If your FICO® ScoreÎ is 725, it’s in the “Good” range of scores, which are from 670 to 739. The average U. S. FICO® Score, 714, falls within the Good range. A large number of U. S. lenders consider consumers with Good FICO® Scores “acceptable” borrowers, which means they consider you eligible for a broad variety of credit products, although they may not charge you the lowest-available interest rates or extend you their most selective product offers.

Approximately 9% of consumers with Good FICO® Scores are likely to become seriously delinquent in the future.

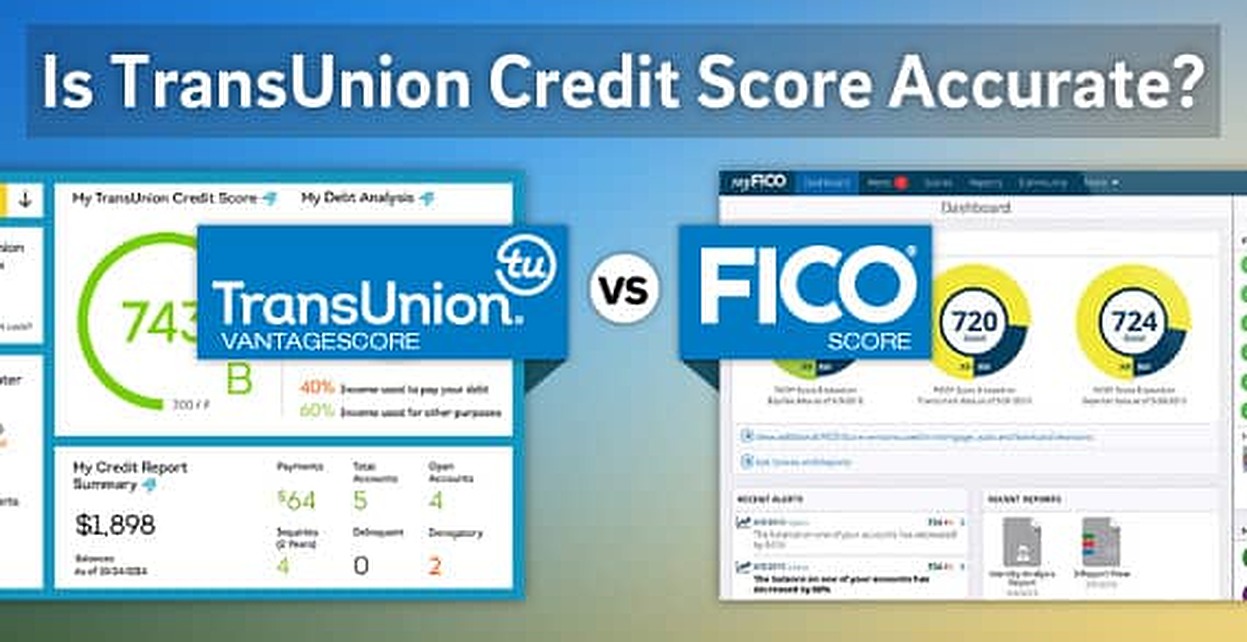

When lenders look at your credit applications, one of the most important things they look at is your credit score. Your chances of getting new credit are better if your credit score is high, and the interest rates are usually lower as well. TransUnion is one of the three main credit bureaus. Their scale is different from many other credit scoring models, so you may be wondering, “Is a 725 credit score good for TransUnion?” Let’s find out.

What is a Good Credit Score?

In general, a credit score of 700 or above is considered good by most lenders. The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850. According to FICO, a score between 670 to 739 is categorized as Good. On the FICO scale, a score of 725 would be towards the higher end of this Good range.

But TransUnion has a different scoring system called VantageScore. It has a range of 300 to 850, the same as FICO. A score between 661 and 780 on the VantageScore scale means that the person is good. With a 725 VantageScore, your credit score is very close to what TransUnion calls “Good.”

TransUnion Credit Score Range

Here is how TransUnion categorizes credit scores using the VantageScore model

- Excellent: 781-850

- Good: 661-780

- Fair: 601-660

- Poor: 500-600

- Very Poor: 300-499

There is no doubt that a TransUnion VantageScore of 725 is in the Good range. In fact, it’s near the top of this range, not too far from an “excellent” credit score.

What a Good TransUnion Score Means

If your TransUnion credit score is around 725, it means you have a good credit history and haven’t been late on many payments. Lenders view borrowers with scores in this range favorably. If you have a 725 VantageScore, you should be able to get most loans and credit cards with moderately low interest rates.

Here are some benefits of having a TransUnion score of 725:

- Increased approval odds for credit cards and loans

- Access to prime and super prime lending rates

- Higher credit limits and borrowing power

- Lower interest rates, saving you money

- Strong negotiating position with lenders

While a score of 725 doesn’t guarantee you the lowest rates or biggest loans, it does mean you’ll qualify for competitive offers. You’ll also have an easier time getting approved compared to applicants with lower scores.

Is 725 an Excellent TransUnion Score?

