A Simplified Employee Pension IRA (SEP IRA) is a traditional IRA for self-employed people and small-business owners.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

A SEP IRA, or Simplified Employee Pension, is a type of retirement account available to small-business owners with few or no employees, self-employed individuals, and those earning a freelance income. It has low start-up and operating costs, as well as no mandatory filing or contribution requirement annually, which makes it a cost-effective and flexible retirement option for small-business owners.

Are you scratching your head trying to figure out whether a SEP IRA or Roth IRA is better for your retirement plans? You’re not alone! As someone who’s spent countless hours researching retirement options for both myself and our blog readers, I can tell you that this decision ain’t always straightforward. The right choice depends on your specific situation – especially if you’re self-employed or run a small business.

Let’s dive into the nitty-gritty of both retirement accounts so you can make a choice that’ll actually work for your future.

What’s a SEP IRA Anyway?

SEP stands for Simplified Employee Pension, and it’s an Individual Retirement Account designed especially for business owners and self-employed folks. Think of it as the entrepreneur’s retirement buddy.

Here’s the deal with SEP IRAs:

- Employer contributions only: Only the employer (which might be you if you’re self-employed) can contribute to a SEP IRA

- Higher contribution limits: You can contribute up to 25% of compensation or $70,000 in 2025 (up from $69,000 in 2024), whichever is less

- Tax-deferred growth: You don’t pay taxes on your investments while they grow in the account

- Tax-deductible contributions: Contributions reduce your taxable income right now

- Required minimum distributions (RMDs): You must start taking money out at age 73 (or age 75 if born in 1960 or later)

If you’ve got employees there’s a big catch – you have to contribute the same percentage of compensation to all eligible employees’ accounts as you do to your own. So if you put in 20% for yourself you gotta do 20% for everybody else too!

And What About Roth IRAs?

A Roth IRA is a totally different animal It’s an individual retirement account that anyone with earned income can open (assuming they don’t make too much money)

Here’s the skinny on Roth IRAs:

- After-tax contributions: You pay taxes on money now before it goes into the account

- Tax-free growth and withdrawals: Your investments grow tax-free AND you don’t pay taxes when you take the money out in retirement

- Lower contribution limits: Only $7,000 in 2024 and 2025 (or $8,000 if you’re 50 or older)

- Income restrictions: You can’t contribute if your income exceeds certain limits

- No RMDs: You’re never forced to take money out during your lifetime

- Flexible withdrawals: You can take out your contributions (not earnings) anytime without penalties

For 2025, you can’t contribute to a Roth IRA if you make more than $165,000 as a single filer or $246,000 if married filing jointly. There’s a phase-out range where you can make partial contributions if you earn just under these thresholds

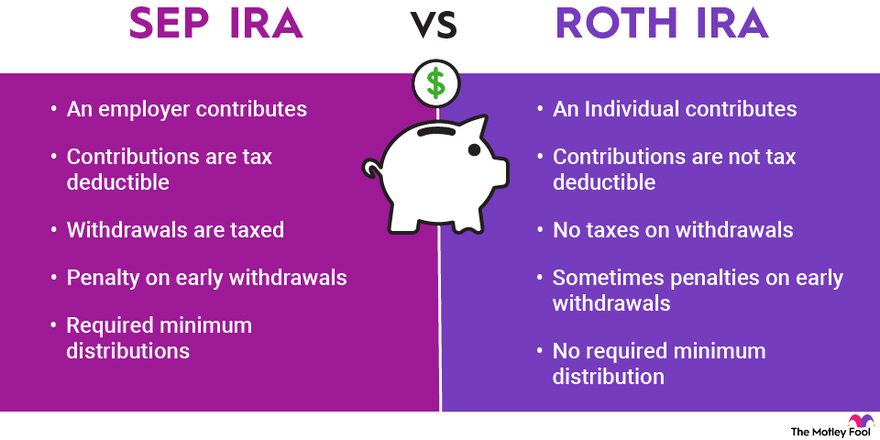

The Big Showdown: SEP IRA vs. Roth IRA

Let’s compare these retirement accounts head-to-head:

| Feature | SEP IRA | Roth IRA |

|---|---|---|

| Who contributes | Employer only | Individual |

| 2025 Contribution limit | $70,000 or 25% of comp (whichever is less) | $7,000 ($8,000 if 50+) |

| Tax deduction | Yes | No |

| Taxation on withdrawals | Yes (as ordinary income) | No (tax-free) |

| Early withdrawal penalty | Yes, before age 59½ | Only on earnings, not contributions |

| Required Minimum Distributions | Yes | No |

| Income restrictions | No | Yes |

So Which One’s Better? It Depends!

