It is possible to have a 700 credit score when a default payment goes to collections. That being said, it’s not likely your credit score will stay at 700 once this happens. Credit scores tend to drop once there’s a report of collections.

If you have ever been on the receiving end of calls from a debt collector, you will know well the anxiety that comes with an account in collections. According to the Urban Institute, about 64 million Americans had a debt collection account as recently as August 2022. 1.

No one wants a credit account to be passed off to a debt collection agency, but it happens often to those experiencing financial difficulties that make it challenging to cover their monthly payments on time.

When someone doesn’t pay back a loan or credit card bill, the lender or credit card company will sell the debt to a collection agency so they don’t have to go through the trouble of collecting it themselves. This is not only done for loans and credit card balances but also for landlords, utility companies, and medical service providers.

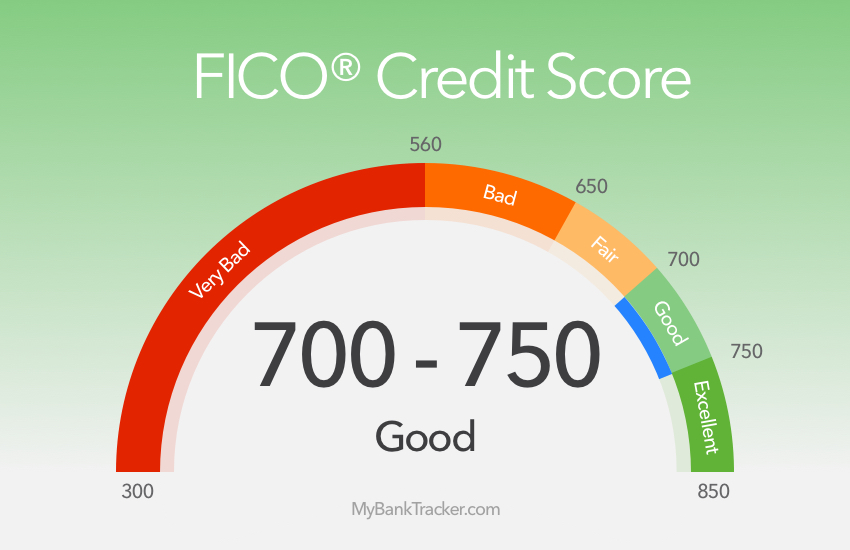

If you are looking to improve your credit score after a collection account, you may be wondering “can you have a 700 credit score with collections?” A good place to start is to gain a clearer understanding of the credit scoring system, and frequently check your credit reports. You can learn more about how collection accounts hurt your credit and what you can do to improve it there.

Having charge offs on your credit report can significantly impact your credit scores. A charge off occurs when a creditor writes off a debt as a loss because it has been delinquent for a long period, usually 180 days. This can cause a huge drop in your scores. So is it possible to reach a credit score of 700 or above if you have charge offs?

The short answer is yes, you can reach 700+ even with multiple charge offs on your credit reports. While charge offs make rebuilding credit an uphill battle, with time and effort, a 700+ score is achievable.

In this article, we’ll explore how charge offs affect your credit, how to handle charge offs, and tips to rebuild your credit to 700 and beyond even with charge offs.

How Charge Offs Impact Your Credit Scores

Charge offs can severely damage your credit scores in several ways:

-

Payment History: A charge off is essentially an extremely late payment of 180+ days. This will tank your payment history, which makes up 35% of your FICO score.

-

Amounts Owed: Charge offs increase your overall debt burden. Having cards that are maxed out and charged off will hurt this factor, which makes up 30% of your score.

-

Credit Utilization High balances on charged off accounts also increase your credit utilization ratio, Going over 30% hurts your score

-

Public Records: The charge off itself will show up in the public records section of your credit reports and drag down your score.

-

Age of Credit History: Accounts that have been charged off will be taken off your report after 7 years. This will make the average age of your accounts younger.

