People with credit scores between 300 and 850 have good credit. Scores between 670 and 739 are bad. Credit scores of 740 and above are very good while 800 and higher are excellent.

For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good. A score in the high 700s or 800s is considered excellent. About a third of consumers have FICO® ScoresÎ that fall between 600 and 750âand an additional 48% have a higher score. In 2023, the average FICO® Score in the U. S. was 715.

Lenders use their own criteria for deciding whom to lend to and at what rates. But a higher credit score can generally help you qualify for a credit card or loan with a lower interest rate and better terms. The two main types of credit scores, the FICO® Score and VantageScore® credit scores, vary slightly in their ranges but have similar scoring factors.

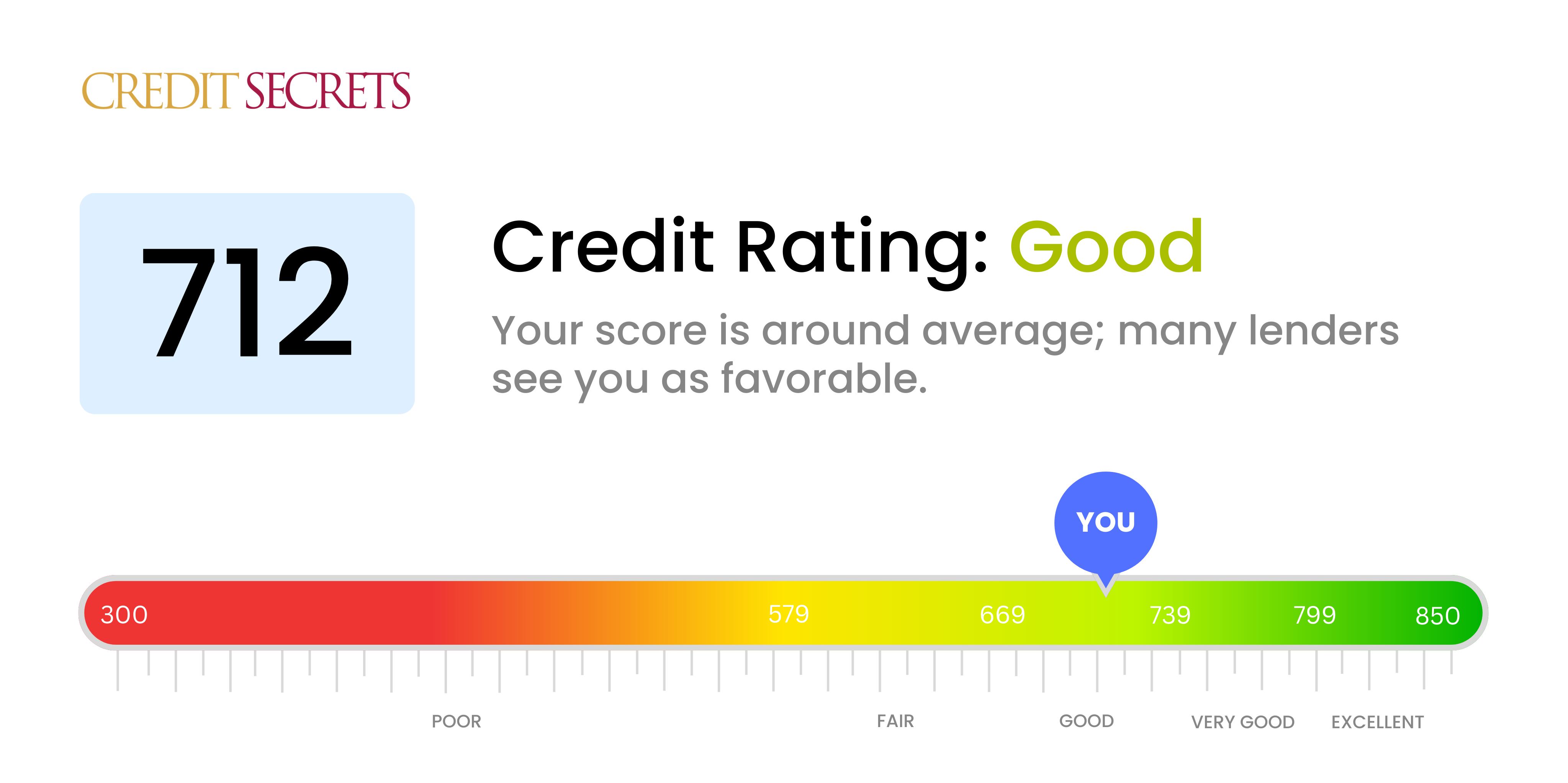

Your credit score is one of the most important numbers in your financial life. It plays a key role in determining whether you can get approved for credit cards, loans, mortgages, apartments, and more. So where does a 712 credit score stand – is it good or bad?

In short, yes, 712 is considered a good credit score by most lenders. It falls within the “good” credit tier, which ranges from 670-739 on the FICO scoring model used by most lenders.

While a higher score is always better, someone with a 712 FICO score is generally seen as a dependable borrower who lenders are likely to approve. However those with excellent credit (scores above 750) will qualify for the very best rates and terms.

What is a Good Credit Score?

The FICO credit scoring model ranges from 300 to 850. The threshold for a “good” score is typically 670 or higher. Here’s how the credit tiers break down:

- Exceptional: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

You have “good” credit if your score is 712. This means lenders think you’ll be a good borrower who pays their bills on time and keeps their debt levels manageable.

While you may not get approved for top-tier credit cards or the very best interest rates, a wide range of lending options are available

What Can You Get With a 712 Credit Score?

A 712 credit score gives you good approval odds for most credit products, including:

- Mortgages

- Auto loans

- Personal loans

- Credit cards without an annual fee

- Credit cards with rewards

