How IRAs are taxed depends on whether the IRA is a traditional or a Roth IRA. Traditional IRAs involve making tax-free contributions, meaning you contribute to your IRA before taxes are taken out. This may reduce your taxable income for the year in which you’ve contributed to your IRA, therefore reducing the amount of tax you pay that year. When you start withdrawing from your account at retirement age, you will pay taxes on the funds you take out. With a Roth IRA, you contribute to your IRA after you’ve paid taxes for the year; and when you make withdrawals at retirement age, you don’t pay any taxes on the funds you take out.

Have you ever wondered when exactly you need to pay taxes on your Roth IRA? It’s a common question that confuses many people planning their retirement. I’m gonna break it down for you in simple terms today so you can make the best decision for your financial future.

The short answer With a Roth IRA, you pay taxes NOW (on contributions) rather than LATER (on withdrawals)

But there’s a lot more to understand about how Roth IRA taxes work, and knowing these details could save you thousands of dollars down the road. Let’s dive deeper into this topic!

The Fundamental Tax Trade-Off of Roth IRAs

The defining characteristic of a Roth IRA is its unique tax treatment. Here’s the basic deal:

- Now (Contributions): You contribute with after-tax dollars (money you’ve already paid income tax on)

- Later (Withdrawals): Your qualified withdrawals in retirement are completely tax-free

This is the exact opposite of traditional IRAs, which give you a tax break now (through tax-deductible contributions) but require you to pay taxes later (when you withdraw the money in retirement).

As Andrea Coombes from NerdWallet puts it, “When it comes to the Roth IRA, it’s all about delayed gratification.” You’re essentially choosing to pay your taxes upfront in exchange for tax-free growth and withdrawals later.

How Roth IRA Contributions Are Taxed

When you put money into a Roth IRA, you’re using funds that have already been taxed. Typically, this comes from your bank account, which holds earnings from your paycheck after taxes have been withheld.

Some key points about Roth IRA contribution taxes:

- You don’t get a tax deduction for Roth IRA contributions

- You don’t report Roth IRA contributions on your tax return

- You can’t deduct them from your taxable income

For 2025, you can contribute up to:

- $7,000 if you’re under age 50

- $8,000 if you’re 50 or older

However, your ability to contribute might be limited by your income. For 2025, the contribution limits start phasing out if your modified adjusted gross income (MAGI) is:

- Between $150,000 and $165,000 for single filers

- Between $236,000 and $246,000 for joint filers

If your income exceeds these upper thresholds, you cannot directly contribute to a Roth IRA (though there are workarounds like a “backdoor Roth IRA”).

How Roth IRA Earnings Are Taxed

Here’s where the magic happens! While your contributions don’t give you an immediate tax benefit, what happens inside your Roth IRA is pretty amazing:

- All investment earnings grow completely tax-free

- Dividends? Tax-free

- Interest? Tax-free

- Capital gains? Tax-free

This tax-free growth allows your money to compound more efficiently over time, potentially resulting in a larger retirement nest egg compared to taxable accounts.

Roth IRA Taxes on Withdrawals

The real benefit of a Roth IRA becomes clear when you start taking money out in retirement. For qualified withdrawals, you pay:

- No federal income taxes on your contributions

- No federal income taxes on your earnings

This is a huge advantage! Think about it – all that investment growth over decades can be withdrawn without paying a single penny in taxes.

However, there are specific rules that determine whether your withdrawal is qualified or not.

Rules for Tax-Free Qualified Withdrawals

For your withdrawal to be completely tax-free, you must meet two conditions:

- The 5-year rule: You must have opened and funded a Roth IRA at least 5 tax years ago

- Age requirement: You must be at least 59½ years old

There are a few exceptions to the age requirement. You can also take tax-free withdrawals if:

- You become totally and permanently disabled

- The distribution goes to your beneficiary after your death

- You’re using up to $10,000 for a first-time home purchase (lifetime limit)

