As Social Security Disability attorneys in Tennessee, we often hear from clients who wonder what will happen to their Social Security Disability Insurance (SSDI) benefits when they reach retirement age. Many worry about potential changes to their monthly payments or fear losing benefits entirely.

To better understand this important transition, continue reading or contact our legal team today at (865) 299-7080.

When you’re receiving Social Security Disability Insurance (SSDI) benefits, one of the most common questions is about what happens when you get older. The transition from disability to retirement benefits happens automatically, but understanding when and how this occurs can help you better plan for your future.

The Simple Answer: Full Retirement Age

Social Security disability benefits automatically convert to retirement benefits when you reach your full retirement age This transition happens seamlessly without requiring any action on your part,

According to the Social Security Administration (SSA) the law does not allow a person to receive both retirement and disability benefits on one earnings record at the same time. This means that once you reach full retirement age your SSDI benefits will convert to regular Social Security retirement benefits.

What Is Full Retirement Age?

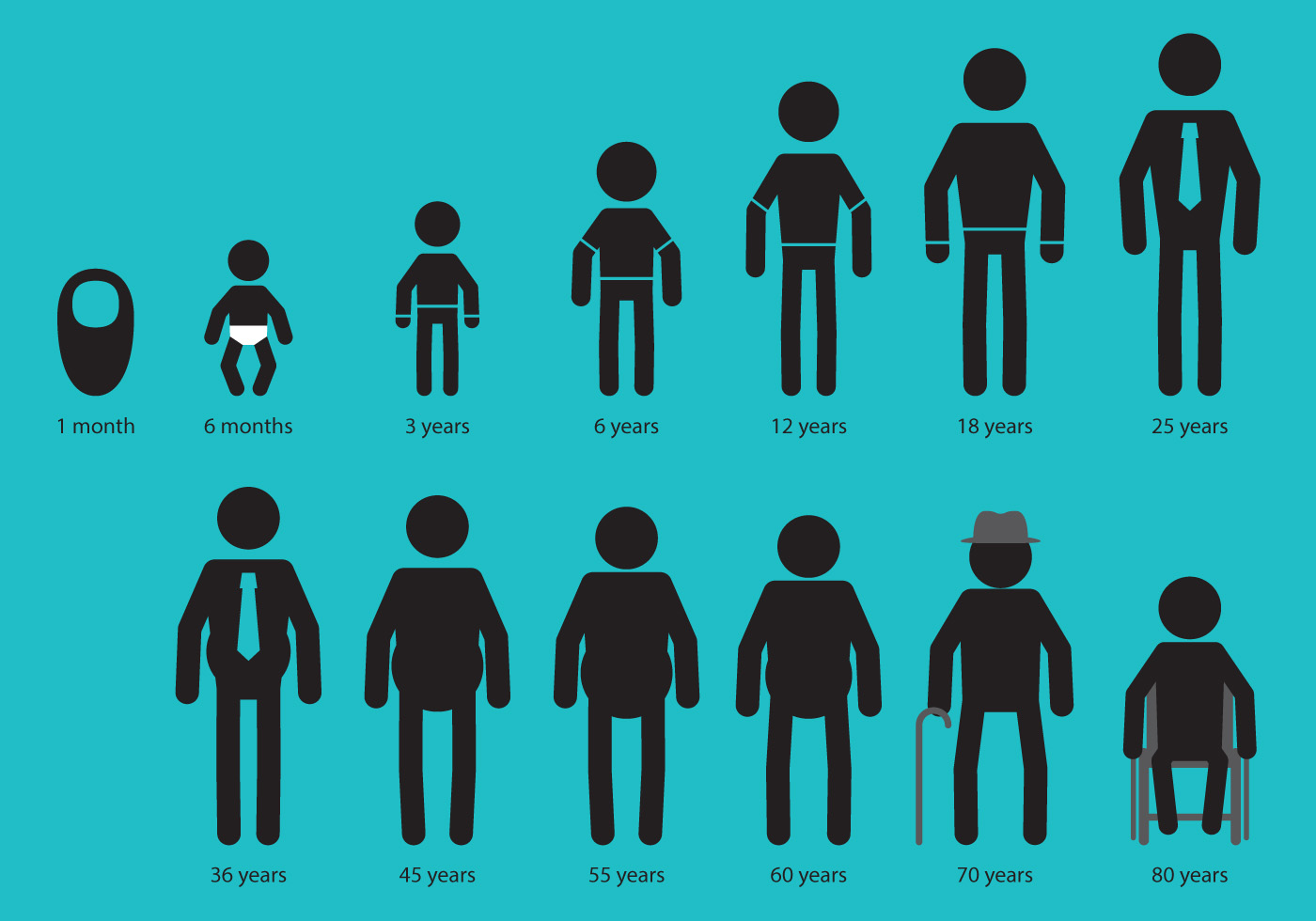

Your full retirement age depends on when you were born:

- For people born before 1937: Full retirement age is 65

- For people born in 1957: 66 years and 6 months

- For people born in 1958: 66 years and 8 months

- For people born in 1959: 66 years and 10 months

- For people born in 1960 or later: 67 years

If you were born in 1958 and are turning 65 in 2023, you’ll need to wait until you’re 66 years and 8 months old before reaching full retirement age when your SSDI benefits will convert to retirement benefits.

Will My Benefit Amount Change?

For most SSDI recipients, the amount of your monthly payment will remain the same after converting to retirement benefits. When you become eligible for disability benefits, Social Security sets your benefit amount as if you had already reached full retirement age.

There is one exception: if you’re receiving workers’ compensation or a public disability benefit from a government job where you didn’t pay Social Security taxes. These additional benefits might reduce your SSDI payment amount, but that reduction may end when you reach full retirement age, potentially increasing your monthly check.

