“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board is made up of financial experts whose job it is to make sure that all of our content is fair and unbiased.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our content is written by professionals with a lot of experience and is edited by experts in the field to make sure it is fair, correct, and reliable.

Our loans reporters and editors cover the topics that people care about most, such as the different types of loans available, the best rates, the best lenders, how to pay off debt, and more. This way, you can feel good about putting your money to work. Bankrate logo.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

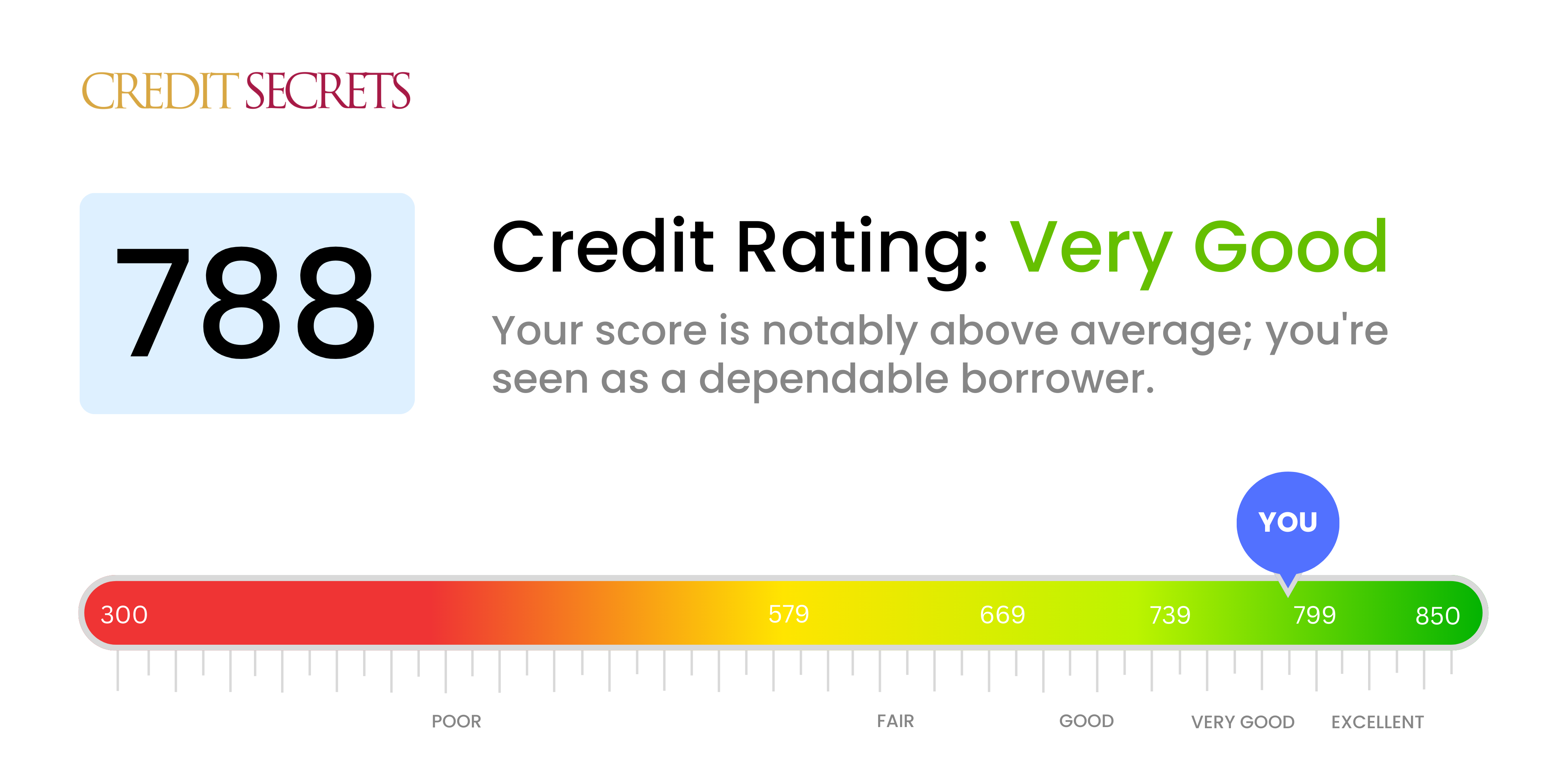

Most lenders think that a credit score of 788 is great. Your high credit score means you should be able to easily get a car loan with a low interest rate. Here’s what to expect when you apply for auto financing with a 788 credit score:

What Credit Score is Needed for a Car Loan?