You also have a decent shot at low-interest credit cards with an intro 0% APR period But you may fall just short of super-premium cards with big sign-up bonuses or luxury travel perks

Overall, a 712 FICO score demonstrates responsible credit usage. You’ll have your choice of lenders and should be offered competitive rates. Just don’t expect ultra-low interest rates reserved for those with pristine credit.

Who Has a 712 Credit Score?

Based on the normal distribution of FICO scores:

- 38.12% of Americans fall in the “exceptional” credit tier (720-850).

- 17.33% are in the “very good” range (660-719).

- 13.47% have “fair” credit scores (620-659).

- 31.08% are rated “poor” (300-619).

That means a 712 score puts you ahead of almost half of Americans. It’s also a better score than most younger adults have. According to FICO, only 24. 3% of Generation Z (born 1999-2010) have scores between 700-749.

Higher incomes also correlate with better credit scores. Over 60% of Americans earning $75,000-$99,999 per year have scores above 700. But income isn’t destiny when it comes to credit scores. With responsible money management, you can achieve a score over 700 even with a moderate income.

How to Improve Your 712 Credit Score

While a 712 credit score gives you access to plenty of credit, you may want to improve it further to get approved for top rewards credit cards and the lowest interest rates. Here are some tips:

-

Pay bills on time. Payment history has the biggest impact on your scores. Set up autopay or reminders to never miss due dates.

-

Lower credit utilization. Try to keep balances below 30% of your credit limits. Making bigger payments can help.

-

Don’t apply for new credit often. Too many hard inquiries from applications will ding your score temporarily. Wait 6-12 months between applications.

-

Correct errors on your credit reports. Dispute any inaccurate information with the credit bureaus to potentially boost your scores.

-

Let credit age and mix improve. As your accounts age and you responsibly manage different types of credit, your score will gradually improve.

You might be able to raise your credit score to “very good” or even “exceptional” with time and careful credit management. But your credit score of 712 is already good enough that you can get good loans and credit cards.

How Does a 712 Credit Score Compare?

-

A 712 credit score beats the average U.S. credit score of 714. You’re doing better than more than half of Americans.

