Have you ever tried to pay a bill with a credit card but were turned down? You may have almost reached your credit limit. This shows how much a credit card company might lend you, based on things like your income and credit history.

Applying for an increased credit limit could be a good option if you want to boost your purchasing power. However, you should only do so if you are able to pay off the balance or at least the minimum monthly payments. Here are some tips on how to increase your credit limit.

Getting approved for a higher credit limit can give your finances a nice boost. But will requesting an increase result in a hard pull on your credit? In this comprehensive guide, we’ll explain how credit inquiries work and if American Express does a hard pull when you ask for more purchasing power.

What is a Hard Pull?

When you apply for new credit, lenders have to check to see if they can trust you. So that they can do this, they get your credit report from one of the three main credit bureaus (Experian, Equifax, or TransUnion). This is called a “hard inquiry.” This causes a hard pull to show up on your report.

Too many hard inquiries in a short period can temporarily ding your credit score by a few points. Each hard pull remains on your report for two years but stops impacting your score after about a year.

Soft pulls or soft inquiries, on the other hand, have no effect on your score. These happen when you check your own credit or a lender checks your report for pre-screening offers. Hard pulls involve you initiating an application for credit.

Why Do Credit Card Issuers Conduct Hard Pulls?

When you apply for a new credit card, the card issuer wants to review your full credit history to assess your creditworthiness before extending you more credit.

The same is true when you request a higher limit on an existing card, especially if it’s a large increase. The bank wants to verify you can responsibly handle a higher credit line based on factors like your income, outstanding debts, and payment history.

Does Amex Always Do a Hard Pull for CLI?

The good news is that American Express doesn’t check your credit just because you ask for a higher limit. Here’s what Amex says about hard vs. soft pulls for credit limit increases:

- Soft pull if you request a credit limit increase on your existing Amex card

- Soft pull if Amex reviews your account to offer you an automatic CLI

- Hard pull only if you decline Amex’s automatic CLI offer and request a higher amount

As you can see, Amex primarily relies on soft pulls, which have no impact on your score. This makes them one of the most friendly card issuers when it comes to requesting more purchasing power.

You only do a hard pull in the third situation, where you basically start a new application for an even higher limit after already being offered an automatic increase.

When Will Other Lenders Do a Hard Pull for CLI?

Amex doesn’t like to do hard pulls for credit line increases, but other big issuers aren’t always as open to soft pulls. Here is a summary of other banks’ policies:

- Hard pull: Bank of America, Barclays, Chase, U.S. Bank, USAA

- Soft pull: Capital One, Wells Fargo

- Varies: Citi (hard pull if a significant increase)

As you can see, Capital One and Wells Fargo join Amex in mainly using soft pulls for existing customers seeking higher limits. But other big banks will ding your score with a hard inquiry when you request more credit.

How Often Can I Request a CLI with Amex?

There is no outright limit to how frequently you can ask Amex for a higher credit line. That said, requesting an increase multiple times a year could signal credit issues to Amex and prompt additional review of your account.

To maximize your chances of approval, it’s best to wait at least 6 months between CLI requests. You want to be able to demonstrate a positive history with on-time payments and responsible credit use over an extended timeframe.

Amex also wants to see your financial situation has improved, which takes time. Factors like increased income, a higher credit score, and lower credit utilization can bolster your case for more credit.

8 Tips for Getting Approved for an Amex CLI

While Amex won’t ding your credit with a hard pull simply for requesting a CLI, approval isn’t guaranteed. Use these tips to boost your chances of success:

1. Ask after at least 6 months of cardmembership – Don’t request an increase as soon as you get the card. Wait until you’ve established a positive history with Amex.

2. Have low credit utilization – Keep balances low compared to your limit, ideally under 30%. High utilization signals credit risk.

3. Make payments on time – Payment history is key. Consistently paying at least the minimum – or better yet, paying in full each month – will help your case.

4. Have excellent credit – Aim for a score of at least 720 before requesting more credit. Higher scores convey creditworthiness.

5. Wait 6+ months between CLI requests – Don’t push your luck asking over and over. Space out increase requests by at least 6 months.