5 Important Things to Know About the Transition

1. The Process is Automatic

You don’t need to do anything when your SSDI benefits convert to retirement benefits. The Social Security Administration handles this transition automatically, and you’ll continue to receive your monthly check just as before.

2. You Cannot Collect Both Benefits Simultaneously

It’s important to understand that you cannot receive both Social Security disability and retirement benefits at the same time on the same earnings record.

3. Early Retirement Doesn’t Apply to SSDI Recipients

While most people can choose to take reduced Social Security retirement benefits as early as age 62, if you’re collecting SSDI, you won’t be able to convert your benefits to retirement benefits until you reach your full retirement age.

4. Earning Limitations are Removed

When receiving SSDI benefits, there are strict limits on how much you can earn through work before it affects your benefits. Once your benefits convert to retirement benefits, these earnings limitations are lifted. This means you can work part-time and earn additional income without impacting your monthly benefit amount.

5. Medicare Eligibility Continues

If you’ve been receiving SSDI for at least 24 months, you’re already enrolled in Medicare, even if you’re under 65. When your disability benefits convert to retirement benefits, your Medicare coverage will continue without interruption.

Understanding the Difference Between SSDI and Regular Social Security

SSDI and regular Social Security retirement benefits have different purposes but are both administered by the Social Security Administration.

SSDI (Social Security Disability Insurance)

- Provides benefits to people who cannot work due to a disability

- Requires having enough work credits and recent work history

- Has strict medical eligibility requirements

- Includes a waiting period for Medicare eligibility (typically 24 months after SSDI approval)

Regular Social Security Retirement Benefits

- Provides benefits to retirees based on age and work history

- Calculated based on lifetime earnings

- Can be taken as early as age 62 (with reduced amounts) or delayed until age 70 (with increased amounts)

- Medicare eligibility begins at age 65

Financial Planning for the Transition

As you approach full retirement age, it’s a good idea to review your overall financial situation. Here are some steps to consider:

-

Verify your information: Make sure your personal information is current with the Social Security Administration.

