Getting laid off or fired can be a stressful, even traumatic experience. It’s also a time to make sure you take care of your personal finances. Here are some tips on how to handle your 401(k).

If you’ve been let go of or laid off, or if you just want to feel more prepared in case it happens, you have questions—like, “what happens to my 401(k) if I get fired?” Let us walk you through what to do with your 401(k) if your employment ends unexpectedly.

Losing a job can be an extremely stressful time Along with the emotional toll, there are practical financial matters to deal with, like what happens to your 401k This important retirement savings account represents years of contributions, investment growth and quite possibly, a substantial amount of your net worth.

It’s natural to wonder – do I lose my 401k if I get fired? The good news is the money in your 401k still belongs to you even if you’re terminated. While there are some factors to consider, you typically have options when it comes to accessing these funds.

What Is a 401k?

A 401k is an employer-sponsored retirement savings account. You contribute pre-tax dollars from each paycheck, investing the money for growth over decades. Many employers also match contributions up to a certain percentage.

The IRS places limits on how much you can contribute each year. For 2023, the contribution limit is $22,500 for those under age 50. Those 50 and older can contribute an extra $7,500 as a “catch-up” contribution.

Your 401k savings grow tax-deferred. You owe income taxes when you eventually withdraw the money, ideally in retirement. If you withdraw funds early, you’ll pay a 10% penalty unless you qualify for an exception.

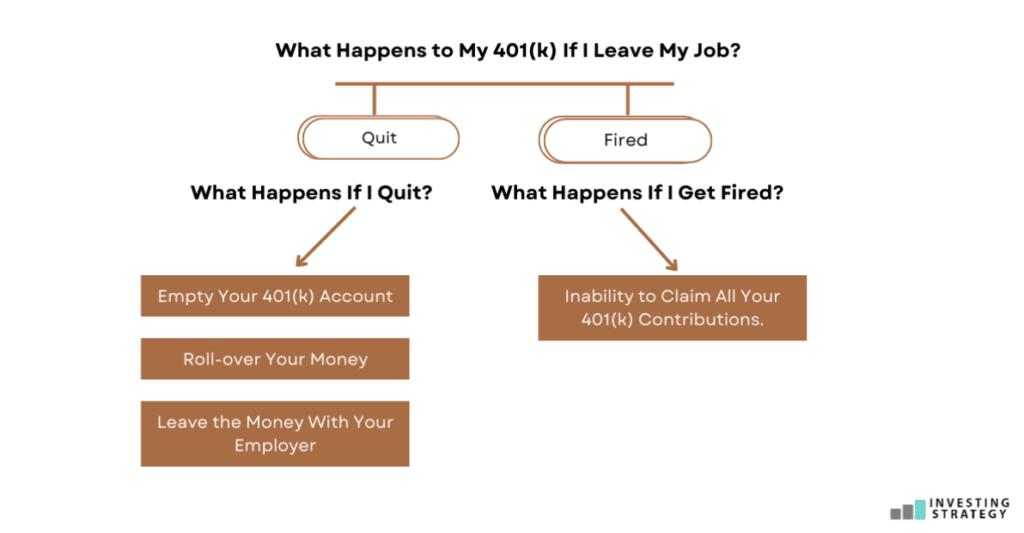

Do You Lose Your 401k If Fired?

Fortunately, getting fired or laid off does not automatically forfeit your 401k balance. The contributions you’ve made belong to you. Your former employer can’t take that money back.

On the other hand, you might not get all of your employer’s matching contributions. A vesting schedule is used by many companies. This means that you get to own their matching funds over time.

For instance, your boss might use a cliff vesting schedule that lasts for 3 years. That means you’d have to work there for three years before you could get it. Those matching funds go back to the company if you quit early.

Check your summary plan document to confirm your employer’s vesting schedule. After you leave, you’re entitled to any contributions you made, plus any matching funds that have vested.

What Are Your 401k Options If Fired?

When you lose your job, you have choices regarding your 401k balance:

- Leave it in your former employer’s 401k plan

- Roll it over to an IRA or new 401k

- Cash out the funds

Let’s explore the pros and cons of each option.

Leave It In the Old Plan

You can leave your 401k in the plan of your old employer, at least for now. This requires no action on your part.

The advantages are that it’s simple, your money stays invested and you can still manage your account. The downsides are that you can’t contribute going forward, and it may be difficult to make changes.

Companies can force out accounts under $5,000. So this option works best if you have a sizable 401k balance.

