Getting a mortgage can seem like a maze of paperwork and requirements. One key document that gives mortgage lenders insights into your financial fitness is your tax returns. But how many years of tax returns do they need to review? Let’s break down exactly how far back mortgage lenders dig into your taxes.

Why Lenders Request Your Tax Returns

When applying for a mortgage submitting one to two years of personal and business tax returns is standard protocol. But why do lenders need to see your taxes in the first place? There are a few key reasons

-

To Confirm Your Income: Lenders use your tax returns to confirm where and how much money you make. This helps them figure out how much of a loan you can get.

-

To Assess Income Stability: By reviewing 2 years of returns, lenders look for steady, consistent income over time. This gives them confidence you can manage mortgage payments long-term.

-

To Calculate Your Debt-to-Income (DTI) Ratio: Lenders use your income to calculate your DTI ratio, which measures how much of your income covers existing debts. The lower your DTI, the more qualified you look.

-

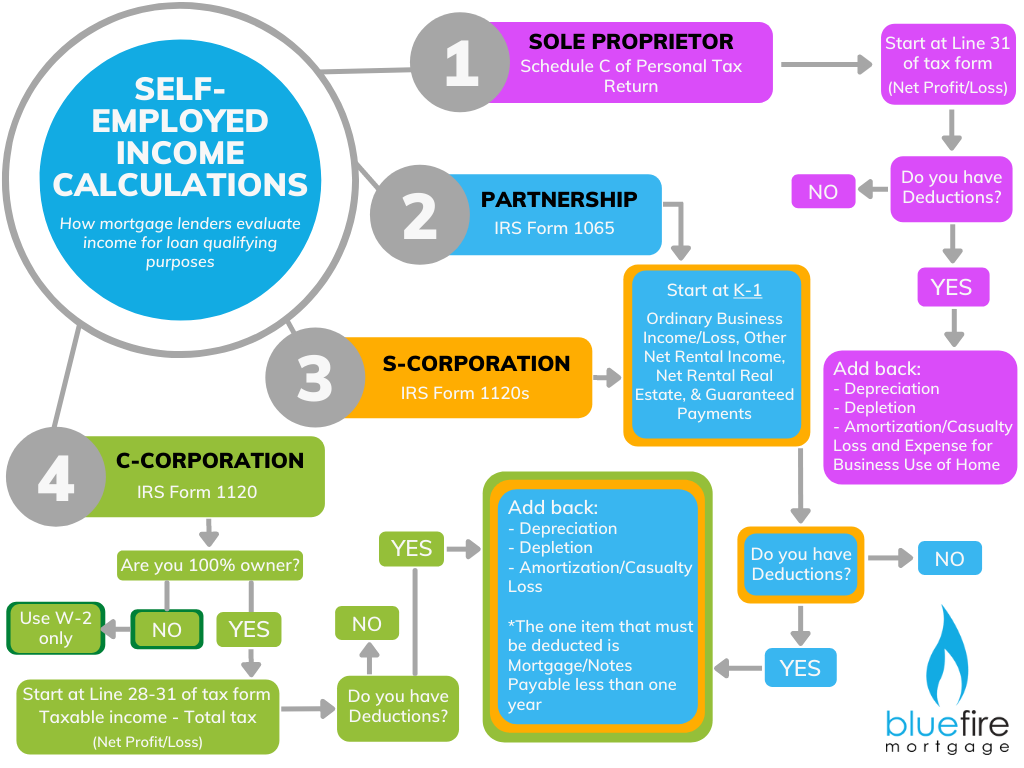

To Review Deductions: Some tax deductions can reduce your qualifying income amount. Lenders want to understand how your deductions impact your borrowing ability.

The Standard: 1-2 Years of Tax Returns

The majority of conventional lenders need two to three years of personal federal income tax returns as part of the mortgage application process. They also usually ask for two to three years of business tax returns if you own a majority stake in a business.

Two years of tax returns gives lenders a complete picture of your financial history and demonstrates consistent earnings over time. Providing multiple years of returns also helps mitigate concerns if your income fluctuated in one year.

In some cases, lenders may ask for additional tax documentation:

-

Real Estate Investors: May need 2 years of Schedule E forms for rental properties

-

Self-Employed Borrowers: May need Profit and Loss statements to complement tax returns

-

Non-Tax Filers: May provide tax transcripts

So in most situations, you can expect to show tax returns from the current year and previous year.