A credit score of 725 is good, but falls just short of excellent on the TransUnion VantageScore scale. To be considered excellent, your TransUnion credit score would need to be 781 or higher. However, a 725 score is only 56 points away from excellent. With continued responsible credit management, you may be able to boost your score into the excellent range over time.

How a 725 TransUnion Score Compares

- 45% of consumers have TransUnion scores lower than 725

- The average VantageScore is around 675

- Millennials have an average TransUnion score of 673

- 21% of consumers have TransUnion scores in the good range

As you can see, a 725 TransUnion VantageScore is well above average and better than what most consumers have. By having a score in the good range you have access to moderately competitive interest rates from lenders.

What Impacts Your TransUnion Credit Score

TransUnion considers several factors when calculating your VantageScore, including:

-

Payment history – Your track record of on-time payments and any missed or late payments. This is the most influential factor, accounting for over 30% of your score.

-

Credit utilization – The percentage of your total available credit you are currently using. It’s recommended to keep this below 30%.

-

Credit history length – How long you’ve been using credit. The longer your established credit history, the better.

-

Credit mix – What types of credit accounts you have, such as mortgages, installment loans, and revolving credit like credit cards.

-

Recent credit inquiries – When you apply for new credit, an inquiry shows on your report. Too many recent inquiries can lower your score temporarily.

-

New credit – Opening several new credit accounts in a short period can lower your score.

How to Raise Your 725 TransUnion Credit Score

While a 725 VantageScore is good, there’s still room for improvement. Here are some tips to continue boosting your TransUnion credit score:

- Maintain low credit utilization ratios below 30%

- Continue making on-time monthly payments

- Allow credit inquiries to age and minimize new applications

- Don’t close your oldest credit accounts

- Build your credit history by keeping accounts open

- Correct any errors on your TransUnion credit report

With diligent credit management over time, you can increase your score towards the excellent range. Monitor your TransUnion VantageScore regularly to check your progress.

Is a Credit Score of 725 Good or Bad?

Overall, a 725 credit score is good whether you’re looking at the FICO model or TransUnion’s VantageScore scale. It’s well above average and demonstrates responsible credit management. With a TransUnion score in this range, you’ll have access to competitive interest rates from lenders.

While an excellent credit score above 780 would be ideal, a 725 VantageScore still puts you in a strong position when applying for new credit. Continue practicing positive credit habits, and you can reach the next credit tier. Monitor your TransUnion credit report and VantageScore regularly to ensure accuracy.

How to improve your 725 Credit Score

A FICO® Score of 725 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 725 FICO® Score is on the lower end of the Good range, youll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range (580 to 669).

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, youll receive information about ways you can boost your score, based on specific information in your credit file. Youll find some good general score-improvement tips here.

How to build up your credit score

Your FICO® Score is solid, and you have reasonably good odds of qualifying for a wide variety of loans. But if you can improve your credit score and eventually reach the Very Good (740-799) or Exceptional (800-850) credit-score ranges, you may become eligible for better interest rates that can save you thousands of dollars in interest over the life of your loans. Here are few steps you can take to begin boosting your credit scores.

Check your FICO ScoreFICO® regularly. Tracking your FICO® Score can provide good feedback as you work to build up your score. Recognize that occasional dips in score are par for the course, and watch for steady upward progress as you maintain good credit habits. To automate the process, you may want to consider a credit-monitoring service. You also may want to look into an identity theft-protection service that can flag suspicious activity on your credit reports.

Avoid high credit utilization rates. High credit utilization, or debt usage. Try to keep your utilization across all your accounts below about 30% to avoid lowering your score.

Try to establish a solid credit mix. The FICO® credit-scoring model tends to favor users with multiple credit accounts, and a blend of different types of credit, including installment loans like mortgages or auto loans and revolving credit such as credit cards and some home-equity loans. This doesnt mean you should take on debt you dont need, but it suggests you shouldnt be shy about prudent borrowing as appropriate.

Make sure you pay your bills on time. Avoiding late payments and bringing overdue accounts up to date are among the best things anyone can do to increase credit scores. Establish a system and stick to it. Whether its automated tools such as smartphone reminders and automatic bill-payment services or sticky notes and paper calendars, find a method that works for you. Once youve stuck with it for six months or so, youll find yourself remembering without being nagged (but keep the reminders around anyway, just in case).

Why Equifax, Experian, and Transunion Have Different Scores

FAQ

Is 725 TransUnion score good?

Key Takeaways: A good credit score falls in the range of 661 to 780 for the VantageScore® 3. 0 model. A good credit score is the result of consistent good habits, like making your payments on time and keeping your credit balances low.

Can I buy a house with a 725 credit score?

Yes, it’s possible to buy a house with a 725 credit score. While a 725 score is considered good, Experian says lenders generally prefer higher scores for better interest rates.

What is a good TransUnion score?

A “good” TransUnion credit score, according to the VantageScore 3. 0 model, typically falls within the range of 661 to 780. Scores above 781 are generally considered “excellent”.

What can I do with a 725 credit score?

What Does a 725 Credit Score Get You?Type of CreditDo You Qualify?Personal LoanYESAuto LoanYESNo Annual Fee Credit CardYESCredit Card with RewardsYES.