Roughly 66% of cars financed go to borrowers with scores of 661 or higher, but those with lower scores have options.

The products shown on this page are mostly or entirely from our advertising partners. They pay us when you click on one of their links and then do something on our site. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

If youre looking to buy a car, the process could get more expensive soon. The Trump administrations tariffs could affect the auto industry, driving up prices. Knowing your credit score now can help you enter the buying process on strong footing.

The credit bureau Experian found in a report for the first quarter of 2020 that about 2066 percent of financed cars were for people with credit scores of 661 or higher (Experian Information Solutions). State of the Automotive Finance Market Q1 2025. Accessed Jun 9, 2025. View all sources. The average credit score for a new-car loan was 756, while the average credit score for a used-car loan was 684.

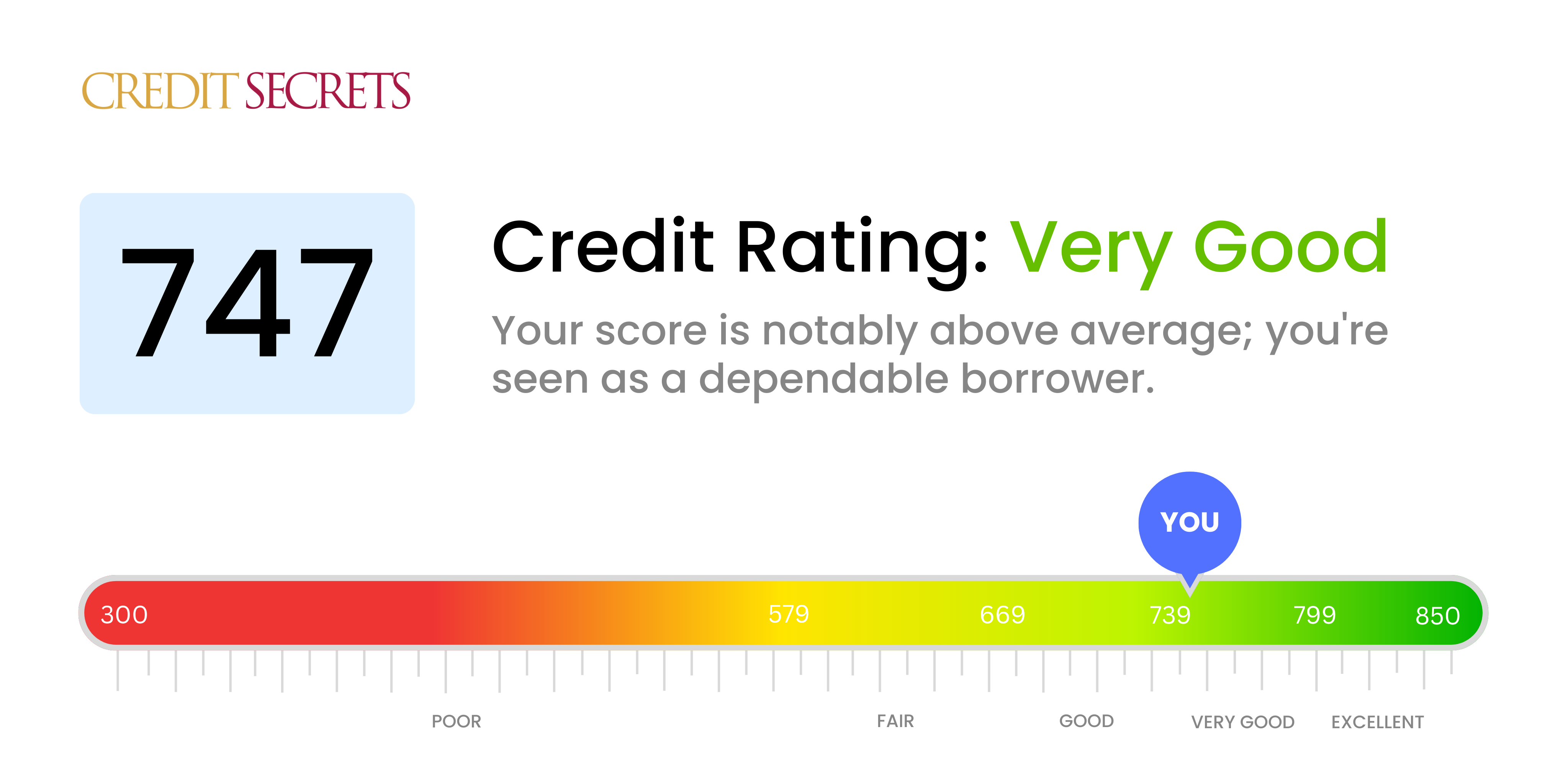

Getting a car loan and getting good interest rates are both dependent on having good credit. Your credit score of 747 means you have good credit and can easily buy a car. What does a 747 credit score mean? How does it affect your auto financing options? Read this article to learn how to get the best deal on your next car.

What Does a 747 Credit Score Mean?

Your credit score is a three-digit number that gives lenders an idea of how likely you are to repay debts Scores range from 300 to 850, with higher scores indicating lower risk to lenders.

One of the main credit scoring companies, FICO, says that a credit score of 747 is “excellent.” It is in the “very good” range of scores, which is 740 to 799.

With a score this high, you have demonstrated responsible credit management in the past. You likely have a long credit history, make payments on time, keep credit card balances low, and have minimal recent credit inquiries.

Just 1% of consumers have credit scores in the very good range. So a 747 puts you well above average when it comes to your creditworthiness.