Roll Over to an IRA or New 401k

Rolling your 401k into an IRA or new employer’s 401k allows you to keep saving in a tax-advantaged way. You’ll maintain control over investment choices and won’t owe taxes or penalties.

Most of the time, an IRA gives you the most investment options and the lowest fees. A new 401k might be a good idea if it has access to institutional funds or if you want to move your retirement savings to one account.

If you choose a rollover, request a direct rollover to avoid mandatory 20% withholding.

Cash Out Your 401k

With this option, you request a lump-sum distribution, cashing out your 401k balance. While easy and tempting, it should be a last resort.

Cashing out triggers income taxes on the entire withdrawn amount. You’ll also owe a 10% early withdrawal penalty if under age 59 1/2.

By cashing out, you lose years of potential tax-deferred growth. You give up the 401k’s advantages. Only withdraw early if absolutely needed to pay the bills.

How Should You Handle Your 401k After Being Fired?

Losing a job is always tough. But you don’t necessarily lose your 401k too. In most cases, the smartest moves are:

- Leave your 401k with your former employer if it’s a quality plan.

- Roll it over to an IRA for more flexibility.

- Avoid cashing it out if at all possible.

Take time to review your options and make an informed decision about your 401k. While employment ends, your need for retirement savings does not. With smart choices now, your 401k can continue working for you.

Other financial moves to make after a job loss

Track your debts with an app, create a spreadsheet or just write it by hand everything including car payments, credit card balances and your mortgage. Consider making only the minimum payments for the time being—and see if you can work out a temporary payment plan with credit card companies.

You can leave your money where it is

If you have more than $5,000 in your 401(k), you can leave it in your old employer’s plan —even if you have less than that, it’s worth asking if they may still let you leave the money where it is. If you have less than $5,000, your employer has the option of making you take a distribution, but not all employers will exercise that right.

This is the easiest option, and the one many people choose when they’re fired suddenly. Of course, you might not even have time to decide what to do with your 401(k) money before you get fired or laid off. Taking the distribution also allows you to use the money as a safety net while you consider your next career move.

What Do I Do With the 401(k) From My Old Job?

FAQ

What happens to my 401k if I’m fired?

If you’re fired, your 401k may require removal from the fund and rolling it over to another fund. While the company can’t take the money you put into the fund, you’ll need to make arrangements for the management of your retirement savings. You can usually leave your 401(k) with your employer if you move on to another job.

Can an employer reclaim a 401(k) if you get fired?

The employer may legally reclaim their contributions in a pension plan with employer contributions, such as through matching. Whether or not your employer can do this will depend on whether you are vested in the plan, which differs from the security of a 401 (k) if you get fired, where your contributions remain protected. What is vesting?.

What happens to my 401k if I lose my job?

If you lose your job, your 401k is likely to experience some changes. While the company can’t take any of the money you put into the fund, you may have to remove the money from the fund and roll it over to another fund. The company cannot take any of the money you put into the fund.

What happens if you are fired from a retirement plan?

If you have a retirement plan with an employer and are then fired from the company, that employer can’t take away any money you have contributed to the retirement plan, as in the case of a 401 (k) after being fired. Can you lose your pension if fired?.

What happens if a 401(k) is terminated?

No matter what happens, your 401(k) contributions will be safe. However, any employer contributions to a pension plan, usually around 200% of the total contributions, may be at risk, depending on your investment status. Check 401 (k) plan details to secure your retirement funds. Find the right lawyer for your legal issue.

Can I Leave my 401(k) to a new employer?

You can: Leave your money in your old employer’s 401 (k), provided that the plan allows it. Roll it over into a new employer’s 401 (k) or an individual retirement account (IRA). Cash it out and pay the applicable taxes and penalties. Let’s explore each option for your retirement savings account in a bit more detail. 1.

What happens to a 401k when fired?

When you are fired, your 401(k) remains yours. You have several options: you can leave it in your former employer’s plan (if permitted), roll it over into an IRA or a new employer’s plan, or cash it out.

How long can an employer hold your 401k after termination?

Most of the time, when you quit your job, your employer can hold on to your 401(k) funds until you decide what to do with them. If the balance is below a certain threshold (often $5,000 or $1,000, but this can vary by plan), the employer may be required or allowed to force a distribution.

Can a company refuse to give your 401k after you’re fired?

If you have more than $5,000 in your 401(k), your former employer cannot force you to cash out or roll over the funds without your permission. If you quit or are fired, you may lose employer contributions that are not fully vested.

What happens when an employer terminates a 401k?

You can either cash out the money (less federal income taxes withheld) or move the money to a different employer plan or your own retirement account.