Are you wondering if your income is too high for a Roth retirement account to be beneficial? You’re not alone. The conventional wisdom in financial planning suggests minimizing current tax liability whenever possible, but this approach isn’t always best for everyone – especially high earners.

I’ve spent countless hours researching this topic, and I’m gonna share everything you need to know about when Roth accounts stop making financial sense based on your income level.

Understanding the Roth vs. Traditional Decision

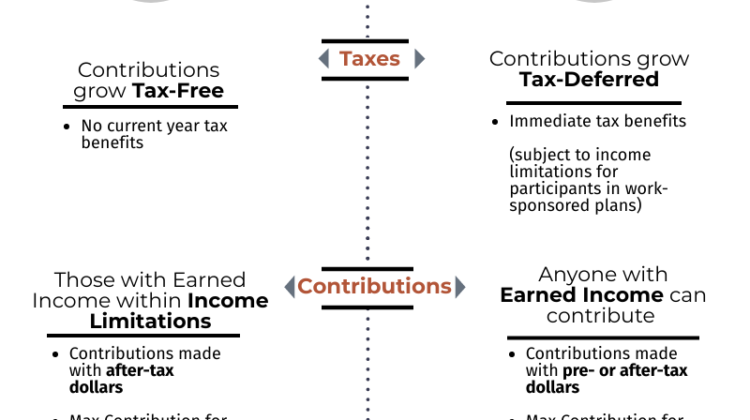

Before diving into specific income thresholds, let’s clarify the fundamental difference between Roth and traditional retirement accounts:

Roth Accounts:

- Contributions made with after-tax dollars

- No immediate tax deduction

- Tax-free withdrawals in retirement (if certain conditions are met)

- No Required Minimum Distributions (RMDs) for Roth IRAs

Traditional Accounts

- Contributions reduce your current taxable income

- Immediate tax benefit in the contribution year

- Withdrawals taxed as ordinary income in retirement

- Required Minimum Distributions starting at age 73

The basic question becomes Do you want tax benefits now (traditional) or later (Roth)?

Income Limits for Direct Roth IRA Contributions

For 2025, you can’t directly contribute to a Roth IRA if your Modified Adjusted Gross Income (MAGI) exceeds:

| Filing Status | Phase-Out Range | Full Ineligibility |

|---|---|---|

| Single/Head of Household | $150,000-$165,000 | Above $165,000 |

| Married Filing Jointly | $236,000-$246,000 | Above $246,000 |

| Married Filing Separately | $0-$10,000 | Above $10,000 |

But just because you can’t directly contribute doesn’t automatically mean Roth strategies aren’t beneficial!

When Roth Accounts May Not Make Sense for High Earners

1. You’re Currently in a High Tax Bracket with Lower Expected Retirement Income

The most obvious situation where Roth doesn’t make sense is when your current tax rate is significantly higher than your expected retirement tax rate.

For instance, if you’re earning $500,000+ annually and are in the top federal tax bracket (37%), but expect substantially lower retirement income, paying those high taxes now through Roth contributions might be suboptimal compared to traditional contributions.

2. You Need the Immediate Tax Deduction

If you’re a high earner struggling with cash flow or trying to reduce current tax liability for specific reasons (like qualifying for certain tax credits or deductions), the immediate tax savings from traditional contributions might be more valuable than Roth’s future tax-free withdrawals.

3. You Don’t Have Long Until Retirement

The Roth advantage grows with time. If you’re close to retirement (within 5-10 years), the tax-free growth benefit diminishes significantly. In this case, traditional contributions might make more sense since you’ll likely be in a lower tax bracket during retirement anyway.

Roth Strategies That Still Work for High-Income Earners

Despite income limitations on direct Roth IRA contributions, several strategies remain available to high earners:

1. Roth 401(k) Contributions

Unlike Roth IRAs, Roth 401(k)s have no income limits. For 2025, employees can contribute:

- $23,500 for those under 50

- $31,000 for those 50-59

- $34,750 for those 60-63

This is a significant advantage for high-income earners who still want Roth benefits.

