Its an age-old question we receive, and to answer it requires that we start with the basics: What is the definition of a credit score, anyway?.

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report. Your credit scores are based on things like how well you’ve paid your bills in the past, how much debt you have, and how long your credit history is.

There are many different credit scoring models, or ways of calculating credit scores. Credit scores are used by potential lenders and creditors, such as: banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Credit scores help creditors determine how likely you are to pay back money they lend.

Its important to remember that everyones financial and credit situation is different, and theres no credit score “magic number” that guarantees better loan rates and terms.

Getting a credit score of 898 is a big deal that shows you know how to handle your credit well. But is 898 a “good” score? If so, where does it fall in the credit score ranges? Let’s look at what makes 898 a great score, how uncommon it is, and what you need to do to get and keep it.

What Does a Credit Score of 898 Mean?

An 898 credit score is firmly in the “exceptional” range, regardless of which credit scoring model is used. The most common credit score ranges are:

- FICO Scores: 300-850

- VantageScores: 300-850

FICO and VantageScore both consider scores above 800 to be exceptional. 898 would be near the top of the range for most scoring models.

Specifically a credit score of 898 means

- You’ll get easily approved for new credit at the best rates

- Lenders see you as representing extremely low risk

- You’ve demonstrated flawless credit management over time

- You’ll qualify for top-tier status with lenders

In short, 898 is an amazing score that unlocks the most favorable lending terms and exemplifies your creditworthiness.

How Rare is a Credit Score of 898?

Less than 1% of consumers have credit scores exceeding 860 according to FICO so a score of 898 puts you in very exclusive company!

It’s exceptionally rare to see someone with a score over 850. Even achieving a perfect 850 is uncommon – only 1.31% of Americans with a FICO Score have hit that high mark.

Reaching near-perfect credit takes years of dedication for most people. That’s why 898 and other top-tier scores are attained by a small fraction of borrowers.

Is 898 the Highest Possible Credit Score?

While 898 is exceptional, it’s not technically the maximum score possible.

Some older VantageScore models go up to 990. There are some that still use old models, so a 990 score might still show up on your credit report. Most now use the same 300–850 scale as FICO.

Additionally, industry-specific FICO Scores range from 250-900. So a credit card-specific FICO Score could potentially be 900 or more.

Realistically though, once you’re in the 850+ range it becomes increasingly difficult to inch your score higher. And for practical purposes, an 898 FICO or VantageScore already qualifies you for the best possible lending terms.

What Does It Take to Reach a Credit Score of 898?

Achieving near-perfect credit takes time and meticulous financial habits. Here are tips to reach and maintain a score of 898:

-

Pay all bills on time, every time. Payment history is the most important factor. Never miss a payment if possible.

-

Keep credit utilization low. Experts recommend keeping overall utilization below 30%. The lower the better.

-

Limit new credit applications. Too many new accounts can lower your score, so only apply if you need to.

-

Monitor credit reports. Verify all information is correct and catch any suspicious activity early.

-

Have long credit history. Letting accounts age and build history over many years helps.

-

Use a mix of credit. Get both installment loans (like mortgages and car loans) and revolving loans (like credit cards).

To get a credit score of 898, you have to work hard and be responsible over time. But many people can reach their goal if they work hard at it, and the money they make makes it worth it!

What Does a Credit Score of 898 Get You?

A stellar 898 credit score unlocks the most favorable loan terms and elite status with lenders. Benefits include:

-

Easy credit approvals – Borrowers with 898 scores sail through application processes.

-

Low interest rates – Exceptional scores qualify you for the lowest rates lenders offer. This saves substantially on credit costs over time.

-

High credit limits – Lenders are comfortable extending larger credit limits given the low risk.

-

Excellent rewards programs – Premium credit cards with lucrative rewards and perks are available options.

-

VIP treatment – Many lenders extend their best service and concierge benefits to top-tier borrowers.

The financial advantages of reaching the 800+ credit score club are significant and wide-ranging. If you have the discipline to achieve an 898, you’ll reap rewards for years to come.

How to Maintain a Credit Score of 898

Reaching the 800s is an accomplishment – but staying there requires vigilance. To maintain excellence:

- Continue paying all bills early or on time

- Keep credit utilization minimal on all accounts

- Be prudent and selective about applying for new credit

- Monitor credit reports to quickly address errors

- Let accounts continue aging and building history

Even one misstep can drop your score when you’re at the top of the range. Consistently stellar financial habits got you to 898 – keeping it there means maintaining the same diligence.

