If your credit score is 726, you are right in the middle. According to Experian, the average American consumer has a FICO Score of 714 as of 2021, and anything in the range of 670 to 739 is generally considered to be a good credit score.

Most lenders see a credit score of 726 as average, which means you pay your bills on time most of the time. This article will go into more detail about what a 726 credit score means when you apply for loans and what you can do to raise it.

Your credit score is one of the most important numbers in your financial life. It plays a big role in determining whether you can get approved for credit cards, loans, and other financing, and what interest rates and terms you’ll pay. So where does a 726 credit score stand? Is it good or bad?

The short answer is that 726 is considered a good credit score by most lenders, Let’s take a deeper look at what that means,

What is a Good Credit Score?

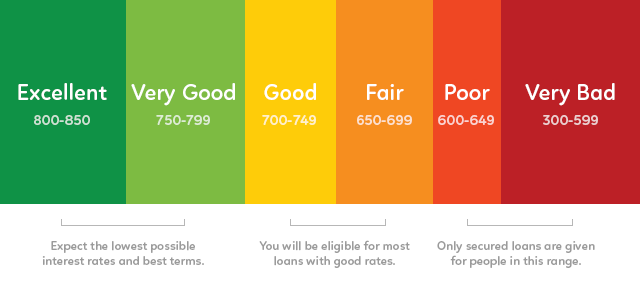

There are several ways to score credit, but the FICO® Score is the one that is most often used. FICO® Scores range from 300 to 850. In general:

- 800-850 is exceptional

- 740-799 is very good

- 670-739 is good

- 580-669 is fair

- Below 580 is considered poor

With a score of 726, you have good credit. The closer you are to 740, the better, because you’ll be able to get more credit with better terms.

According to FICO®, a score of 726 is better than 45% of people. So you’re doing better than nearly half of consumers when it comes to your creditworthiness.

What a 726 Credit Score Means for Lenders

A 726 credit score signals to lenders that you are a low-risk borrower who is likely to repay debts responsibly. Key factors that contribute to your solid score include:

-

A history of on-time payments You have a track record of paying your bills on time each month, which is the most important factor making up your score

-

Reasonable credit utilization. You’re using a moderate percentage of your total available credit limits on credit cards and loans. Keeping your utilization below 30% is ideal.

-

A decent credit history length. You’ve likely had credit for a few years to over a decade. Longer positive histories boost scores.

-

A mix of credit types. There are both installment loans (like car loans) and revolving credit (like credit cards) on your credit report. Using different credit products responsibly helps your score.

While lenders view borrowers with scores in the good range favorably, you may not get the rock bottom interest rates or biggest credit lines reserved for those with excellent credit scores above 740. But you’ll still have many options.

Credit Card Options with a 726 Credit Score

A 726 credit score makes you eligible for most credit cards, including rewards cards with great perks. Here are some of the types of credit cards you can likely qualify for

-

Cash back credit cards – Earn cash back on purchases to redeem for statement credits or deposit into your bank account. Look for standard flat-rate cards or ones with bonus categories like grocery stores or dining.

-

Travel rewards cards – These cards let you earn points on purchases that convert into frequent flyer miles, hotel stays, and other free travel. Some cards also offer perks like airport lounge access.

-

0% intro APR cards – When you have a big purchase upcoming, 0% intro APR cards let you finance it over time without interest charges for 12-18 months. Just be sure to pay off the balance before rates rise.

-

Balance transfer cards – Transfer existing credit card balances to a new card with a 0% intro APR to save on interest and pay down debt faster.

You may not qualify for ultra premium travel cards with annual fees over $500. But there are plenty of rewards cards with reasonable fees or no annual fee at all.

Loan Rates with a Good Credit Score

In addition to credit cards, a 726 credit score makes you eligible for most consumer loans at competitive rates, including:

-

Auto Loans – Good credit scores qualify for the best auto financing rates, whether you’re buying from a dealership or bank. Prime borrowers can often get APRs under 5%.

-

Mortgages – Scores of 740+ get the lowest rates, but 726 is still considered good for mortgage approval. You’ll have options for conventional loans and government-backed FHA, USDA and VA loans.

-

Personal Loans – Unsecured personal loans up to $35-40k are attainable for applicants with good credit. These loans can be used to consolidate debt, fund home improvements or make other large purchases.

