“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors cover the topics that people care about most, such as the different types of loans available, the best rates, the best lenders, how to pay off debt, and more. This way, you can feel good about putting your money to work. Bankrate logo.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo.

Getting a new car is an exciting experience. However, getting a loan for a new car can be hard if your credit isn’t great. A lot of people with a credit score of 600 want to know if they can get a loan for a new car. If your credit score is in the 600s, you can still get auto loans, but there are some important things to keep in mind.

What Credit Score is Needed for a New Car?

There isn’t a set credit score that lenders need in order to give you a new car loan. However, scores below 660 are generally considered subprime. Experian says that the average credit score for people who bought a new car in the first quarter of 2022 was 748. If your credit score is between 600 and 660, you might be able to get a loan, but you’ll probably have to pay a lot more in interest than people with good or excellent credit.

Here’s a breakdown of typical new car loan rates by credit tier

- Super Prime (781-850): 5.18%

- Prime (661-780): 6.70%

- Nonprime (601-660): 9.83%

- Subprime (501-600): 13.22%

- Deep Subprime (300-500): 15.81%

As you can see, buyers with credit scores in the subprime range can expect to pay over double the interest rate compared to those with prime or better credit.

Getting a Car Loan with a 600 Credit Score

The best rates and terms will go to borrowers above 660, but getting approved in the low 600s is possible. Here are some tips:

-

Shop around – Compare rates from banks credit unions and online lenders. Subprime specialists may offer better terms than mainstream lenders.

-

Consider a co-signer – Adding a co-signer with good credit can help you qualify and get a lower rate. Just be sure the co-signer understands the obligation.

-

Make a large down payment – Putting down 20% or more shows lenders you’re committed. This can help offset credit risk.

-

Look at shorter terms – Opt for a 36 or 48 month loan instead of 60-72 months. This may help secure an approval.

-

Improve your credit – Pay down balances and dispute errors to boost your score before applying. Even small improvements can help.

It is possible to get a loan for a new car even if you have bad credit, but you should know what will happen. Expect to pay more in interest over the life of the loan than people with good credit. Make sure you can afford the monthly payment by doing the math.

Credit Score Factors in New Car Loan Approval

When reviewing an application for a new vehicle, lenders look at more than just your credit score. Other key factors include:

-

Income: Lenders want to see that you have a steady monthly income that will allow you to pay for the car payment.

-

Debts – Too many outstanding debts compared to your income could impact approval odds.

-

Down payment – The more you put down, the less risk for the lender.

-

Loan term – Opting for a shorter term signals you can handle higher payments.

-

Co-signer – Having a co-signer with good credit can improve your chances.

While your credit score plays a big role, having other positive factors in your favor can help offset a lower score.

Strategies to Get a New Car with 600 Credit

If your heart is set on a new car but your credit score is around 600, here are some tips that could help your chances:

-

Get pre-qualified – Many lenders allow you to check rates with a soft credit pull. This helps set expectations.

-

Choose an affordable model – Opting for an inexpensive, budget-friendly new car puts less strain on your finances.

-

Make a large down payment – Put down as much as you can afford to show lenders your commitment.

-

Have a co-signer ready – Ask a friend or relative with excellent credit to co-sign so you can get approved and a better rate.

-

Work to improve your credit – Increasing your score even a small amount in the months before applying can help.

-

Consider buying from a BHPH dealer – Buy here, pay here (BHPH) dealers are more likely to approve subprime buyers. However, interest rates are often sky-high.

The bottom line is that buying a new car with a 600 credit score is challenging but doable. Having realistic expectations about lenders’ credit requirements, and taking steps to improve your loan appeal, will serve you well as you navigate the process. With determination and perseverance, you can end up in the driver’s seat of that new car.

What credit score is needed to buy a car?

The average credit score was 748 for a new car and 684 for a used car, according to data from Experian.

There is no official minimum credit score required to buy a car, but most lenders have minimum standards for financing. Your credit score demonstrates your likelihood of repaying a loan, which is why it is one of the main tools lenders use when determining if you qualify for a car loan. Generally speaking, the higher your credit score, the more likely you are to be approved for an auto loan and receive a competitive interest rate.

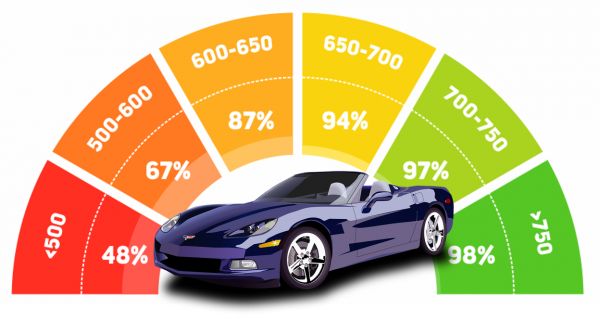

This table illustrates loan risk distribution, which is the percentage of people in each credit band auto lenders chose to finance. You are much more likely to be approved for an auto loan with a score of 600 or above because lenders have low risk tolerance for borrowers.

| New car financing | Used car financing | All car financing | |

|---|---|---|---|

| Super prime (781-850) | 47.44% | 22.34% | 30.75% |

| Prime (661-780) | 35.62% | 35.26% | 35.38% |

| Nonprime (601-660) | 10.87% | 18.35% | 15.84% |

| Subprime (501-600) | 5.61% | 20.69% | 15.64% |

| Deep subprime (300-500) | 0.46% | 3.36% | 2.39% |

Those with credit scores under 500 accounted for just 2.39 percent of all auto loans in the first quarter of 2025. Scores between 501 and 660 fared better and accounted for over 30 percent of auto loan originations.

Auto loan interest rates by credit score

When you apply for a car loan, the average auto loan rate you receive will primarily be based on your credit score.

| Credit score | New cars | Used cars |

|---|---|---|

| Super prime (781-850) | 5.18% | 6.82% |

| Prime (661-780) | 6.70% | 9.06% |

| Nonprime (601-660) | 9.83% | 13.74% |

| Subprime (501-600) | 13.22% | 18.99% |

| Deep subprime (300-500) | 15.81% | 21.58% |

Borrowers in the super prime range are more likely to qualify for auto loans with below-average rates. That said, there are bad credit auto loans available, but the cost of financing a car may be significantly higher. Learn more:

Can You Get a Car With a 600 Credit Score

FAQ

Can a 600 credit score buy a car?

You can still buy a car with a credit score of 600, but the loan terms and interest rates may be stricter. While a score of 600 is generally considered subprime, it’s not a barrier to car ownership.

How much loan can I get with a 600 credit score?

For FICO, a fair or good credit score is between 580 and 739. For VantageScore, a fair or good credit score is between 601 and 780. You can get a personal loan from Upgrade for as little as $1,000 or as much as $50,000. Most lenders start the loan amounts at around $3,000.

What credit score is needed for a $20,000 car loan?

There’s no minimum credit score required to get an auto loan. However, a credit score of 661 or above—considered a prime VantageScore® credit score—will generally improve your chances of getting approved with favorable terms. For the FICO® Score Θ , a good credit score is 670 or higher.

How much to put down on a car with a 600 credit score?

The general rule of thumb is to put down at least 20% for a new car and 10% for a used car. But any size down payment can help lower your monthly payments and reduce the amount of interest you pay over the course of the loan.