The Takeaway: Is 898 a Good Credit Score?

There’s no debate – a credit score of 898 is exceptional by any standard. This near-perfect score represents flawless credit management and extensive positive history.

While reaching 898 is rare, it’s attainable for those with financial discipline. And it’s well worth the effort. An 898 score unlocks the most favorable lending terms, elite status, and convenience few borrowers enjoy.

So congratulations if you’ve hit this credit score pinnacle! Your financial life is sure to benefit. If 898 remains elusive, take heart – with responsible habits over time, you can steadily improve your score and reap rewards along the way.

What is the average credit score?

As of January 2024 the average credit score in the United States was 701. While this is the average credit score, it falls in the Fair Range.

What are credit score ranges and what is a good credit score?

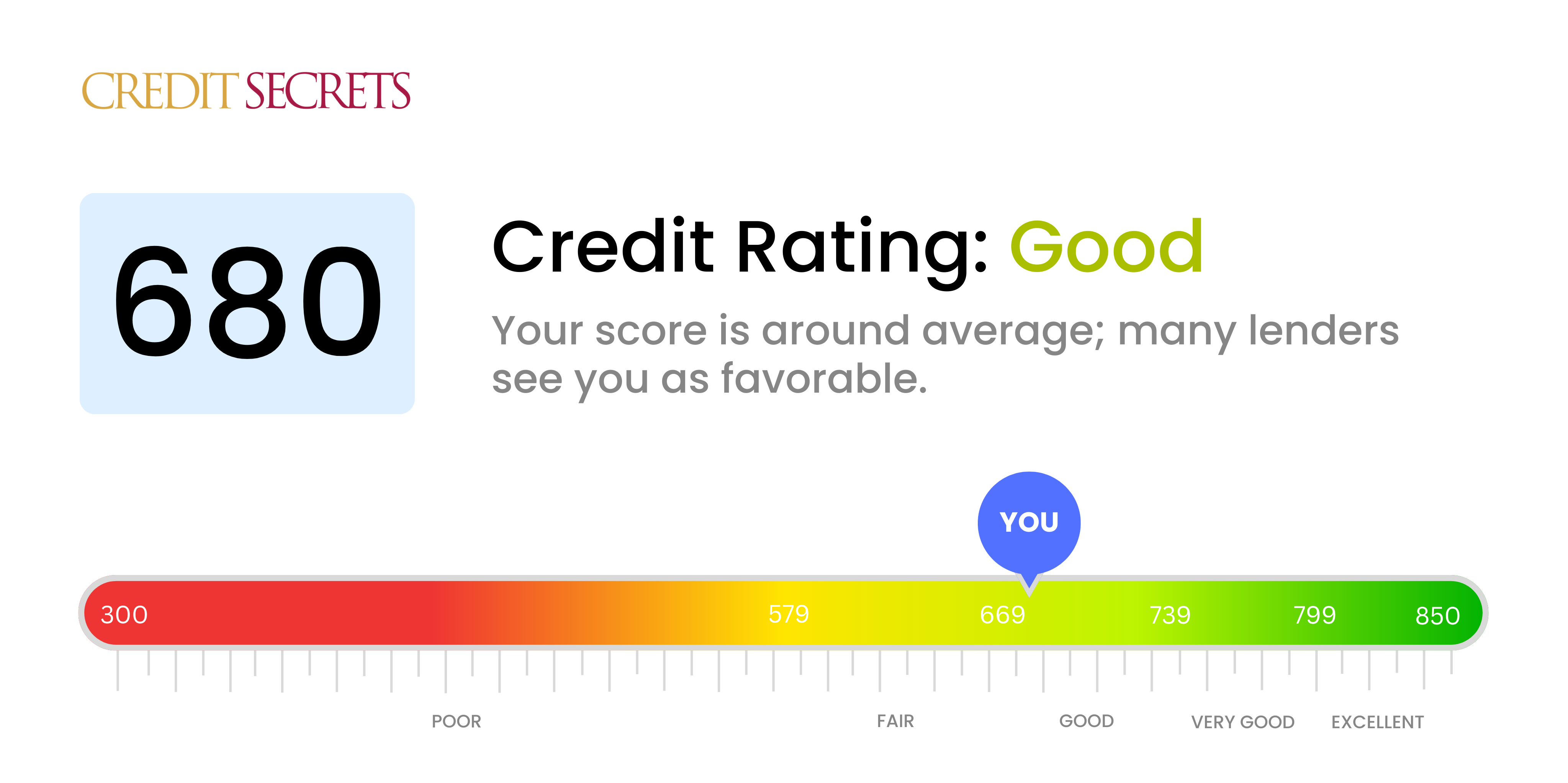

Credit score ranges vary depending on the scoring model. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit. Most credit score ranges are similar to the following:

- 800 to 850: Excellent Credit Score Individuals in this range are considered to be low-risk borrowers. They may have an easier time securing a loan than borrowers with lower scores.