While each lender sets their own underwriting standards, a 726 FICO® Score means you should have your choice of high-quality lending options. Shop around for the most competitive rates.

How to Raise Your Credit Score from Good to Excellent

If you’re looking to improve your already good 726 score, here are some tips:

-

Lower credit utilization – Get balances below 10% of limits to boost scores. Consider making extra payments before your statement date.

-

Don’t miss payments – Delinquencies can seriously hurt, so stay on top of due dates and set up autopay if you ever forget.

-

Limit hard inquiries – Each application causes a hard inquiry that dings your score a few points temporarily. Only apply for credit you need.

-

Ask your creditor for a higher limit. Higher limits help you keep your utilization low without having to spend less. Just don’t run up higher balances.

-

Wait for score improvement – It takes time for positive changes to raise your scores. Be patient and keep practicing good credit habits.

With diligent credit management, you can reach that 750+ score tier and qualify for the most favorable lending offers.

How to Check Your Credit Score

The first step is getting updated copies of your credit reports and FICO® Scores from Experian, Equifax and TransUnion. You can get these from sources like:

-

Free reports and scores from Credit Karma – Get updated scores monthly based on your TransUnion and Equifax reports. They also provide free credit monitoring.

-

Free annual credit reports – AnnualCreditReport.com lets you check each report from the major bureaus once per year. No scores provided.

-

FICO® Score packages – Purchase your FICO® Scores and full three-bureau credit reports directly from myFICO.com or Experian.com.

Checking at least annually helps you monitor for errors and track your credit health over time. Make sure to compare FICO® Scores from each bureau since they may differ. With a 726 credit score, you’re doing well, but monitoring is key to catching any dips early and addressing issues.

The Takeaway

A FICO® Score of 726 falls into the good credit range, though it’s on the lower end. Borrowers with good credit have access to most credit products, like credit cards and auto loans, but won’t necessarily get the very best terms reserved for 740+ scores.

Still, a 726 credit score represents responsible credit management overall. As you build your credit history and continue practicing good habits, your score should continue to increase over time. Monitor your scores closely, and you’ll soon be in that excellent score tier.

Can I get a personal loan with an 726 credit score?

You can get a personal loan with an 726 credit score, but not every lender may approve you. Some lenders require scores well into the 700s for consideration. However, depending on the lender, you may get a personal loan with rather competitive terms.

Upstart-powered personal loans are designed primarily for borrowers who may not have top-tier credit but are considered credit-worthy based on non-traditional variables, so you may want to consider checking your loan offers if you’re in the market.

Can I get a credit card with an 726 credit score?

The short answer is yes. You should be able to get a standard (non-secured) credit card with a FICO Score in the realm of good credit scores. Having said that, there are a couple of big caveats.

For one thing, you aren’t likely to qualify for some of the best credit card offers in the market. To get the best rewards credit cards, balance transfer offers, and best 0% APR offers, lenders may want to see excellent credit, with scores significantly higher than yours. You also might not get as high of a credit limit as consumers with higher scores.

Second, your credit score is just one part of the credit card approval process. Lenders will also take your other debts and employment situation into consideration. In fact, it’s not uncommon for consumers in the elite credit tiers to get rejected because their other debts are a bit too high.

Is 726 A Good Credit Score? – CreditGuide360.com

FAQ

What can a 726 credit score get you?

You will likely qualify for most loans with a 726 credit score, and this is true for auto loans. However, it’s important to realize that your credit score can make a big difference in the interest rate you get. And this is especially true in auto lending.

What is a realistically good credit score?

People with credit scores between 300 and 850 have good credit. Scores between 670 and 739 are bad. Credit scores of 740 and above are very good while 800 and higher are excellent. For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good.

Can I buy a car with a 726 credit score?

Can I get an auto loan with an 726 credit score? Absolutely. Your 726 credit score will qualify you for an auto loan, assuming your income justifies it. That being said, it’s important to know that the interest rate you get can depend on your credit score.

How rare is a 750 credit score?

A credit score of 750 is considered “very good” and is above the average credit score in the United States. It’s not as uncommon as having a perfect score of 800 or more, but it still gives you a lot of advantages with lenders.