-

Review your benefits statement: Check your expected income to confirm what you’ll receive after the transition.

-

Create a budget: Consider any changes in expenses or additional income sources you might have in retirement.

-

Understand Medicare options: Review your Medicare coverage options, including whether a Medicare Advantage plan might benefit you.

-

Consider additional retirement income: Evaluate any other retirement income sources you might have, such as pensions or retirement accounts.

Common Questions About the Transition

Can I switch to retirement benefits before full retirement age?

No, if you’re receiving SSDI benefits, you must wait until your full retirement age for the conversion to retirement benefits to occur.

Will I need to reapply for benefits when I reach full retirement age?

No, the transition from SSDI to retirement benefits happens automatically without any action required on your part.

Will my Medicare coverage change when my benefits convert?

No, your Medicare coverage will continue without interruption when your SSDI benefits convert to retirement benefits.

Can I work without losing my benefits after the conversion?

Yes! Once your benefits convert to retirement benefits, the earnings limitations that apply to SSDI recipients are lifted. You can work and earn additional income without affecting your Social Security retirement benefits (though certain earnings limits may apply if you’re under full retirement age).

How Work History Affects Your Benefits

Your work history plays a crucial role in determining both your eligibility for SSDI and the amount of your benefits.

Work Credits Requirement

To qualify for SSDI, you need to have earned enough work credits through your employment history. Typically, you need 40 credits, with 20 earned in the last ten years before becoming disabled. However, younger workers may qualify with fewer credits.

These same work credits will determine your eligibility for retirement benefits when the conversion occurs.

Impact of Employment Gaps

Gaps in your employment history can affect your benefit amounts. Since benefits are calculated based on your earnings record, inconsistent work history or periods of low earnings can result in lower monthly payments.

Conclusion

The transition from Social Security Disability Insurance to regular Social Security retirement benefits happens automatically when you reach your full retirement age (between 66 and 67 for most people today). This change doesn’t require any action on your part, and for most beneficiaries, the payment amount remains the same.

Understanding this process helps you plan effectively for your financial future. The key points to remember are:

- SSDI benefits convert to retirement benefits at full retirement age

- The conversion happens automatically

- Your benefit amount usually stays the same

- Work restrictions are lifted after conversion

- You can’t receive both disability and retirement benefits simultaneously

By staying informed about these changes, you can better manage your finances and make the most of your Social Security benefits throughout your retirement years.

Remember, if you have specific questions about your situation, it’s always best to contact the Social Security Administration directly or consult with a financial advisor who specializes in retirement planning.

When Does SSDI End?

Your SSDI benefits don’t simply stop when you get older. Instead, they smoothly convert to retirement benefits when you reach your full retirement age. This conversion happens automatically, and most importantly, it won’t change the amount of money you receive each month.

When Does Social Security Disability Convert to Regular Social Security Retirement Benefits?

Many people ask us, “Will my SSDI change when I turn 62?” While 62 is the earliest age you can claim Social Security retirement benefits, your SSDI benefits will not automatically convert. This is because the conversion only happens when you reach full retirement age.

62 is the age when you can claim early retirement benefits. If you claim these benefits, your monthly payments will be reduced by a percentage until you reach full retirement age. This age varies depending on your birth year.

For most people receiving SSDI today, the full retirement age falls between 66 and 67 years old. If you were born in 1960 or later, your full retirement age is 67. This is when your disability benefits will convert to retirement benefits.

Full retirement ages for other birth years are:

- 1937 or earlier: 65 years old

- 1938-1942: 65 years old plus 2-10 months, depending on the year

- 1943-1954: 66 years old

- 1955-1959: 66 years old plus 2-10 months, depending on the year

It should be noted that you can collect both SSDI and early retirement benefits at the same time. However, you cannot collect SSDI on top of full retirement benefits.