2. Backdoor Roth IRA

The backdoor Roth strategy involves:

- Making after-tax contributions to a traditional IRA (up to $7,000 in 2025, or $8,000 for those 50+)

- Converting those funds to a Roth IRA

This works regardless of income level, though it’s most beneficial if you don’t have other pre-tax IRA assets (due to the pro-rata rule).

3. Mega Backdoor Roth

If your employer’s 401(k) plan allows after-tax contributions beyond the standard deferral limits, you can potentially contribute up to:

- $70,000 total for those under 50

- $77,500 total for those 50+

- $81,250 total for those 60-63

Then roll over those after-tax contributions to a Roth IRA. This strategy can be extremely powerful for high-income earners.

Factors Beyond Income That Influence the Roth Decision

Future Tax Rate Expectations

This is probably the most important factor. If you expect tax rates to rise significantly in the future (either due to personal circumstances or government policy changes), Roth accounts become more attractive even for current high-income earners.

The federal tax rates are currently at historical lows, and many tax provisions are set to sunset in 2026, potentially leading to higher rates.

Estate Planning Considerations

Roth IRAs can be incredibly valuable estate planning tools since:

- They don’t have RMDs

- Beneficiaries can inherit them tax-free

This makes them particularly attractive for wealthy individuals who don’t need the money in retirement and want to pass assets to heirs.

Diversification of Tax Treatment

Having retirement savings across both pre-tax and Roth accounts creates “tax diversification,” giving you flexibility in managing your tax situation in retirement. This strategy makes sense at almost any income level.

Real-World Example: When a High Earner Should Consider Roth

Let’s look at a scenario:

Maria earns $300,000 annually, putting her well above the Roth IRA income limits. She’s 45 years old and expects to maintain a high income throughout retirement due to multiple income streams (business interests, rental properties, etc.).

For Maria, making Roth 401(k) contributions makes excellent sense because:

- She’ll likely be in the same or higher tax bracket in retirement

- She values the flexibility of no RMDs

- She wants to leave tax-free assets to her children

Deciding Between Roth and Traditional: Key Questions

To determine if Roth makes sense for your situation, ask yourself:

- Will my tax rate in retirement be higher or lower than it is now?

- Do I need the current tax deduction from traditional contributions?

- Am I comfortable paying taxes now for tax-free growth later?

- Will tax rates in general rise in the future?

- Is estate planning an important consideration for me?

The Bottom Line

There’s no single income threshold where Roth accounts stop making sense. The decision depends on your current tax bracket, expected future tax rate, time horizon, and financial goals.

For many high-income earners, Roth strategies (particularly Roth 401(k), backdoor Roth IRA, and mega backdoor Roth conversions) can still be incredibly valuable tools – despite conventional wisdom about deferring taxes.

The most important thing is to consider your unique financial situation rather than making decisions based solely on your income level. Sometimes paying more taxes now through Roth contributions is the smarter long-term strategy, even for those in the highest tax brackets.

I always recommend consulting with a qualified financial planner who can analyze your specific circumstances and help you make the optimal choice between Roth and traditional retirement savings.

Roth IRA strategies for high-income households

Roth IRAs offer many benefits, such as the potential for tax-free growth and tax-free withdrawals that are not subject to required minimum distributions (RMDs). Here are a few ways high-income earners can leverage this tax-advantaged account:

What it is: A Roth 401(k) is a retirement savings account that may be offered as part of an employer-sponsored 401(k) plan. It allows you to make after-tax contributions that have tax-free growth and tax-free withdrawals that are not subject to RMD requirements.

How it works: A Roth 401(k) is similar to a Roth IRA, but the key differentiator is that it’s tied to your employer and its contributions limits. While there are no income limits to be able to contribute, you are subject to IRS limitation on the amount you can contribute. The maximum you can contribute to a Roth 401(k) is $23,500 in 2025 ($31,000 for investors age 50 and older and $34,750 for investors 60-63), but that ceiling includes pre-tax contributions to a 401(k) as well.