How a 747 Credit Score Helps You Get a Car Loan

Having a 747 credit score gives you significant advantages when financing a car purchase:

-

Better chances of approval: With excellent credit, you’re very likely to get approved for an auto loan from most lenders. Your strong credit history makes you look like a low-risk borrower.

-

Lower interest rates: The higher your score, the lower the interest rate lenders will offer you. Even a small difference in APR can save you thousands over the life of the loan. With a 747 score, you can expect to get some of the best rates available.

-

Better loan terms: In addition to lower rates, you may also qualify for longer repayment terms, smaller down payments, and waived origination fees. Lenders are willing to offer you more favorable terms because you pose little risk of default.

-

Your good credit score means that many lenders will want to lend you money. This gives you more financing options. You should be able to get a loan from any bank, credit union, or online lender.

What Interest Rate Can I Get on a Car Loan with a 747 Score?

While rates vary by lender, here are some averages for auto loan rates by credit score:

| Credit Score | New Car APR | Used Car APR |

|---|---|---|

| 781-850 (Super Prime) | 5.18% | 6.82% |

| 741-780 (Very Good) | 6.70% | 9.06% |

| 661-740 (Good) | 9.83% | 13.74% |

Your credit score of 747 means that most lenders will give you rates between 206 and 7% for a new car and 208 to 9% for a used car.

Shopping around and comparing loan offers from multiple lenders can help you score an even lower rate and save more money. Also be sure to negotiate the best deal you can directly with the car dealer.

Tips for Maximizing Your 747 Credit Score

Even though your credit is already in excellent shape, here are some tips to maintain or potentially improve your score even more:

-

Keep balances low on credit cards and other revolving credit lines. High utilization can hurt.

-

Make all payments on time, every time. Payment history is a big factor.

-

Be mindful of how many credit inquiries you have. Too many can signal increased risk.

-

Check your credit reports regularly for any errors that could be dragging down your scores.

-

Consider letting existing accounts age and avoiding opening too many new ones. Length of credit history matters.

-

If you have any collections or charge-offs, try to get them removed or paid off.

-

Manage debt carefully and keep it as low as is comfortable for your situation.

The Bottom Line

A 747 credit score puts you in an excellent position when applying for an auto loan. You can expect easy approval from lenders along with low interest rates and great loan terms. Maintain solid credit habits and your 747 score will serve you well as you shop for your next car.

Bring a bigger down payment

A big down payment can help offset a bad credit score by lowering your monthly payments. It might even help you get a lower interest rate. For some lenders, a big down payment might make you appear less risky, despite a lower credit score.

Bring documents showing financial stability

If your credit score is low, potential lenders are less likely to see you as a risk if they can see you have stability in other areas of your financial life. Bringing documentation such as your most recent pay stubs and proof of address to show lenders how long you have lived at your current address and worked at your employer could help you seem more reliable.

Customer with 480 credit score wants to buy a $60,000 car with little money down‼️

FAQ

Can I get a car loan with a 747 credit score?

Compare car loans on Credit Karmato explore your options. Can I get a credit card with a 747 credit score? With good credit scores, you might qualify for credit cards that come with enticing perks like cash back, travel rewards, or an introductory 0% APR offer that can help you save on interest for a period of time.

Is a 747 credit score a good credit score?

A 747 credit score is considered a good credit score by many lenders. Here’s what it means to have good credit and how you can maintain your score. × Download the app 4. 74. Get 8% off Intuit Credit Karma Credit Cards for Shop Credit Cards, Balance Transfer Cards, Rewards Cards, Travel Cards, Cash Back Cards, and 20% off APR Cards for Business Cards.

How does your credit score affect a car loan?

If your credit score is higher, you may be able to get a lower interest rate. This means that you will pay less each month and over the life of the loan. Understanding how your credit score affects your ability to secure a car loan can help you make informed decisions and potentially save you money over the lifetime of the loan.

What credit score do you need to buy a car?

The report also found that on average, the credit score for a used-car loan was 684, while the average score for a new-car loan was 756. What is the lowest credit score I need to buy a car? Different lenders have different requirements, so there isn’t a single score that you need.

What is a good credit score for a car loan?

Usually, higher scores mean lower interest rates on loans. According to Experian, a target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.70% or better, or a used-car loan around 9.06% or lower. Superprime: 781-850. 5.18%. 6.82%. Prime: 661-780. 6.70%. 9.06%. Nonprime: 601-660. 9.83%. 13.74%.

Should I check my credit score before buying a car?

If you’re considering buying a new or used car on credit, check your credit score before approaching a lender or car dealership. While there’s no one-size-fits-all credit score required to buy a car, understanding your score can help you secure the most favorable terms for your auto loan.

Is 747 a good credit score to buy a car?

Your FICO® ScoreΘ falls within a range, from 740 to 799, that may be considered Very Good. A 747 FICO® Score is above the average credit score. Borrowers with scores in the Very Good range typically qualify for lenders’ better interest rates and product offers.

What can I do with a 747 credit score?

A 747 credit score opens doors. We’re talking better loan offers, lower interest rates, and even access to premium credit cards.

What credit score do you need to buy a $30,000 car?

To qualify for a $30,000 car loan, most lenders prefer to see a credit score of at least 660 to 700. That being said, your credit score is only one part of the equation. Lenders will also consider: Your debt-to-income ratio (how much you owe compared to how much you earn)

Can I get a loan with a 747 credit score?

… 747 or higher, you are likely to have access to a wide range of financial products and services, including personal loans with favorable terms and conditions