The Paycheck Protection Program (PPP) has provided a vital lifeline for many small businesses during the COVID-19 pandemic. This program administered by the U.S. Small Business Administration (SBA) offers potentially forgivable loans to help companies retain employees and cover other expenses. But are self-employed farmers and agricultural producers eligible for these PPP loans?

The short answer is yes. Self-employed farmers can absolutely benefit from the PPP program. However, as with any government initiative, there are plenty of nuances, limitations, and specific eligibility criteria to understand. This comprehensive guide will explain everything self-employed farmers need to know about securing a PPP loan.

Overview of PPP Loan Eligibility for the Self-Employed

To begin, the PPP program is open to anyone who is self-employed and can show proof that they were in business as of February 15, 2020. Applicants must show proof that they are self-employed and make money, like Schedule C tax forms, 1099-MISC forms, or bank statements.

The SBA is letting self-employed people use gross income instead of net profit to figure out the loan amount for 2020 PPP loans. The maximum loan amount is 2. 5 times the monthly gross income, up to a maximum of $20,833 for a person who doesn’t have any employees.

Self-employed farmers can qualify for this calculation method They simply need to supply their gross farm income from Schedule F tax forms or other documentation

Special PPP Provisions for Farmers and Ranchers

The PPP program does contain some special provisions that apply to agricultural producers, farmers, and ranchers.

For example, farms or ranches are eligible for PPP loans if:

-

They have 500 or fewer employees.

-

Their average annual receipts are $1 million or less

-

They meet the SBA’s alternative size standard (max $15 million net worth and max $5 million average net income).

In addition, small agricultural cooperatives may receive PPP loans if they satisfy other eligibility criteria.

Only employees who mostly live in the United States can be counted when figuring out payroll for loan purposes. This impacts producers who use H-2A or H-2B visa workers.

Overall, the PPP program is designed to be inclusive of self-employed farmers, just like any other self-employed small business owners. The same opportunities and benefits apply.

Step-By-Step Guide to Applying for a Farmer PPP Loan

Now that we’ve clarified self-employed farmer eligibility, let’s walk through the step-by-step process of actually obtaining a PPP loan:

-

Determine your maximum loan amount. For self-employed farmers, this will be 2.5 times your monthly gross income from your Schedule F, up to $20,833.

-

Compile your supporting documentation. This includes Schedule F forms, 1099-MISC forms, and any other proof that you are self-employed and how much money you make.

-

Find an approved SBA lender. You can apply through any bank, credit union, or other lender that participates in the SBA’s 7(a) loan program.

-

Submit your loan application. Supply all required documentation and complete the lender’s application forms.

-

Receive loan approval and funding. If approved, the lender will fund your PPP loan within days.

-

Use the loan proceeds on eligible expenses. At least 60% must be used for owner compensation.

-

Apply for forgiveness. After spending all funds, apply to have your PPP loan forgiven.

That’s the entire process in a nutshell. It’s fairly straightforward for self-employed farmers who have all their paperwork and finances in order.

What Expenses Are Eligible for PPP Loan Forgiveness?

One huge benefit of PPP loans for farmers is that all or a portion of the borrowed amount can be forgiven. However, to receive forgiveness, borrowers must use the loan proceeds on eligible expenses within a set timeframe.

For self-employed farmers, here are the major categories of eligible expenses:

-

Owner compensation – This refers to the gross income amount used to calculate your maximum loan amount. At least 60% of the total loan must be spent on owner compensation.

-

Employee payroll – If you have hired farm workers, you can use PPP funds to cover employee payroll and benefits.

-

Business mortgage interest – Interest payments for any mortgage on real estate used for your farming operation.

-

Rent and utility payments – Business rent and utility payments for electricity, gas, water, transportation, telephone, or internet access.

-

Operating expenses – General operating expenses such as machinery repairs, cost of goods sold, insurance premiums, etc.