Mega backdoor Roth IRA

What it is: A mega backdoor Roth IRA — also known as a 401(k) after-tax Roth IRA conversion — is a strategy in which you convert after-tax contributions from your 401(k) plan to a Roth IRA. If you are max funding your 401(k) deferral limit and want to put away more money, this strategy may make sense for you. Not all 401(k) plans offer this capability, but if yours does, it presents a unique opportunity. The 401(k) limit on total employer and employee contributions far exceeds the traditional IRA limit of $7,000 or $8,000 for those 50+ years old.

How it works: After you reach the 401(k) elective deferral maximum of $23,500 for 2025 ($31,000 for age 50 and older and $34,750 for ages 60-63) and your employer adds matching funds, you may be able to add post-tax funds for a total of up to $70,000 ($77,500 for age 50 and older and $81,250 for ages 60-63). You then roll over post-tax funds to a Roth IRA. If the related pre-tax amounts are rolled to a traditional IRA, there are no tax consequences on the Roth IRA rollover.

Roth Conversions Have Changed: The Math You Were Using Is Now Wrong

FAQ

Is a Roth 401(k) a good investment?

Even in the high tax bracket, a Roth account might still make sense for you if you’re within the limits and you’re allowed to contribute. If a Roth 401 (k) is offered by your company, there is no income limit. Can it be that simple?

How do I handle a Roth conversion discussion?

The best way to handle a Roth conversion discussion is to break it into two parts: the conversion phase and the retirement phase. Let’s start with income taxes on the conversion. If your income is low enough you can convert up to the point where the undesired tax bracket begins. The 0% tax bracket is a no-brainer.

How much money can a high earner put in a Roth?

Mega Amounts into Roth: By doing this, a high earner can potentially put tens of thousands of extra dollars into Roth each year. For example, if you maxed your normal $22,500 and got employer contributions, you might still have, say, $30,000 of space left under the limit.

Are Roth IRA earnings tax-free?

Tax-free distributions of Roth earnings. In order for the earnings from the Roth IRA to be distributed tax-free — not the principal amount originally converted — five years must have passed since your first Roth IRA account is established.

Should you invest in a Roth IRA or a traditional account?

If you’re planning to have more money and more income in retirement than you do today based on your financial plan, the traditional account is just going to compound your taxes later. Even in the high tax bracket, a Roth account might still make sense for you if you’re within the limits and you’re allowed to contribute.

How much can you contribute to a Roth IRA in 2025?

For 2025, you’re allowed to contribute up to the annual limit to a Roth IRA as a single tax filer or head of household if your modified adjusted gross income (MAGI) is less than $150,000. The amount you can contribute declines depending on how high your MAGI is between $150,000 and $165,000.

When would a Roth IRA not make sense?

Key Takeaways. People close to retirement and savers who expect to be in a higher tax bracket after they retire tend to benefit more from a traditional IRA. Roth IRAs may not be best for Investors who want tax-deductible donations in the year they contribute rather than tax-free withdrawals years later.

What income level is too high for a Roth IRA?

The Roth IRA income limit to make a full contribution in 2025 is less than $150,000 for single filers, and less than $236,000 for those filing jointly. If you’re a single filer, you’re eligible to contribute a portion of the full amount if your MAGI is $150,000 or more, but less than $165,000.

Why is Roth IRA not good for high incomes?

Roth IRAs are powerful retirement savings accounts that allow tax-free growth and tax-free withdrawals in retirement, provided certain conditions are met. However, if you earn above a certain dollar amount, you aren’t eligible to directly contribute to one.

At what age does a Roth no longer make sense?

If your age is between 40 and 50, it is not obvious whether conversion makes sense. If your age is greater than 50, it likely doesn’t make sense to convert because there is not enough time to allow the Roth IRA growth to exceed the tax cost today.