Lenders don’t have a set minimum credit score that you need to get a car loan. But your credit score tells lenders how likely it is that you will pay back the loan. Lenders see you as less of a risk when your score is high.

At least a “good” credit score in the 660–760 range is what most lenders want. Most of the time, though, you need a credit score above 760 to get the best rates.

According to Experian data, the average credit score for a new car loan is 748 and the average for a used car loan is 684. So with your 788 score, you are well above what most buyers have when financing a vehicle.

Credit Score Ranges and Interest Rates

Your 788 credit score is in the “excellent” range according to FICO and VantageScore, which are the two most common.

Here are the credit score ranges and the average interest rates borrowers can expect in each tier

- 300-579 (“very poor”): 17.97% APR for new cars, 22.57% for used

- 580-669 (“fair”): 12.38% for new, 16.72% for used

- 670-739 (“good”): 7.77% for new, 10.79% for used

- 740-799 (“excellent”): 4.11% for new, 5.83% for used

- 800-850 (“exceptional”): 3.07% for new, 4.03% for used

As you can see, your 788 score puts you in line for the lowest rates. You can expect average interest rates around 4% for a new car and 5-6% for a used car loan.

Auto Loan Approval Odds with a 788 Score

FICO provides data on the percentage of auto loan applications that get approved based on the applicant’s credit score range:

- 300-579: 45% approval odds

- 580-669: 55% approval odds

- 670-739: 70% approval odds

- 740-799: 85% approval odds

- 800-850: 91% approval odds

So with your 788 credit score, you have a 91% chance of being approved for the car loan you want. Lenders see you as an extremely low-risk borrower.

Other Factors Affecting Your Auto Loan Terms

While your credit score is important, lenders also consider other factors when setting your interest rate and loan terms:

- Down payment amount: The more you put down, the less risk for the lender.

- Loan term: Shorter terms pose less risk.

- Income: Lenders want to see you can afford the payments.

- Existing debts: Too many balances can signal increased risk.

- Vehicle type: New or used, luxury or economy – risk varies.

But even considering these other criteria, your excellent 788 score will qualify you for the top rates and terms the lender offers.

Should I Shop Around for Better Rates?

Even with top-tier credit, it can pay to shop around with multiple lenders. While one may approve you at 4% interest, another may go as low as 3% due to increased competition for excellent borrowers.

Getting pre-approved by several lenders also gives you bargaining power at the dealership’s finance office. If they can beat the rate you already have from a bank, great. If not, you can decline their financing offer without pressure.

Credit Score Needed for Specific Auto Loan Programs

Some special auto loan programs or incentives have minimum credit score requirements:

- 0% financing deals: Usually 740+

- Lease deals: 680-700+

- Employee/affinity discounts: 670+

- Special rebates: No minimum score but higher is better

Your 788 score surpasses even the top requirements, making you eligible for the full range of promotional financing offers.

How Much Can I Borrow with a 788 Credit Score?

As a general guideline, you can comfortably afford a monthly car payment up to 10-15% of your gross monthly income with a credit score in the mid-high 700s. For example:

- Gross monthly income: $5,000

- 15% of income: $750

- Maximum affordable payment: $750

This payment cap accounts for not just your loan amount but also factors in insurance, gas, and maintenance costs.

To find the maximum loan amount, use an auto loan calculator and input your desired loan term, interest rate, and payment cap.

For example, with excellent credit, a 60-month new car loan at 4% interest and a $750 monthly payment, you could potentially borrow up to $35,000. Your exact loan maximum will depend on the figures for your situation.

Maintaining Your Excellent Credit Score

Now that you’ve worked hard to achieve an excellent 788 credit score, you want to keep it high over the life of your auto loan to qualify for the best rates on future financing needs. Here are some tips:

- Make your car payments on time every month

- Keep credit card balances low (below 30% of limits)

- Don’t open too many new accounts right away

- Check for any errors on your credit reports

- Monitor your credit score monthly

A car loan is a great way to build positive payment history with an installment loan. As long as you make all your payments on time, your 788 score should hold steady or even improve while paying off your auto loan. Enjoy the perks and savings your excellent credit provides!

