“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most — how to save for retirement, understanding the types of accounts, how to choose investments and more — so you can feel confident when planning for your future. Bankrate logo

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

Are you planning for retirement? Got your savings all lined up but worried about how much Uncle Sam will take? Well, I’ve got some good news for ya! Depending on where you choose to settle down, you might be able to keep more of your hard-earned retirement money in your pocket.

As we approach 2025, several states continue to offer significant tax advantages for retirees. I’ve researched the latest information from reliable sources like AARP, Kiplinger, and Empower to bring you this comprehensive guide on states that don’t tax retirement income.

Why State Taxes Matter for Retirees

Before diving into which states are tax-friendly, let’s talk about why this matters. When planning for retirement, most folks focus on:

- How much they’re saving

- How their investments are performing

- Healthcare costs

But many overlook state taxation, which can significantly impact how long your retirement nest egg lasts. Different states tax retirement, pension, and Social Security income very differently.

Types of Retirement Income That May Be Taxed

States may tax various types of retirement income:

- Pension payments

- 401(k) withdrawals

- IRA distributions

- Social Security benefits

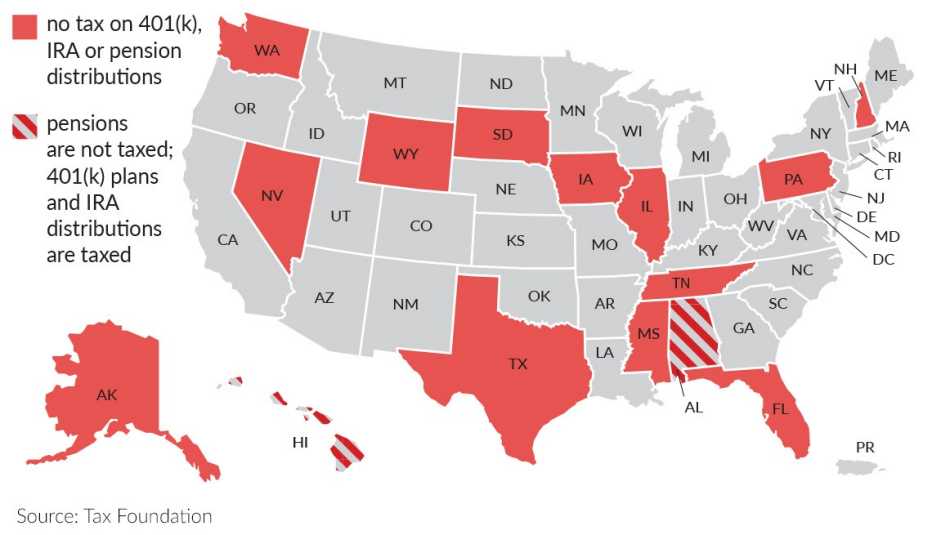

States That Don’t Tax Any Retirement Income

Let’s start with the states that are completely tax-free for retirees:

States with No Income Tax (8 States)

These states don’t have ANY individual income tax which means all your retirement income is automatically tax-free

- Alaska

- Florida

- Nevada

- New Hampshire (currently phasing out its tax on interest and dividends)

- South Dakota

- Tennessee

- Texas

- Washington

While these states don’t tax income, it’s important to note that some may have higher property taxes or sales taxes. For example, Washington has one of the highest sales tax rates in the country at about 9.43%.

States That Don’t Tax Pension Income (15 States Total)

According to Kiplinger these 15 states don’t tax pension income (includes the 8 no-income-tax states plus 7 additional states)

- Alabama – Exempts private sector defined benefit pensions, military retirement, and government pensions

- Alaska – No income tax

- Florida – No income tax

- Hawaii – Pension distributions are tax-free if you didn’t make contributions to the plan

- Illinois – Exempts income from qualified employee benefit plans

- Iowa – Exempts pension income for residents 55 and older

- Mississippi – No tax on pensions (except for early retirement)

- Nevada – No income tax

- New Hampshire – No income tax (phasing out interest and dividends tax by 2025)

- Pennsylvania – No tax on eligible employer-sponsored retirement plans

- South Dakota – No income tax

- Tennessee – No income tax

- Texas – No income tax

- Washington – No income tax

- Wyoming – No income tax

States That Don’t Tax IRA & 401(k) Distributions

AARP lists 13 states that don’t tax IRA and 401(k) distributions:

- Alaska

- Florida

- Illinois

- Iowa (for taxpayers 55 and older)

- Mississippi

- Nevada

- New Hampshire

- Pennsylvania (unless taken early)

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

States That Tax Social Security Benefits

While most states don’t tax Social Security benefits nine states still do as of 2025

- Colorado

- Connecticut

- Minnesota

- Montana

- New Mexico

- Rhode Island

- Utah

- Vermont

- West Virginia (will completely phase out this tax in 2026)

Some of these states offer tax breaks based on age or income level.

