |

| 6 | 25.7% |

| 7 | 28.9% |

| 8 | 31.9% |

| 9 | 34.7% |

| 10 | 37.3% |

| 11 | 39.7% |

| 12 | 42% |

With state pension age rising, these reductions could be even higher for younger members.

Flexible Retirement Options to Consider

If full retirement at 55 with a reduced pension doesn’t sound appealing, there are other options that might give you the best of both worlds:

1. Partial Retirement

This clever option lets you:

- Take some of your pension while continuing to work

- Choose between 20% and 100% of your pension benefits

- Continue building additional pension in the 2015 Scheme

- No need to take a break or change jobs (though you’ll need to modify your contract)

From October 2023, even members of the 1995 Section can access partial retirement.

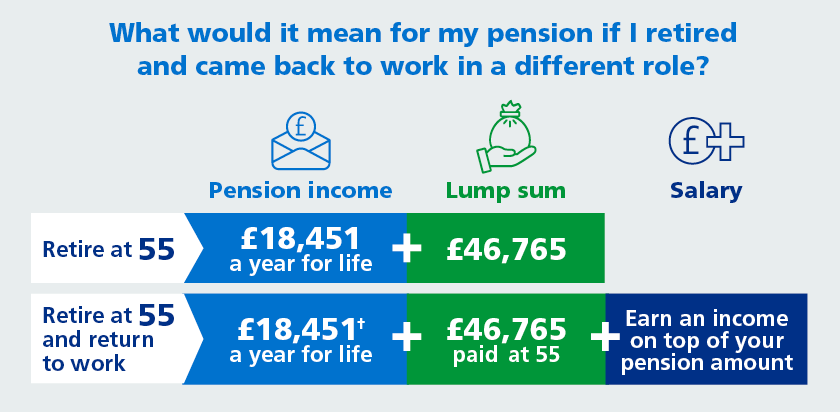

2. Retire and Re-join

Another flexible option that lets you:

- Retire and take your full pension

- Take a brief break

- Return to NHS work and re-join the NHS Pension Scheme

- Continue building more pension benefits in the 2015 Scheme

- Work as many hours as you like without pension abatement

This option has been available to 2008 and 2015 scheme members, and from April 2023, 1995 section members can also re-join the 2015 scheme if they return to NHS employment.

3. Wind Down or Step Down

You could also:

- Reduce your hours (“winding down”)

- Take a less senior position (“stepping down”)

- Start drawing some pension benefits while still working

Real-Life Example: What Early Retirement Might Look Like

Let’s look at a concrete example of what retiring at 55 might mean financially:

Imagine you’re 55 years old, were in the 1995 Section until March 31, 2015, and then joined the 2015 Scheme. You’re earning £47,672 (Band 7).

If you partially retire at 55 taking 100% of your 1995 benefits:

- You’d get around £13,348 per year for life

- Plus a lump sum of £44,449

- You could reduce your hours by 50% and continue working part-time

- At age 60, you could fully retire and take your 2015 benefits too, giving you an additional £8,239 per year

This gives you income while working reduced hours and sets you up for a more comfortable full retirement later.

Important Considerations Before Retiring at 55

Before you submit that retirement paperwork, here are some crucial factors to think about:

1. Financial Readiness

Ask yourself:

- Do I have enough savings outside my pension?

- Have I paid off my mortgage and other major debts?

- How will inflation affect my pension over a potentially long retirement?

- Do I have other income sources to supplement my reduced pension?

2. Tax Implications

Remember:

- You can typically take 25% of your pension as a tax-free lump sum

- The rest of your pension counts as income and is taxable

- The lifetime allowance was abolished in April 2024, but there’s still a limit on tax-free lump sums (£268,275)

3. Health and Lifestyle

Consider:

- Your current health status

- Your family medical history and likely longevity

- Whether you’re mentally ready to retire or might miss work

- How you’ll stay active and engaged during retirement

4. Career Satisfaction

Ask yourself:

- Am I genuinely ready to leave my NHS career?

- Would flexible retirement options be better than full retirement?

- Do I still get satisfaction from my work?

- Would I regret leaving completely at 55?

How to Apply for Early Retirement

If you’ve decided early retirement is right for you, here’s what to do:

- Contact NHS Pensions directly to request early retirement

- Complete the necessary application forms (available from your employer or NHS Pensions)

- Speak with your line manager about your retirement plans

- Get financial advice from a specialist who understands NHS pensions

Final Thoughts: Is Retiring at 55 Right for You?

So, can you retire at 55 with an NHS pension? Absolutely! But should you? That’s a more complex question.

The pension reductions are significant, especially for 2008 and 2015 scheme members. For many NHS staff, partial retirement or retire and re-join options might offer a better balance – giving you more free time while preserving your financial security.

We’ve seen many NHS professionals struggle with this decision. Some rush into early retirement only to find their reduced pension doesn’t stretch as far as expected. Others discover they miss the structure and purpose of work.