When 3+ Years of Returns May Be Needed

You might have to show more than 2 years of tax returns in some situations:

-

Inconsistent Income: If your income has jumped around over recent years, lenders may request 3+ years to prove stability.

-

Self-Employed Applicants: Lenders may want 3+ years of returns to assess your earnings trend.

-

Using Current Year’s Income: If your loan depends on your most recent tax return, lenders want the IRS to have processed it first. This may mean waiting to apply until you’ve filed taxes for that year.

-

Insufficient Credit History: Applicants with limited credit history may need to provide additional income documentation like tax returns.

The more complex your financial situation, the further back lenders may look. Be prepared to provide 3-4 years of returns if you have multiple businesses, real estate investments, etc.

Strategies for Optimizing Your Tax Returns

If you’re applying for a mortgage soon, keep these tips in mind to optimize your tax returns:

-

File Early: Submit your tax returns ASAP before applying for your mortgage. This prevents processing delays.

-

Maintain Consistency: Having stable income across your returns makes approval easier. Avoid any red flags like job changes.

-

Think About Your Deductions: Some deductions lower your taxable income, so plan how you’ll make your claim. Consult a tax pro if needed.

-

Discuss Any Issues: Be upfront with your lender about anything that may raise concerns, like changes in dependents or filing status.

Following these best practices sets you up for mortgage success!

Alternative Loan Options Without Tax Returns

If your tax returns don’t provide an accurate picture of your earnings, there are mortgage options that don’t require tax return submission:

-

Bank Statement Loans: Lenders verify your income using bank account deposits and balances. Ideal for self-employed borrowers or those with non-traditional income sources.

-

Asset-Based Loans: Loan amount is calculated as a percentage of your total assets like retirement accounts or investment balances.

-

DSCR Loans: Specialty loans for real estate investors based on property cash flow, not personal income.

-

VA Loans: Certain VA loan programs don’t require tax return documentation.

The right lender can help you find a loan that fits your unique financial circumstances.

The Bottom Line

Most mortgage lenders require 1-2 years of recent tax returns to underwrite your loan. But for certain applicants, providing 3+ years of tax documentation may be prudent to showcase income stability. If you want to avoid the tax return route altogether, specialized loan programs are available. As you embark on your home financing journey, understand how far back lenders dig into your tax history so you can strategize accordingly!

Regular payments, irregular activities

Another thing to be cautious about regarding bank statements is monthly payments that don’t align with a disclosed credit account on your mortgage application.

Typically, your credit report will pull in your credit cards, auto loans, student loans, and other debt accounts. But some creditors don’t report to the major credit bureaus, such as Equifax or Experian.

For instance, if you got a private, personal, or business loan from an individual instead of a financial institution, those debt details may not appear on your credit report.

However, the monthly $300 automatic payment on your bank statement will likely alert the lender of a non-disclosed credit account.

Do mortgage lenders look at bank statements before closing?

Your loan officer will typically not re-check your bank statements right before closing. Mortgage lenders only check those when you initially submit your loan application and begin the underwriting approval process.

However, as the closing date for a mortgage approaches, your lender will re-check some aspects of your financial financial situation to ensure that nothing significant has changed since the initial approval.

Some of the key things that mortgage lenders re-confirm right before closing include:

- Credit report

- Debt-to-income ratio

- Employment and income

If you’re eager to buy that new high-definition TV for your living room, it’s a good idea to wait until after the closing. In general, you should avoid financing any large purchases or opening new lines of credit (like a credit card) between mortgage approval and closing.

New debts can affect your credit score and debt-to-income ratio (DTI). This could seriously affect your loan approval and interest rate.

In addition, if anything changes with your income or employment prior to closing, let your mortgage lender know immediately. Your loan officer can decide whether any changes to your financial situation will impact your loan approval and help you understand how to proceed.

What do mortgage lenders look for on your tax returns?

FAQ

Will an underwriter see if I owe the IRS?

Yes, underwriters will likely discover if you owe money to the IRS, especially if it appears on your tax returns or credit report. This can have a negative impact on your financial profile and may affect the interest rate and terms you qualify for.

Do you need 3 years of tax returns to buy a house?

The majority of mortgage lenders want to see tax returns from the last one to two years. If you haven’t filed, they won’t work with you.

Can I get a mortgage with a 1 year tax return?

People who want to borrow money should have a history of jobs and a year’s worth of tax returns ready to be used. The borrower must have a 2-year employment history, but only 1 year of income tax return is used to qualify the borrower.