The purpose of this content is to teach, so it may include details about products, features, or services that SoFi does not offer.

When you piggyback on someone else’s credit card, you become an authorized user on their account. Usually, this is in service of establishing credit for the first time or building your credit score.

While piggybacking credit can serve as an important tool as you establish firm financial footing, there are also situations in which it can be risky. Because of this, it’s important to understand how piggyback credit works before using this strategy.

Piggybacking credit by becoming an authorized user on someone else’s account can be an attractive option for building your credit history and improving your credit score. However, there are some risks with piggybacking that mean it could actually hurt your credit instead of helping it. In this article, we’ll take an in-depth look at how piggybacking works, who can benefit from it, and the potential downsides so you can make an informed decision.

What is Piggybacking and How Does It Work?

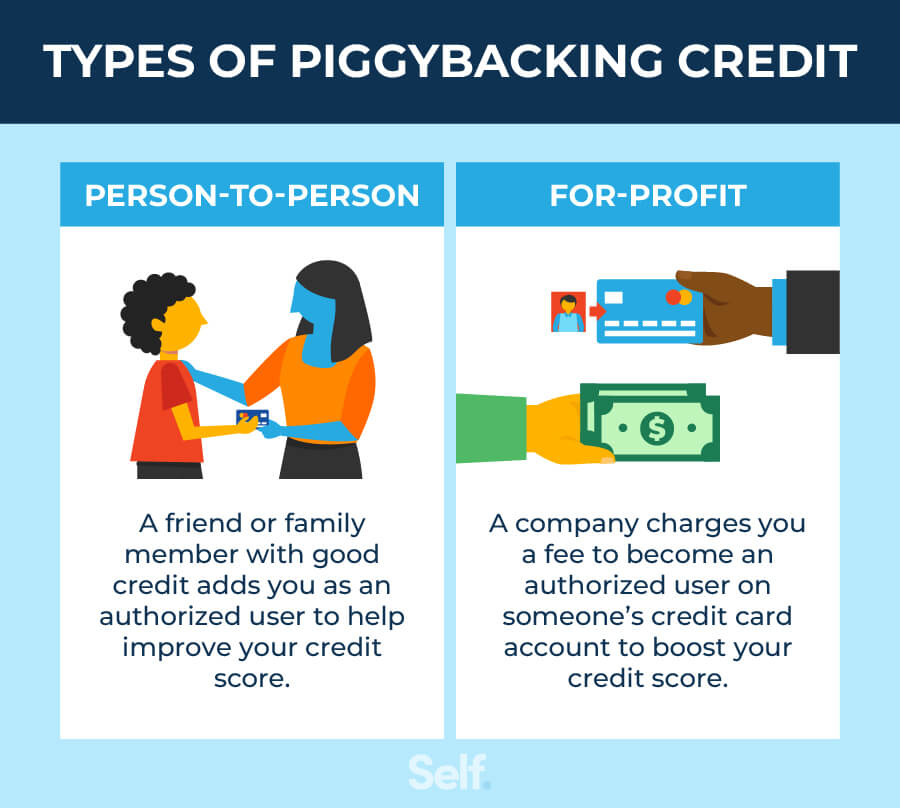

Piggybacking simply means becoming an authorized user on someone else’s credit card for the purpose of improving your credit score and history

There are a few ways this can be done

-

Asking a family member or friend with good credit to add you as an authorized user on their credit card account

-

Paying a company to match you with a stranger who will temporarily add you as an authorized user on their account.

-

Purchasing “tradelines” from a company that connects buyers and sellers of authorized user accounts.

In all cases, the authorized user’s credit report shows the full payment history of the primary cardholder. This can help things like length of credit history and on-time payments.

Many advocates argue this can help democratize access to credit by letting people benefit from others’ good credit. However, some tactics are controversial and there are risks involved.

Who Might Benefit From Piggybacking?

Piggybacking can be most useful for those with:

-

No credit history – Piggybacking can help establish a history.

-

Short credit history – Adding aged accounts can increase the length.

-

Limited number of accounts – Increasing your number of accounts helps.

-

Late payments or collection accounts – The AU’s good history can offset those.

-

Low credit scores – Boosting factors like payment history can increase scores.

-

Difficulty getting approved for credit – Piggybacking can make approval easier.

So people who are new to credit or who have made some mistakes can benefit the most from piggybacking. Those with already good, long credit histories likely won’t see dramatic improvements.

Can Piggybacking Hurt Your Credit?

Yes, there are some risks to be aware of that could mean piggybacking ultimately damages your credit instead of helping it.

Derogatory Marks on the Account

There will be late payments, high balances, and other problems on the main cardholder’s account that will also show up on your report. This can drag down your score instead of improving it.

Removal From the Account

If the main cardholder decides to take you off as an authorized user, your history will be cut back again, wiping out any benefit.

Lower Average Age of Accounts

Adding a new authorized user account can decrease your average age of credit history, negatively impacting your score.

Credit Limit Decreases or Account Closures

If a lender gives you credit based on a piggybacked score and your score goes down after the AU status ends, they may lower your limit or close your account.

Legal Issues

While legal, some tactics like paid piggybacking could be viewed as misrepresentation by lenders. This could get you into hot water.

Fraud Risks

Giving your personal info to piggybacking companies exposes you to fraud and identity theft risks.

Overextension

If piggybacking makes a lender give you more credit than you can handle, it can lead to getting overextended and damaging your credit with missed payments.

Tips to Avoid Potential Downsides

If you want to try piggybacking, here are some tips to minimize risks:

-

Carefully vet any paid piggybacking companies and check reviews. Avoid any that seem sketchy or use fake SSNs.