At the end of the day, this is a deeply personal decision that depends on your financial situation, health, and what you want from your post-NHS life. Getting expert financial advice is probably the wisest first step you can take.

Whatever you decide, those years of dedicated NHS service have earned you the right to a fulfilling retirement – whether that starts at 55, 60, or beyond!

Remember, pension rules and reduction factors can change, so always check the most current information from NHS Pensions before making your decision.

When can you retire from the NHS?

As a member of the NHS Pension Scheme, you’ll have both a Normal Pension Age and a Minimum Pension Age. The Normal Pension Age is the age at which you can take your full pension benefits with no reductions, while the Minimum Pension Age is the earliest at which you can start to draw benefits – but your pension will be reduced.

Both your Normal and Minimum Pension Ages depend on which section of the scheme you belong to:

| NHS Pension scheme section | Normal Pension Age | Minimum Pension Age |

|---|---|---|

| 1995 section | 60 (unless you have Special Class (SC) or Mental Health Office (MHO) status)* | 55 (but some members can leave at 50)** |

| 2008 section | 65 | 55 |

| 2015 scheme | 65 or state pension age, whichever is higher | 55 |

*If you have Special Class (SC) or Mental Health Office (MHO) status within the NHS Pension Scheme, you may be eligible for an early retirement age of 55.

**If you joined the 1995 section before 6th April 2006, you can usually take early retirement from the NHS at 50. If you joined the 1995 section on or after that date, your Minimum Pension Age will be 55.

Not sure which section you’re in? Find out more in our guide to the NHS Pension Scheme.

Is early retirement right for you?

After dedicating years of your life to looking after others, a long retirement will feel well earned. But if you’re considering early retirement from the NHS, the benefit reductions outlined above aren’t the only costs you should consider.

When you call time on your career early, you’re not just missing out on a few more years building your pension pot, but also giving yourself more years of retirement to fund. It’s therefore essential that you plan properly and assess exactly what income and expenditure your later years might bring.

Ideally, you’ll have other retirement income alongside your pension – perhaps from property, investment plans or savings. There’ll certainly be plenty to pay for, particularly if you’re planning to travel – but at the same time, some expenses (like your mortgage or your children’s education) may already have been paid for.

To get a clearer understanding of whether you can afford to retire early, speak to a Specialist Financial Adviser from Wesleyan Financial Services who can help you make the most of the benefits you’ve built up in the scheme. Please note advice charges may apply.

The NHS Pensions Podcast | Episode 5 | Partial Retirement

FAQ

Can I take early retirement from the NHS?

*If you have Special Class (SC) or Mental Health Office (MHO) status within the NHS Pension Scheme, you may be eligible for an early retirement age of 55. **If you joined the 1995 section before 6th April 2006, you can usually take early retirement from the NHS at 50.

When can I retire from NHS pension?

* If you joined the 1995 section before 6th April 2006, you can usually take early retirement from the NHS pension at age 50. If you joined the 1995 section on or after that date, your minimum pension age will be 55. Pay scale, are you at the top? This is more applicable to salaried doctors than GMP/GDP’s.

Can I retire and re-join the NHS pension scheme?

If you’re not ready to stop work altogether, you can retire and take your full pension, then return to work after a short break and re-join the NHS Pension Scheme to keep building your future pension benefits. This is called retire and re-join. It’s already available to members in the 2008 Section and 2015 Scheme.

How many NHS pension schemes are there?

Once upon a time, there was only one NHS pension scheme and this meant retiring early for most doctors and dentists, was prior to age 60. We now have three schemes (arguably four if you include NEST) all with different retirement ages.

Can a person retire at 50 if he joined NHS 1995?

Sign in or register to get started. So a person can retire at 50 (with actuarial reductions) if they joined NHS 1995 section before April 2006 (55 if joined after April 2006). My questions are:

What happens if I return to NHS work after retirement?

Important If you return to NHS work after retirement, you may be eligible to rejoin the 2015 Scheme and build up further pension benefits. From 1 April 2023 this includes members who have retired with 1995 Section benefits. If you are not eligible, your employer may have to automatically enroll you in another scheme.

How much do I lose if I take my pension at 55?

What’s the best age to retire with an NHS pension?

The normal pension age is same as the member’s state pension age or age 65, whichever is later. Members can retire earlier or later depending on the Section or Scheme they are in. The NHS Pension Scheme overview (PDF:185 KB) provides more detail about each Scheme.

Can you retire at 55 with a pension?

For most retirees, Social Security and (to a lesser degree) pensions are the two primary sources of regular income in retirement. You usually can collect these payments early—at age 62 for Social Security and sometimes as early as age 55 with a pension.

How many years do you need for a full NHS pension?

For members who elect to contribute to the scheme after they have attained 45 years pensionable membership, any benefits payable will be assessed taking into account the reckonable pay up to the date they cease contributing to the scheme/retire. Pension benefits will be calculated using the most beneficial 45 years.