Benjamin Franklin once said, “An investment in knowledge pays the best interest. ” Investing a million dollars can seem like a daunting task, but its a smart move to grow your wealth and secure your financial future.

Before diving into the world of investing, you should educate yourself on the available options and develop a solid strategy. You can make your money work for you and reach your financial goals if you know what to do and get the right help.

In this article, well explore some smart options and strategies on how to invest 1 million dollars. So lets dive in and start building a brighter financial future.

Having $1 million to invest is a goal for many, but knowing the best way to invest such a large sum can be challenging. With proper planning and smart investing, $1 million can generate enough returns to last for decades. Here are some of the best options to consider when investing $1 million in 2025:

Understand Your Goals and Risk Tolerance

It’s important to think about your financial goals and how much risk you’re willing to take before making any investments. This will help you choose the right mix of assets and strategy for your $1 million portfolio.

Consider factors like your age, time horizon until retirement, income needs, and ability to withstand volatility. This will help determine your comfort level with equities versus lower-risk assets like bonds Generally, the younger you are and the longer your time horizon, the more aggressive you can be with riskier assets

Pay Down Debt

Eliminating high-interest debts like credit cards and personal loans can be one of the best things you can do for your money. This lowers the risk and guarantees a return equal to the interest rate.

Paying off a credit card charging 20% interest provides a 20% return, likely higher than you could reasonably expect from most investments. Prioritize any debt with interest rates above around 5-6%.

Max Out Retirement Accounts

Maximizing tax-advantaged retirement accounts like 401(k)s and IRAs should be a priority. This allows your investments to grow tax-free, boosting long-term returns.

Between $22,500 and $6,500 can be put into a 401(k) or an IRA in 2025. That goes up to $30,000 for a 401(k) and $7,500 for an IRA if you’re over 50. Fund these accounts first before taxable investing.

Build a Diversified Portfolio

The bulk of a $1 million portfolio should be diversified across stocks, bonds, and other uncorrelated assets like real estate. This blend of assets balances growth from stocks with the stability of bonds.

A reasonable starting point is 60% in stocks and 40% in bonds, adjusting based on your risk tolerance. Split the stock portion across US and international indexes. Include a mix of bond types like Treasuries, corporates, and municipals.

Diversifying within each asset class protects against any one investment declining severely. Rebalance periodically to maintain target allocations.

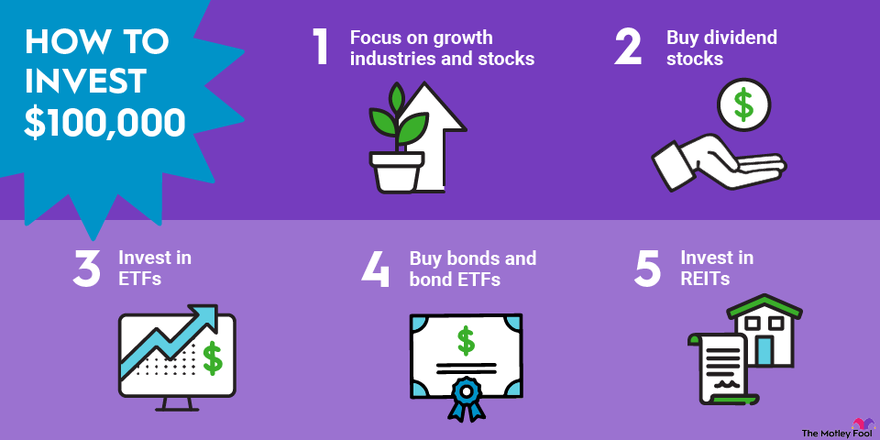

Utilize Index Funds and ETFs

Low-cost index funds and ETFs are excellent building blocks for a diversified million-dollar portfolio. They provide instant diversification and market returns at a fraction of the cost of actively managed funds.

Stick to broad market indexes for core holdings – an S&P 500 fund for US large-cap stocks or a Total International Stock ETF for developed and emerging market exposure. Use bond index funds for safer assets.

Invest in Dividend Stocks

Good dividend stocks can give you steady income and keep your portfolio from going up and down too much. For million-dollar accounts, blue chip stocks with a history of growing dividends are the best stocks to hold.

Focus on companies that regularly increase dividends faster than inflation, providing rising income to offset inflation. Target dividend yields of 2-4% and payout ratios under 60% for the best balance of income and growth.

Consider Real Estate Investment Trusts

REITs provide exposure to real estate assets like apartments, offices, and retail centers. They benefit from rising property values and steady rental income. REITs pay above-average dividends, adding income to a portfolio.

Stick to larger REITs investing in defensive property sectors like apartments, self storage, data centers, and healthcare facilities. These provide relative stability. A 5-10% REIT allocation can enhance diversification and reduce volatility.

