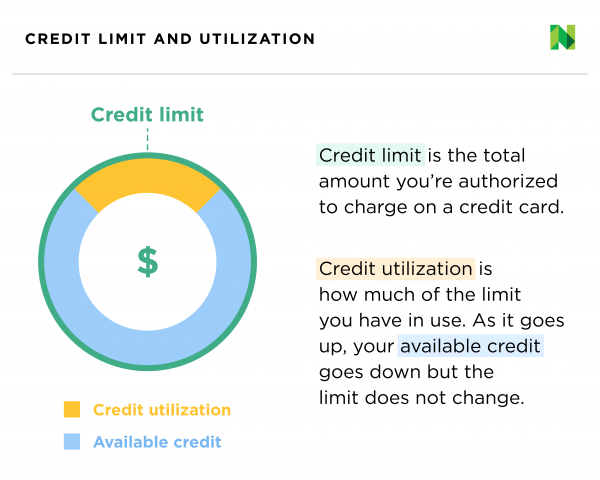

Credit limit is the total amount you can charge, while available credit is the unused amount within your limit.

The products shown on this page are mostly or entirely from our advertising partners. They pay us when you click on one of their links and then do something on our site. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

You’ve applied for a credit card and were approved (congrats!), but that doesn’t mean you have unlimited spending power.

It’s important to know your card’s credit limit, which is the maximum amount you can spend on your card. Also important: your available credit, which is the limit minus your current balance. These numbers both play a big role in your credit score.

The amount of available credit on your credit card is how much you can spend before you reach your credit limit. But should you use all of that available credit, or is it better to only use some of it?

It might be tempting to use up all of your credit, especially if you need to buy something big. But doing so can negatively impact your credit scores. Having credit that you don’t use can help your credit score, though.

We’ll talk about how available credit works, when you should (and shouldn’t) use it all, and how it can make your credit score worse.

What is Available Credit?

This term refers to the amount of credit you can still use on a credit card or line of credit. To find it, take your credit limit and take away your current balance.

For example, if your credit card has a $5,000 limit and your current balance is $2,000, your available credit is $3,000.

As you use your card, your available credit decreases. When you make payments, it increases. If you pay your balance in full each month, your available credit resets to the full credit limit at the start of each billing cycle.

Available credit gives you a real-time look at how much room you have left to spend on that account before maxing it out Monitoring it can help prevent overspending and exceeding your limit

Should You Use All Your Available Credit?

Technically, you can spend up to 100% of your available credit. But doing so regularly can damage your credit. Here are a few pros and cons to consider:

Pros

- You can make larger purchases without exceeding your limit

- Temporary usage won’t hurt your credit if you pay it off quickly

Cons

- Puts your credit utilization ratio close to 100%, severely hurting your scores

- Risk of debt spiral if you can’t pay off the purchases quickly

- Potential fees and penalties for exceeding your limit

To avoid negative impacts, experts recommend keeping your utilization below 30%. On a $5,000 limit card, that means keeping your balance under $1,500.

Only use all of your available credit if absolutely necessary. And have a plan to pay it off ASAP before interest accrues.

How Available Credit Impacts Your Credit Scores

The biggest factor available credit affects is your credit utilization ratio. This compares how much of your total revolving credit limits you’re using.

The lower your utilization, the better for your scores. As you use more available credit, your utilization creeps upward.

Going over 30% can start to negatively impact your credit. Maxing cards out leads to an even bigger drop.

That’s why it’s important to only use the available credit you need. Keeping your utilization low demonstrates you’re able to manage credit responsibly.

Tips for Managing Your Available Credit

Here are some tips to make the most of your available credit without hurting your credit scores:

-

Monitor usage: Check available credit regularly to avoid surprises or overspending.

-

Use budgeting tools: Apps can help track spending versus available credit.

-

Make payments early: Paying before your due date frees up credit sooner.