The honest truth is that whether a SEP IRA or Roth IRA is better depends on your unique situation. Here’s how to figure out which might be right for you:

A SEP IRA Might Be Better If:

-

You’re a high-income business owner or self-employed person who wants to save a LOT for retirement. The high contribution limits of a SEP IRA blow the Roth IRA’s limits out of the water.

-

You want tax savings now rather than later. SEP contributions are tax-deductible, reducing your current tax bill.

-

You have a higher income now than you expect to have in retirement. If you’ll be in a lower tax bracket when you retire, paying taxes later (with a SEP) could make more sense.

-

You don’t have employees or you’re willing to contribute the same percentage for all eligible employees.

A Roth IRA Might Be Better If:

-

You expect to be in a higher tax bracket in retirement than you are now. Pay taxes at your lower rate today, enjoy tax-free withdrawals later.

-

You want flexibility in withdrawals before retirement. The ability to take out contributions anytime without penalty is a huge plus.

-

You want to avoid RMDs and let your money grow tax-free for as long as possible.

-

You want to leave tax-free money to your heirs. A Roth IRA can be an excellent estate planning tool.

-

You’re just starting out or have moderate income levels that make the Roth contribution limits sufficient for now.

Can You Have Both? Absolutely!

Here’s a little secret many folks don’t realize – you can actually have BOTH a SEP IRA and a Roth IRA! This strategy gives you the best of both worlds:

- Tax deductions today through your SEP IRA

- Tax-free growth and withdrawals tomorrow through your Roth IRA

- Diversified tax treatment in retirement

- Higher total contribution potential

Just remember that having a SEP IRA can affect the deductibility of traditional IRA contributions (though not Roth IRA eligibility directly).

Real-World Examples

Let me share a couple examples to make this more concrete:

Example 1: Sarah the Freelance Designer

Sarah makes about $100,000 per year as a self-employed graphic designer. She wants to maximize her retirement savings and reduce her current tax bill. A SEP IRA allows her to contribute up to $20,000 (20% of her net self-employment income), giving her a significant tax deduction now while building her retirement nest egg.

Example 2: Miguel the Marketing Manager

Miguel earns $75,000 at his marketing job where he has a 401(k). He’s also doing side gigs that bring in an extra $15,000. He’s already maxing his workplace 401(k), but wants to save more. A Roth IRA is perfect for him – he can contribute $7,000 from his side hustle income and enjoy tax-free growth and withdrawals later.

A Few Gotchas to Watch Out For

Every retirement account has its quirks, and these two are no exception:

-

SEP IRA employee requirements: If you have employees that are 21 or older and have worked for you in 3 of the last 5 years, you generally must include them in your SEP plan

-

Roth IRA income calculations: The income limits are based on your modified adjusted gross income (MAGI), which requires some calculation

-

Tax planning complexity: Having multiple retirement accounts can complicate your tax situation

My Final Two Cents

After helping dozens of small business owners figure out their retirement strategies, I’ve noticed that many entrepreneurs benefit from starting with a SEP IRA in their highest-income years, then potentially converting portions to a Roth IRA during lower-income years (though this strategy needs careful tax planning).

For W-2 employees with side hustles, often the Roth IRA makes more sense for that extra income, especially if they already have tax-advantaged retirement options through their main job.

The most important thing is to actually START saving for retirement. Whether you choose a SEP IRA, a Roth IRA, or both, taking action now puts you ahead of most Americans who aren’t saving enough for their future.

Remember, this decision doesn’t have to be permanent either. As your income, tax situation, and goals change throughout your career, you can adjust your retirement saving strategy accordingly.

What retirement accounts are you currently using? Have you found one option works better for your situation? Drop me a comment below with your experiences – I’m always curious to hear what’s working for real people!

Note: While I’ve made every effort to provide accurate information, tax laws and retirement account rules change frequently. Always consult with a qualified financial advisor or tax professional before making major financial decisions.

What is a SEP IRA?

A SEP IRA (simplified employee pension) is a type of individual retirement plan that helps business owners and self-employed individuals save for retirement. Its similar to a traditional IRA in that contributions are tax-deductible for the business. Investments also grow tax-deferred until retirement, when distributions are taxed as income.