Why does the interest rate matter on a car loan?

Interest is the price you pay each month to borrow money. The higher your interest rate, the more you pay overall for your loan. Even reducing your interest rate by a fraction of a percentage point can save you hundreds of dollars.

For example, we calculated the cost of a car loan with a $30,000 balance and a term of 60 months. A borrower with excellent credit will pay around $150 less per month than a borrower with poor credit — and may end up saving over $11,000 in interest over the life of the loan.

| Average new car loan interest rate | Monthly payment | Total interest paid |

|---|---|---|

| 5.18% | $569 | $4,117 |

| 6.70% | $590 | $5,388 |

| 9.83% | $635 | $8,094 |

| 13.22% | $686 | $11,159 |

| 15.81% | $727 | $13,591 |

Economic and market conditions

Broader market factors also play a role in setting the industry’s minimum rates. When the federal funds rate is high, as dictated by the Federal Reserve, it costs lenders more to borrow money. In turn, you are likely to face higher interest rates.

Following three cuts in 2024, the current fed funds target rate is 4.25 to 4.5 percent. These cuts came after nearly two years of steady rate hikes and should result in lower rates for most financial products, including auto loans. While the Federal Reserve didn’t raise or lower the rate during the most recent FOMC meeting in June, there may be changes over the course of the year, so keep an eye on the market.

If you have strong credit, experts forecasted auto loan rates may see a decent decrease through 2025. However, those with poor credit are less likely to see relief. If that’s you, focus on comparing bad credit auto loan rates.

What Credit Scores Do Dealerships Use For Auto Loans?

FAQ

Can a 788 credit score get a car loan?

Most auto lenders will lend to someone with a 788 score. With Very Good credit scores, you should qualify for the best interest rates they have to offer. However, lenders also look at other factors, so there’s no guarantee that you’ll be approved for a loan. See also: 10 Best Auto Loans for Good Credit.

Can you get a mortgage with a 788 credit score?

Nearly 70% of first mortgages go to borrowers with credit scores below 780, so you should be able to finance your home purchase without issue. Student loans are some of the easiest loans to get if you have a credit score below 788. About 90% of applicants are approved.

How do I get a 788 credit score?

There’s no secret to getting a 788 credit score. Rather, it simply requires consistency and commitment. You should pay your bills on time, only use a small amount of the credit you’re given, and try to make any mistakes you’ve made look like they were rare rather than normal.

How much is a 750 credit score for a car loan?

A buyer with a 750 FICO score may qualify for $85000 at 96 months, but a 650 score may be maxed out at $35000 for 72 months. In the credit score auto loan calculator, move the time and money squares all the way to the right to see your highest payment. How much does interest rate affect my monthly payment?.

Can you get a credit card with a 781-850 credit score?

The current average APR rate for a person with a 781-850 credit score when buying a new car is 4.75% and 5.99 when buying a used car. It’s possible to get a credit card with no credit, but you need to know which types of accounts to apply for (and which applications to avoid as well). A credit score between 661 and 780 is considered Prime.

Is 850 a good credit score for a car loan?

If your credit score is between 781 and 850, you’re classed as having Super Prime credit. 850 is the highest possible credit score on the VantageScore and FICO rating systems. People with Super Prime credit scores are likely to be offered the lowest interest rates on a car loan, as lenders will see them as very financially responsible.

What credit score is needed for a $30,000 car loan?

Quick Answer. While it’s possible to get an auto loan with nearly any credit score, most lenders are looking for buyers in the prime credit score range with a credit score of 661 or above for the best terms and rates.

What can I do with a 788 credit score?

People with credit scores of 788 typically pay their bills on time; in fact, late payments appear on just 8.6% of their credit reports. People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms.

What credit score is needed for a $20,000 car loan?

There is no minimum credit score required to buy a car, but most lenders have minimum requirements for financing. Most borrowers need a FICO score of at least 661 to get a competitive rate on an auto loan.

What is the minimum credit score to get a car?

According to Car and Driver, “Most used auto loans go to borrowers with minimum credit scores of at least 675. For new auto loans, most borrowers have scores of around 730. The minimum credit score needed for a new car may be around 600, but those with excellent credit often get lower rates and lower monthly payments.”Sep 26, 2024