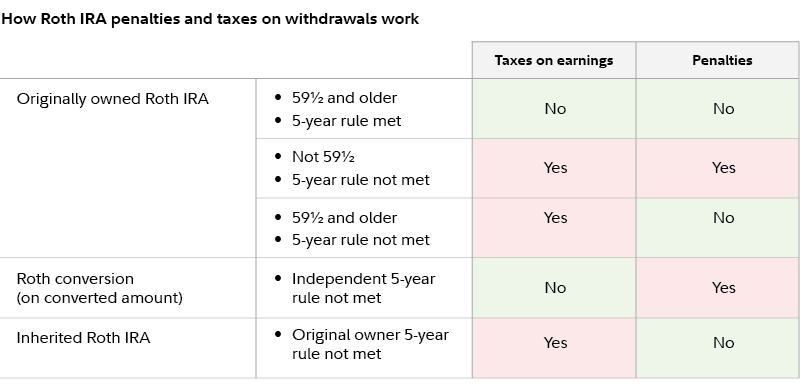

Tax Treatment of Non-Qualified Withdrawals

What happens if you need to take money out before meeting those requirements? The IRS has specific ordering rules that determine how your withdrawal is taxed:

- First out: Contributions – You can withdraw your direct contributions at any time, for any reason, completely tax and penalty-free

- Next out: Earnings – Once you’ve withdrawn all contributions, you start taking out earnings

If you withdraw earnings as part of a non-qualified distribution:

- The earnings are taxed as ordinary income

- If you’re under 59½, you’ll typically also face a 10% early withdrawal penalty

Let’s look at an example:

If you’ve contributed $20,000 to a Roth IRA and it has grown to $25,000, you could withdraw the first $20,000 anytime without taxes or penalties. But if you withdrew the remaining $5,000 of earnings before meeting the qualified withdrawal rules, that amount would be taxable and likely subject to the 10% penalty.

Roth IRA vs. Traditional IRA: Tax Comparison

To fully understand the Roth IRA tax situation, it helps to compare it with a traditional IRA:

| Feature | Roth IRA | Traditional IRA |

|---|---|---|

| When you pay taxes | Now (on contributions) | Later (on withdrawals) |

| Contributions | After-tax (no deduction) | Pre-tax (tax-deductible)* |

| Growth | Tax-free | Tax-deferred |

| Qualified withdrawals | Tax-free | Taxed as ordinary income |

| Early withdrawals | Contributions always tax-free; earnings may be taxable with penalty | Usually taxable with penalty |

| RMDs | None for original account owner | Required at age 73 |

*Traditional IRA deductions may be limited if you or your spouse has a workplace retirement plan and your income exceeds certain levels.

When a Roth IRA Makes More Tax Sense

A Roth IRA might be the better choice tax-wise if:

- You expect to be in a higher tax bracket in retirement than you are now

- You want tax-free growth and withdrawals in retirement

- You want flexibility to withdraw contributions without penalties if needed

- You want to avoid required minimum distributions (RMDs)

- You want to leave tax-free money to your heirs

When a Traditional IRA Makes More Tax Sense

On the other hand, a traditional IRA might be more tax-efficient if:

- You’re pretty sure your tax bracket will be lower in retirement than it is now

- Your income is too high for Roth IRA contributions, but you qualify for a traditional IRA deduction

- You want to reduce your current taxable income (through the deduction)

Do You Pay Taxes on Roth 401(k) Contributions?

Similar to Roth IRAs, Roth 401(k) contributions are made with money that has already been taxed. You don’t get an upfront tax deduction, but qualified withdrawals in retirement will be tax-free.

The main differences from a Roth IRA are:

- Higher contribution limits ($23,000 in 2025, or $30,500 if you’re 50 or older)

- No income limits for participation

- Required minimum distributions (though these can be avoided by rolling over to a Roth IRA)

Could Roth IRAs Be Taxed in the Future?

Some people worry that the government might change the rules and start taxing Roth IRA withdrawals in the future. While nobody can predict what Congress might do, it seems unlikely they would completely eliminate the tax-free withdrawal feature of Roth IRAs, as this would effectively end the program and discourage retirement savings.

The Roth IRA program continues to grow rapidly, making increasingly larger contributions to the nation’s economy. The government generally has an interest in encouraging long-term retirement savings.

Key Takeaways About Roth IRA Taxes

To summarize what we’ve learned about when you pay taxes on a Roth IRA:

- You pay taxes NOW: Contributions are made with after-tax dollars, providing no immediate tax deduction

- Your money grows TAX-FREE: All earnings accumulate without any taxation while in the account

- You withdraw TAX-FREE LATER: Both contributions and earnings can be withdrawn tax-free in retirement if you follow the rules

- Contributions can be withdrawn anytime: Your direct contributions can be taken out tax-free and penalty-free regardless of age or how long you’ve had the account

Final Thoughts

I believe Roth IRAs offer one of the best tax deals available for retirement savings. Yes, you pay taxes now on the money you put in, but the potential for decades of tax-free growth and completely tax-free withdrawals in retirement can be incredibly valuable.