-

Only piggyback with extremely trustworthy friends/family with excellent credit.

-

Review the primary account’s history first to check for any negatives.

-

Calculate how it will impact your average age of credit before adding an account.

-

Start with a small limit if getting your own card to avoid overextension.

-

Monitor your reports to ensure it’s helping more than hurting.

-

Have a backup plan to remove the AU if it starts damaging your credit.

The Bottom Line

When done carefully, piggybacking can give your credit a valuable boost. But it also carries risks that could set your credit back if you aren’t cautious. Weigh the pros and cons carefully for your situation before moving forward. Monitoring your credit and planning for potential downsides can help minimize risks.

What Is For-Profit Piggybacking?

Here’s where things get tricky. If you don’t have a friend or family member who’s willing to make you an authorized user on their account, you can seek out the help of a tradeline service. A tradeline is another word for a revolving credit account or installment loan on your credit report.

The tradeline service can match you with a stranger who has good credit, and, for a fee, they’ll add you to their account. The cardholder receives a portion of that money, and you won’t receive a physical card or access to the account.

Tradeline services haven’t been without controversy. One reason is that buying a tradeline might be seen as a way to trick lenders into thinking you have better credit than you really do. If perceived as fraud, this could have some legal ramifications.

Engaging a tradeline service can also be pricey. There are different types of credit, and the cost can range from a few hundred to a few thousand dollars.

It’s also important to understand that you’re only authorized on the cardholder’s account for a short period of time. Your credit score may go up at first, but it may go down again when the account is closed.

How Does Credit Card Piggybacking Work?

Before explaining how piggybacking works, it’s worth considering why your credit score is important. Your credit score is a three-digit number, typically between 300 and 850, that provides an indicator of your creditworthiness. Credit card companies, banks, and other lenders will look at your score to determine how risky it is to extend credit to you.

Borrowers with the highest scores are seen as the lowest risk. In other words, they are the most likely to pay their bills on time and the least likely to default on their debt. Lenders are often willing to extend the most favorable credit card terms and conditions, including interest rates, to these borrowers.

Individuals with lower scores are seen as presenting higher potential risk. Their low scores indicate that they’ve likely had trouble paying their bills on time in the past. As a result, lenders may be less willing to extend credit. If they do, it may come with higher interest rates to compensate the lender for the increased risk they’re taking on.

If you don’t have a credit history or are looking to build yours, credit card piggybacking can help. That’s because when you become an authorized user on someone else’s card, their credit history for that account has an impact on yours.

When you become an authorized user, that account pops up in your credit report. If the primary account holder has a long history of paying their bills on time or they keep their balance low, this might have a positive effect on your credit. If the account has been open for a long time, say 15 years, it will read on your credit report as a 15-year account. Since length of credit history has an effect on your credit score, this can prove helpful in building your score.

Beware, however, that the impact on your credit score doesn’t always move in the positive direction. If the primary account holder misses payments, for example, the account could have a negative effect on your credit.

Can piggybacking hurt credit?

FAQ

Is piggybacking credit a good idea?

While being an authorized user on someone else’s credit card account (piggybacking credit) may be beneficial for the authorized user, the primary cardholder who has added the authorized user could see their credit score negatively impacted if the authorized user has a poor credit history.

Can piggybacking negatively impact your credit?

If piggybacking is done incorrectly, it can negatively impact your credit. Since the full history of the credit account is reflected in the piggybacker’s credit file, any derogatory factors will also appear.

Is piggybacking a good idea?

Piggybacking might be a good tool for someone who hasn’t built their credit history and needs a boost. Building credit takes time and by piggybacking off someone with an established credit history, you can improve your credit score much faster. It might work out well if you do it with a friend or family member you trust.

Can you piggyback on someone else’s credit card?

You may encounter businesses that offer piggybacking services for a fee, sometimes marketed as authorized tradelines for sale. They promise to make you an authorized user on the credit card accounts of one or more strangers for a limited period of time.

What are the two types of credit piggybacking?

There are two types of credit piggybacking: when a friend or family member with good credit adds you to their credit card account as an authorized user, typically resulting in a card with your name on it attached to their account; and when someone illegally obtains your personal information to add themselves as an authorized user to your credit card account.

Can piggybacking credit boost your credit score?

Piggybacking credit may be a method that could help improve a low credit score. If you have found yourself with a low credit score for any reason, SoFi Securities LLC, an affiliate of SoFi Bank, N. A. , offers various financial products, including brokerage and active investing.

Does piggybacking affect credit?

For those with limited credit history or lower credit scores, piggybacking can be an effective way to boost their creditworthiness. However, choosing a responsible cardholder is essential, as their credit behavior will directly affect the authorized user’s credit rating. Mar 5, 2025.

How much will my credit score go up if I add an authorized user?

Typically, becoming an authorized user may lead to changes in your credit score within a few months. According to Credit Sesame and Nerdwallet, it takes about 30 days for those with credit ratings below 550 to see a 10% increase. Those with higher scores might see slower progress.

What is the 2 3 4 rule for credit cards?

The 2/3/4 rule: According to this rule, applicants are limited to two new cards in 30 days, three new cards in 12 months and four new cards in 24 months.

How do I raise my credit score 100 points in 30 days?

For most people, increasing a credit score by 100 points in a month isn’t going to happen. But if you pay your bills on time, get rid of your consumer debt, don’t carry large balances on your cards, and keep a mix of secured and consumer loans, your credit score could go up in a few months.