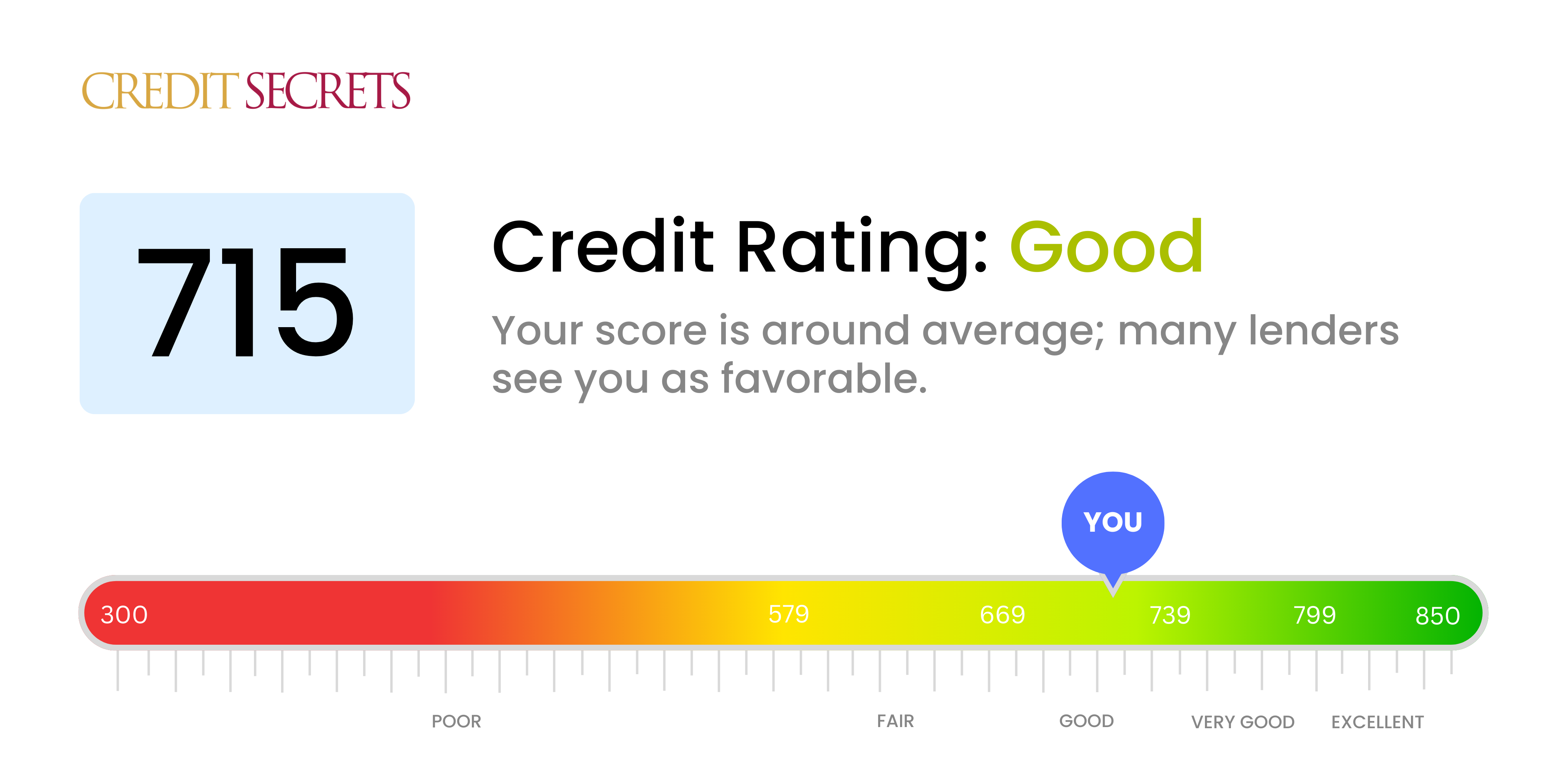

If your credit score is 715, you are right in the middle. According to Experian, the average American consumer has a FICO Score of 714 as of 2021, and anything in the range of 670 to 739 is generally considered to be a good credit score.

Most lenders consider an 715 credit score to be an average credit score that shows you generally pay your bills on time. In this article, we’ll take a deeper dive into what your 715 credit score means when it comes to applying for loans, and what you can do to improve your score.

Buying a car is an exciting experience. However, it also involves a lot of planning and budgeting. One of the most important things that determines the terms of the loan you can get to buy a car is your credit score. So, can someone with a score of 715 buy a car?

The short answer is – yes, a credit score of 715 is considered good by most lenders and will allow you to qualify for competitive auto loan rates. However, there are some nuances to be aware of. Let’s take a detailed look at what credit score you need to buy a car and how a 715 credit score impacts your auto loan.

What Credit Score is Needed to Buy a Car?

There isn’t one specific score that’s required to buy a car because lenders have different standards. However, the vast majority of borrowers have scores of 661 or higher.

Here’s a quick overview of the credit score ranges:

- Excellent credit: 780-850

- Good credit: 670-739

- Fair credit: 580-669

- Poor credit: 300-579

In general, lenders look for borrowers in the prime range or better, so you will need a score of 661 or higher to qualify for most conventional car loans.

Is 715 a Good Credit Score for an Auto Loan?

A credit score of 715 puts you safely in the good credit range. This means you have a strong credit history and responsible borrowing behavior, making you a very desirable borrower in the eyes of auto lenders.