When deciding between a Roth IRA and traditional IRA, think about your current tax situation and what you expect in retirement. If you think your tax rate will be higher in retirement, a Roth IRA probably makes more sense. If you think it’ll be lower, a traditional IRA might be better.

Remember, it’s not an all-or-nothing decision! Many people benefit from having both types of accounts, giving them tax diversification in retirement.

Have you decided whether to pay your retirement taxes now or later? I’d love to hear your thoughts on this important financial decision!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor or tax professional before making investment decisions.

Which Is Better: Roth or Traditional?

It depends on your financial needs and circumstances. Of course, no one can predict what will happen in the future, but if you expect to be in a lower tax bracket when you reach retirement age, financial professionals generally recommend a traditional IRA option. This allows you to lower your income taxes as you contribute to your IRA, then withdraw money at retirement at a presumably lower tax rate.

If, however, you expect to be in a higher income tax bracket in your retirement years, a Roth IRA may be to your advantage. This allows you to take care of the taxes now and enjoy tax-free withdrawals later in life, without having to pay more taxes because you’re in a higher tax bracket.

What is the Roth IRA Five-Year Rule?

To withdraw from a Roth IRA without penalty, you must be age 59½ and have held the account for a minimum of five years. This is often called the “Five-Year Rule.” The clock for five years starts on January 1 of the year in which you made your first contribution. If you withdraw from the account before the five-year mark, you will pay a 10% penalty and income taxes on earnings withdrawals.

Pay Taxes Now, or Later?

FAQ

Do you pay taxes on a Roth IRA?

Since you pay taxes upfront on the money you put into a Roth IRA, all the returns your investment earns over the years are tax free. Once you reach age 59 ½, and have had the account open for at least five years, you can withdraw any amount without incurring a tax liability. So when am I taxed on the Roth IRA? Can anyone contribute to a Roth IRA?

Are Roth IRA contributions taxable?

That means you don’t report Roth IRA contributions on your tax return, and you can’t deduct them from your taxable income. Instead, you pay taxes on the money before you put it into the account, and your investment grows tax-free. You can then withdraw those contributions at any time tax-free.

Do you get a tax break if you put money into a Roth IRA?

So you don’t get a tax break on that money in the year that you made it. In the example above, you would have paid taxes on that $5,000 you contributed each year for 30 years before you put it into the Roth IRA.

Do Roth withdrawals add to income?

What we know for certain are the current rates. So, if an investor chooses a Roth, they pay taxes now at a known current tax rate and don’t have to worry about future tax rates as future qualified withdrawals are not subject to taxes. Compounding the consideration, Roth withdrawals do not add to income.

Are Roth IRA withdrawals tax-free?

Roth accounts are funded with after-tax dollars, and withdrawals are tax-free if they meet the definition of a qualified distribution. These characteristics are the opposite of traditional IRAs and 401 (k) plans, where tax deductions are taken in the year of contribution and taxes are paid on withdrawals.

Should young investors pay tax on Roth contributions?

In addition, younger investors, who are early in their careers, are not making as much as they will be in 20 years. Paying taxes on Roth contributions now, while they are in a lower tax bracket, can result in a huge boon for them later as they receive qualified tax-free withdrawals when they are making more money.

Do you pay taxes on Roth IRA contributions now or later?

Contributions to a Roth account are made on a “post-tax” basis. You pay taxes up-front and contributions cannot be deducted from your yearly income, but when you reach retirement age both the earnings and contributions can be withdrawn tax-free.

Is Roth taxed before or after?

Roth IRA contributions are made with after-tax dollars. Traditional, pre-tax employee elective contributions are made with before-tax dollars. No income limitation to participate.

How to avoid paying taxes on a Roth IRA?

Contribute to a Roth IRA

Once you meet certain conditions—typically reaching age 59 ½ and holding the account for at least five years—you can withdraw both contributions and earnings without owing further taxes. This contrasts with traditional IRAs, where distributions are taxed as ordinary income.

What time of year is best to do a Roth conversion?

The optimal time to convert the Traditional IRA to a ROTH IRA is in the same year that the contributions were designated for. As an example, to make the conversion for tax year 2023, during 2023.