When it comes to credit limit increases, your credit scores could be affected in a few ways. But it depends on how the increase happens and how an expanded credit limit is used.

Here are some facts that will help you understand how raising your credit limit might impact your credit scores.

It can be helpful to have a higher credit limit on your credit card sometimes. But there are some possible downsides that you should think about as well. This article will look at the pros and cons of having a higher credit limit and help you decide if raising your limit is the right thing to do for you.

How Credit Limits Are Determined

When you open a new credit card, the issuer will determine your initial credit limit based on factors like your income, existing debts, credit score and credit history. Issuers want to extend enough credit to meet your needs, but not so much that you are likely to rack up debt you can’t repay.

Credit limits are not set in stone. Many issuers will periodically review your account and increase your limit if you have demonstrated responsible use of credit. You can also request a credit limit increase yourself at any time.

Potential Benefits of a Higher Limit

Here are some of the advantages that could come with increasing your credit limit:

-

Lower credit utilization ratio—This number compares your balance to the total amount of credit you have access to. Keeping it low is good for your credit score. A higher limit makes it easier to do this.

-

Being able to buy big things—You can charge expensive things without going over your limit or having to pay cash.

-

Emergency buffer – Extra credit could help cover unexpected expenses between paychecks or if you lose income.

-

Easier approval for new credit – Lenders may view unused credit limits favorably when considering applications.

-

Higher total borrowing power—Your total combined credit limits are used to decide if you can get a mortgage and other loans.

Potential Downsides of a Higher Limit

While benefits exist there are also some potential drawbacks to weigh

-

Overspending risk – Having more available credit makes it easier to overspend. This can lead to carrying credit card balances and paying expensive interest charges.

-

Lower chances of other loans – High total credit limits could make you look less creditworthy for some other loans like mortgages.

-

Credit score dings – Applications for higher limits often require hard credit inquiries, which could cause small, temporary score drops.

-

Higher minimum payments – If you carry a balance, minimum payments due each month will be higher with a larger limit.

-

Difficulty getting limit lowered – Trying to voluntarily lower your limit in the future can be challenging with some issuers.

Tips for Managing a Higher Limit

If you do obtain an increased credit limit, here are some tips to avoid potential downsides:

-

Set a budget and stick to it – Don’t use the extra credit as justification to overspend.

-

Pay in full each month – Avoid interest charges by paying your balance off completely.

-

Split large purchases into multiple payments – This prevents spikes in your utilization.

-

Ask for automatic increases to stop – This prevents limits from rising faster than needed.

-

Track your credit score – Make sure the limit increase doesn’t negatively impact your rating.

-

Have a savings buffer – Maintain emergency savings so you aren’t tempted to rely on credit.

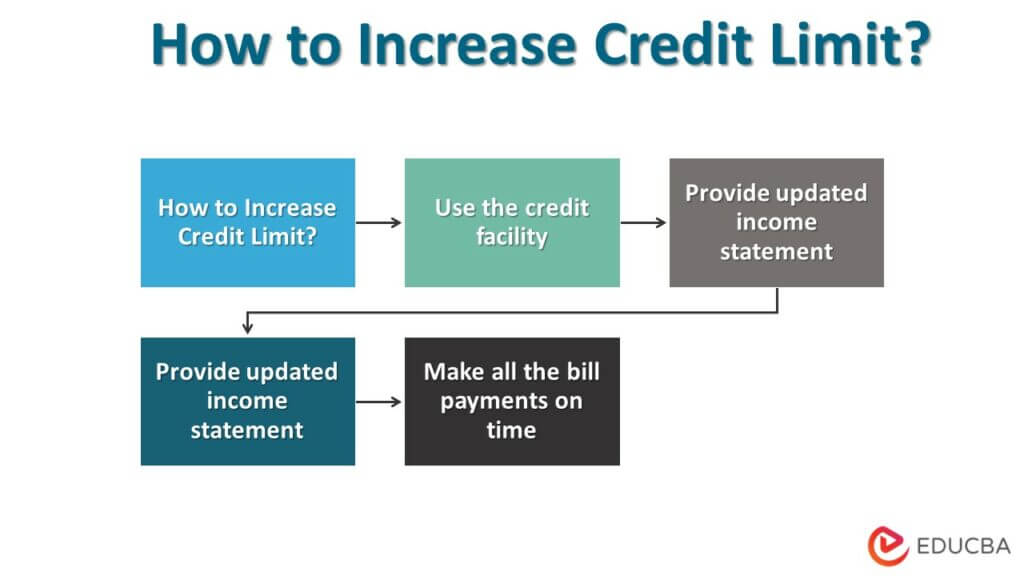

How to Request a Higher Limit

If you decide a higher credit limit is right for you, here are some options for requesting an increase:

-

Apply through your online account – Many card issuer websites have an online application you can easily complete.

-

Call your issuer – There is often a number on the back of your card you can call to make the request.

-

Visit a branch – For issuers like banks with local branches, you can apply in person.

-

Wait for automatic increases – Some issuers automatically periodically raise responsible customers’ limits without them asking.

-

Apply for a new card – Opening a new account is another way to increase your total available credit.

Is a Higher Limit Right for You?

Determining if increasing your credit limit is a smart financial move depends on your unique situation. Carefully weigh the pros and cons. A higher limit can be helpful in moderation but also risky if misused. Monitor your credit scores and have a plan to avoid overspending before requesting more available credit.

How long does it take to get a credit limit increase?

Getting a credit limit increase depends on your situation and your issuer. If youâre eligible for a credit limit increase, your request may be approved almost immediately. But requests might take longer, especially if your issuer asks for more information to review a request.

Can your credit limit be reduced?

Your credit card company can also decrease your credit limit. Some of the reasons could include a number of missed or late payments or not using the card for a certain amount of time. If your credit limit is reduced, that means your credit utilization ratio could go up, which may cause your credit scores to decrease.

5 Steps to get MASSIVE CREDIT Limit Increases (FAST)

FAQ

Does a higher credit limit help credit score?

Yes, having a higher credit limit might help your credit score. This is because it lowers your credit utilization ratio, which is a very important part of credit scoring.

Is it good to have higher credit card limit?

A higher credit card limit can help you fund a large purchase or other essentials you need or provide a financial safety net if you have an unexpected expense. Oct 16, 2023.

Is it beneficial to have a high credit limit?

A higher credit limit gives your greater flexibility to fund expensive purchases, including emergency expenses. Lowers your credit utilization ratio. Your credit utilization ratio is the amount of revolving credit you’re using divided by the total amount of revolving credit you have access to. It’s usually shown as a percentage.

Is it better to have a credit card with a high limit?

“A credit card with a high limit can allow for some serious spending and shows that the provider in question has faith that you’ll pay off the balance. “However, these credit cards usually have higher yearly fees, so think about whether the extra money you can spend is really worth it.” ”.