Comparing the Most Tax-Friendly States for Retirees

Let me break down the complete tax picture for some of the most retiree-friendly states:

Wyoming

- Income tax: None

- Sales tax: 4% state rate (average combined rate of 5.44%)

- Property tax: 0.55% effective rate (12th lowest in the country)

- Estate/inheritance tax: None

Wyoming tops our list as the most tax-friendly state overall!

Florida

- Income tax: None

- Sales tax: 6% state rate (average combined rate of 6.95%)

- Property tax: 0.79% effective rate (28th highest)

- Estate/inheritance tax: None

No wonder so many retirees flock to the Sunshine State!

Nevada

- Income tax: None

- Sales tax: 6.85% state rate (average combined rate of 8.24%)

- Property tax: 0.49% effective rate (3rd lowest in the country)

- Estate/inheritance tax: None

Despite the high sales tax, Nevada’s lack of income tax and low property taxes make it attractive.

Illinois

While Illinois doesn’t tax retirement income, there are some downsides:

- Income tax: 4.95% flat rate on non-retirement income

- Sales tax: 6.25% state rate (average combined rate of 8.89%)

- Property tax: 2.07% effective rate (2nd highest in the nation)

- Estate tax: Yes, on estates over $4 million

So even though your retirement accounts are safe from tax, Illinois might not be the most economical choice overall.

Other Factors to Consider

Taxes shouldn’t be the only factor in your retirement location decision. Consider:

- Cost of living – A tax-free state might have higher costs in other areas

- Healthcare access – Quality and proximity to medical facilities

- Climate – Do you want warm weather year-round or four seasons?

- Proximity to family – Being close to loved ones often outweighs tax benefits

- Community – Access to activities, amenities, and like-minded individuals

Tax Breaks for Retirees Even in Taxing States

Even if you live in a state that taxes retirement income, many offer special breaks for seniors:

- Property tax exemptions – Many states offer homestead exemptions for seniors

- Extra personal exemptions – Some states give taxpayers 65+ an additional exemption

- Income thresholds – Some states only tax retirement income above certain amounts

- Tax credits – Special credits available just for senior taxpayers

Planning Tips for Tax-Efficient Retirement

- Diversify retirement accounts – Having both traditional and Roth accounts gives you flexibility

- Consider relocation timing – If moving to a tax-free state, time your distributions accordingly

- Consult a tax professional – State tax laws are complex and change frequently

- Reassess annually – Tax situations change as you age and laws evolve

Popular Retirement Income Tax Questions

Are military pensions taxed differently?

Many states that tax other retirement income still exempt military pensions. For example, Alabama exempts military retirement pay from state taxes.

If I move mid-year, how is my retirement income taxed?

You may need to file part-year resident returns in both states. Your income will typically be allocated based on residency days in each state.

Can I avoid state taxes by having my retirement checks mailed to a tax-free state?

No! You pay taxes based on your legal residence, not where your checks are sent.

Do tax-free states make up for lost revenue in other ways?

Absolutely! States with no income tax often have higher sales taxes, property taxes, or other fees to make up for the missing revenue.

What’s Changing in 2025 and 2026?

Keep an eye on these upcoming changes:

- Iowa is reducing its tax rates and moving to a flat 3.9% rate by 2026

- Mississippi is lowering its tax rate to 4% by 2026

- New Hampshire will completely repeal its tax on interest and dividends by 2025

- West Virginia will finish phasing out Social Security benefit taxation in 2026

Bottom Line: Do Your Research Before Moving!

While many states offer attractive tax benefits for retirees, the overall financial picture includes property taxes, sales taxes, and cost of living. What works best depends on your specific retirement income sources and lifestyle.

I always recommend consulting with a financial advisor or tax professional before making any big moves based on tax considerations. Tax laws change regularly, and what’s true today might not be true tomorrow.

Have you considered relocating for tax reasons in retirement? I’d love to hear about your experiences in the comments below!

And remember, while taxes are important, they’re just one part of a happy retirement. Finding a community you love and maintaining quality of life should be at the top of your priority list!

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

- Just because you’ve retired doesn’t mean your income is tax-free.

- How a state taxes various forms of retirement income can have a big impact on your spending plans.