-

Refinancing SBA EIDL loans – If you received an SBA Economic Injury Disaster Loan (EIDL), you can roll that amount into a PPP loan.

As long as you use the PPP funds on any combination of these eligible expenses, you can qualify for partial or even full forgiveness.

What Documentation Is Required for PPP Loan Forgiveness?

To receive forgiveness on a PPP loan, farmers must submit an application to their lender along with documentation verifying eligible expenses.

Required documentation may include:

-

2019 and 2020 Schedule F tax forms

-

Invoices, receipts, and bank records proving eligible expenses

-

Payroll records like Form 941, Form 940, and state tax filings

-

1099-MISC forms for contract workers

-

Lease agreements and utility invoices

-

Records of health insurance premiums and retirement contributions

The more documentation and evidence you can provide, the better your chances of qualifying for full PPP loan forgiveness.

Can Farmers Apply for a Second PPP Loan?

Under the latest COVID-19 relief legislation, some small businesses are eligible to apply for a “Second Draw” PPP loan if they previously received a First Draw loan. This includes self-employed farmers.

The criteria to qualify for a Second Draw PPP loan include:

-

Previously received a First Draw PPP loan and used full amount only on eligible expenses

-

Have no more than 300 employees

-

Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020

-

Maximum loan amount is 2.5 times the average monthly gross income, up to $2 million

So farmers who meet these requirements can essentially double dip and get two rounds of PPP loan funding. This provides an extra layer of support for those still struggling during the pandemic.

The PPP loan program remains a vital lifeline for many small businesses across the country, especially in agriculture. Self-employed farmers can absolutely tap into these funds by following the guidance and criteria outlined here. With proper documentation and reporting, PPP loans can be largely or even entirely forgiven, effectively converting them into non-taxable grants. Hopefully this guide provides farmers with clarity and confidence in pursuing this financial assistance option.

Farms with no employees can still benefit from the Paycheck Protection Program

Self-employed farmers can apply for PPP loan funds based on their 2020 gross income. Application deadline is March 31.

The Paycheck Protection Program (PPP) was created in the CARES Act in 2020 to provide forgivable loans to small businesses, including farms. Much has been made of the provisions that focus on payroll expenses. However, PPP loans are also available to self-employed farmers based on gross income. This was one of several updates provided by the Consolidated Appropriations ACT (CAA) in December of 2020.