The FICO score can drop by up to 100 points or more if you have a charge off. The impact also depends on your overall credit profile. People whose credit is already bad see a bigger drop than people whose credit is already bad.

Handling Charge Offs: Do’s and Don’ts

Here are some important things to remember when your accounts get charged off.

DO continue paying your other accounts on time

One of the biggest mistakes is neglecting your other accounts once you have charge offs. Payment history has the greatest impact on your scores. So keep all your other accounts in good standing and make on-time payments.

DO maintain low credit utilization

Keep balances on your open revolving accounts as low as possible, ideally below 30%. High utilization will exacerbate the damage from charge offs.

DON’T ignore charge offs

You are still legally obligated to pay charge offs. The creditor or a collection agency can pursue payment through a lawsuit. Ignoring it also allows penalties and interest to build up.

DO negotiate payoffs or settlement offers

Try to negotiate a payoff or settlement for less than the full balance. Get any offer in writing before sending payment. This can help limit damage to your finances.

DON’T restart the clock

Avoid making payments after charge off unless you can pay in full. Partial payments can restart the 7-year reporting period, causing further damage.

Tips to Rebuild Your Credit Score to 700+ With Charge Offs

Rebuilding credit after charge offs takes time and discipline. But take the right steps, and you can absolutely surpass 700. Here are some tips:

-

Pay charge offs in full, if possible. While credit scoring models focus more on recent payment history, paying charge offs can still help. If you can’t pay in full, try negotiating a payoff for less.

-

Get and stay current. If your charge offs are due to financial hardship, get current on your payments as soon as possible. Then make future payments on time. This will demonstrate you’ve gotten back on track.

-

Become an authorized user. Ask a friend or family member with great credit to add you as an authorized user. This can give your credit a boost.

-

Open new credit responsibly. Apply for new credit cards or loans to add positive information to your reports. Make sure to keep balances low and payments on time.

-

Limit hard inquiries. Too many applications can raise red flags and hurt your scores, so only apply for credit you need.

-

Wait for charge offs to fall off. As charge offs pass the 7-year mark, they will fall off your reports, increasing your scores. But don’t wait idly, take other steps too.

With consistent effort over time, a 700+ score is realistic even with the black mark of charge offs. For inspiration, check out real stories like this one where a person reached 700+ with 8 charge offs. So don’t lose hope! Stay diligent, and you can rebuild your credit even from a low starting point.

How To Improve Improving Your Credit Score After Collections

There are many things you can do to raise your credit score if you have a collection account on your report. A 700 credit score may not be too difficult to reach if you have paid off your collection account and you are using one of the newer credit scoring models. However, if you want to play a more active role in boosting your credit score, there are several strategies you can employ to get the results you want to see. These are some methods to repair your credit after collections:

- Pay your bills on time

- Don’t close your credit accounts

- Pay off your credit card balances

- Maintain a low credit utilization ratio

- Keep an eye on your credit history and inform the credit bureaus of any mistakes on every report they send you.

If you want to rebuild your credit after a collection account, here are some of the most important things to remember:

Can Paying Off Collections Improve Your Score?

Newer models for figuring out credit don’t count collection accounts with no balance, so if you pay off your balance, your credit score should go up. However, older models still count collection accounts even if they have been paid off. This means that they will still show up on your credit report even after you have paid them off. Some lenders still use the older scoring models, especially mortgage loan lenders, so it is important to be aware either could be used.

How much does your credit score improve when charge-offs disappear?

FAQ

Can you have a good credit score with a charge-off?

If you haven’t raised your credit card balances, missed payments, gone into collections, etc., your score will go up. if everything else stays the same and you’ve paid a charge off, your score will improve.

Can I get a 700 credit score with charge-offs?

I have a single charge-off that is six years old and hasn’t been paid off yet. My scores are 716 and 720 on the two credit bureaus where it shows up (it doesn’t show up on Equifax, where my score is 782). However, it is still possible to have a score above 700, even though it will lower your score.

Will my credit score go up if I pay off collections?

Is a charge-off worse than a collection?