Utilize a Financial Advisor

Managing a million-dollar portfolio is complex, making an experienced financial advisor invaluable. They can provide personalized guidance on asset allocation, rebalancing, tax optimization, and risk management.

Look for fee-only advisors who serve as fiduciaries. They are legally required to provide unbiased advice that is in your best interests, not theirs. Vet their experience and qualifications carefully when making this important choice.

Maintain an Emergency Fund

Even substantial portfolios should maintain cash reserves in savings for unexpected expenses. Set aside at least 6 months of living expenses in FDIC-insured accounts like high-yield savings and CDs. This ensures you won’t have to sell investments at the wrong time.

Invest Appropriately for Your Time Horizon

As you approach retirement, begin shifting toward more conservative assets to preserve capital. Hold several years of withdrawals in cash to avoid selling during market declines.

Work with an advisor to develop a withdrawal strategy using dividends, interest, and strategic asset sales to fund spending needs. This “bucket strategy” reduces risk in later years.

Remain Flexible and Rebalance Periodically

Market conditions and asset valuations are constantly changing. Review your portfolio at least annually and rebalance to target allocations. Trim appreciated assets and buy more of those that have declined.

Work with your advisor to adjust your investment plan over time as your goals and risk tolerance evolve. What works at 40 may need modifications at 60. Remain open to adapting as circumstances change.

How Much Interest Does 1 Million Dollars Earn Per Year?

If youre lucky enough to have a million dollars to invest, youre probably wondering how much you can expect to earn in interest each year. The answer depends on several factors, including the type of investment you choose, your investment horizon, and your risk tolerance.

Stocks are a popular investing choice; historically, they have delivered an average yearly return of about 10%. This means that a $1 million investment in the stock market could potentially earn you around $100,000 per year in interest.

If you explore a concentrated stock position or allocate a significant portion of your wealth to a consistently well-performing stock, you can maximize certain stocks. However, this strategy only works if youre guided by informed decisions and effectively manage associated risks and rewards.

Of course, the returns are not guaranteed, and risks are associated with investing in stocks. Its essential to have a well-diversified investment portfolio and a long-term investment horizon to mitigate the risk of market downturns. With $1 million to invest, it makes little sense to go it alone. A financial advisor can provide objective and informed guidance to help you attain your financial goals. Please choose a value.

Real estate investing is another alternative to consider. Real estate investment trusts (REITs) and real estate crowdfunding platforms offer opportunities to invest in commercial and residential properties and earn a return on your investment.

The average annual return for REITs is around 8%, which could translate to a return of $80,000 per year on a $1 million investment. Real estate investments also offer tax benefits and the potential for capital appreciation.

Bonds and money market accounts may be a good option for those with more conservative risk tolerance. Treasury bonds and municipal bonds typically offer lower returns but come with less risk.

With a bond paying a 2% interest rate, a $1 million investment could earn you $20,000 per bond pay interest income annually. High-interest savings accounts are another low-risk option, with interest rates averaging around 0.5%. A $1 million investment in a money market account could earn you $5,000 per year in interest income.

Another great option you can explore is the Lyons Enhanced Yield Strategy. This investment strategy produces optimal tax efficiency while ensuring a consistent high-level income. This consistency is independent of market direction.

Private Lending Or Peer-To-Peer Lending

Private lending or peer-to-peer lending can be an excellent option for those looking for alternative investments with potentially higher returns. Private lending involves providing loans to individuals or businesses with personal capital, while peer-to-peer lending consists in connecting borrowers with investors through online platforms.

Peer-to-peer lending can offer the potential for higher returns than traditional investments such as bonds or savings accounts.

When investing, its essential to consider factors such as credit quality, loan terms, and borrower risk. Its also essential to understand the potential risks and a solid understanding of the investment platform and how it operates.

Investing in cryptocurrency can offer the potential for significant returns and high-interest loans, but it also comes with significant risk. Cryptocurrencies such as Bitcoin and Ethereum are highly volatile and can experience significant price fluctuations in a short period.

When investing in cryptocurrency, its essential to have a solid understanding of the technology and market trends. Its also essential to have a plan to manage risk and not invest more than you can afford to lose.

How Do I Invest $1,000,000?

FAQ

What is a good return on $1 million dollars?

How much can you make if you invest $1 million? It depends on how you invest it. Based on historical returns over the past century, putting the money in the S&P 500 could generate $100,000 in a year on average, though volatility means you could lose as much as $431,000 or make as much as $542,000 in a single year.

What is the safest way to invest $1 million dollars?

The best you can do to minimize the risk, is buy investing in government bonds. Government bonds have the lowest risk. But, government bonds also have the lowest return on investment. You might be making only 3% or 4% on your investment. Well, inflation is higher than that, which means you are actually losing money.

What is the smartest thing to do with 1 million dollars?

The smartest thing to do with $1 million is to invest it wisely, focusing on both growth and income generation.