6. Have higher income – An income boost since getting your card can help justify a higher limit. Paystubs may be requested as proof.

7. Lower your debt – Reducing debts owed to other lenders demonstrates you can handle more credit responsibility.

8. Ask for only a moderate increase – Don’t get greedy. Asking to double your limit often raises red flags resulting in denial.

Alternatives If Amex Denies Your CLI Request

If Amex declines your request for an increased limit, here are some potential next steps:

-

Wait 6 months and reapply – Give yourself more time to improve your financial profile and try again later.

-

Request a lower increase – Ask for less than your original request. A smaller boost may be approved.

-

Apply for a different Amex card – Getting approved for a new card gives you more overall purchasing power.

-

Request an increase on another card – Try your luck requesting a CLI with another issuer that may use different criteria.

-

Improve your credit – Pay down debts, increase income, and continue making timely payments to boost your score over time before reapplying.

Weigh the Pros and Cons Before Requesting a CLI

A higher credit limit can provide more financial flexibility. But it also risks tempting you into overspending. Carefully weigh the pros and cons before requesting an increase.

Potential Pros:

- Make large purchases more easily

- Lower your credit utilization

- Access funds in an emergency

- Build credit through responsible use

Potential Cons:

- Risk overspending and racking up debt

- Debt can be hard to pay off later

- Missed payments damage credit score

- Higher limit reduces chances of future CLI approvals

As long as you trust yourself to spend smartly and make payments on time, requesting an occasional bump to your Amex credit line can offer some nice perks. Just be sure to make your requests strategically to maximize approval odds while minimizing credit score impacts.

Benefits of an increased credit limit

One of the benefits of increasing your credit limit is being able to improve your credit utilization ratio. If you raise the amount of credit you can access but keep your spending at the same level or less, you will lower your credit utilization ratio, which could help your credit score. With a higher credit score, you may be able to access lower interest rates and better terms on future loans, such as a mortgage.

A credit card limit increase allows you to make larger purchases more easily. It can ensure your access to credit in case of emergency, like unexpected car or home repairs.

How to increase credit limit

Consider the following four ways to increase your credit limit.

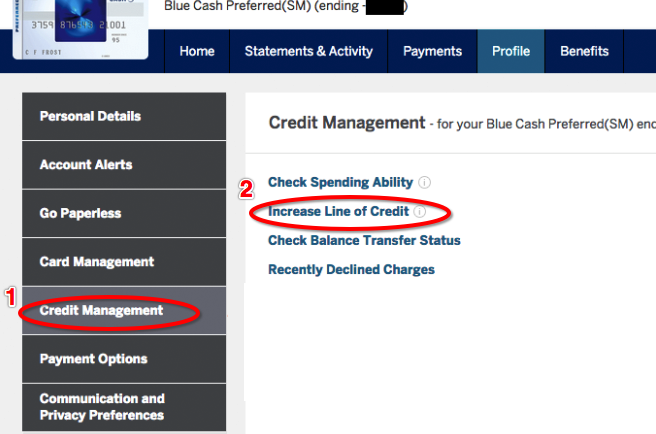

AMEX Blue Cash Everyday: Easy Credit Limit Increase Guide!

FAQ

Does American Express do a hard pull for a credit increase?

A credit line increase request may not always trigger a hard pull from American Express, but it’s still a factor that you should keep in mind. Apr 15, 2025.

Does Amex have a 2-90 rule?

Amex 2-in-90 rule American Express restricts card approvals to no more than two within 90 days. This means that even if you follow the 1-in-5 rule above and get two cards more than five days apart, you still can only get those two cards within 90 days. So far, there are no exceptions to the Amex 2-in-90 rule.

Do you get a hard inquiry for credit limit increase?

When you ask your lender to raise your credit limit, they may do a full credit check, which is also known as a “hard inquiry,” to see if they think you are eligible. This process can have a minor, negative effect on your credit scores.

Does Amex pull credit for upgrade?

Upgrading your credit card with American Express doesn’t directly affect your credit score. When you apply for a new credit card, the company that gives out the cards will usually do a hard credit check as part of the review process.