Here are some key benefits of having a 715 credit score when applying for a car loan:

-

Prime lenders: You can get loans from banks, credit unions, and other mainstream lenders who offer the best rates.

-

To get better loan terms, you need a score of 715 or higher. This will help you get longer loan terms, lower down payments, and easier approval for bigger loans.

-

Lower interest rates: If you have good credit, you will pay less interest on your loan over its life. Expect rates between 4% and 6% with 20715, compared to 10% in 2010 for people with bad credit.

What Interest Rate Can I Get on a Car Loan with 715 Credit Score?

Your credit score plays a significant role in determining the interest rate you receive on your auto loan. Generally, the higher your credit score, the lower your interest rate will be.

According to Experian, in Q4 2022, the average used car loan rate for borrowers with good credit (660-719 score) was 9.63%. For new cars, it was 6.79%.

This table provides estimates of the rates that a 715 credit score could qualify you for today:

| Loan Type | Average Interest Rate with 715 Credit |

|---|---|

| New Car | 4.5% – 6.5% |

| Used Car | 7% – 9% |

So with a score of 715, you can expect competitive rates, but they won’t be as low as someone with excellent credit (scores above 760). Even minor improvements in your score can make a difference.

How to Get the Best Car Loan Rates with a 715 Credit Score

Even though a 715 credit score puts you in a good position, there are still ways to optimize your chances of securing the best possible auto loan rates.

Here are a few tips:

-

Lower your debt-to-income ratio: Lenders look at your total monthly debt payments versus income. Keeping this ratio low will help your case.

-

Make a larger down payment: Putting down 20% or more gives you the best rates. Bigger down payments signal you’re a lower-risk borrower.

-

Consider getting a co-signer: Adding someone with a higher score as a co-signer can help you land better terms.

-

Compare offers from multiple lenders: Don’t just accept the first loan you’re offered. Shop around to find the most competitive rates.

-

Ask about discounts: Many lenders offer rate discounts for setting up autopay or having an existing banking relationship.

-

Improve your credit: A couple months focused on credit improvement could bump your score over the 720 mark and save you money.

With some work, a 715 credit score can definitely lead to favorable auto financing. Shop smart, negotiate from a position of strength, and you’ll end up with the best possible deal.

Can I Get 0% Financing with a 715 Credit Score?

0% financing deals allow you to finance a car without paying any interest over the term of the loan. This can save you thousands of dollars compared to a standard loan.

Unfortunately, 0% financing offers are only extended to borrowers with tip-top credit, usually 760+ scores. Lenders view 0% loans as risky, so they only provide them to the most creditworthy applicants.

With a 715 score, you can get competitive rates but likely won’t see 0% offers. Only around 2% of new car buyers and 1% of used car buyers qualify for 0% financing.

However, some lenders provide subsidized rates to specific brands or models. These can get down to 1-3% for qualified buyers. So while true 0% financing may be out of reach, you can still find very low rate deals in the 1-4% range if you shop carefully.

The Bottom Line

A credit score of 715 is considered good by most automobile lenders. It shows a strong history of responsible borrowing and debt repayment.

While excellent credit (760+) unlocks the very best rates and incentives, a 715 score means you’ll still qualify for competitive new and used car loan financing. Lenders will view you as a prime, low-risk applicant.

Focus on lowering your debt, minimizing hard credit inquiries, and comparing loan offers to get the ideal auto financing package. With some work, a 715 score can secure you favorable loan terms that match your budget and needs.

Can I get a personal loan with an 715 credit score?

You can get a personal loan with an 715 credit score, but not every lender may approve you. Some lenders require scores well into the 700s for consideration. However, depending on the lender, you may get a personal loan with rather competitive terms.

Upstart-powered personal loans are designed primarily for borrowers who may not have top-tier credit but are considered credit-worthy based on non-traditional variables, so you may want to consider checking your loan offers if you’re in the market.

Can I get a credit card with an 715 credit score?

The short answer is yes. You should be able to get a standard (non-secured) credit card with a FICO Score in the realm of good credit scores. Having said that, there are a couple of big caveats.

For one thing, you aren’t likely to qualify for some of the best credit card offers in the market. To get the best rewards credit cards, balance transfer offers, and best 0% APR offers, lenders may want to see excellent credit, with scores significantly higher than yours. You also might not get as high of a credit limit as consumers with higher scores.

Second, your credit score is just one part of the credit card approval process. Lenders will also take your other debts and employment situation into consideration. In fact, it’s not uncommon for consumers in the elite credit tiers to get rejected because their other debts are a bit too high.

Credit Scores for Buying a Car: Current Tiered Rates & Scores (Former Dealer Explains)

FAQ

Can I get a car with a 715 credit score?

Key takeaways. You don’t need a certain credit score to buy a car, but most lenders have minimum requirements for loans. Most borrowers need a FICO score of at least 661 to get a competitive rate on an auto loan.

What can you do with a 715 credit score?

With a 715 credit score, you’re likely to qualify for a wide range of financial products and services, although reaching the next band will help you land lower interest rates and even better deals, saving you money in the long run.

What credit score is needed for a $30,000 car loan?

There’s no minimum credit score required to get an auto loan. However, a credit score of 661 or above—considered a prime VantageScore® credit score—will generally improve your chances of getting approved with favorable terms. For the FICO® Score Θ , a good credit score is 670 or higher.

How rare is an 800 credit score?

An 800 credit score is relatively rare, with approximately 23% of Americans achieving this “exceptional” FICO score range (800-850), according to The Motley Fool.