- States can have major differences in how they tax capital gains, Social Security and retirement plan distributions.

When their working days eventually come to an end, many retirees will think about the best place to spend their golden years. Not all states treat retirement income — such as pension payouts or distributions from 401(k) plans and IRAs — the same way, which makes state and local taxes a key consideration for anyone expecting to be on a fixed income during this time.

Here’s what you need to know about how different states tax retirement income, including the states where you won’t pay taxes at all.

States with an income tax that don’t tax retirement income

In addition to the nine states above that don’t have an income tax at all, four states do not tax retirement income: Illinois, Iowa, Mississippi and Pennsylvania.

Illinois charges a flat state income tax of 4.95 percent, but all retirement income is exempt from paying the tax. This includes pension payments, as well as distributions from retirement plans such as 401(k)s and IRAs. Social Security payments are also exempt.

As of 2023, Iowa residents over the age of 55 are no longer taxed on their retirement income thanks to a 2022 law. Iowa now has a flat rate of 3.8 percent on taxable income after a new law was passed in May 2024.

Mississippi state income tax rates are 0 percent on the first $10,000 of taxable income and 4.4 percent on income above that level for the 2025 tax year, but retirement income is not taxed as long as you’ve met the plan requirements. This means that early distributions from retirement plans may not qualify as retirement income and could be subject to tax and a penalty. The tax rate is set to be reduced gradually to 3 percent by 2030, with further decreases until the tax is eliminated entirely. The rate will fall to 4 percent in 2026.

Pennsylvania charges personal income tax at a flat rate of 3.07 percent. Retirement income is not taxed in Pennsylvania as long as plan requirements are met. Withdrawals from retirement plans such as IRAs prior to reaching the necessary age (59 1/2) may result in taxes.

Which States Do Not Tax Retirement Income

FAQ

Which states don’t tax retirement income?

Which States Won’t Tax Your Retirement Income? Thirteen states currently don’t tax retirement income: Alaska, Florida, Illinois, Iowa, Mississippi, Nevada, New Hampshire, Pennsylvania, South Dakota, Tennessee, Texas, Washington and Wyoming.

Which states do not tax 401(k) distributions?

States that do not tax 401 (k) distributions are generally the same states that don’t tax income. Those states include Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming. New Hampshire and Washington don’t tax 401 (k) distributions either. Which states do not tax pensions?

Is retirement income tax-free?

Some states have no income tax at all, so all retirement income is tax-free at the state level. Most states specifically exclude Social Security benefits from taxation. Some others also exempt retirement account distributions and pensions, but most have a mix of approaches to taxing retirement income.

Do states tax retirees?

As of the 2025 tax year, nine states don’t tax retirees’ income of any type — but not necessarily as a favor to their older residents. These states simply don’t charge any income tax on any resident. Instead, these states collect enough revenue from other sources (like sales tax, or business taxes) to fund their state’s governmental operations.

Which states do not tax pensions?

States that do not tax pensions include the nine states that have no income tax — Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Additionally, six states — Alabama, Hawaii, Illinois, Iowa, Mississippi, and Pennsylvania — exclude pension income from state taxation.

Which states do not tax income?

Eight of them – Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming – don’t tax wages, salaries, dividends, interest or any sort of income. New Hampshire, the ninth state, has no state income tax on wages, salaries, retirement account withdrawals or pension payments.

What states don’t tax your Social Security for retirees?

There are currently seven states in which individual income is not subject to tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. In two other states — New Hampshire and Tennessee — only dividends and interest are subject to state taxes.

What is the most tax-friendly state for retirees?

- Mississippi. Of all the states that won’t take a cut of traditional retirement income, Mississippi has the lowest property taxes, with a median tax bill of $1,189.

- Tennessee. …

- Wyoming. …

- Nevada. …

- Florida. …

- South Dakota. …

- Iowa. …

- Pennsylvania. …

Where is the best place to retire without income tax?

Alaska does not tax personal income, capital gains, or inheritance and estates. It also does not have a statewide sales tax, though municipalities have an average tax of 1.821%. Therefore, it’s worthwhile for retirees considering Alaska to research different parts of the state to find the best tax environment for them.

Where is the best place to retire to avoid taxes?

- Panama – Complete foreign income exemption + extensive discounts.

- Belize – Zero tax on all foreign income (QRP program)

- Malaysia – No tax on foreign passive income (MM2H program)

- Costa Rica – Territorial taxation + excellent healthcare.

- Greece – 7% flat tax on all foreign income for 15 years.