-

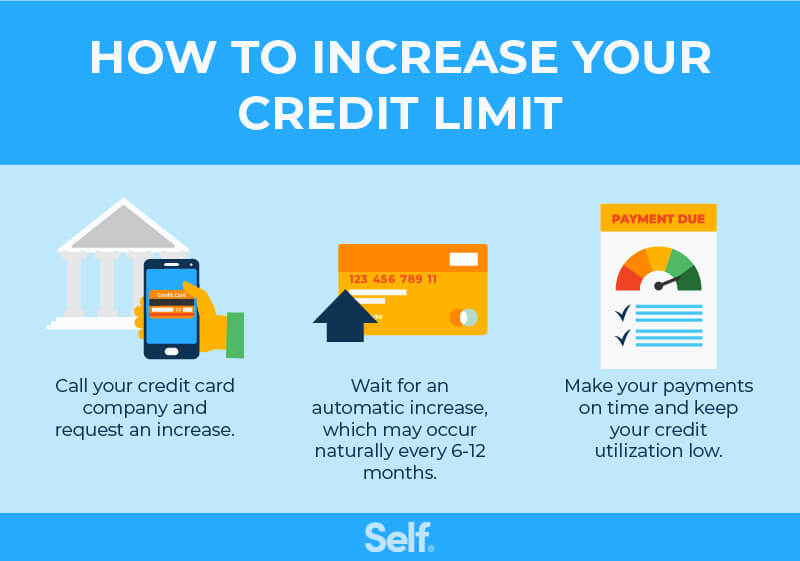

Ask for limit increases: More available credit means room for higher utilization when needed.

-

Have a payoff plan: If you use all your credit, know how and when you’ll pay it off.

-

Use cash or debit if possible: Less credit usage means lower utilization.

-

Divide payments between multiple cards: Spreading spending across cards keeps individual utilization lower.

The key is using your available credit strategically. Limit usage to necessities, pay balances quickly, and keep overall utilization low.

What Happens If You Spend Beyond Your Available Credit

If you spend more than your remaining available credit, you will exceed your credit limit. This can lead to fees, penalties, and other consequences:

-

Declined transactions: The purchase taking you over the limit may be declined.

-

Over-limit fees: Most issuers charge a fee for exceeding your limit, typically $25-38.

-

Higher APR: The card issuer may raise your interest rate for going over.

-

Lowered credit limit: Your limit could be decreased for consistently maxing out the card.

-

Closed account: In severe cases of overspending, the issuer may close your account entirely.

-

Credit score impact: Maxing out cards and exceeding limits causes significant credit score damage.

Aside from emergencies, it’s wise to avoid spending past your available credit. The short-term gain isn’t worth the long-term consequences. Monitor your usage and pay balances promptly.

FAQs About Available Credit Usage

Can I use all my available credit for a large purchase?

You technically can, but it’s often not recommended. It’s better to only use what you can quickly repay before interest charges accrue. Consider other financing options for large purchases.

What is a good percentage of available credit to use monthly?

To avoid hurting your credit, keep usage below 30% of your total available credit. Ideally 10% or less is best.

If I pay off my balance completely does that free up available credit?

Yes, paying your balance down to $0 will replenish your available credit back to the full credit limit at the start of the next billing cycle.

What if I have high available credit but low usage, does that help my credit?

Yes! Having access to more available credit than you use demonstrates responsible usage, helping your credit scores.

Can I increase my available credit without a hard credit check?

Some issuers may increase your credit limit without doing a hard inquiry, which won’t hurt your credit. But most do hard checks when considering limit increases.

The Bottom Line

Available credit gives you spending flexibility but isn’t meant to be used all the time. Keeping your utilization low is key for maintaining good credit.

Only use most or all of your available credit when absolutely necessary. Have a repayment plan and focus on bringing balances down quickly. Monitor your usage routinely and ask for occasional credit limit increases.

Managing available credit wisely takes some work. But it allows you to strategically use credit while also keeping your credit scores in good shape.

Credit limit and your credit score

Knowing your credit limit is important because credit utilization — how much of your credit limits youre using — is a major credit scoring factor.

There’s no harm in keeping your credit utilization ratio low. In fact, people who use very little of their credit limits tend to have the best credit scores. But if you use too much of your credit, you could be viewed by potential lenders as a higher risk, which could complicate the process of applying for things like a car loan or home loan.

According to the 2030 rule, you should not use more than 2030% of your credit limit. This will help you keep your debt-to-credit ratio high. Staying under 10% is even better.

The 30% rule works like this in real life: if you have a credit card with a $1,000 limit, it’s best not to have more than $300 in balance at any given time. One way to keep the balance below this threshold is to make smaller payments throughout the month.

You can calculate your credit utilization per card or overall.

In the video below, Nerd Sally French shares thoughts on how many cards to have, with helpful information on credit limits and credit utilization starting at time marker 6:07.

What does available credit mean?

Your available credit is the amount thats left once you subtract your balance from your credit limit on any given card. For example, say your credit limit is $1,000 and you paid the balance in full last billing cycle. If you’ve spent $300 this billing cycle, you still have $700 in available credit before you hit your limit. But it’s important to note that “maxing out” your credit card is not recommended, because it will damage your score.

If you pay off your credit card in full, the available credit resets back to $1,000. But if you sometimes carry a balance on the card, keep your credit limit in mind so that you don’t suffer credit score damage or get into debt too difficult to recover from.