- 740 to 799: Very Good Credit Score Individuals in this range have demonstrated a history of positive credit behavior and may have an easier time being approved for additional credit.

- 670 to 739: Good Credit Score Lenders generally view those with credit scores of 670 and up as acceptable or lower-risk borrowers.

- 580 to 669: Fair Credit Score Individuals in this category are often considered “subprime” borrowers. Lenders may consider them higher-risk, and they may have trouble qualifying for new credit.

- 300 to 579: Poor Credit Score Individuals in this range often have difficulty being approved for new credit. If you find yourself in the poor category, its likely youll need to take steps to improve your credit scores before you can secure any new credit.

Lenders use credit scores along with a variety of other types of information — such as information you provide on the credit application (for example: income, how long you have lived at your residence, and other banking relationships you may have) in their loan evaluation process. Different lenders have different criteria when it comes to granting credit. That means the credit scores they accept may vary depending on their criteria.

Score providers, such as the three nationwide credit reporting agencies (NCRAs)—Equifax®, Experian® and TransUnion®—and companies like FICO® use different types of credit scoring models and may use different information to calculate credit scores. Therefore, credit scores may be different from each other. Not all creditors and lenders report to all credit score providers.

What is a GOOD Credit Score in 2025? What’s the Average Credit Score Overall & By Age / Generation?

FAQ

Is an 898 credit score good or bad?

How to Improve Your 898 FICO Score An 898 credit score is excellent. Before you can do anything to increase your 898 credit score, you need to identify what part of it needs to be improved, plain and simple.

What is a good VantageScore credit score?

The latest VantageScore 3. 0 and 4. This is the same range that the base FICO® Scores use, from 300 to 850. A good score is between 661 and 780. VantageScore doesn’t have industry-specific credit scores, but it has released updated models over the years.

What is an excellent credit score?

An excellent credit score is between 781 – 850 based on the VantageScore ® 3. 0 model. If you want to have great credit, you need to keep up good credit habits like paying your bills on time and keeping your balances low. Beyond “good” and “excellent,” VantageScore ® 3. 0 classifies other ranges as well.

What is a good FICO credit score?

FICO’s industry-specific credit scores have a different range: 250 to 900. But the middle categories are still grouped together, and a “good” FICO® Score for that industry is still between 670 and 739. Scores above that are considered very good or exceptional.

How long does it take to get a VantageScore credit score?

While FICO typically requires at least six months of credit history, VantageScore can create a score with just one month of reported credit activity. FICO scores range from 300 to 850. VantageScore 2.0 ranged from 501 to 990, but the newer VantageScore 3.0 and 4.0 match FICO’s 300 to 850 scale to reduce confusion.

What is a good credit score for a car?

A score of 720 or better puts you in the “excellent” credit score range. Atlanta-based credit expert John Ulzheimer, who has worked for FICO and credit bureau Equifax, says a healthy range depends on what your goals are. If you want to buy a car, you probably need a score of at least 720 to get the lowest interest rates, he says.

How rare is 900 credit score?

In some countries that use other models, like Canada, people could have a score of 900. The current scoring models in the U.S. have a maximum of 850. And having a credit score of 850 is rare. According to the credit reporting agency Experian, only about 1.3% of Americans have a perfect credit score, as of 2021.

What does a credit score of 898 mean?

Credit scores from 660 to 900 are generally considered good, very good, or excellent. There’s no “magic number” to reach when it comes to receiving better loan rates and terms.

What is a realistically good credit score?

For a score with a range of 300 to 850, a credit score of 670 to 739 is considered good. Credit scores of 740 and above are very good while 800 and higher are excellent. For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good.

How rare is credit score over 800?

What it means to have a credit score of 800. A credit score of 800 means you have an exceptional credit score, according to Experian. According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.