Need to back up? How traditional IRAs workAdvertisement

Charles Schwab |

Interactive Brokers IBKR Lite |

Coinbase |

|---|---|---|

| NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.8 /5 |

NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

5.0 /5 |

NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.6 /5 |

|

Fees $0 per online equity trade |

Fees $0 per trade |

Fees 0% – 4% varies by type of transaction; other fees may apply |

|

Account minimum $0 |

Account minimum $0 |

Account minimum $0 |

|

Promotion None no promotion available at this time |

Promotion None no promotion available at this time |

Promotion Get $200 in crypto when you sign up. Terms Apply. |

| Learn More | Learn More | Learn More |

SEP IRA rules: Who is eligible?

Generally, SEP IRAs are best for self-employed people or small-business owners with few or no employees.

Heres why: If you have employees whom the IRS considers eligible participants in your plan, you must contribute on their behalf, and those contributions must be an equal percentage of compensation to your own.

- Eligible participants are employees who are 21 or older, have worked for you for at least three of the past five years, and have made a minimum of $750. For example, if an employee worked for you in 2022, 2023 and 2024 and made $850, you would need to make a contribution for them for the 2025 plan year.

- If you want to stash away 15% of your compensation for yourself, you must also contribute 15% of that employees compensation to their plan. Note that this is just an example — SEP IRAs are subject to contribution limits listed above.

- Employees own and control their own accounts.

Because of that rule requiring equal contributions as a percentage of compensation, a SEP IRA is generally best for self-employed people or small-business owners with few or no employees.

» Are you on track for retirement? Check our retirement calculator to find out

Why Roth Investments Are Better Than Traditional

FAQ

Is a SEP IRA better than a Roth IRA?

A SEP IRA can be better for some individuals than a Roth IRA. In particular, a SEP IRA is best for self-employed business owners with just a few employees looking to maximize their retirement savings. The high contribution limit allows them to save a lot of money and defer taxes on those contributions, saving them money upfront.

Is a SEP IRA a good investment?

SEP IRAs and Roth IRAs are both tax-advantaged retirement accounts in which individuals can invest in a range of assets, but their tax structures and who can contribute are what differentiate these accounts the most. A SEP IRA may be a good option if you: Are an employer. A business of any size, even self-employed, can establish a SEP IRA.

Are SEP IRAs tax-free?

However, the Secure Act 2.0 allows the option of Roth SEP IRAs. A Roth SEP IRA is funded with post-tax money, but retirement withdrawals are tax-free. Aside from contribution limits and taxation, there are a few other SEP IRA rules you should know.

Can I contribute to a SEP IRA and a Roth IRA?

An important point to remember is that you cannot contribute to both a SEP IRA and Roth IRA in the same year, so you must choose between them if eligible. In 2025, the annual contribution limit for Roth IRA is $7,000 for employees who are 50 or younger. For employees who are over 50, Roth IRAs allow additional catch-up contributions up to $1,000.

What is the difference between a SEP IRA and an IRA?

SEP stands for Simplified Employee Pension; IRA is an abbreviation for Individual Retirement Account. Just like any other IRA, a SEP IRA is fully owned and controlled by the beneficiary of the account (the employee). But unlike a typical IRA, the employer is responsible for 100% of contributions to the account.

Are SEP IRAs tax deductible?

Unlike traditional IRAs, you can’t deduct contributions to a Roth IRA on your taxes. Nonetheless, any profits you earn are free from taxation, and you won’t be taxed on qualified withdrawals during your retirement. SEP IRAs have higher contribution limits compared to Roth IRAs.

Is a SEP better than a Roth IRA?

If you prefer tax-free withdrawals and anticipate a higher tax bracket in retirement, a Roth IRA may be ideal. However, if you’re a small business owner seeking tax-deductible contributions for yourself and your employees, a SEP IRA could be the better fit.

What is the downside of SEP IRA?

What is the downside of a SEP IRA? There are several potential disadvantages of a SEP IRA. One is that employers have to make equal percentage-based contributions to employees, so a small business owner might not be able to afford their own SEP IRA contributions plus those for employees.

Can I have both a Roth IRA and a SEP IRA?

Should I convert my SEP IRA to a Roth IRA?

Tip. Converting a SEP IRA to a Roth IRA can be a sound retirement planning strategy if you can afford to pay the taxes now. This is especially true if you expect to be in a higher tax bracket after you retire.