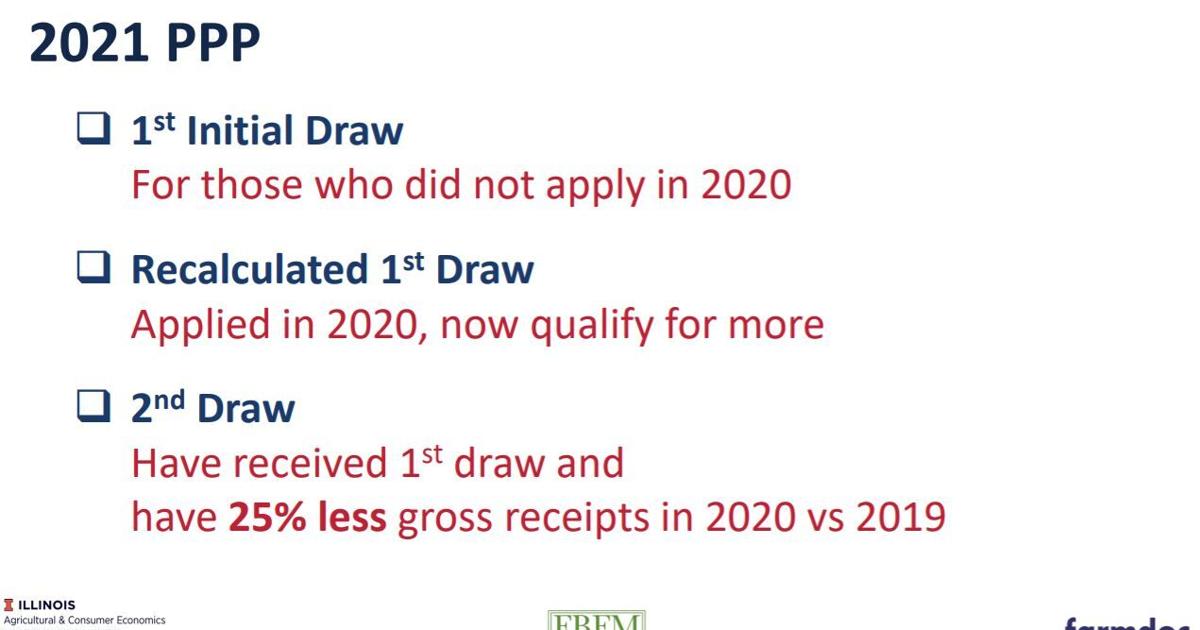

The CAA re-opened applications for First Draw loans to farms that had not yet received one and created a Second Draw loan for farms that had already received a First Draw loan. First Draw loans are open to most farms that experienced a negative economic impact due to COVID-19. Second Draw loans require that the business have experienced a 25% reduction in gross receipts in any quarter of 2020 as compared to the same quarter of 2019.

For sole proprietors and single-member LLCs, the owner compensation portion of new PPP loans is based on the farm’s gross income. The owner compensation portion of the loan amount is 2.5 months of the farm’s total annual gross income. Thus, the maximum amount of this portion of the PPP loan is $20,833. Farms with gross income under $100,000 may be eligible for a lower amount.

First Draw loans under the CARES Act were based on net income, rather than gross income. Sole proprietors and single-member LLCs with First Draw loans remaining unforgiven may be able to have their loan amount recalculated using their gross income.

Other business entities are subject to different loan amount calculations. Partnerships and multi-member LLCs are also eligible for the owner compensation portion of the PPP loan amount. However, their amount is based on net income up to $100,000 per member. Loan amounts for S corporations and C corporations are based exclusively on payroll expenses but the covered employees can include company owners.

Provisions of the PPP loans for the owner compensation portion of the loan amount are essentially the same as the portion for payroll expenses. The funds must be spent on eligible expenses during a period of 8 to 24 weeks after the loan funds are received. At least 60% of the funds must be spent on payroll and/or owner compensation. The remaining funds must be spent on qualifying operating expenses. After the funds are exhausted, the farmer can apply for forgiveness of the loan. As much as 100% of the loan may be forgiven if the funds are spent as required. As a result, the loan is closed without repayment once forgiveness is approved by the Small Business Administration.

The PPP loan program is administered by SBA-approved lending institutions. Applications for the loan funds, as well as for forgiveness, are conducted by these lenders. Interested farmers should contact their lender or check the SBA website for an approved lender. The deadline for both first and second draw loan applications is March 31.

Additional information on the PPP and other coronavirus relief programs can be found at the SBA website. Please contact Michigan State University Extension farm business management educator with concerns or questions.

Farmers are now eligible for PPP

FAQ

Can I still get a PPP loan for self-employed?

Where to apply for PPP. As a self-employed person, you can apply for a PPP loan once the pool of 1,800 qualified SBA lenders opens up.

Did farmers get PPP loans?

Individual SBA loan data revealed that almost 121,000 farm operations applied for a total of $6. 0 billion in PPP loans. That would account for 17 percent of farm businesses presumed eligible based on the 2019 ARMS.

Are farmers exempt from self-employment tax?

Individuals must pay self-employment tax on income derived from the trade or business of farming. This includes income earned by the sharecropper under a sharecropping arrangement.

Who is not eligible for PPP?

Could I be ineligible for a PPP loan even if I meet the requirements? obtained a direct or guaranteed loan from SBA or any other Federal agency that is currently delinquent or has defaulted within the last seven years and caused a loss to the government.