-

It’s a higher score than the averages for Millennials (16.1% with 700-749 scores) and Gen Z (24.3% with 700-749).

-

712 is a worse score than what top earners have. Over 60% of Americans making $75k-$100k have credit scores higher than 700.

-

People with 712 credit scores have an average of 3.8 credit cards and a 41% chance of a late payment in the last 2 years.

-

To reach a “very good” credit score over 740, focus on reducing credit utilization, never missing payments, and letting your credit history age.

The Bottom Line

A credit score of 712 is considered good by lenders. It generally makes you eligible for approval on most loans and credit cards at decent interest rates. However, people with excellent scores above 750 are more likely to get the very best terms.

If you have a 712 score, you have creditworthiness to be proud of. But there’s still room for improvement. Keep practicing good credit habits, and your score will gradually increase to give you access to the most exclusive borrowing offers.

What Is a Good Credit Score to Buy a House?

To increase your odds of approval and qualify for a lower-rate mortgage, you should aim to have a credit score in the good range or higher. Thats a FICO® Score of at least 670.

The minimum credit score you need to buy a house could range from around 500 to 700, but will ultimately depend on the type of mortgage loan youre applying for and your lender. Many lenders require a minimum credit score of 620 for a conventional mortgage. Other types of mortgages have different credit score requirements.

| Minimum Credit Score for Government-Backed Mortgages | |

|---|---|

| FHA home loans | 500 – 579 (10% down payment) 580+ (3.5% down payment) |

| USDA loans | 580 – 620 may be required by lenders, but there is no set minimum |

| VA loans | 620+ generally required by lenders |

Remember that your credit score plays an important role in determining the interest rate and payment terms on a mortgage loan. Lenders base the interest they charge on how risky they view you as a borrower. So while it may be possible to get a mortgage with bad credit, youre typically better off improving your score before you apply for a mortgage.

How to Improve Your Credit Scores

To improve your credit, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment on time. Even a single payment thats 30 days past due can hurt your credit scores, and the late payment will stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you and help you stay in good standing.

- Keep your credit card balances low. Your credit utilization rate is an important scoring factor that compares the balances and credit limits of revolving accounts, such as credit cards, from your credit report. A low credit utilization rate can help your credit scores, and people with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. Having several open and active credit accounts can thicken your credit file and make qualifying for credit easier. A mix of open installment and revolving accounts can also improve your scores.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

- Review your credit reports regularly. Look over each of your three credit reports for inaccuracies or fraudulent accounts that might be hurting your credit scores; for example, an account thats incorrectly reported as past due or a credit card with a high balance that you didnt open. You have the right to dispute errors and have the creditor or credit bureau investigate.

Other factors can also impact your scores. For example, increasing the average age of your accounts could help your scores. However, thats often a matter of waiting for existing credit accounts to age rather than taking action.

Checking your credit scores might also give you insight into what you can do to improve them. For example, when you check your FICO® Score 8 from Experian for free, you can get an overview of how lenders see you based on your credit:

Youll also get an overview of your score profile, with an explanation of whats helping and hurting your score the most.

Is 712 A Good Credit Score? – CreditGuide360.com

FAQ

What can a 712 credit score get you?

With a 712 score, you can access credit cards, mortgages, auto loans, and personal loans. You may qualify for competitive rates and terms on loans, though likely not the best available. Based on your score, you may be able to get credit cards that offer rewards, cash back, and maybe even a 0% introductory interest rate.

Is 712 a good credit score to buy a house?

That’s a FICO® Score of at least 670. The minimum credit score you need to buy a house could range from around 500 to 700, but will ultimately depend on the type of mortgage loan you’re applying for and your lender. Many lenders require a minimum credit score of 620 for a conventional mortgage.

How rare is a 700 credit score?

A credit score of 700 is not rare, but it’s not exceptionally common either. It’s considered a “good” credit score, and roughly 60% of consumers in the US have a score of 700 or higher.

How to get an 800 credit score?